What is a Payment Gateway? Create Your Payment Gateway: Need to Build or Just Buy?

What is a payment gateway? A payment gateway processes online payments by authenticating and transmitting cardholder data within the transaction flow in a secure manner.

A payment gateway ensures the seamless operation of the payment ecosystem by facilitating online payments for consumers and businesses. According to Statista, the COVID-19 pandemic swept the world of eCommerce, with online sales reaching $5.7 billion in 2022. Similarly, payment-related fraud increased in 2022, resulting in $41 billion in losses. These numbers make a payment gateway an indispensable instrument for tackling the complexities of online payment processing and ensuring a secure and seamless checkout experience.

If you’re an online merchant, you don’t need to be an expert on payment gateways, but it’s important to comprehend how an online transaction flows from your customer to your bank account. Join us as we explain what is a payment gateway and every aspect of payment gateways.

I. What is a Payment Gateway?

A payment gateway enables merchants to take debit and credit card payments from customers. This term encompasses both the physical card-reading devices found in brick-and-mortar stores and the payment processing portals found in online stores.

After a customer places an order, the payment gateway verifies the customer’s card information and determines whether they have sufficient funds in their account to pay you.

II. Who needs to use a custom payment gateway

From Adamo Software’s experience, businesses seeking to implement payment functionality in a web or mobile application frequently question whether they should utilize a payment gateway or develop a custom solution. Until now, integrating a prebuilt payment gateway has been the most popular option, as it enables digital payments quickly and easily.

However, an out-of-the-box gateway is not always the most economically feasible option. The prebuilt gateway can increase the fees charged by third-party payment gateway providers. They may also necessitate substantial customization and integration efforts with the required applications.

Adamo Software recommends a custom payment gateway in the following circumstances:

_ You need a payment gateway providing specific capabilities, e.g., support for all required payment methods, including crypto payments, sophisticated recurring payments, AI-powered fraud detection, or on-demand scalability to manage the growing amount of payment transactions during peak times. As your business grows or transforms, you require a solution that can be readily updated with new features.

_ You want to integrate a payment gateway system with your existing software seamlessly and cost-effectively. For example, an eCommerce website, a customer portal, a mobile banking app, or an accounting system.

_ You intend to monetize your payment gateway by charging other businesses to use it. For instance, if you own an eCommerce marketplace, you can offer merchants the ability to receive payments via your custom-built payment gateway for a fee.

III. What are the benefits of a payment gateway?

1. Convenience

When you integrate with a payment gateway, your customers can make purchases at any time, regardless of whether you are minding the store or not. Providing your consumers with the option to shop at their leisure is convenient for both you and them.

2. Faster payments

As a business owner, you understand how difficult it is to receive payment. Instead of having the hassle of agreeing to pay on a certain date and then forgetting to do so, many customers prefer to pay promptly and get it over with. Payment gateways make this possible, creating a win-win situation for both you and your customers.

3. Better security

Customers are most concerned about online payment security. The use of payment gateways significantly reduces the risk of credit card fraud for three primary reasons:

_ The card information of the consumer is transmitted securely to the payment gateway. This means that only the consumer and the card issuer will have access to their information.

_ Every payment gateway must be PCI DSS compliant, which means they must adhere to specific security standards to ensure that your consumers’ card data is processed securely.

_ Card services provide an additional security protocol called 3-D Secure. This necessitates that the consumer generates a password for each card they use to make an online payment.

IV. Must-have payment gateway components

1. Fraud Protection Systems

Each merchant seeks a completely safe and secure payment gateway that will facilitate acquiring the client’s trust. This is why security is so important. Merchants typically ensure that a payment gateway possesses detection and prevention mechanisms for fraudulent activity. The activation of such mechanisms is essential for any payment gateway.

Therefore, every user’s personal information requires a comprehensive framework and protection measures. In addition to coding techniques, your developers should employ the best security and data protection procedures.

2. Tokenization

Tokenization entails substituting a personal account number (PAN) with a randomly generated alphanumeric identifier known as a token, which is meaningful only to the payment processor. This is done to guarantee the security of confidential financial data.

3. Recurring Payments

Creating a payment schedule is a useful functionality for both merchants and customers, as it increases cash flow and improves customer retention. Customers will enjoy the adaptability and convenience offered by this feature.

4. Software integration

Integration of payment gateway with business software used in your organization is an essential part of payment gateway implementation. A centralized reporting system will provide you with multiple benefits, including time savings, improved accuracy, and streamlined transaction reconciliation.

5. Scalability

A solution’s architecture should be scalable so that it can easily manage an increase in workload. A payment gateway should cope with spikes in money transfers, such as Black Friday. It is crucial to readily modify and update payment gateways, and cryptocurrencies and contactless payments are two examples of why scalability is important.

Remember that using legacy systems, outdated software, or hardware, is a bad idea. Therefore, modernizing and continually updating your software is essential.

6. Disputes and Arbitration

Users utilize payment gateways with a specialized interface for managing bank disputes.

7. Hosted Payment Gateways

Through the implementation of a hosted payment gateway, you can reduce the risks and limit your liability. Once a merchant’s application redirects to it, no secure data passes through the cart. That is the central point.

8. Virtual Terminal

Virtual terminal transforms your computer into a sales transaction recording and monitoring service. In addition, this feature enables compliant payment processing, global payment receipt, and global transaction monitoring and tracking. All of these possibilities make virtual payment an absolute necessity when establishing a payment gateway with robust functionality.

9. Working Hours (24/7)

If you intend to launch a global online or mobile payment gateway that will serve consumers from various parts of the globe, you should take time zones into account. Ensure that users can reach your website and support staff at all hours of the day and night. They should receive immediate assistance for any question.

In addition to live support from humans, implement chatbots that serve as FAQs. Problem-solving skills are essential for all types of users. If your gateway is not available 24/7, you risk losing a portion of your clients.

Consider incorporating at least some of these features into your project. Also, it would not harm to investigate alternative online payment gateway solutions and implement any missing features.

V. How online payment works

The process of making online payment may appear simple to consumers as they shop, but several procedures must occur behind the scenes:

_ At checkout, the customer selects a payment method.

_ It is encrypted and sent to the payment processor via a payment gateway.

_ The sale is authorized.

_ The customer’s card issuer, bank, or digital wallet must authorize the transaction.

_ The funds are transferred to the merchant bank after payment processing fees are deducted.

Also read: What is data tokenization technology? How to strengthen payment processing security

VI. How to create a payment gateway: 7-step processes

Step 1: Perform a feasibility analysis

Duration: 1-3 weeks

The consultants at Adamo Software thoroughly assess the economic viability of developing a custom payment gateway for each business by analyzing the unique payment handling requirements of each client and their existing IT infrastructure. We present a list of tangible benefits that a custom payment gateway can offer to the company, as well as a high-level estimate of development costs and a return on investment calculation, based on the findings of the analysis.

Step 2: Create payment gateway software and formulate a project plan

Duration: 4-7 weeks

The Adamo Software team provides a comprehensive list of payment gateway requirements that describe:

_ All of the functional features a payment gateway should offer.

_ The categories of data that the solution should be able to process (e.g., personal information about customers, credit card information, e-wallet credentials).

_ Non-functional requirements for the payment system (such as performance, scalability, availability, and data integrity).

_ Security and compliance requirements must be satisfied (e.g., PCI DSS for secure credit card payment processing, AML, and KYC requirements to prevent payment fraud).

_ Requirements for a checkout page’s visual design, structure, and content.

A well-designed requirements specification serves as the foundation for the following:

_ Design of a payment gateway’s architecture and its interaction with the necessary systems.

_ A collection of features for a personalized payment gateway, including security features.

_ UI/UX design of a transaction page.

_ Integration API design to enhance the integration capabilities of the payment gateway.

_ A development project plan that includes project objectives and key performance indicators, deliverables, a schedule, and a risk mitigation strategy.

Step 3: Select the ideal technology stack

Duration: 2-3 weeks

Adamo Software specifies the technologies and instruments required to construct an online payment gateway and integrate it with relevant corporate solutions and external systems. We compare the available technologies and tools in the context of the documented business requirements and design the optimal technology stack, taking into account the client’s priorities (e.g., rapid development, and reduced project cost).

Step 4: Develop a payment gateway

Duration: 4-7 months, depending on the complexity.

Typically, Adamo Software’s development of a payment gateway comprises the following phases:

1. Creating environments for the automation of development and delivery (CI/CD pipelines, container orchestration, etc.).

2. Developing the back end of a customized payment gateway, including integration APIs.

3. Develop a customer-facing checkout page and administrative interface for monitoring the efficacy of the payment gateway.

4. Implementing a secure database to store sensitive consumer information.

5. Running quality assurance procedures concurrently with development to validate the payment gateway’s quality and correct any defects before deployment.

Step 5: Deploy the solution in production

Duration: 1-2 weeks

Once the payment gateway has passed functional and nonfunctional (including security) testing, the Adamo Software team configures the solution’s infrastructure, backup and recovery procedures, and then deploys the payment gateway using an automated process.

Step 6: Integrate the gateway with other systems

Duration: 1-8 weeks, depending on the integration complexity.

The team at Adamo Software implements and tests gateway integrations with required systems (an app that hosts a checkout page, payment processing system, accounting software, etc.) to ensure the smooth and secure flow of data between the parties involved in payment initiation and settlement processes.

Step 7: Support and evolve the payment gateway

Duration: Continuous

_ Monitors the efficacy of the payment gateway and resolves any potential issues (such as insufficient payment processing speed or payment data processing errors).

_ Adapts the solution to the increasing number of payment transactions.

_ When necessary, upgrade the functionality of the payment gateway (adding new payment currencies, payment methods, UI elements, etc.)

_ Regularly verify the compliance of payment gateways with PCI DSS and other pertinent data security standards and regulations.

VII. Legal requirements that can be considered for payment gateways

1. PCI DSS Compliance

Payment Card Data Security Standard’s primary function is to increase the security of credit card data and secure debit card transactions from fraud and data theft. PCI DSS lays the foundation for operational and technical requirements that must be defined to protect account data.

PCI DSS addresses the following tasks:

_ Storage of credit card information

_ Contacts with protected cardholder info

_ Transfer of cardholder data to a third-party

_ Progression of digital transactions or card-based payments

Checking all requirements for your country of residence is insufficient if your payment gateway is available in multiple countries. Investigate the legal aspects of each region your project will cover.

While studying PCI DSS, remember the four compliance levels, which are based on the annual number of credit and debit card transactions:

Level 1: Traders who process more than six million transactions per year are required to conduct an internal audit once per year.

Level 2: Traders who process between one and six million transactions per year must complete an assessment using a Self-Assessment Questionnaire (SAQ).

Level 3: Traders who process 200,000 to million transactions annually must complete an annual SAQ assessment and quarterly network audits.

Level 4: Traders who conduct fewer than 200,000 transactions annually must still complete an assessment.

2. EMV

EuroPay, Mastercard, and Visa have devised the EMV standard for chip-based fraud prevention technology. These embedded processors in credit and debit cards provide an additional layer of security and are more difficult to forge than magnetic stripes.

3. EMV 3-D Secure

EMV 3DS was developed to assist global merchants and payment card issuers in mitigating the risks of card-not-present fraud and enhancing the security of e-commerce payment transactions.

It entails adding a verification process with the card issuer to provide an additional layer of protection against fraud. Traditionally, the customer must input a password associated with the card or a code sent to their mobile device.

4. PA-DSS

PA-DSS is the Payment Application Data Security Standard applied to the software development of payment applications. It provides app-developing software vendors with uncomplicated data standards. The primary objective of the standard was to ensure that software companies do not store prohibited information, such as CVV2, magnetic strip, or security PIN.

5. P2PE

The point-to-point encryption standard mandates that cardholder data must be encrypted immediately after being read by a payment terminal and remain encrypted until it is processed by the payment processor. Thus, the standard guarantees that stolen information cannot be used and protects data during its transmission from one location to another.

6. HSM

HSM, also known as a hardware security module, is a generally recognized standard for protecting private keys and associated cryptographic activities. In addition, it provides encryption, decryption, and digital signature services for various applications.

In the process of developing a payment gateway, security and compliance go hand in hand. You will be able to ensure the security of eCommerce transactions if you adhere to the above standards and rules.

VIII. How much does it cost to build a payment gateway system?

In calculating the upfront costs of the payment gateway, you should factor in the development of the gateway, its maintenance, PCI certification, cutting-edge technology, and, if applicable, licensing, regulations, and partnerships. We estimate an MVP for a payment gateway to cost between $150,000 and $250,000. The greater a payment gateway’s functionality, the greater its development costs.

Building a payment aggregator requires the additional resource of time. Creating a payment aggregator from inception can take six to twelve months.

Your team contributes to the cost of developing the gateway and, ultimately, to its success. The salaries of the development team consume most of the payment aggregator’s development budget. Lastly, the cost of employing developers depends on factors such as the employee’s technical experience, your choice of technology stack, and your project’s engagement model.

In the long term, it is advantageous to develop a payment gateway if you have the time and resources to do so, as you will save money on subscriptions, increase revenue, and be able to customize the infrastructure to suit your business’s needs. However, there is an alternative that enables you to set up your payment gateway without starting from zero and in a short time.

IX. Tips when using payment gateway development services: IT Experts’ Advice

1. Interaction between Merchants, Buyers, and Marketplace Operators

It is the responsibility of a merchant of record (MoR) to initiate a user’s payment on their behalf. The selling party should transfer a portion of their funds to the market as a commission. When functioning as a MoR, a marketplace can collect all funds from sales and distribute a portion of these funds to sellers.

When designing a transaction sequence, your service’s client is the third party. Determine how much information your service will collect from its consumers, as well as whether it will serve businesses or individuals. You may permit the direct exchange of products between your users. In other terms, choose between a B2B, B2C, or C2C marketplace. Do not disregard factors such as legal considerations for AML, KYC, induction procedures, etc.

How you choose and implement data protection measures depends on the nature of the data you collect and store. Ensure the safe transmission of all data. Examine data protection regulations and financial aspects thoroughly. The General Data Protection Regulation (GDPR), for instance, has the following technical requirements:

– Data anonymization

– Data storage periods

– Users have the right to know what data you store and why

– Restricted access to information for employees and third parties

– “The right to be forgotten”

Before moving on to subsequent stages of payment gateway development, you should bear this in mind.

2. Integration

If your service requires online transaction processing, ensure that your payment gateway includes payment providers. Two options could prove useful:

– Redirection entails navigating the user to the Payment Provider’s designated, external transaction page.

– API integration of a payment service provider (PSP, abbreviated). In this instance, the internal transaction page is a client-side component of the platform.

Notably, some platforms may only permit one approach, whereas another may appear unattainable. Therefore, you must determine whether you want an internal or external checkout page. In addition, add-ons and secondary themes should not be overlooked.

After establishing a payment gateway, you must implement various supporting processes and functions for sign-in and purchase. For example, these may include risk management and anti-fraud solutions. Again, you have the option of integrating a third-party provider, adhering to the PSPs’ risk assessments, or developing your solution. Consider integrating SMS and email services to communicate with your customers.

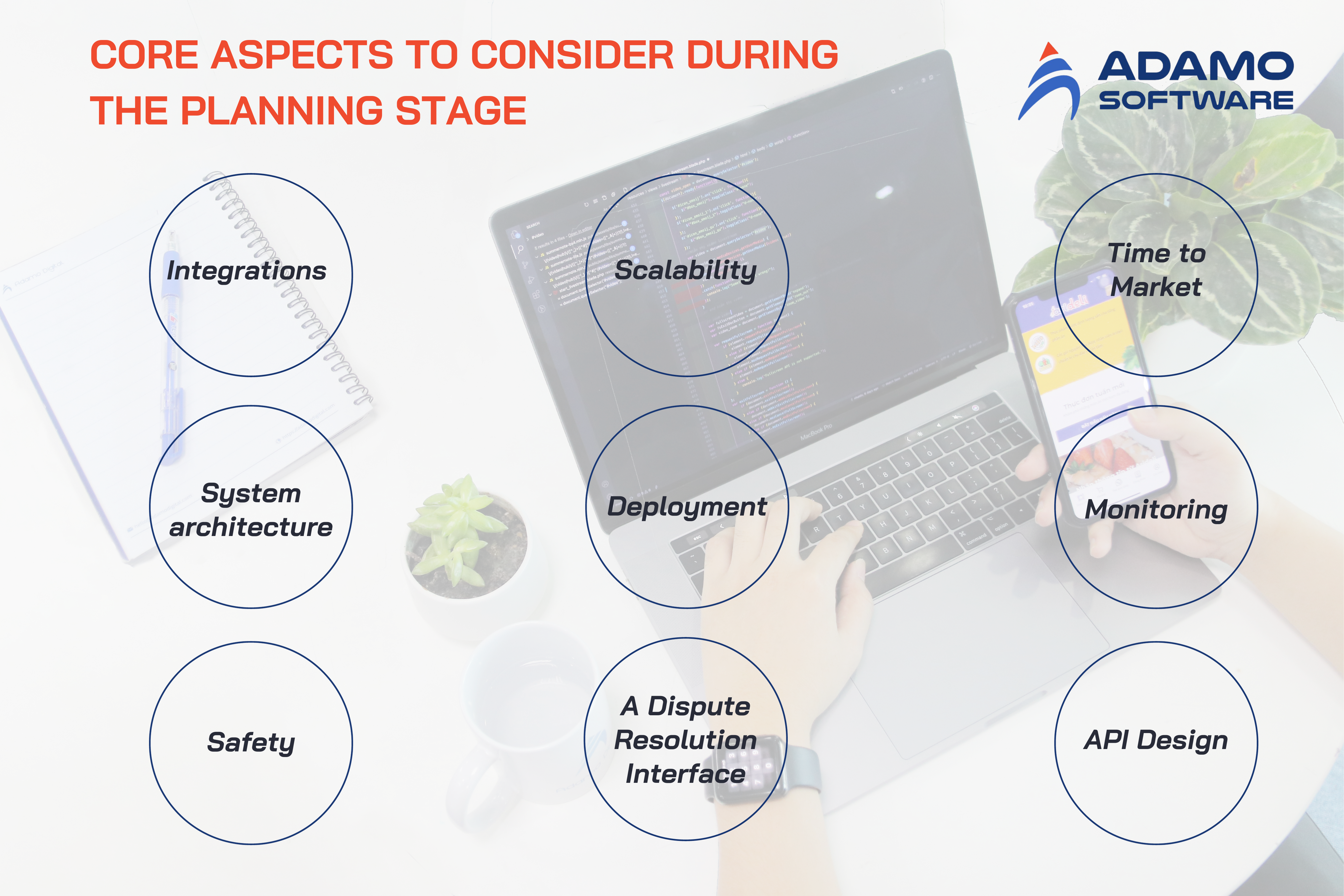

3. Scalability

To develop a payment gateway from scratch, you must have a solid understanding of the relevant numbers and determine how rapidly your system will operate. Choosing the number of transactions that must be completed within a given period is another crucial factor. The remaining factors include:

– Maximum predicted peak load per minute, per hour, and day.

– Estimated number of transactions in one year, several years afterward, etc.

– Dates and times when you intend to handle a particular transaction volume.

Consider progressively expanding capacities or having everything in place from the start.

It is vitally important to make precise estimates in this situation. Can you perceive the distinction between 50,000 transactions per 24 hours and 10 transactions per minute? That is what we intend.

4. Time to market

Depending on variables such as scalability and features, the implementation duration may be longer or shorter. Keep in mind one “golden rule:” The greater the system’s complexity and scalability, the more time it will “eat” during the construction process. Here are several conceivable scenarios:

– Their good is already accomplished. It may have necessary features and relevant scalability characteristics. This is the best course of action if users overwhelm your service with sign-up procedures and transactions. However, you may have invested in infrastructure that languishes until your marketplace gains traction.

– The product must be released as quickly as feasible. Without an experienced staff of software engineers, it is impossible to achieve this objective. There is no assurance that the final product will include all necessary scalability options with this variant. It is possible to avoid elevated risks by granting access to a restricted group of users first.

With Agile methodology, the second option becomes feasible. It expedites delivery times, minimizes risk, and boosts team productivity. It is crucial to estimate the number of users and transactions. Then, you can create a minimum viable product (MVP) capable of handling this quantity. Adding functions to increase scalability is always a good notion. Consistently updating your product is essential.

5. System architecture

5.1. Deployment

If you intend to deploy in multiple data centers or want your payment gateway application to function in multiple countries, you must consider regulatory nuances.

Then, consider whether you want national instances to be united with instances from other nations under a single comprehensive system. You can make it an entirely local model. In other words, choose between a universal account and multiple accounts for various regions. You should consult with attorneys before deciding on this issue.

5.2. Monitoring

This stage is responsible for monitoring the health and condition of the infrastructure and ensuring that all system elements are active at all times. Controlling the business comes next. It involves monitoring the number of transactions, new sign-ups, and other activities. It is crucial to ensure that the system can handle the burden when the number of actions exceeds expectations.

5.3. Safety

Knowledge and compliance with Know Your Customer and Anti-Money Laundering regulations, as well as local laws, are the foundation of security. Ensure that you adhere to global guidelines, such as the well-known standard PCI DSS. Verify that each developer of a custom payment gateway adheres to safe coding practices.

Aside from that, ensure that your development team follows secure coding practices to ensure the privacy and security of sensitive personal and financial data provided by customers. Protect this information by implementing SSL encryption and two-factor authentication.

6. A dispute resolution interface

The Dispute Resolution Interface is another element of the payment gateway development process that you should not overlook. It allows for the efficient creation, validation, encoding, and processing of disputes.

7. Branching out: API Design

API design is a crucial element of creating a payment gateway. The key to success is a well-considered combination of the most up-to-date design practices with fundamental technical functions that guarantee accessibility and usability. Focus on developing a secure, quick, and simple-to-implement API. Ensure that its structure is uniform and straightforward and that it provides a plain error message when an error occurs.

Make APIs as consistent as feasible. It would be ideal if a single API could process numerous payment options and information.

X. Adamo Software – Help Build Custom Online Payment Gateways

Adamo Software, a premier software development company in Vietnam, automates payment collection, reducing the amount of administrative work your team must perform when pursuing invoices. Learn how Adamo Software can assist you with software development services by contacting us immediately!