Payment Processing for travel industry: Creating own payment gateway

Because of the ever-complicated and competitive business landscape and the increasingly demanding customer, smooth payment processing for travel industry has become necessary. As travelers get used to the convenience of payments online, we see an ever-growing need for tailored payment solutions. Helping your business thrive will involve building your payment gateway and creating a personalized payment experience, one tailored to your customers.

A proprietary payment gateway can help the travel business reduce transaction fees and increase security and compliance with industry regulations. In this article, we will outline the basics of payment processing for travel industry and show you how to create one for your business. In this competitive marketplace, we will help travel businesses understand the technical requirements and navigate the regulatory landscapes that can make their business thrive.

Let’s go through the foundations of building a robust payment processing system that caters to your travel industry requirements.

I. How does payment process for travel industry work?

To understand how payment processing for travel industry works, let’s first identify its components: payment processors and payment gateways merchant accounts.

Merchant account

A merchant account is like a third party for your transaction with your customer. This is an account that accepts payments by credit or debit card. The money is placed in your merchant account if your travel business gets transactions. The funds can be transferred to your normal bank account for usage, such as rent and utilities. With merchant accounts, you can handle online payments and card processing terminals at the same time.

Payment Processors

If the merchant account holds the funds, a payment processor manages the transaction. The payment processor is responsible for communicating and passing the important data between the customer and the merchant account. It records transaction activity and reaches out to the customer’s bank and your merchant account. All transaction details, including CVV codes and expiration dates, are verified to ensure a safe payment processing experience for the travel industry.

Payment Gateway

The payment gateway is a virtual point-of-sale system. For in-person transactions, customers swiped their cards through a physical point-of-sale terminal. When online purchases are made, they securely enter their payment information into a payment gateway. This gateway acts as a hunter, capturing the needed data and sending it to the payment processor for a valued action!

The customer submits their information, and the payment gateway gets it and sends it to the payment processor. Then, the processor verifies this information. The transaction is completed once all the information has been verified. Once processed, the funds are sent to the merchant account until you decide to withdraw or transfer them.

II. Advantages of developing your own payment gateway

Building your payment gateway is a complicated process, but the benefits to businesses, particularly those in the travel industry, are significant. For clarity and more detail, here are some benefits of creating a custom gateway for payment processing for travel industry.

1. Better control of the payment process

Control over your payment gateway means you fully control how payment is processed. You can configure the gateway according to your business and customer’s needs. This can also involve integrating advanced security features that secure sensitive data and comply with the regulations. Furthermore, you can create a user interface that matches your brand personality, improving customer recognition and trust.

You have customization options to make the checkout and experience more intuitive for your users. In the travel industry, this level of control is particularly beneficial for retaining clients and attracting repeat business. Ultimately, it helps to take the customer experience to the next level.

2. Cost savings

As most third-party payment gateways charge transaction fees, using them can add up quite a bit. This is especially true in the case of a business that processes a high volume of transactions. You can save money by developing your gateway for payment processing for travel industry and eliminating these fees. There may be initial development expenses, but it can be a big win in the long run.

This is especially good for larger travel companies that have to deal with many bookings a day. Using a self-developed payment gateway, the funds go directly into the merchant account with no charges from third-party providers. This makes room for better financial management and better profitability.

3. Revenue generation

Opening opportunities for additional revenue streams comes with creating your gateway for payment processing for travel industry. If your gateway is rich and stable, you can sell that to other businesses in the travel industry or others. It is a source of income for your company and gives you a place in the technology versus a service provider. Marketing your payment gateway to other businesses will get you new clients. It also allows you to leverage the payment gateway’s unique features and capabilities to create partnerships. These partnerships will leave your brand more visible and reach further than ever before.

4. Integration

Self-developed payment processing for travel industry gateway supports easy integration with internal systems, such as Customer Relationship Management (CRM) or Enterprise Resource Planning (ERP). This integration makes data exchange between platforms smooth, which is crucial for real-time reporting and data analysis. That means better management of customer interactions and better operational efficiency for travel companies using payment processing for travel industry solutions. With interconnected systems, businesses can improve customer support capabilities and make data-driven decisions with the enhanced insights of all systems.

5. Global expansion

Third-party gateways may not fully support payment processing for travel industry needs, like handling all currencies and payment methods. This can restrict international growth for businesses looking to scale globally. When you develop your own payment gateway tailored for payment processing for travel industry, you can allow multiple currencies and payment methods specific to different regions. The flexibility here makes it easier to satisfy international customers who want to make payments in their preferred ways. Not only does this widen your market, but it also helps make customers satisfied and comfortable with their payment experience.

6. Customer experience

With a custom payment processing for travel industry gateway, you can create a checkout that reflects how you want your customers to experience it. With a streamlined checkout flow, you can reduce the number of redirects and transaction friction, which is especially critical in the travel industry. Users often abandon their carts because the checkout process is too complex or lengthy. Focusing on user experience helps decrease cart abandonment, boost conversion rates, and ultimately increase sales and customer loyalty.

While developing your payment gateway has many advantages, there are important considerations to keep in mind:

First, partnering with a third-party payment provider can also bring many benefits of a custom payment gateway. This support means that many businesses may not need to build their system but rather find third-party solutions that do the same things with less complexity. Through established providers, companies can use advanced features and security without the investment in development and maintenance.

Second, building your payment gateway is not an easy task. This venture should be done only if the business does a thorough cost-benefit analysis. Creating a payment gateway is an investment on the financial side, both in time and expertise. Companies have to deal with a complex set of compliance regulations, secure their software sufficiently, and keep updating it perpetually. And these requirements can be detrimental to resources and distract from core business operations.

Weighing the potential benefits against these challenges is necessary to decide whether applying travel payment integration is for your business.

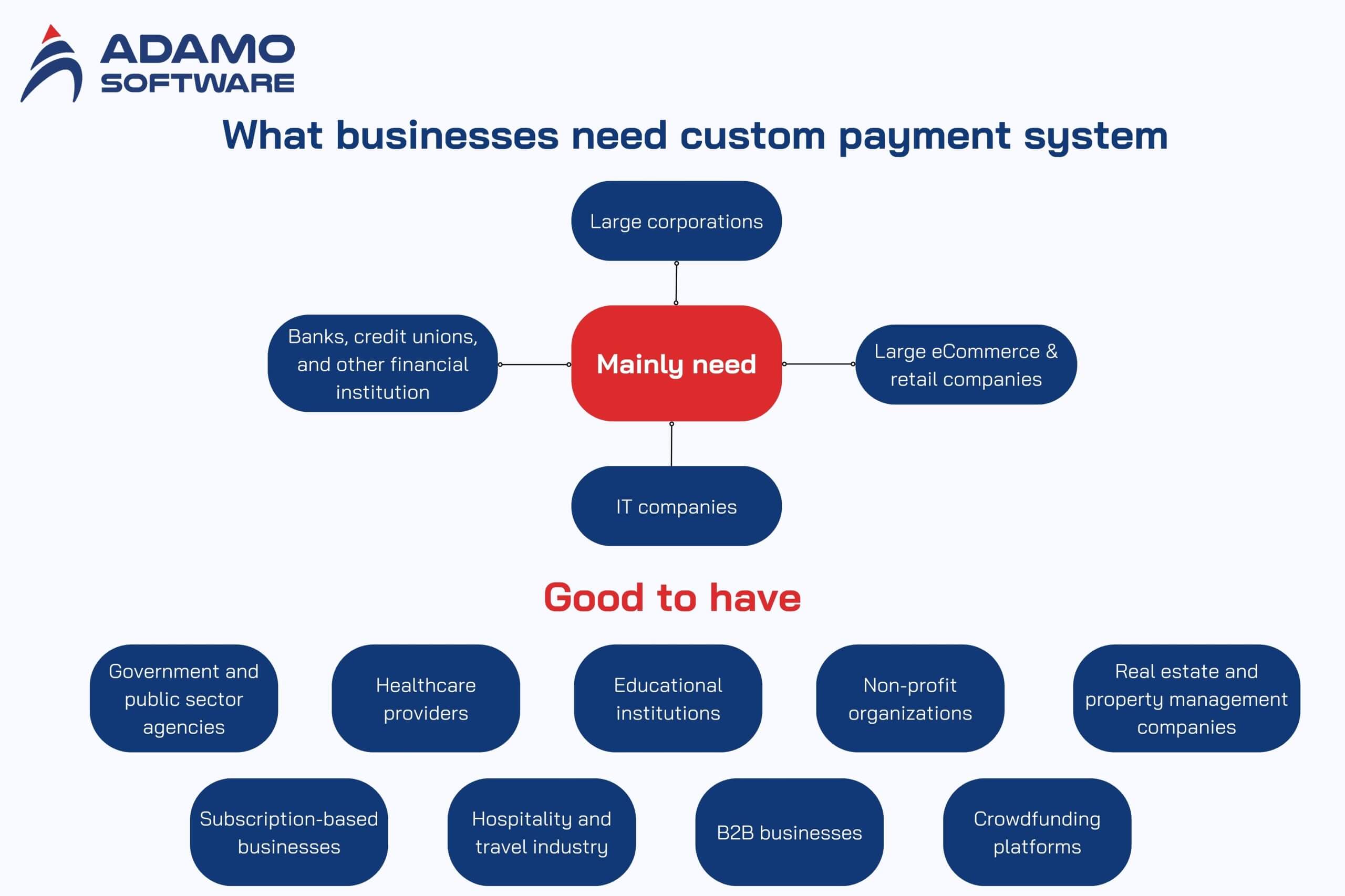

III. Who needs to build a custom payment processing for travel industry

How can you determine if building a custom payment processing system for travel makes sense for your company? Well, it depends on a lot of things: resources, growth, requirements for each industry, etc. Some businesses surely need to develop their gateway solution for payment processing for travel industry. Here are some of the examples of such businesses:

- Large corporations: They handle various financial transactions domestically and internationally, often large corporations. The travel industry can have a custom system of payment processing for travel industry for department transfers and multiple currency processes. It can also connect to an already established enterprise software and keep to the many regional financial regulations. For large businesses in need of scalable and secure payment solutions, having this level of customization is required.

- Large e-commerce and retail companies: E-commerce and retail companies depend heavily on high numbers of transactions during peak periods. Therefore, using a custom payment processing for travel industry solution, giving customers multiple online payment options can improve the checkout experience. This integration could also communicate with inventory and supply chain systems, reducing transaction fees. Investing in a tailored payment processing system from a travel payment business will allow them to increase customer satisfaction and improve operational efficiency.

- IT companies: In some cases, companies that offer B2B services or SaaS platforms have their billing model. That may include subscription-based or milestone-based billing systems. A custom payment processing solution can automate recurring payments and international transactions. Through integration with project management tools, these companies can better streamline their financial operations. Therefore, payment processing for travel industry will become more efficient.

- Financial institutions such as banks, credit unions, and so forth: In this world of financials, banks, credit unions, and other financial institutions are what it’s all about. They have complex transactional needs that need specialized solutions. A custom system designed for payment processing for travel industry can help improve internal processes while utilizing innovative customer services. Furthermore, it can connect with other banking systems if there are strict regulations and security standards that will make customers put their trust in them.

Many other types of companies could benefit from custom payment processing systems:

- Government and public sector agencies: Custom payment systems can be used by government and public sector agencies to handle big-ticket transactions, such as tax collection, fines, and public fund disbursements. The systems guarantee accuracy and meet regulations.

- Healthcare providers: These systems can be tailored to manage patient billing, link to health records, and handle insurance claims. However, they can also protect sensitive healthcare provider data.

- Educational institutions: Custom systems of payment processing for travel industry can still manage tuition, donations, and all other payments, which works great for educational institutions. They can also easily plug into student databases for a simpler financial journey.

- Non-profit organizations: Nonprofit organizations may need special systems to manage donations, memberships, and fundraising. And that’s good: it offers transparency and trust in donors.

- Real estate and property management companies: By linking these transactions with property databases, real estate and property management companies can automate bank rent collection and lease payments, property sales, etc.

- Subscription-based businesses: Custom systems for businesses with recurring billing give a better experience to subscription-based business users.

- Hospitality and travel industry: Booking management, ticketing, and reservation systems have very specific needs for the hospitality and travel industry. Integration with booking databases and support for multi-currency transactions is required.

- B2B businesses: Custom systems are written to work for B2B businesses that have their own invoicing and bulk transaction needs, whether it’s international payments.

- Crowdfunding platforms: Integrating the payment gateways to handle the campaign-specific collections and disbursements makes the campaign-specific collections and disbursements transparent and secure.

You may wonder why companies even look for custom payment processing for travel industry or others. Conventional bank solutions are something many stick to, and e-commerce businesses rely on built-in processing on top of platforms like Shopify or Amazon. However, due to transaction volume, business location, and other reasons, companies choose custom payment solutions for reasons such as:

- Meeting specific needs

- Long-term cost efficiency

- Flexibility and scalability

- Competitive advantage

- Seamless integration with existing software

- Enhanced security features

- Full control and ownership

- Avoiding third-party restrictions

- Improved branding

- Enhanced user experience

- Regulatory compliance

Generally, custom payment processing for travel industry is a worthwhile investment for larger companies. These are the ones that require solutions for their unique operational, security, or regulatory concerns and sometimes their need to scale.

IV. How to strategize a custom payment processing solution

A custom payment processing solution is a strategic approach, especially for payment processing for travel industry. Let’s break down how it can meet unique business needs:

1. Understanding Business Requirements

The first thing to do is to pinpoint specific business goals and needs, particularly for payment processing for travel industry. This implies the analysis of current processes, identification of problems, and identification of future targets. But it’s important to understand whether the goal is better invoice management, stronger security, or ease of system integration.

2. Scalability and Flexibility

It is particularly true for any growing business to be able to remain agile and flexible, especially with custom payment processing for travel industry. Rising transaction volumes, the requirement for new products, and the need to adapt to changing business models are necessitating systems for companies. Therefore, scaling out the solution into multiple processors is needed and allows you to leverage the power of scalable computing.

3. Compliance and Security

In financial transactions, compliance and security are of great importance. A custom payment processing solution must be created to meet regulatory standards such as PCI DSS and GDPR and industry-specific rules. Additionally, encryption or multi-factor authentication is a must for security to secure payment data and limit fraud and data breach risk.

4. User Experience

A payment system cannot succeed without a good user experience (UX). It needs a user-friendly interface, clear workflows, and communication. UX leads to more benefits for businesses because it increases user adoption, reduces errors, and improves customer satisfaction.

That sums up all of the considerations that businesses need to be aware of when planning payment processing for travel industry. If businesses follow these strategies, they can build custom payment processing solutions that best serve their needs and future growth. Building a custom system of payment processing in the context of travel industry is unquestionably becoming more crucial than ever. Putting it on your plan and getting your hands on executing it as soon as possible will gain you a significant advantage in the market. If you’re unsure how to start, consider reaching out to a travel and hospitality software development company for help!

V. How Adamo Software can help

Adamo Software can help customers create their own payment gateway for payment processing for travel industry needs. We help travel businesses securely and efficiently accept payments by providing tailored solutions. We know that this sector is about so many currencies that need to be handled correctly and have payment methods to take care of.

With Adamo, you can leverage the payment gateway that fits your requirements perfectly to simplify transactions for flights, hotel bookings, and more. We’ve got a team making sure our payment process goes smoothly, and that customer experience and loyalty are very high. What’s more, we also safeguard your business and customers from fraud by implementing robust security measures.

Want to take control of your payment processing? Adamo Software is ready to help you build your custom payment gateway now!