Travel Payment Integration: Benefits, Challenges & Implementation Guide

Travel payment integration is becoming essential for travel companies. Let’s learn about this with Adamo Software!

Currently, the travel industry has been growing with different types of tourism, exploration, and experience. Travel businesses must focus on payment options to satisfy varying tourist needs and enhance their experience. Travel payment integration enables the acceptance of multiple payment sources, such as credit cards, e-wallets, and cryptocurrencies. However, when implementing this, businesses may face many challenges. Let’s learn about the implementation of travel payment integration with Adamo Software!

Through this blog post, you will have an insight into the definition of travel payment integration, the benefits of integrating payment systems, and how payment integration works in the travel field. Besides, we also provide you with some common challenges in travel payments, how to integrate a payment gateway into your travel platform, and some frequently asked questions. All information has been thoroughly researched and updated to the latest trends. So, let’s read our post and find some useful information!

I. What is travel payment integration?

Travel payment integration is the process of connecting payment systems with travel platforms so that transactions can be safe and seamless. This integration simplifies tourist travel payment processing. Payment integration supports diverse options like credit cards, e-wallets, and bank transfers. This brings convenience to both businesses and customers.

The integration not only connects different payment portals with the agency’s website, booking portal, travel mobile app, and web applications but also ensures security and financial policy compliance. Travel businesses should comply with PCI DSS for customer card security. PCI DSS ensures secure card transactions and data protection.

An effective travel payment integration must be able to handle cross-border transactions. This allows travel agencies, tour operators, and other travel companies to accept payments from customers in different regions without currency or transaction method barriers. For seamless international transactions, the system requires multi-currency support, automatic exchange rate features, and compatibility with global payment gateways. The system also needs flexible payment provider integration for diverse market needs.

In general, travel payment integration links payment systems to travel platforms, providing secure and convenient transactions. Effective integration requires cross-border support, security compliance, and multicurrency capabilities for global travel.

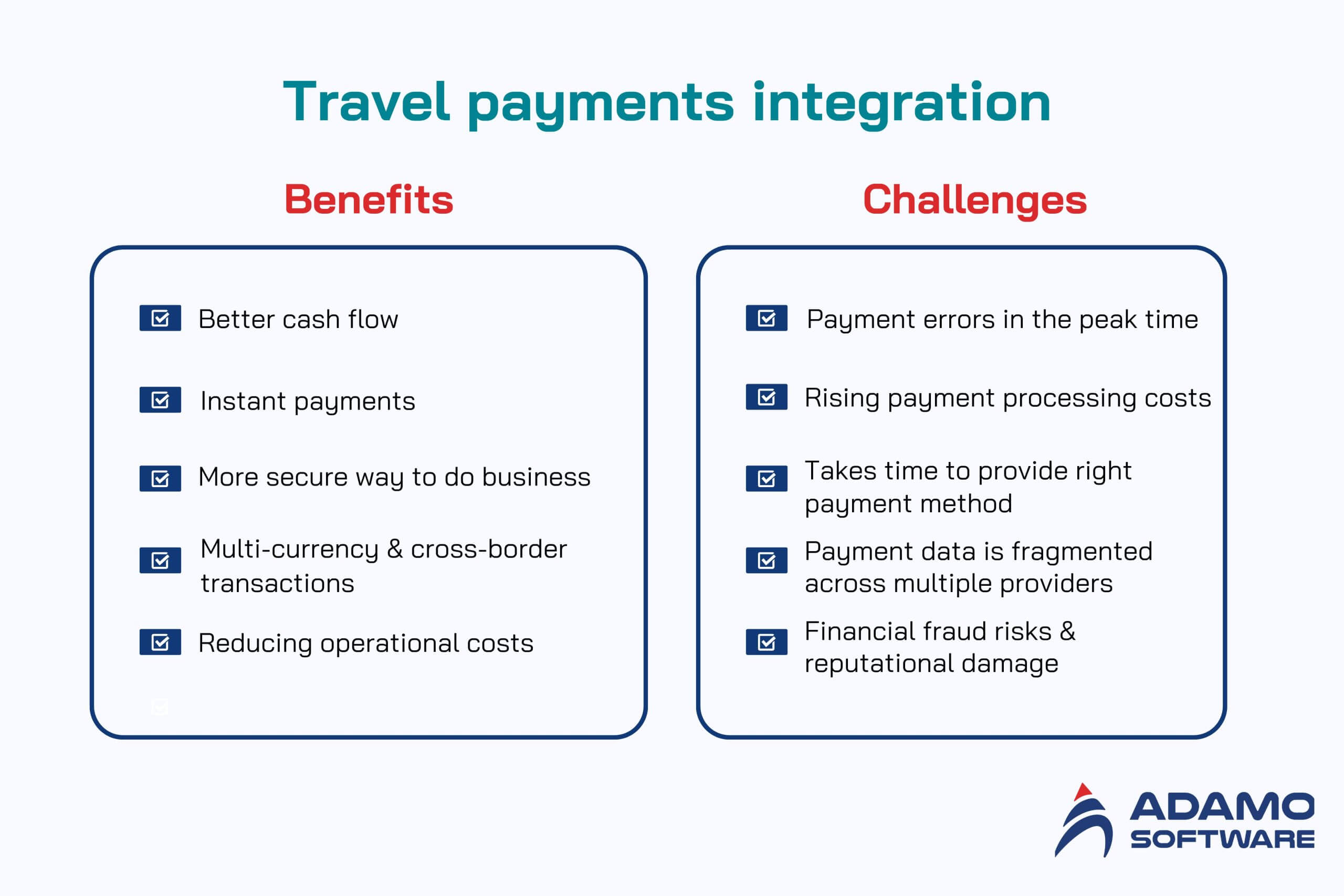

II. Benefits of integrating payment systems in travel agencies

Travel payment integration brings many benefits to travel agencies, tour operators, and other businesses working in the travel industry. Let Adamo Software discuss these in detail.

Better cash flow

By integrating payment systems into existing platforms, travel agencies can effectively manage their cash flow through transaction process automation. Instead of manually processing the payments from customers, travel payment integration helps businesses receive money quickly and easily track cash flow in and out. This optimizes financial management, reduces late payments, and stabilizes business capital.

To optimize cash flow management, you may provide discounts for immediate payments or establish a flexible payment plan. In addition, you can also establish clear cancellation policies upfront for efficient business operations.

Instant payments

With travel payment integration, the transactions can be immediately processed without waiting for a long time. Your customers can pay instantly when booking flights, hotel rooms, or tours and receive confirmation right away without contacting the customer care department. Whereas you can receive money immediately without having to worry about manual payment confirmation. This increases the transaction speed and enhances customer experience.

Thanks to the instant payments function from the travel payment integration, your business can maintain stable cash flow and avoid lost revenue due to canceled or delayed transactions. Real-time payments enable you to control revenue, track sales accurately, and improve financial planning.

Besides, travel payment integration also helps to reduce risks related to disrupted transactions or technical issues. By integrating with different virtual cards in travel, travel agencies can benefit from rapid transaction processing, minimizing payment errors and ensuring all transactions are carried out smoothly. This helps to optimize business efficiency and build trust with customers so that they can feel secure when booking travel services online.

Providing a more secure way to do business

Travel agencies, tour operators, and other businesses in the travel industry must focus on payment security. Travel payment integration can help them ensure the security of each transaction, protect customer payment information, and avoid fraud risks. Advanced payment systems combine payment diversity with strong fraud and cyberattack protection.

Your business must comply with international security standards, especially PCI DSS, to protect transactions. As mentioned, the PCI DSS standards serve to secure payment card transactions and to safeguard cardholder personal information. This regulation protects payment card information, mitigating the risk of theft or unauthorized utilization.

By complying with the PCI DSS regulation, you can ensure the encryption and secure processing of customer card data, which significantly reduces the potential for information breaches.

Besides regulation compliance, the travel payment integration may take advantage of data encryption and two-factor authentication (2FA) technology to enhance transaction security. Data encryption secures payment information during transmission, preventing data theft. Meanwhile, two-factor authentication requires users to confirm their identity with an additional method, such as an OTP (One-Time Password) code or biometric verification. This reduces the risk of unauthorized transactions even if login information is stolen.

Supporting multi-currency and cross-border transactions

Travel payment integration allows travel agencies to support multi-currency and cross-border transactions. This allows tourists to pay in their preferred currency without manual conversion. The payment systems will automatically update exchange rates in real-time, ensuring transparency and minimizing costs when transacting internationally. Thanks to this, travel agencies, tour operators, and other travel companies can easily expand globally thanks to the removal of payment barriers.

Reducing operational costs

Thanks to travel payment integration, businesses can reduce costs related to manual transaction processes. By automating payment confirmation, reconciliation, and management, businesses can optimize resource allocation and prioritize the enhancement of service delivery.

Overall, thanks to the above benefits, travel payment integration can help travel companies improve operational efficiency. Besides, this creates a fast, safe and convenient payment experience for customers, thereby increasing customer trust and using the services.

Ready to Outsource?

Get top-tier IT talent without the hassle. Contact us now!

III. Common challenges in travel payments

While travel payment integration offers many benefits, it also comes with various challenges. Let’s explore some common issues that you may face when integrating the payment systems into your existing platforms with Adamo Software!

Losing customers due to payment errors in the peak time

During peak travel seasons or major promotions, the number of customers booking flights, hotels, and tours can surge. High transaction volume can overload the payment system, causing delays or errors. If customers cannot pay for the services immediately, they may become frustrated and abandon the booking. A disrupted transaction can make them doubt the security of the platform or fear losing money without receiving a booking confirmation. This increases the risk of customers switching to competitors with more stable payment systems.

Besides affecting customer experience, the errors in payment also contribute to reducing revenue. When a transaction fails, customers may not return to trying again, especially for highly competitive services such as low-cost airfares or limited time offers. Furthermore, customer service teams must handle more support requests, increasing operational pressure and management costs.

To improve this situation, when conducting the travel payment integration, you may want to invest in a digital wallet in travel that is flexible, can handle high loads, and has a backup plan in case of problems. In addition, multi-channel payments ensure smooth transactions by distributing load during peak times.

Rising payment processing costs

The rise in payment processing costs is also among the challenges you must face when implementing travel payment integration. Transaction fees from payment gateways, banks, and financial service providers can add up over time. Especially if your company focuses on international customers with many international transactions, you may incur additional foreign exchange fees and other surcharges. These costs directly impact the profits of your company.

To optimize costs and maintain profits, you may want to compare and negotiate with payment service providers. By comparing and negotiating, you can find different service providers that suit your business model. Besides, instead of depending on one payment platform, you can integrate with various payment portals and choose the most suitable option for each type of transaction.

It takes too long to provide the right payment method.

Your travel payment integration may result in customer suspicion and distrust due to the long payment processing time. Integrating new payment methods often takes time due to complex processes, high-security requirements, and differences in financial regulations from region to region. Failure to update can lead to customer loss to competitors with flexible payments.

To deal with this issue, you can use multiple platforms like Stripe, PayPal, and Apple Pay simultaneously, instead of individual integrations. Besides, flexible API payment system integration helps to shorten your travel payment integration deployment time.

Payment data is fragmented across multiple providers.

Payment data fragmented across multiple providers is also among the difficulties of travel payment integration. Many businesses use multiple payment service providers to support different markets. However, this can result in data fragmentation, complicating revenue management. Decentralization of data may hinder financial management efficiency. Travel businesses can use a centralized platform to simplify transaction tracking and analysis.

Financial fraud risks and reputational damage

Payment fraud is a major concern when you implement travel payment integration. Fraudulent activities like stolen card use and fake bookings cause major financial harm. Additionally, poor data protection may lead to lost credibility and legal issues. You can use AI and machine learning to detect and prevent fraud.

In general, travel payment integration is not only a technical problem but also involves financial management and data security. Businesses need to have a clear strategy to optimize payment systems, minimize risks, and improve customer experience.

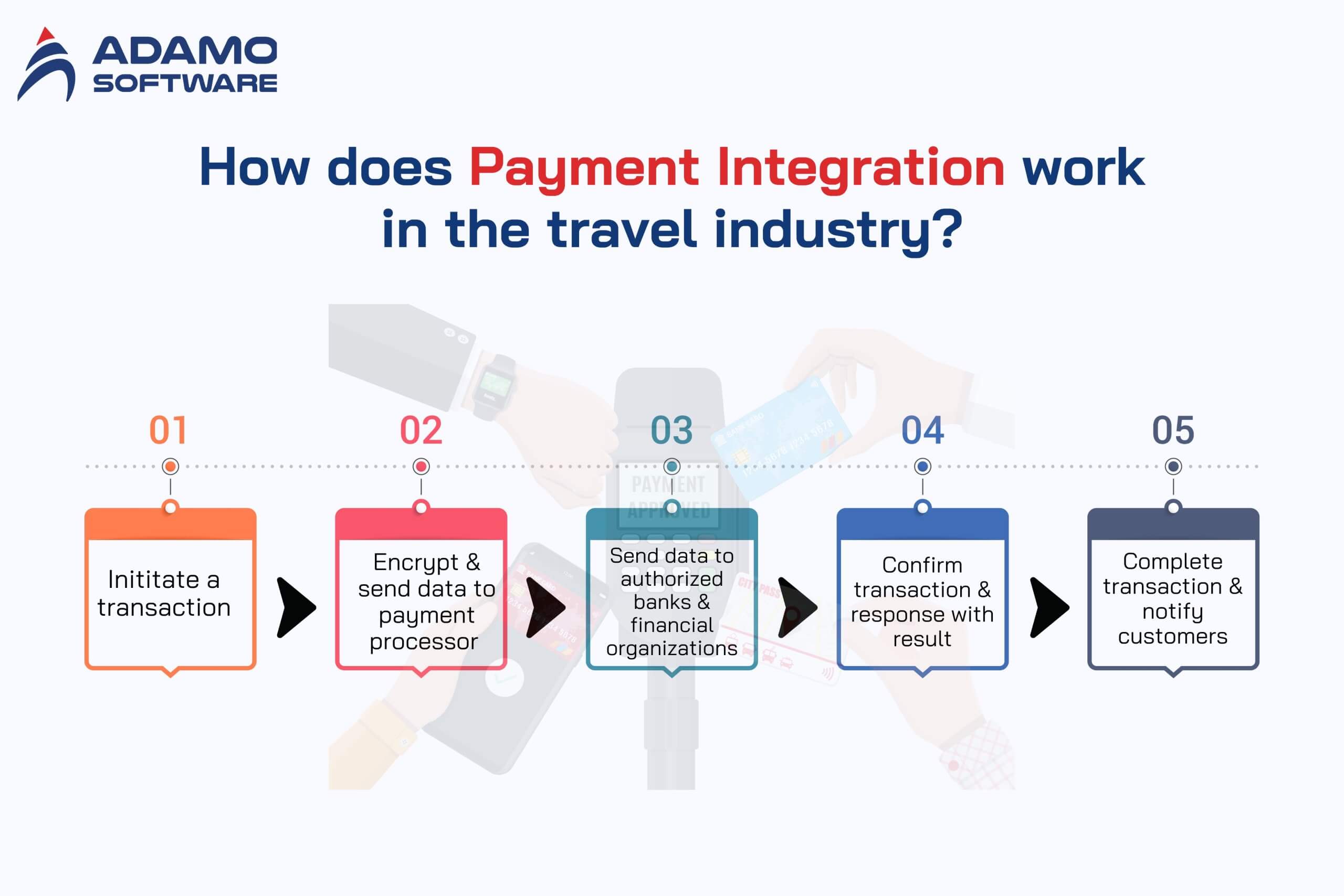

IV. How does payment integration work in the travel industry?

Travel payment integration helps businesses process transactions between customers, travel agencies, and service providers quickly, securely, and seamlessly. The integration must follow a strict process that ensures transactions are secure and fast. Let Adamo Software discuss some basic steps in the integration process.

Initiating a transaction

When customers pay for their services or deposit money into the system, the payment system will automatically collect transaction information. This data includes the amount, payment method (credit card, e-wallet, bank transfer, etc.), customer information, and booking details (airline tickets, hotels, tours, etc.).

Encrypting and sending data to the payment processor

The next step of the travel payment integration is encrypting and sending data to the payment processor. The system’s API employs encryption to safeguard transaction data before sending it to the payment processor, ensuring data security. The payment processor is responsible for checking the transaction information and transmitting the data to the relevant bank or financial institution.

Sending data to authorized banks or financial organizations

As mentioned, upon checking the information, the payment processor will send the data to authorized banks or financial organizations and check the validity of the transaction. This is an important step in the travel payment integration that allows travel businesses to ensure that the customer’s card or account has sufficient balance and is not blocked due to security issues.

Confirming the transaction and responding with the result

If the transaction is approved, banks or financial organizations will send a confirmation code back through the payment gateway. This code confirms transaction success and enables further processing. If the transaction is rejected, the system will send an error message and ask the customer to try again with another method or check the payment information.

Completing the transaction and notifying the customers

After receiving the confirmation code, the system will update the transaction status, send a notification to the customer, and grant access to the booked service. For example, automated confirmation emails with booking details are sent upon successful hotel payment.

In general, travel companies can offer secure, seamless, and convenient global payments through this process. This not only enhances customer satisfaction but also optimizes operational processes, reduces risks, and improves business performance.

V. How to integrate a payment gateway into your travel platform

As mentioned, travel payment integration speeds up transactions, improves customer experience, and increases revenue. To ensure this process goes smoothly, let’s consider the steps below.

Defining your payment needs

Before implementing travel payment integration, you need to identify your payment needs. This includes identifying the popular payment methods that customers expect, such as credit cards, e-wallets, bank transfers, and cryptocurrencies. Additionally, the scope of operations, whether they are domestic or international transactions, and security and financial compliance requirements must also be focused on. Assessing needs at the outset helps you choose the right solution and avoid unnecessary costs during the implementation process.

Comparing and choosing payment service providers

Your travel payment integration cannot be completed without comparing and choosing payment service providers. You may want to research and compare payment service providers to find optimal solutions. Some important factors to consider include transaction fees, multi-currency support, security features, and the ability to integrate with existing systems. Popular platforms such as Stripe, PayPal, Adyen or local solutions can be considered depending on the target market.

Setting up travel payment integration

After selecting the right providers, you will proceed to integrate the payment system into your company’s existing platforms. This can be done through the API provided by the provider. During this payment processing for travel industry, you need to ensure that the system is capable of processing payments automatically, supporting refunds, and protecting customer data according to security standards.

Thorough testing before deployment.

Before deploying the travel payment integration, you must conduct comprehensive testing to ensure that all transactions are accurate and secure. Testing should cover diverse payment methods, refunds, error handling, and processing speed. If errors are detected, you must optimize and fix them immediately before putting the system into official operation.

Implementing and monitoring

After successfully testing, you can now deploy your travel payment integration for your customers to use. However, continuous monitoring is important to detect and promptly handle problems that may arise. You should analyze transactions, track failures, and improve payment experience based on feedback. In addition, the system needs regular updates for security and payment trend compliance.

VI. Contact with Adamo Software for Travel Payment Integration

Are you looking for a reliable partner that can help you with your travel payment integration? As one of Vietnam’s leading technology companies, Adamo Software can support you with this. We are a trustworthy partner that can help you integrate secure, efficient payment systems and optimize customer experience. With extensive expertise in travel software development, we provide customized solutions to suit each business model. Let’s see how we can help you.

Integrating multiple payment gateways

We support connecting with various payment providers such as Stripe, PayPal, Adyen, Visa, and Mastercard, as well as local e-wallets and payment gateways. This helps you expand your ability to accept payments from customers globally.

Ensuring security and compliance

Adamo Software can help you deploy PCI DSS-compliant solutions and encrypt payment data. Besides, we also integrate anti-fraud features such as AI-based fraud detection, and 3D Secure.

Supporting international payments with multiple currencies

We build systems that can automatically convert foreign currencies, optimize exchange rates, and integrate with international payment gateways. Thanks to this, you can expand your business without currency barriers.

Providing long-term technical support and maintenance

Besides supporting the deployment of your travel payment integration, we also provide long-term technical support and maintenance, ensuring that the payment system always operates stably, and safely and is updated with the latest technology trends. Our technical team is available 24/7 to help troubleshoot quickly and optimize system performance when needed.

Still hesitating whether to choose Adamo Software? Let’s contact us for more detailed information!

FAQs

1. Do payment gateway APIs integrate with travel software?

Yes. Travel agencies can achieve high security with expert API integration. APIs connect to diverse systems, such as booking portals, travel management, hotel reservations, etc.

2. What benefits do payment APIs provide for travel platforms?

Payment gateway APIs ensure secure online transactions for agencies. Additional advantages include rapid payments, international currency, and other features.

3. Do these APIs secure digital wallet payments?

Yes. Payment gateway APIs can protect travel systems from fraud.

4. How to ensure safety when integrating payments?

Businesses should choose solutions that comply with security standards such as PCI DSS, integrate two-factor authentication (2FA), and use AI to detect fraud. Additionally, data encryption and customer information protection are also important factors.

5. How can Adamo Software support payment integration?

Adamo Software provides customized payment integration solutions, supports connection with multiple providers, ensures security, and optimizes system performance. In addition, we also provide 24/7 maintenance and technical support services to ensure stable payment system operation.