Digital wallet in travel: Explore the secret sauce for customer loyalty

Learn how a digital wallet in travel can be the secret sauce for customer loyalty, offering convenience and security for travelers worldwide.

Our digital wallet has become a vital tool for today’s travel environment because of how fast our world moves. People use digital wallets to pay more easily and safely when they’re outside. They can enjoy simpler transactions because this technology gives multiple payment options safely under one system.

With a digital wallet in travel, travelers can view their account balance and spend money securely on any device. Digital wallets include extra budget tracking and local information, which makes travel easier for users.

When companies understand how customer loyalty drives growth, they are more likely to use digital wallets to create better travel experiences. This article examines how a digital wallet in travel simplifies experiences and plays a unique role in building lasting customer bonds. Read on to find out about digital wallet uses and travel payment integration that help travel companies succeed.

I. What is a digital wallet in travel?

A digital wallet for travel uses electronic technology to make payments without physical cards. You can install the app on your phone or smartwatch, including Apple Watch, to make direct payments through your device. Digital wallets let users store financial cards plus tickets and ID cards to save them space and make payments more convenient when traveling. Each digital wallet in travel comes with a unique name. For Apple users, it’s Apple Pay, and for users of Android phones, it’s either Google Pay or Samsung Pay. You can get these digital wallets directly through the App Store and Play Store applications.

II. Main types of digital wallets in travel

Digital wallet apps

Discussions of digital wallets in travel often feature something known as B2C applications. This kind of app lets users shop online, pay without contact at retail outlets, and send money to friends. The leading digital wallet apps are Apple Pay, Google Wallet, and Samsung Wallet. You can also keep tickets, IDs, driver’s licenses, gift cards, and boarding passes in these digital wallets.

Closed-loop wallets

Closed-loop wallets run their operations within their own unique system space. Uber Cash and Walmart Pay services are examples of this system. To improve travel experiences, airlines develop personal digital wallets that function as loyalty programs that allow users to purchase flights and onboard services. These personalized digital wallet in travel options enhance customer convenience. Online travel agencies (OTAs) deploy one integrated system for better reward administration while allowing instant customer refunds. These travel-related digital wallets help increase customer satisfaction by bringing different services into one system.

B2B wallets

Digital wallets made for business-to-business transactions help travel providers and suppliers exchange money. Despite its rarity among digital wallets, PayPal acts as an online shopping platform and offers business services to clients. Businesses can use these digital wallet in travel solutions to handle their travel costs effectively.

Learning about each digital wallet type will help you fully use their features. Each digital wallet in travel offers specific features that can boost user experience by doing separate jobs.

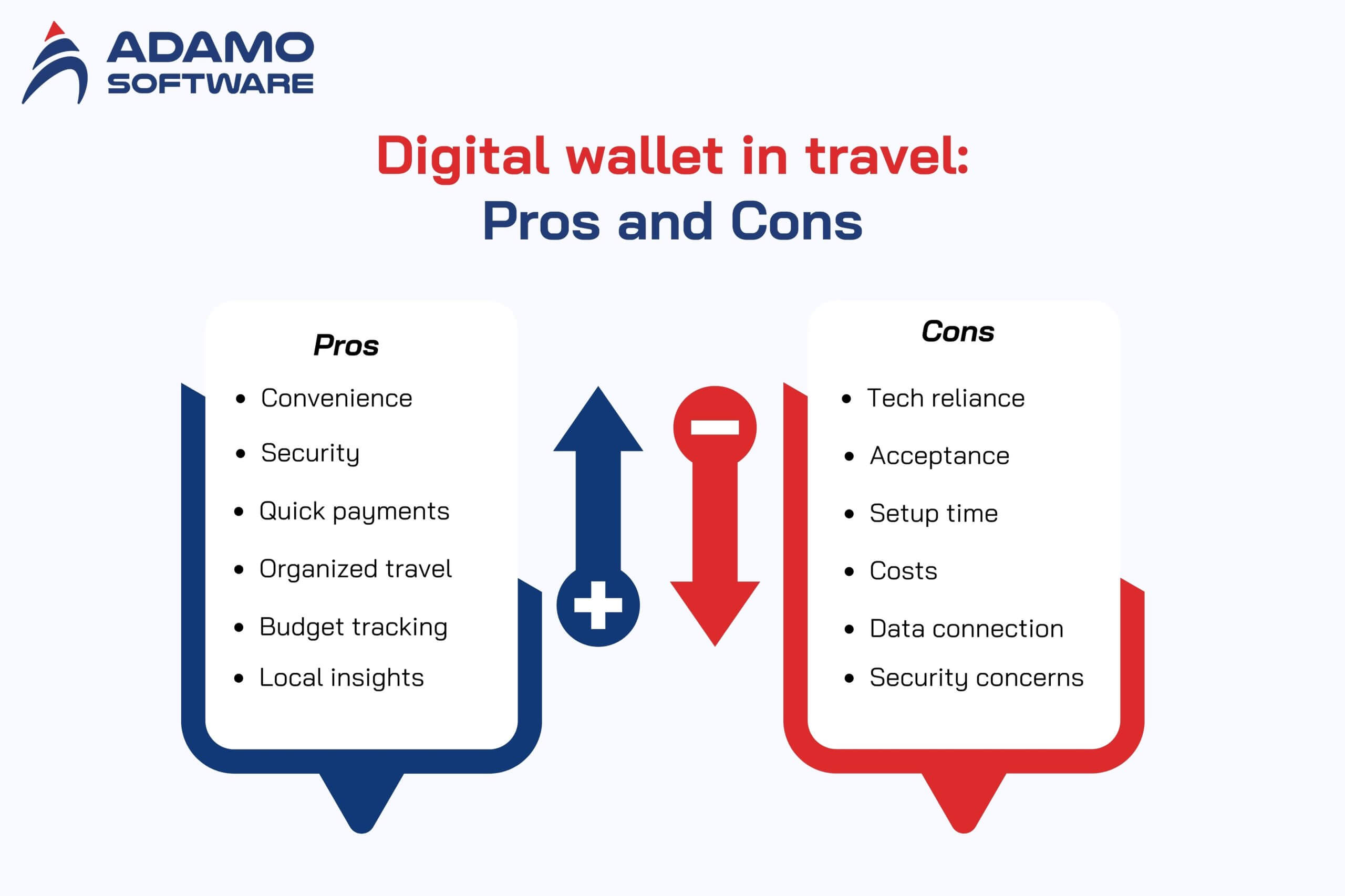

III. Pros and Cons of using digital wallet in travel

Using a digital wallet in travel offers clear benefits and problems travelers should know about. Travelers who understand digital wallet systems can make better payment choices when they travel.

Pros

- Convenience: A digital wallet turns a traveler’s phone into a secure locker with essential payment information. Your digital wallet in travel makes life easier during airport and city travel through unfamiliar areas.

- Security: Digital wallets include upgraded security functions that shield personal data through encryption or tokenization. The security features of a digital wallet in travel protect travelers by helping them avoid currency theft or card loss on their foreign trips.

- Quick payments: Digital wallet transactions move faster than standard payment systems do. Travelers can pay instantly everywhere they go instead of using cash or cards that slow them down.

- Organized travel: A digital wallet lets you keep all your travel documents, including flight passes and ID cards, together in one place. The system simplifies travel management because it centralizes all important documents into one place.

- Budget tracking: Digital wallets include systems that show users their spending details. The system lets people monitor their travel costs right when they occur, which helps them stick to their budget plans better.

- Local insights: Digital wallets use user preferences and real-time location to suggest restaurants and attractions that improve the travel experience.

Cons

- Tech reliance: To use a digital wallet in travel, users need a smartphone that works for payments while maintaining battery power. This means digital wallets stop working when technology fails or the device loses electrical power.

- Acceptance: Digital payment systems are not recognized everywhere globally. When digital wallet acceptance is limited in certain locations, travelers must rely on physical cash or cards for payment.

- Setup time: Setting up your digital wallet demands time and work to connect your bank account with identity verification. Many people find these steps too hard if they know little about computers.

- Costs: A few digital wallets add fees to selected transactions and features. People planning trips should know about the fees before choosing a wallet to handle their travel money

- Data connection: You need an internet connection to use most digital wallet features. When internet access weakens, people will struggle to use their money and make digital payments.

- Security concerns: Although uncommon, digital wallets still have a threat of exploitation or hacking. Users must take regular steps to shield their sensitive data when carrying out transactions on the web.

A digital wallet in travel provides better security and convenience while traveling, but travelers should carefully consider all risks and benefits. When travelers know which benefits and risks their digital wallet in travel offers, they can use the system better during their travels.

IV. Essential features to consider in a digital wallet while traveling

Using a dependable digital wallet brings better travel experiences when you visit other countries. When you use a digital wallet, you can stay safe from theft and save time by not using cash. These digital wallets work with various currencies, including digital currencies, to help you handle your funds efficiently from one country to another. Also, digital wallets now support cryptocurrency cashouts, so you can have more adjustability with your money usage freely while traveling.

To fully take advantage of a digital wallet in travel, remember to look for these essential features:

Security

Effective protection and security must be present in your transactions. Before selecting a digital wallet, confirm its security features for encryption. Check for tools like 2FA and protective measures that help erase data from your device in case of loss or theft.

Compatibility

Determine how many different currencies this wallet supports for your use. When you plan to visit many countries during your trip, remember to consider this function when picking up your digital wallet.

User interface

Find a wallet system that clearly shows its features and functions and handles transactions without problems. In other words, look for one with an easy-to-navigate UI. Take time to learn all menu options and their functions, plus how your wallet works with multiple currency types. A simple and easy-to-use interface supports better transaction performance.

Transaction fees

You must know digital wallet fees when making your travel decision. Keep an eye out for transaction costs when moving money across borders, fees charged by your bank, and import taxes levied on overseas purchases. Knowing expenses ahead will prepare you for unexpected fees.

Support and accessibility

A digital wallet performs better in travel when technical support works properly. You should find no barriers in contacting customer support whenever and wherever you use your digital wallet. Check if you can conveniently get money using local ATM networks and additional payment systems anywhere you travel.

Select a digital wallet for travel that meets most of these important features to get the best results from your experience.

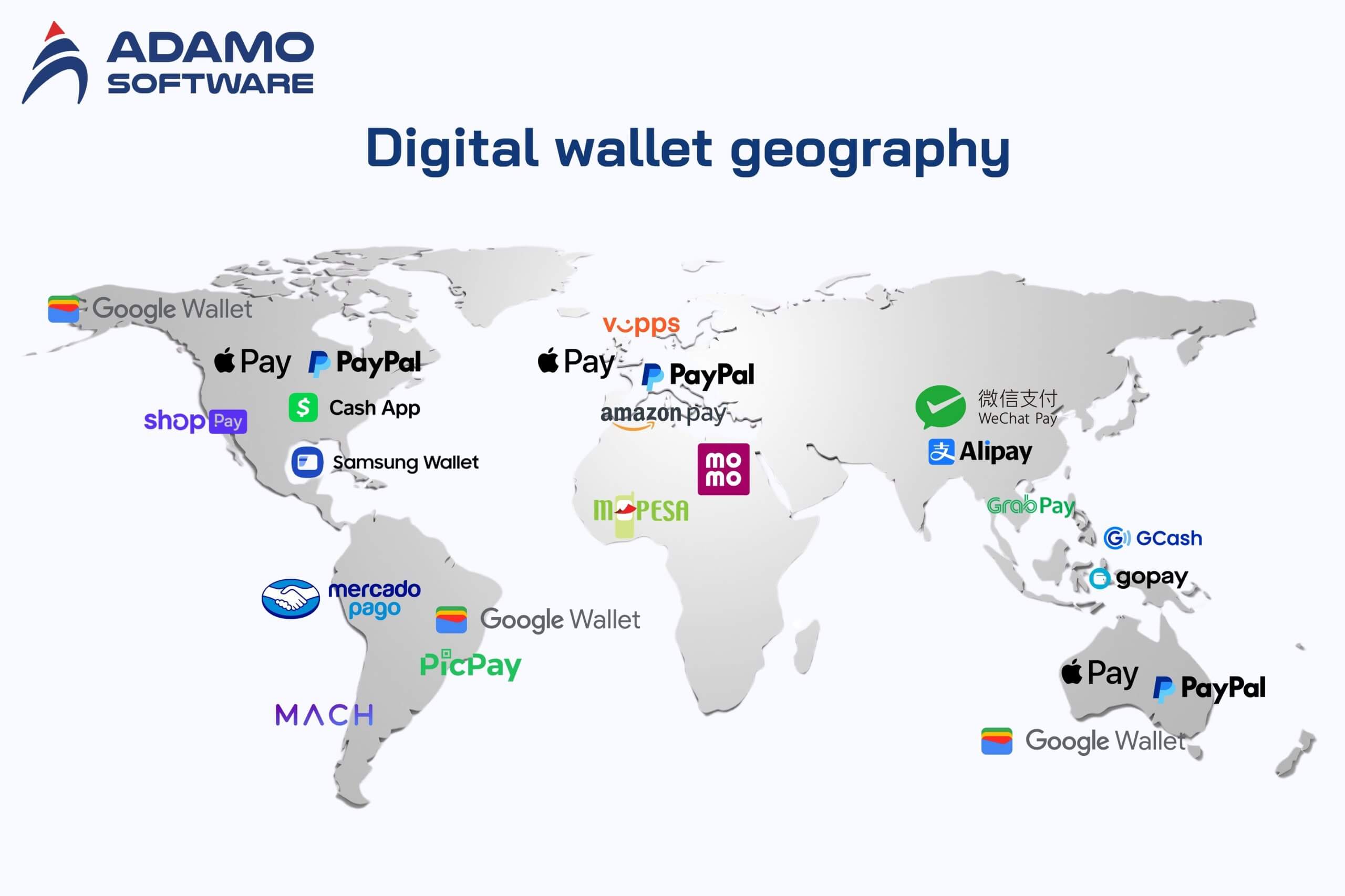

V. Digital wallet geography: Location distribution

1. By region

Digital wallet in travel usage depends on its features and bank account requirements, which vary by country. Leading global digital wallet providers Apple Pay and Samsung Wallet find it hard to win users in areas where basic banking services remain scarce.

The choice of operating system for the device where you install the wallet application also determines how well it works. Android remains the dominant mobile OS for users in India, Brazil, and Mexico because they find it works better than Apple Pay. On the contrary, iOS dominates the mobile payments market in countries like the US, Japan, Canada, Australia, and the UK. These are the regions with substantial spending power among their citizens.

A GPR survey indicates that three major players primarily serve North America. Here, users can make payments through PayPal, Google Wallet, and Apple Pay. Shopify’s Shop Pay and Cash App Pay also recently moved into the payments landscape across North America, further advancing the role of the digital wallet in travel.

PayPal shows a strong market position across Belgium, France, Germany, Italy, Spain, the UK, and other European countries. International payment providers Google Wallet and Apple Pay are also some common choices. Companies targeting specific markets must include local payment apps such as Lydia in France and Vipps MobilePay in Denmark and Norway in their strategies, showing how diverse the digital wallet in travel landscape is across regions.

Mercado Libre operates Mercado Pago Wallet as Latin America’s most popular electronic payment method. Android phone penetration enables global brands, including Samsung Wallet and Google Wallet, to expand their services successfully in Brazil and Mexico. Brazil stands out as the only country that allows Google Wallet to make QR-code payments. Yet, MACH Pay controls the Chilean market, and PicPay leads in Brazil, both critical players in the digital wallet in travel ecosystem.

People in Africa and the Middle East adopt mobile wallets at higher rates since most do not use traditional bank accounts. Users in this region made about 68% of all mobile transactions worldwide during 2022. These wallet app statistics show progress toward new payment methods, though not all payments came through these platforms. M-Pesa stands as the top choice in Africa, while MoMo from MTN leads in mobile wallets across the MEA region.

The digital wallet in travel has expanded fast throughout the Asia-Pacific region, including China, India, and other fast-developing nations. GrabPay functions as a typical digital wallet in Southeast Asia, and its services reach 60% of people without traditional banking options. The Chinese digital wallet market consists of only two major players, Alipay and WeChat Pay, both controlling 90% of online payments.

Strong local brands are also seen in some countries. MoMo stands first in Vietnam, GoPay dominates Indonesia, and GCash leads in the Philippines alongside Paytm’s stronghold in India. Additionally, Google Wallet (now Google Pay) serves many customers since 73% of online shoppers pick this payment method.

In Australia, Apple Pay and Google Wallet are the preferred choices for storing digital payment methods during travel. Consider various factors beyond geography when planning digital wallet integration, as these elements are only part of the overall system integration process.

2. Global vs. local wallets

Companies must combine different wallet options for financial services in today’s worldwide payment environment. They should offer digital payment methods worldwide through global options like PayPal, Apple Pay, and Google Wallet. Also, local systems should be incorporated, like iDEAL in the Netherlands and Bancontact in Belgium. Directing payment options to more types of customers through multiple options will lead to better customer satisfaction across markets.

Using both wallets for market coverage

Global and local wallets give businesses effective ways to serve customers in many different regions. International payment solutions work well for worldwide tourists, but local digital wallets help users in their home regions. When it comes to digital wallet in travel services, businesses should prioritize global compatibility and include local payment options to enhance customer satisfaction.

Considerations for choosing a target market

Pick digital wallets that match the unique payment preferences of each market area you serve. Adding local payment choices to European markets alongside worldwide wallets lets customers make payments in their preferred way. Digital wallet in travel integration will succeed better if you understand how local consumers pay and behave. When your services match customers’ wants and preferences, they enjoy better experiences and return more often.

Combining local and global wallets in our business strategy brings better market reach and higher customer satisfaction. Businesses that support international and local wallets and match them to regional preferences can create payments that fit customers everywhere.

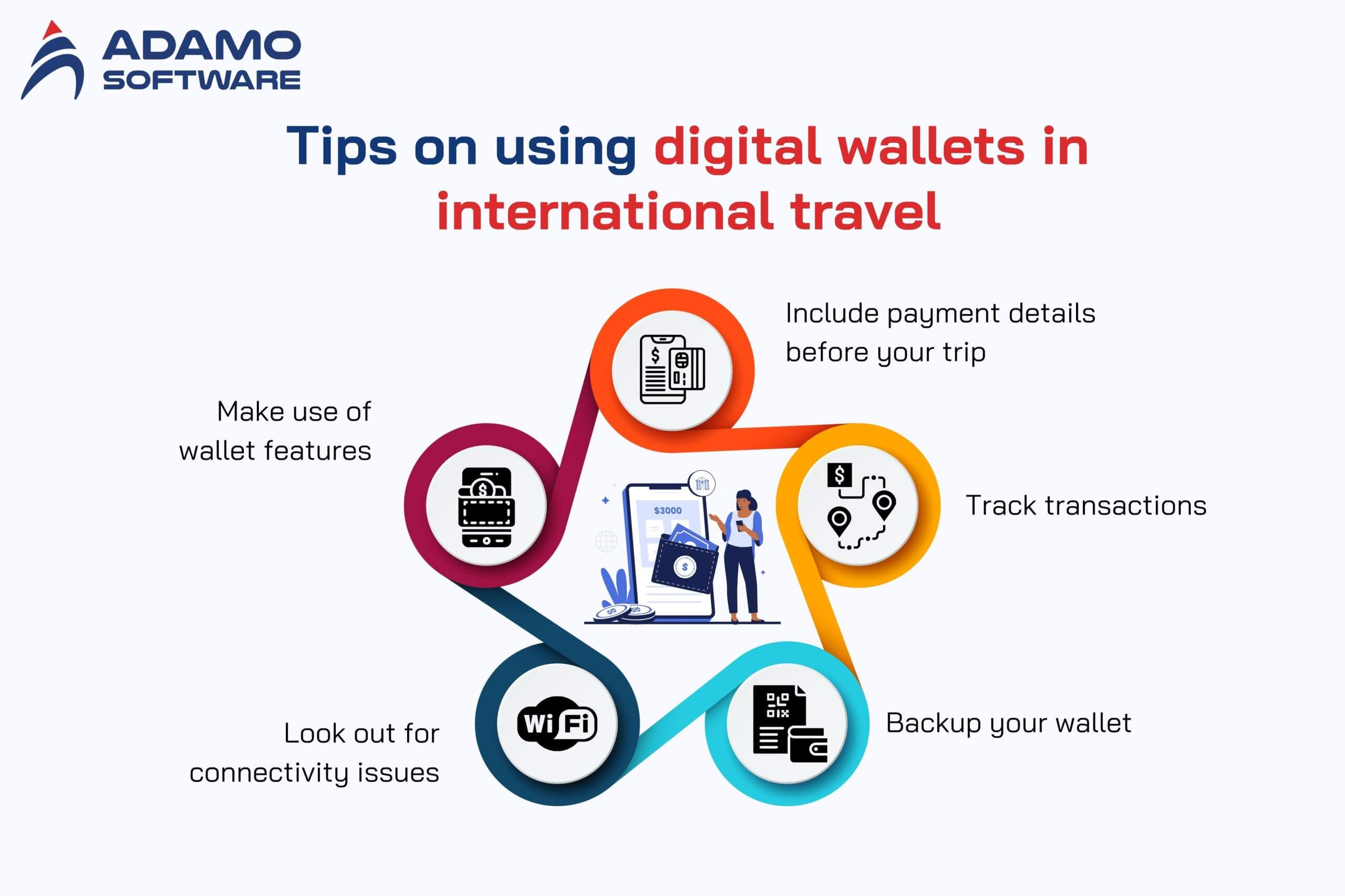

VI. Tips on using digital wallets in international travel

1. Include payment details before your trip

Make sure you add the payment information from your home country before departure. Your digital wallet in travel will automatically work when you reach your destination if you add payment details before departing. Let your bank know your travel dates to prevent them from treating your purchases as security risks.

2. Track transactions

Follow all payments you make through your digital wallet system. It shows your spending habits while helping you spot questionable charges faster. For safer digital wallet in travel use, connect to secure Wi-Fi networks to reduce the risk of cyber threats.

3. Backup your wallet

Save your digital wallet information to backup regularly during your travels. When you make this backup, you can feel secure knowing you won’t lose wallet functionality during your trip. A backed-up digital wallet in travel ensures you’re prepared for unexpected issues.

4. Look out for connectivity issues

Connectivity problems often arise when you travel to another country. Every digital wallet stops working when you lose an internet connection. Keep money in your pocket or have a card ready since digital wallets may fail during your travels.

5. Make use of wallet features

When you select a digital wallet in travel with budgeting and expense-tracking features, you can easily control your money as you explore different places. Digital wallet tools show you where your money goes and keep you from overspending during your vacation.

These tips will help you make the most of digital wallet use during your travels with improved convenience and safety. Technology helps improve your travel experience by freeing your attention from payment concerns so you can enjoy your trip more.

VII. Partnering with Adamo Software for efficient Travel Digital Wallet development

Work with Adamo Software to develop your digital travel wallet quickly. Our travel and hospitality software development team can create customized mobile apps that improve the experience when people use these techs. Our platform includes modern features that simplify banking operations and enhance the payment experience for those who travel.

Through our digital wallet, travel users can access booking management and securely conduct payments from any location. Additionally, Adamo always protects sensitive data during all transaction processes with our priority for security. Our systems are also designed to help everyone easily navigate through the app without any major difficulties.

By working with us, you will be able to stay competitive in the ever-changing travel industry. Contact us now to begin building your digital wallet in travel, and let’s change how travelers pay.