Virtual cards in travel: A Comprehensive Overview of Their Impact

Learn how virtual cards in travel are changing the global landscape of payments with savings, improved management, and protection.

Virtual cards in travel have made it easier and more secure to handle payments within the fast-growing travel industry. These electronic payment systems are changing the face of commerce. It upgrades the way through which travelers and businesses transact. As distinguished from conventional credit cards, virtual typically refers to short-term cards, created in digital form, and assigned to particular purchases. They improved the payment methods for hotel bookings, flights, and other traveling expenses. They provide better security and control options.

As technology advances in travel, using a virtual card has become a necessity for any business. That is why some of their specific clients include air travel agents, and frequent travelers. Many companies seek a fast and easy technique for making their payments. This article will offer an understanding of various aspects of virtual cards in the travel context. They include the types, uses, advantages, and disadvantages.

In this guide, you will learn how virtual cards in travel are changing the global landscape of payments with savings, improved management, and protection.

I. What are virtual cards in travel?

Virtual cards in travel are new payment technologies. They are used to facilitate and bring security to travel-related transactions. Virtual cards are different from plastic credit or debit cards. They are created electronically for certain purposes. It is usually an open single-payment card. It has a single accessibility period, which guarantees every purchase’s safety. These cards hold relevant data like card numbers, expiration date, and CVV, but are completely virtual.

Virtual cards have become indispensable in the travel industry for organizations and tourists. They are frequently employed in making reservations for accommodation, air and other transport, and rental cars. They facilitate cost management compared to other means. By releasing a unique virtual card for each booking or transaction, there will be reduced mistakes and enhanced success.

Most digital cards used in traveling are adaptable, and one can design them based on desire. For example, it can have certain spending limits that cannot be exceeded. Therefore, they are good to be used in corporate travel management to curb misuse of funds set aside for travel. Further, virtual cards are compatible with a travel management solution. Thus, they are an effective payment method.

Another highlight of the use of virtual cards in travel is security. As these cards are virtual, they cannot be stolen or lost as someone might lose a credit card. Moreover, they are disposable, there is no way in which the details involved can be utilized again. Due to this feature, virtual cards have become common to use. Especially for companies that embrace safe and efficient payment methods.

In conclusion, virtual cards in travel are transforming how payments are done in the travel business. Mobile ordering provides unprecedented ease, adaptability, and safety. This makes it essential for both merchants and tourists.

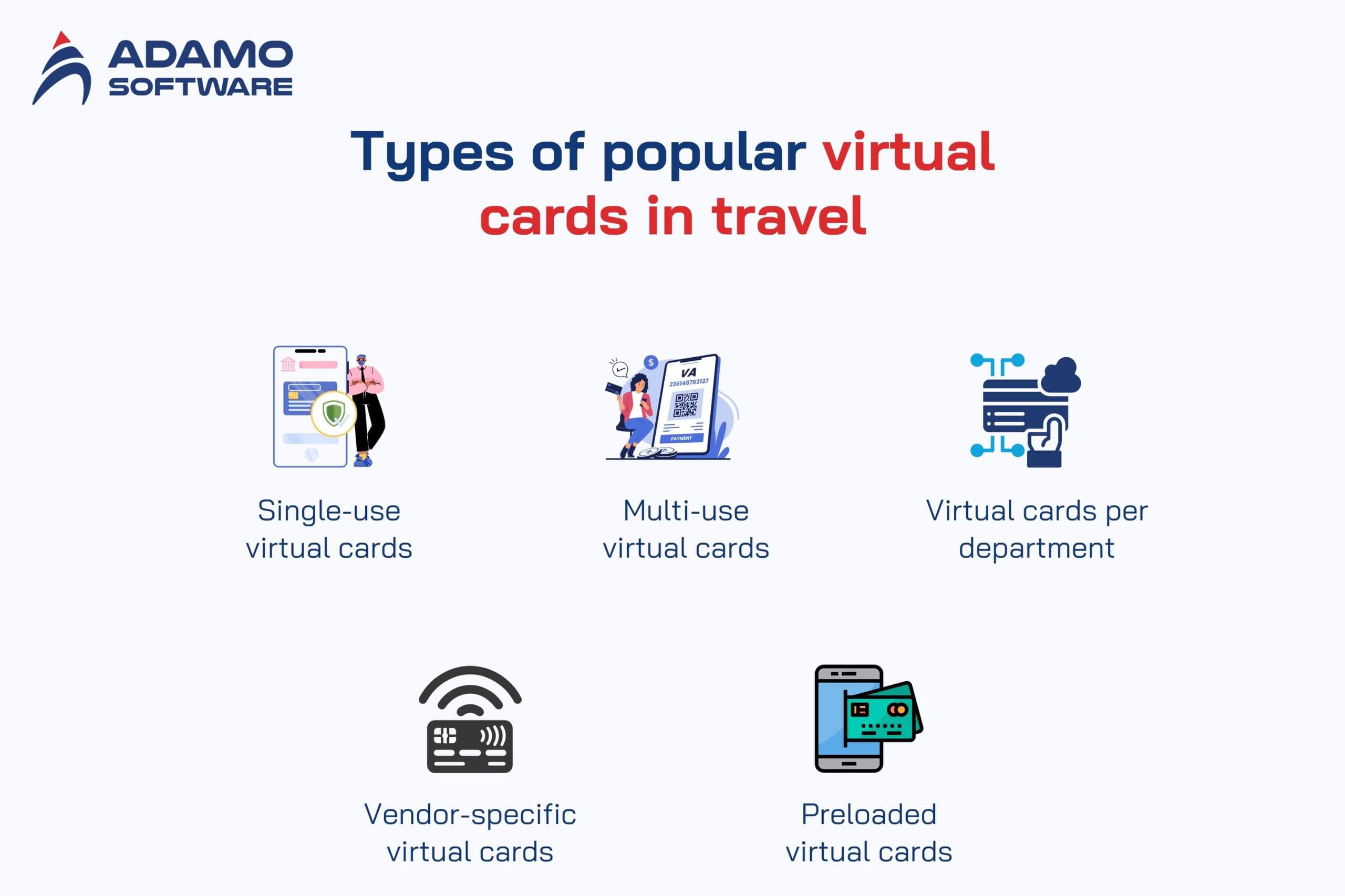

II. Types of popular virtual cards in travel

Travel-related virtual cards are of many forms depending on the needs of the business and the travelers. These cards give flexibility and control which has made it popular in uses such as the travel industry. Here are the most common types of virtual cards used in travel:

1. Single-Use Virtual Cards

These virtual cards are meant to be used for solitary payment. After the payment is made, the card details are deleted, and they cannot be used again. These cards are very safe mainly. Because one has little or no chance of getting cheated or billed for something he did not pay for. Applicable examples of virtual cards in travel are single-use cards where customers use cards. For example, to book a hotel, buy airline tickets, or spend any other amount utilized only once.

2. Multi-Use Virtual Cards

Virtual credit cards are made to be used for several purchases within a given time or amount. These cards are particularly appropriate for extended traveling or group accommodations. These purchases require regular payments or frequent payments. Companies often administer virtual credit cards for corporate traveling purposes to streamline the expenses and reimbursement process easily.

3. Virtual cards per Department

Such virtual cards are provided to specific departments of an organization for their travel expenditure requirements. For this reason, they help businesses to plan, allocate control, and even closely oversee expenditures. For instance, the purchase of travel expenses for a sales team can be facilitated by a special virtual card associated with the department.

4. Vendor-Specific Virtual Cards

Travel management cards are also of two types – general and vendor-specific – and are used only with particular travel suppliers. They are particularly valuable in negotiated partnerships referring to the situations when the businesses enter into close cooperation with preferred travel suppliers. When the usage is limited to certain vendors, the companies have better control over their spending on travel.

5. Preloaded Virtual Cards

Closed–preloaded virtual cards are when the card is created having a predetermined amount of money associated with it. These cards are ideal regarding expenses on petty cash during business travels. For example, there are features that allow a company to pre-set a certain amount of money that may be spent on meals or any other miscellaneous by the traveler. Therefore, this helps to avoid the instances whereby travelers spend so much outside their trip budget.

All types of virtual cards in travel are structured in a way that uniquely solves various problems that companies and travelers undergo. When selecting the most appropriate virtual card, companies stand to enjoy security, spending management, and convenient payments. These new tools are revolutionizing the way payments in travel are done to ensure easier and more effective transactions.

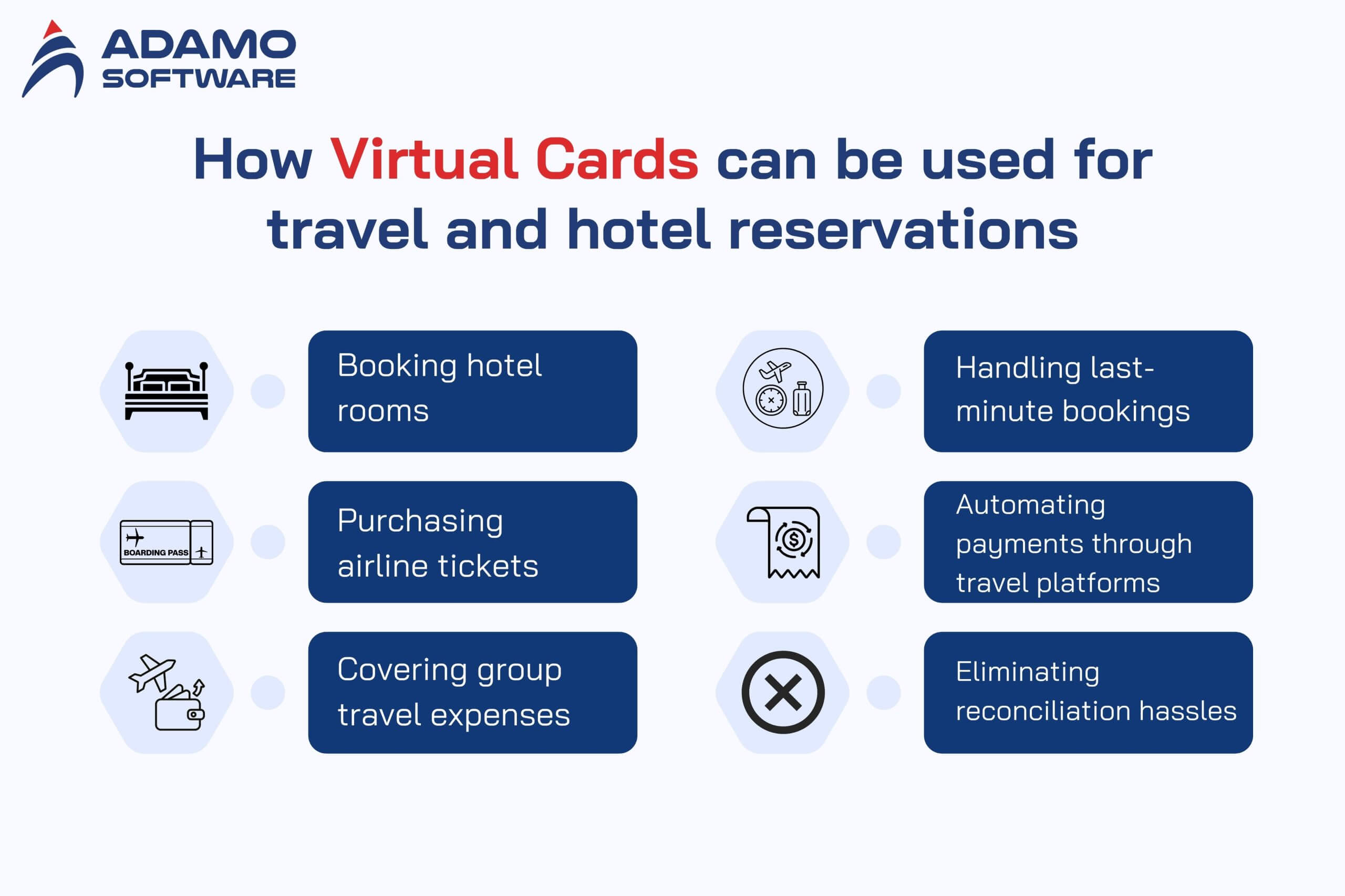

III. How Virtual Cards can be used for travel and hotel reservations

In travel, virtual cards are very useful and occupy a central position in paying for travel and hotel bookings. These help with the completion of the transactions. They would make such transactions more secure and transparent as well. Businesses and travelers can benefit from their features in several ways:

1. Booking Hotel Rooms

In travel, virtual cards are embraced especially in hotel bookings. Travel managers or agencies initiate the creation of a virtual card with a particular spending limit that should correspond to the amount of the reservation. It also helps to prevent the payment from being made to a specific merchant for something different. Hotels get to directly debit the virtual card, and the details of the card deactivate immediately after the transaction is processed. Therefore, it reduces the potential for fraudulent usage of the card.

2. Purchasing Airline Tickets

Airline ticket payment is one of the most common applications of virtual cards by travelers and companies. These cards are simple to use and provide secure operations. Since they are used once only, the card information cannot be used again. Such virtual cards also allow companies to rein in spending by setting a spending limit that would only equal the cost of the ticket.

3. Covering Group Travel Expenses

Virtual cards in travel make it easier to pay by automatically establishing cards for each traveler or booking for corporate group travels. This cuts out the instances in which employees are required to make expenditures on company business. It also gives companies a clear segregation of cost.

4. Handling Last-Minute Bookings

Virtual cards are most suitable to be used in emergencies such as travel or hotel bookings at the last minute. Since it is easy to produce by just using your mobile phone. Companies and travelers can book without stressing about where to get payment methods. Since some may take time to be processed. This is especially important in an emergency or a situation where you must travel unannounced.

5. Automating Payments Through Travel Platforms

Most travel management portals work in conjunction with virtual card solutions. Hence, it makes payments for hotel accommodation and other travel-related expenses automatically. For a given booking, the system generates a virtual card as soon as possible, for the exact amount needed to eliminate errors.

6. Eliminating Reconciliation Hassles

As for virtual cards in travel, every payment made is associated with a distinct purchase. This makes reconciliation between expenses and records much easier for the companies. For example, hotel charges can be easily attributed to the reservation and thus would not be manipulated.

In conclusion, virtual cards in travel have changed the way payments are made for travel and hotel bookings. It is ranked high in security, quickness, and ease. This makes virtual cards a necessity for companies and tourists. These had the effect of giving back control over spending while offering the capability to simplify affairs. This has helped to cement themselves as a trusted solution in the travel industry.

IV. Other applications of virtual cards during business travel

The use of virtual cards in travel does not begin and end with the purchase of a flight ticket or checkout for a hotel. They provide and avail a diverse array of prospects. This travel payment integration enhances the security of business travel. In satisfying diverse payment requirements, the various services enable payment to be organized such that executives gain control over expenses. Here are some key applications of virtual cards during business travel:

1. Covering Transportation Costs

Expenses paid for transportation which may include rented cars, taxis, and internet-based application cars may be made via virtual card. This eradicates the cases of employees having to indulge their own money and then apply for a refund. Holders receive virtual cards for transportation that possess a limited budget for specific spending.

2. Meals and Entertainment Expenses

When they travel ‘for business,’ people end up using their money to pay for meals and other entertainment. Virtual cards for traveling enable a certain amount of money to be spent on these traveling exercises. One virtual card can be created with a specific spending limit designated for it. Employees can use it for restaurant groups or other companies that need to pay bills and other traffic. This can make expense tracking easier.

3. Overhead Control in Conferences and Events

In many scenarios, business travel is predicated on the need to attend a conference or other such gathering. Virtual cards are ideal for registration fees, exhibitions, or renting equipment. Larger organizations can achieve these payments through single-use Virtual Credit Cards.

4. Purchasing Travel Insurance

Another place where virtual cards will also apply in travel is when buying travel insurance for employees. Employers can create a virtual card to pay for an insurance policy. Therefore, travelers would have appropriate protection, but it won’t create extra work.

5. Paying for Miscellaneous Expenses

In business trips, there are always minor but unavoidable costs. They can be parking charges, internet connections, or portage among others. Such payments can be made using virtual cards since it is easier to track the expenses.

6. Handling Emergency Payments

They include health issues that may occur at any point in a journey and need immediate attention. Some emergencies may require a person to purchase something. These cases can be managed through virtual cards which can be instantly created in travel. This will help the travelers access the funds when needed without worrying about security.

7. Integrating with Expense Management Software

Most virtual cards can be reconciled with the expense management platforms. Thus, it makes the reconciliation process easy. Significant for businesses, every single transaction made using a virtual card is recorded and classified based on travel expenses.

Therefore, when managing travel expenses, virtual cards are valuable instruments due to their flexibility in traveling purposes. They offer convenient, safe, and prompt solutions to all payment requirements from on-board meals to emergencies. As presented above, the features of improved control and transparent parameters make virtual cards revolutionize business travel expenses.

V. Explore the benefits of virtual cards for travel agents

Indeed, virtual cards in travel have emerged as one of the critical factors for travel agents in making bookings and payments. They make such intricate procedures complex, increase security, and are revolutionary to the travel industry. Below are the key benefits of virtual cards for travel agents:

1. Streamlined Payment Processes

Travel agents offer a wide range of bookings, for planes, accommodations, and automobiles. Such features enable them to make payments quickly and securely, without necessarily using normal cards. This one takes less time to complete. This method is accurate as it minimizes the interference of human manipulation. Online travel agencies see virtual cards as helpful in making payment easy. Agents can have different cards depending on the transactions they carry out.

2. Improved Security

Another great benefit that accrues to the use of virtual cards in travel is the increased security measures offered. These are digital and single-use only cards, so the chances of identity theft or misuse are minimized. Every Virtual Card has its unique number. Hence, it cannot be manipulated by a third coming. It can also be set with certain limits.

3. Better Expense Tracking

Self-generated virtual cards can also be utilized where travel agents can track the expenses per client or booking. Each of the transactions is written with additional information like the booking reference, or supplier. This makes work easier when conducting an account. It also enables the agents to pass clean receipts to their clients.

4. Simplified Reconciliation

It is rather complex to handle many transactions for diverse clients. Another advantage of virtual cards is that each allows for the smooth and convenient reconciliation of the payment with its corresponding booking. This has a way of eliminating confusion and making a lot of sense as far as the accuracy of the accounting records is concerned. The virtual cards in travel eliminate time. It decreases the amount of paperwork regarding travel agents.

5. Flexibility in Payments

Virtual cards are flexible because travel agents can create cards that serve multiple uses. From purchasing air tickets, making deposit payments on accommodations, or organizing travel for a large group of people, virtual credit cards can be customized appropriately. It is thus useful for agents who are handling multiple travel needs.

6. Global Acceptance

Almost all virtual cards are globally recognized by travel suppliers. Travel agents can also gamble with services from airlines, car rental companies, and hotels in different countries. This helps to avoid the hitches that accompany the use of different currencies in the transaction.

7. Cost Efficiency

Thus, virtual cards help to save costs associated with using and maintaining tangible plastic cards, paying as many transaction fees as possible at the expense of travel agents. They can also escape incremental costs often linked with other payment methods. It gives virtual cards in travel its cost advantage.

8. Enhanced Client Experience

Due to virtual cards, travel agents can provide better and quicker service in making bookings. Clients also can realize more secure transactions and very well-documented invoices. This enhances clients’ experience. Also, virtual cards improve the relationship between travel agents and their customers. Since it is transparent and quick to use.

Therefore, virtual cards in travel give travel agents the necessary tools to improve the work of booking and payment processes. It provides an opportunity for modernizing and enhancing the security, flexibility, and cost efficiency of a financial system. It makes the financial processes easier. Travel agents require the help of Virtual cards to stay ahead of the competition and ensure the best services.

VI. Are there any security concerns for virtual cards in travel?

Virtual cards used in travel services are more secure, as the mentioned benefits have been noted. However, whenever there is a payment method involved, there are crucial issues that need to be solved. It is important to know about the risks associated with virtual cards. Because, though these are more secure than regular debit and credit cards, their risks cannot be completely overlooked. Below are the key security concerns and ways to mitigate them:

1. Fraudulent Use by Unauthorized Access

Even if virtual cards in travel are created for a single or a limited number of transactions, they are also exposed to fraud threats. In a virtual card, for instance, the details of the card can be stolen during a transaction. Then it can be used before the card expires. This risk can be minimized by employing encryption technologies and secure networks for all transactions.

2. Limited Fraud Detection on Some Platforms

Virtual cards are used on various platforms, but not all offer the same measures of fraud identification. If a supplier or a travel agency fails to innovate, fraud may be committed, and its occurrences will not be detected. On the same scale, companies that regulate virtual cards in traveling today should align with service providers offering reliable fraudulent check mechanisms.

3. Human Error in Configurations

Application settings include the following features or parameters for virtual cards – transactional limits, validity, and usage regulations including expiry dates. Mistakes in these configurations put the card at risk for misuse. Such risks can be mitigated by ensuring the staff are well trained in using the tool and how to create and manage the virtual cards.

4. Dependence on Technology

Virtual cards in travel are electronic products. Therefore, their security is vulnerable and depends on technological applications. H – another threat emanating from the service provider’s side risks card details. These include systems down, software bugs, or a data breach. Any business using virtual cards must select reliable service providers whose security level corresponds to the required security level to prevent the intrusion of hackers.

5. Phishing Scams and Social Engineering

Sometimes cybercriminals may try to access virtual card details by sending fake emails, and or posing as superiors within an organization. Such scams can affect travel agents, hotel workers, or any person who comes into contact with bookings. To prevent this, companies should also ensure posting information regarding phishing tries and how the team can avoid them. You can ask consultation from a trusted travel and hospitality software development company.

6. Supplier Fraud

The danger in selecting travel services to purchase is that one might be dealing with con artists. There are risks of losing money since a virtual card may be charged by a fake service provider. These risks could be relatively minimized by working with approved suppliers and checking their authenticity.

Why Virtual Cards Are Still Safer

Nonetheless, virtual cards in travel are among the safest payment tools currently in the world. Because they are disposable and have programmable features. They offer protection that plastic cards or common corporate identities cannot. Consequently, small businesses remain cautious about which virtual card providers they select. They enforce strict controls regarding using virtual cards within their operations, so secure transactions are possible.

Thus, there are certain security issues related to virtual cards in travel. And yet these issues do not seem to be very critical. When using virtual cards, travel businesses can be safe from fraud and breaches. They incorporate high-security features that promise businesses to adopt such solutions.

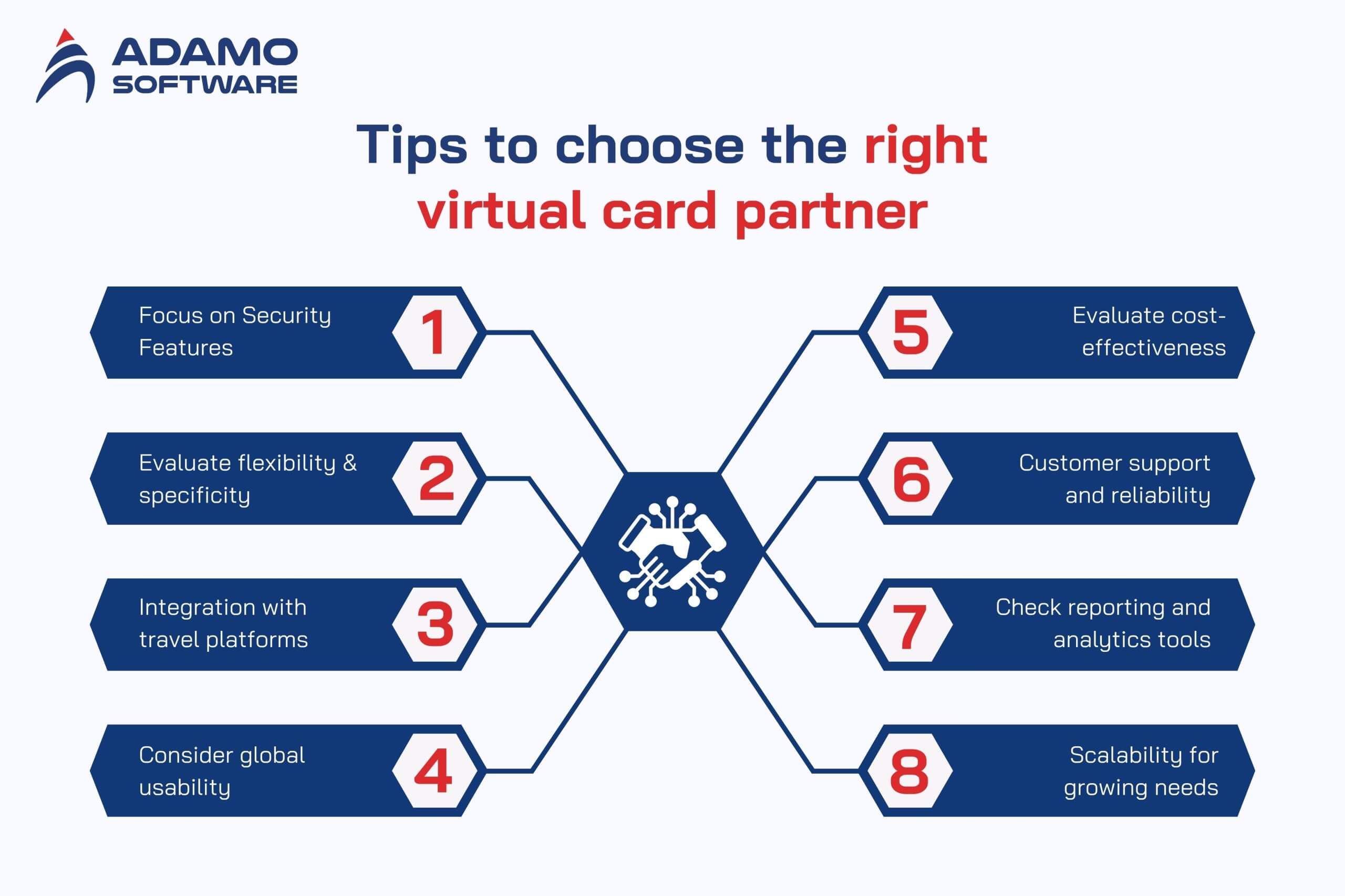

VII. Tips to choose the right virtual card partner

Approaching the right virtual card provider is critical to getting the most out of virtual cards in travel. There are several providers out there, and businesses plus travelers cannot simply rely on the convenience of the provider they will be using. Here are some practical tips to help you choose the best virtual card partner:

1. Focus on Security Features

The first effect or criterion to consider when selecting a virtual card partner is security. Choose providers that use more features than the basic ones. They are encryption, various fraud protection techniques, and constant monitoring. These features will help safeguard your virtual cards in travel against unauthorized access, online fraud, and other cyber vices.

2. Evaluate Flexibility & Specificity

There are various requirements that various companies have concerning virtual cards in travel. Ensure that the provider offers options for customization including limiting the amount of money spent, putting the card’s usage in expiry date, and preventing its use in certain categories of merchants. This flexibility helps you guard the finances keenly while at the same time ensuring flexibility.

3. Integration with Travel Platforms

Hence, the best virtual card partner should easily sync with the most used travel booking sites. They should have adequate expense management applications. Contrary to the traditional one, this integration makes such processes as flight booking, hotel reservation, and payment tracking system-friendly used in the service of Virtual Cards in Travel.

4. Consider Global Usability

If your business requires you to travel internationally, ensure you select a provider who accepts this form of payment globally. Verify if the current virtual cards for travel accept major currencies and are accepted by airlines, hotels, and other travel-related merchants.

5. Evaluate Cost-Effectiveness

Compare their fees and their transaction charges. That is why some virtual card partners may have lower fees for frequent users or provide even better conditions for those who need to pay for numerous services. When dealing with cost, ensure it corresponds to the amount of benefit you are likely to get.

6. Customer Support and Reliability

Peculiar attention should be paid to customer support in the case of travel related to managing virtual cards. Select a partner with good, helpful support staff that can attend to queries relating to technicalities or transactions at any one time.

7. Check Reporting and Analytics Tools

It is crucial to regularly and efficiently report and analyze expenses and discover trends. A good provider should provide comprehensive and detailed reports. This enables the business organization to better manage traveling costs and the status of the virtual cards used for traveling.

8. Scalability for Growing Needs

Your partner in virtual cards should be able to handle more transactions at a go as your traveling requirements rise. Seek providers who have well-scaled solutions to fit your future needs without sacrificing the speed and security of the platform.

A better understanding of the need for security, and flexibility. Customer support will help businesses make the most of virtual cards in travel. But with a good travel partner, one can request properly. This simplifies payment and expenses and just generally makes the whole trip nicer.

VIII. Ready to make a powerful end-to-end payment solution with Adamo Software?

Adamo Software focuses on developing outstanding and unique high-level payment solutions appropriate for your business. We understand how to design and develop standalone platforms. We can guide companies on how best to use virtual cards optimally within the context of travel. Adamo presents efficient, reliable, easy-to-use solutions that meet multifaceted organizational demands.

By partnering with us at Adamo Software, your business will remain strategic in this highly competitive travel sector. Our innovative approach makes Virtual Cards in Travel an essential element bridging contemporary technology and your needs. Choose us as your payment system redesigned today to achieve smooth, fast, safe, and accurate payments.

It is time to move to the next level of innovative and improved industry. Head to Adamo Software to learn more about how we can transform your business through our virtual cards in travel knowledge!

FAQs

1. What are virtual cards in travel?

In travel, virtual cards are virtual payment cards for secured and efficient monetary transactions in the travel market. These are electronic and are being produced for use once or for a particular transaction. They help to avoid revealing peoples’ financial details by concealing them and Payment control – particularly on travel expenses such as a ticket, accommodation or even hiring a car.

2. How do virtual cards operate in travel?

Virtual cards in travel give a new card number every time it conducts a transaction. These numbers are connected to a main account, but their use can be limited by certain amounts, and the validity and usage of the numbers can also be limited. Unlike ordinary credit cards, where an account is created at the onset of the program. The virtual card is generated only when a travel booking is made. The travel service provider is paid through the virtual card.

3. Are virtual cards in travel accepted everywhere?

As virtual cards are becoming popular, nearly every renowned airline, hotel, and travel agency accepts them today. Nevertheless, the website visitor must check the individual acceptance of this payment method. Since there might be some small vendors or companies that do not accept this type of payment.

4. Are the virtual cards in travel usable again?

Historically, virtual cards in the travel space have been one-click cards intended for one specific transaction. However, some providers provide multiple and reusable virtual cards for particular purposes, say, travel expenses only. Specifically, single-use cards are useful to provide security and avoid counterfeit transactions.

5. Are virtual cards secure for travel payments?

Indeed, virtual cards used in travel are very secure. They employ tokenization to obscure crucial information. Those created tend to be so with specific requirements such as daily spending and validity period. Some special attributes make them so effective for avoiding fraud or charges made while traveling while booking a flight.