Travel payment processing: An overview of travel world’s secret weapon

Before the implementation of lockdown measures, UK travel agents processed over 25 million credit card transactions annually, even as 45% of travelers grew accustomed to researching and booking their own travel via mobile devices. The presence of transactions across various currencies, methods, and sales channels necessitates a streamlined and secure payment system, which is essential for achieving success.

The travel industry is a dynamic sector that necessitates efficient and reliable payment processing solutions. This guide addresses the fundamental elements of travel payment processing, encompassing core concepts and the implementation of effective solutions that enhance the customer experience.

I. Understand the basics of travel payment processing

Payment processing involves steps that facilitate a secure transfer of funds from a customer to a merchant during a purchase. A seamless payment process is essential for travel business, enabling acceptance of payments from customers globally for services such as flights, hotel bookings, rental cars, and tour packages.

This process involves the customer, the merchant, their banks, a payment processor, and a payment gateway that manages the technical and safety aspects of transactions. Securely complete transactions to ensure the merchant receives payment for services and the customer is charged accurately.

Various widely used payment methods have become crucial for travel companies to support:

- Credit and debit cards: Customers still expect to pay with Visa, Mastercard, American Express, and other major credit card brands.

- Digital wallets: Apple Pay, Google Pay, and Samsung Pay are gaining popularity for their convenience and security.

- Bank transfer and ACH: Bank transfers provide a secure method for customers to make direct payments from their accounts, especially in certain regions.

- Buy now, pay later: Klarna, Affirm, and Zip offer new financing options that enable customers to pay for trips in installments, appealing to a wider audience of travelers.

Each payment method comes with specific rules, processes, and requirements for travel merchants to adhere to.

Also read: Payment Processing for travel industry: Creating own payment gateway

II. The importance of travel payment processing in travel industry

Before we start, it’s crucial to grasp the significant growth of the travel industry and the impact of digital payments on this expansion:

- The travel industry is set to achieve remarkable growth soon, as per UN tourism.

- Tourism arrivals in 2024 are projected to rise by more than 15% from 2023, exceeding pre-pandemic levels, as reported by the same source.

- By 2028, travelers are expected to make 1.4 billion cross-border trips, reflecting a 17% rise from 2019, as reported by Skift Research.

- 75% of travel executives report that at least 25% of their revenues are derived from cross-border payments.

- As reported by Statista, online sales are projected to make up 76% of total revenue in the Travel & Tourism market by 2028.

In the changing travel industry, customer experience distinguishes various providers. This differentiator is particularly significant in travel as a positive digital experience has become commodified in recent years. Customers expect a seamless travel payment processing for booking flights, accommodations, renting cars, and purchasing travel insurance. Additionally, they expect a strong travel payment processing system that ensures transactions are completed swiftly and securely.

The travel industry handles numerous transactions and various payment options. Travelers arrive from various regions, each with distinct behaviors and favored payment methods like credit cards, digital wallets, and bank transfers. A payment processing system must accommodate various options for a global client.

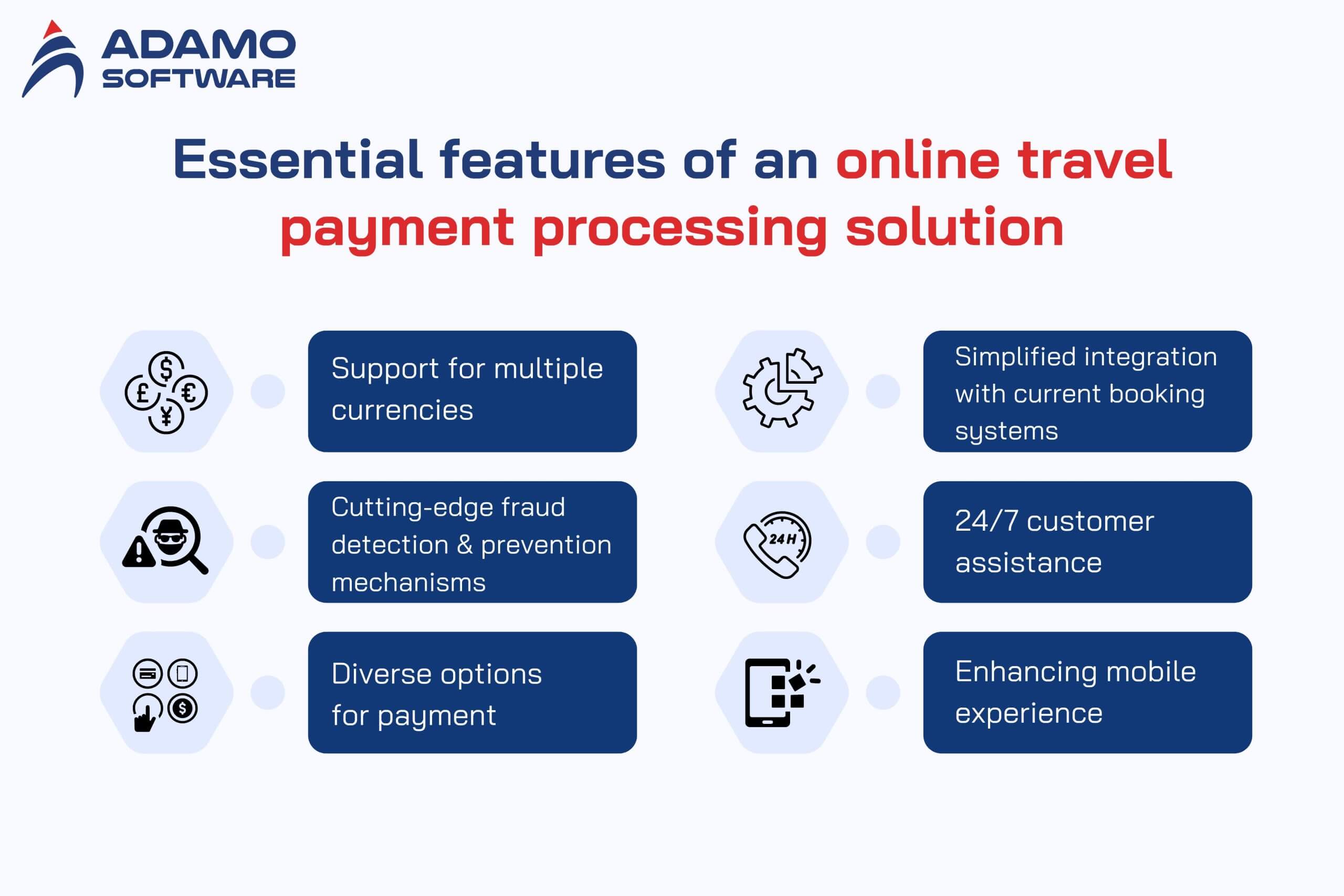

III. Essential features of an online travel payment processing solution

A strong travel payment processing solution is essential for the travel industry, boosting customer loyalty.

1. Support for multiple currencies

Supporting multiple currencies is a critical feature for travelers booking services from various countries.

This feature enables customers to pay in their local currency, reducing conversion fees and enhancing their booking experience by making it more convenient. Additionally, dynamic currency conversion automatically detects the user’s location to display relevant languages and currencies.

2. Cutting-edge Fraud Detection and Prevention Mechanisms

Fraud prevention and security are essential in the travel industry, often targeted due to high transaction values. Mechanisms like real-time analytics and monitoring are essential for protecting against fraud. These tools identify and reduce potential threats before they cause damage, ensuring safety for the business and its customers. One example is tokenization. It enables one-click payments for travelers seeking quick purchases, adding an extra layer of security for these transactions.

3. Diverse options for payment

Skift and Airwallex survey reveals that 72% of customers utilize local payment methods, with 32% using them frequently.

Payment method preferences vary significantly across regions, and customer behaviors are greatly shaped by cultural habits. Therefore, it’s crucial to choose a payment provider that offers a diverse array of alternative payment methods, including digital wallets, BNPL, and cryptocurrencies.

4. Simplified integration with current booking systems

Another essential feature for travel payment processing, this integration streamlines operations for a more efficient workflow. It enables seamless integration of the booking and payment processes, ensuring a consistent and effortless user experience.

5. 24/7 customer assistance

Round-the-clock support is essential in the travel industry because of its global scope. Customers require assistance at any time, and responsive support addresses their concerns quickly. Availability is essential for ensuring customer trust and satisfaction, particularly regarding payment issues.

6. Enhancing mobile experience

The rising prevalence of mobile bookings necessitates an improved payment processing infrastructure for mobile devices. Mobile optimization facilitates seamless payment processing for customers utilizing smartphones or tablets, offering the anticipated freedom and convenience. This functionality is crucial since an increasing number of travelers depend on mobile devices to organize their trip arrangements while on the move.

These attributes collaborate to establish a secure, efficient, and user-centric payment experience that satisfies the requirements of both enterprises and their clients.

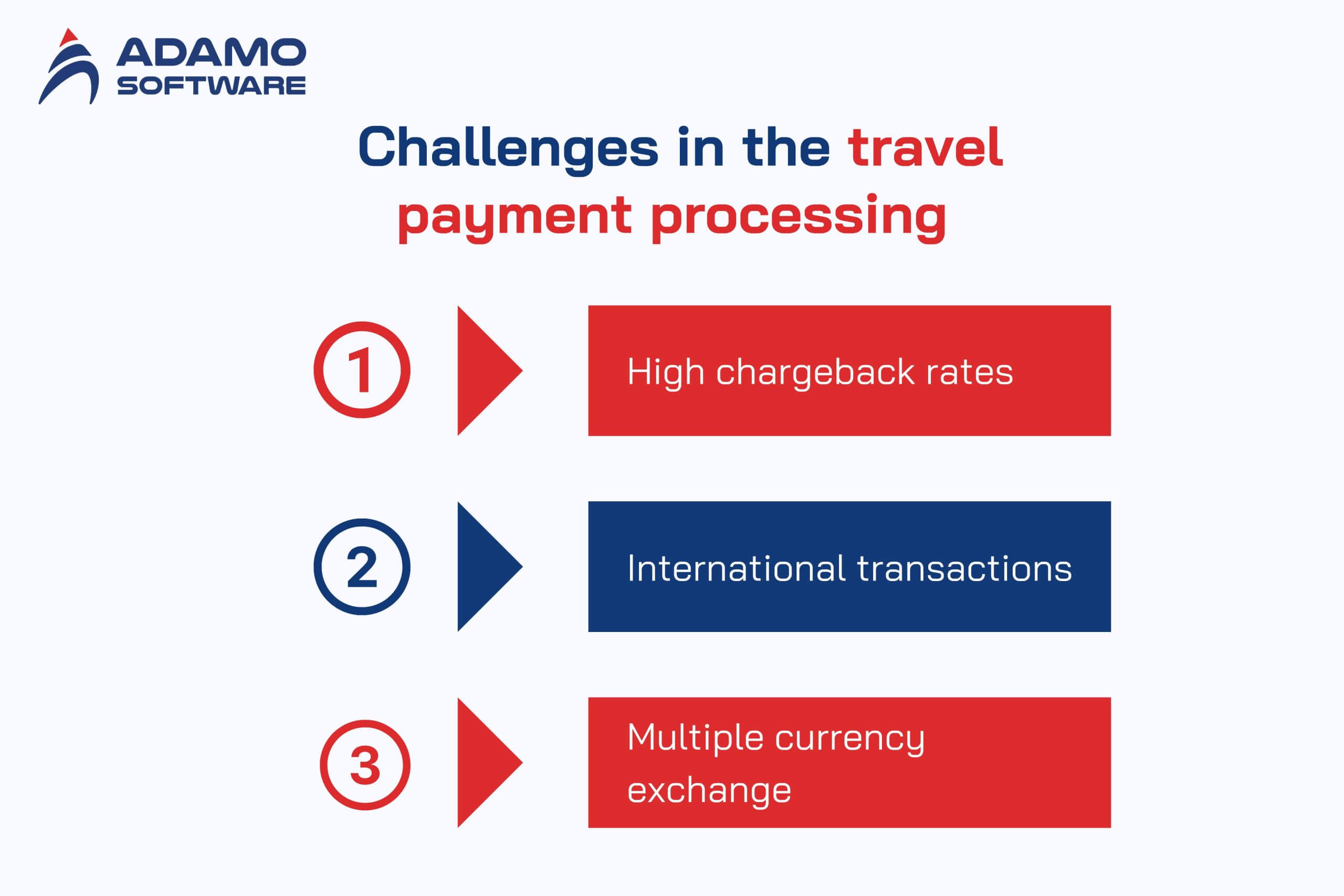

IV. Challenges in the travel payment processing

Streamlining travel payment processing is crucial for travel businesses. However, they face unique challenges that require strategic planning and decisive action:

1. High chargeback rates

Chargebacks, which occur when clients contest transactions, are more prevalent in the travel sector compared to other industries. Last-minute cancellations, flight delays or cancellations, mismatched bookings, and instances of friendly fraud contribute to an increase in chargebacks. This affects revenue, processing expenses, and may lead to the freezing or closure of merchant accounts.

2. International transactions

Managing international payments is essential for travel enterprises catering to global customers. Handling payments across various countries and currencies presents challenges such as fluctuations in exchange rates, compliance with tax regulations, detection of fraud within diverse payment systems, and understanding the preferred payment methods in each nation.

3. Multiple currency exchange

Fluctuating exchange rates can rapidly lead to discrepancies between the prices anticipated by clients at the time of booking and the amounts they are billed following currency conversion. Providing prices in the local currency and monitoring fluctuating exchange rates are essential to avoid unexpected cost discrepancies.

These challenges impact more than solely financial dimensions. Elevated chargebacks diminish profits and may result in increased fees from payment processing services. Challenges associated with international payments can complicate the checkout process for customers booking trips from abroad. Inadequate management of the currency exchange may result in a decline in customer trust and loyalty.

Modern payment solutions and services are specifically designed to address these challenges within the travel industry. Implementing effective strategies such as 3D Secure 2, intelligent routing, travel-specific data tokenization, and collaborating with payment processors experienced in the travel sector enables companies to overcome challenges and provide a seamless payment experience for clients globally.

V. Understanding the Payment Processing by Travel Agents

Travel agents function as intermediaries within the travel ecosystem, linking travelers to a range of service providers, including airlines, hotels, and tour operators. Their responsibilities encompass not only the arrangement of services but also the efficient and secure management of payments. Analyzing the standard payment processing workflow for travel agents offers valuable insights into the characteristics and significance of their operations.

The initial step in the booking process involves the authorization of payment upon customer reservation. In this phase, the travel agent gathers the customer’s payment information and initiates a request for payment authorization. This essential procedure confirms that the customer possesses adequate funds or credit to finalize the transaction, facilitating a booking process that can advance seamlessly without financial interruptions.

Upon collection of payment information, travel agents utilize payment gateways for transaction processing. These gateways are essential to the payment processing system, as they securely transmit payment information between the agent’s booking system and the relevant financial institutions. Payment gateways play a vital role in ensuring the security and integrity of financial data, safeguarding both travel agents and customers against potential fraud and data breaches.

After authorization of the payment, the subsequent step involves transaction settlement. The payment processor facilitates the transfer of funds from the customer’s account to the travel agent’s account. The transfer occurs after deducting any processing fees, which are generally imposed by the payment processor for executing the transaction. This step’s efficiency ensures timely payments to travel agents, facilitating effective cash flow management.

Following successful travel payment processing, travel agents provide the customer with a confirmation and receipt. This step requires the issuance of a comprehensive confirmation email or receipt containing all pertinent booking and payment details. This document acts as evidence of payment, fostering trust with the customer through the demonstration of transparency and clarity in the transaction.

In instances of cancellations or disputes, it is the responsibility of travel agents to manage refunds and chargebacks. This facet of payment processing presents significant challenges, necessitating a robust system for the efficient management of transactions. A well-structured payment processing system facilitates the management of refunds and chargebacks, emphasizing prompt issue resolution and the preservation of elevated customer satisfaction levels.

Each step is critical for facilitating smooth, secure, and efficient payment processing, thereby enhancing the overall customer experience.

VI. Tips to optimize the payment experience

Ensuring compliance and security is essential. However, travel companies must also focus on optimizing the travel payment process to enhance customer experience. An inefficient, unclear, or insecure payment process may result in cart abandonment, unfavorable reviews, and a direct effect on revenue.

Travel businesses can adopt various strategies to improve the user experience during the checkout and payment process.

1. Streamline the procedure

Minimize the steps and fields in the payment process while ensuring security is not compromised. Reduce the frequency of redirects to external websites. A reduction in the number of clicks required for purchase correlates with an increase in the conversion rate.

2. Facilitate mobile payment systems

Given that more than 60% of travel bookings occur on mobile devices, optimizing the payment experience for smaller screens is essential. Facilitate the completion of forms, ensure actions are easily tappable, and utilize mobile wallets to expedite the checkout process.

3. Incorporate a guest checkout option

Requiring customers to create an account prior to payment introduces unnecessary friction in the transaction process. Allow users to complete their purchase as guests while offering the option to create an account afterward to access future benefits.

4. Utilize payment data efficiently

Utilize autofill fields when feasible by securely retaining payment information with the explicit consent of the customer. Implement options for travelers to securely store payment methods to facilitate efficient repeat transactions.

5. Adapt for local contexts and prepare for global applicability

Present prices in the preferred currencies and languages of global audiences. Facilitate their chosen payment methods. Facilitate a seamless checkout experience regardless of the travelers’ point of origin.

6. Ensure clarity and openness

All costs and taxes should be transparently presented in advance, ensuring that customers are fully informed and aware of what to anticipate, thereby eliminating hidden fees and unexpected charges. Consumers generally disfavor unexpected charges following a transaction.

The payment stage frequently presents significant challenges for customers, resulting in a considerable number abandoning their bookings. Facilitating this process enables travel businesses to enhance sales and improve customer satisfaction.

VII. How Adamo Can streamline your travel payment processing

An effective travel payment processing system is crucial for success in the travel industry. It enhances customer experience, operational efficiency, and security.

Adamo Software is dedicated to delivering secure and intuitive travel payment processing solutions specifically designed to meet the distinct requirements of your travel business. Partnering with us allows you to concentrate on providing outstanding travel experiences, while we manage your travel payment processing requirements.