What is a digital wallet? The ultimate guide for beginners

Digital wallets have become increasingly popular as people look to streamline their lives and simplify their finances. According to statistics, in 2021, about 49% of all global e-commerce took place with digital wallets. Some analysts predict that by 2025, this number will increase to 53%.

In Vietnam, using digital wallets to pay is becoming more popular than swiping credit cards. According to McKinsey & Company, 89% of Americans have used at least one form of digital payment by 2022.

Just as online banking revolutionized the way consumers interact with banks, digital wallets are disrupting the way consumers pay for goods with the physical cards they carry.

In this article, let’s learn what a digital wallet is, how it works, and why it is a safe option for users.

I. What is a digital wallet?

What is a digital wallet? A digital wallet meaning an e-wallet. This is a software, electronic device, or online service. It allows individuals or businesses to make electronic transactions. This digital wallet helps store users’ payment information and different payment methods on many websites. There are other items such as gift certificates and driver’s licenses.

Traditionally, digital wallets are usually stored as applications on smartphones. It is also available on desktops, laptops, and tablets. However, digital wallets are most commonly used on mobile applications due to their portability and flexibility.

Digital wallets are becoming more popular because they are convenient to use in certain situations and are more secure than traditional wallets. To use a digital wallet, users must download specific applications created by banks or trusted third parties to use this service.

Significance of a Digital Wallet

- Digital wallets help store all the payment information of users in a secure and convenient form. Therefore, it helps users significantly reduce the need to carry physical wallets and cash which are very cumbersome.

- Companies that provide this service can benefit a lot from digital wallets. Because they need to collect consumer data for their marketing needs. For example, they understand the shopping habits of consumers and increase the effectiveness of their product marketing methods. However, a negative issue is that this leads to a loss of consumer privacy.

- Nowadays, thanks to the use of digital wallets, many developing countries can increase their participation in the global financial market.

- Digital wallets allow users to transfer money to friends and family residing in different countries quickly.

- In addition, digital wallets can eliminate the need to use physical banks and companies to open and maintain bank accounts. Therefore, digital wallets also help connect individuals and businesses in rural and remote areas.

- Digital wallets are essential for making transactions and maintaining cryptocurrency balances.

II. How does a digital wallet work?

A digital wallet is an application designed to leverage the convenience of mobile devices to improve access to financial products and services remotely. A digital wallet essentially eliminates the need to carry a physical wallet by storing all of a consumer’s payment information securely and compactly.

A digital wallet uses the wireless connectivity capabilities of a mobile device such as Bluetooth, WiFi, and magnetic signals to securely transmit payment data from your device to a point-of-sale terminal designed to read the encrypted data and communicate via these signals.

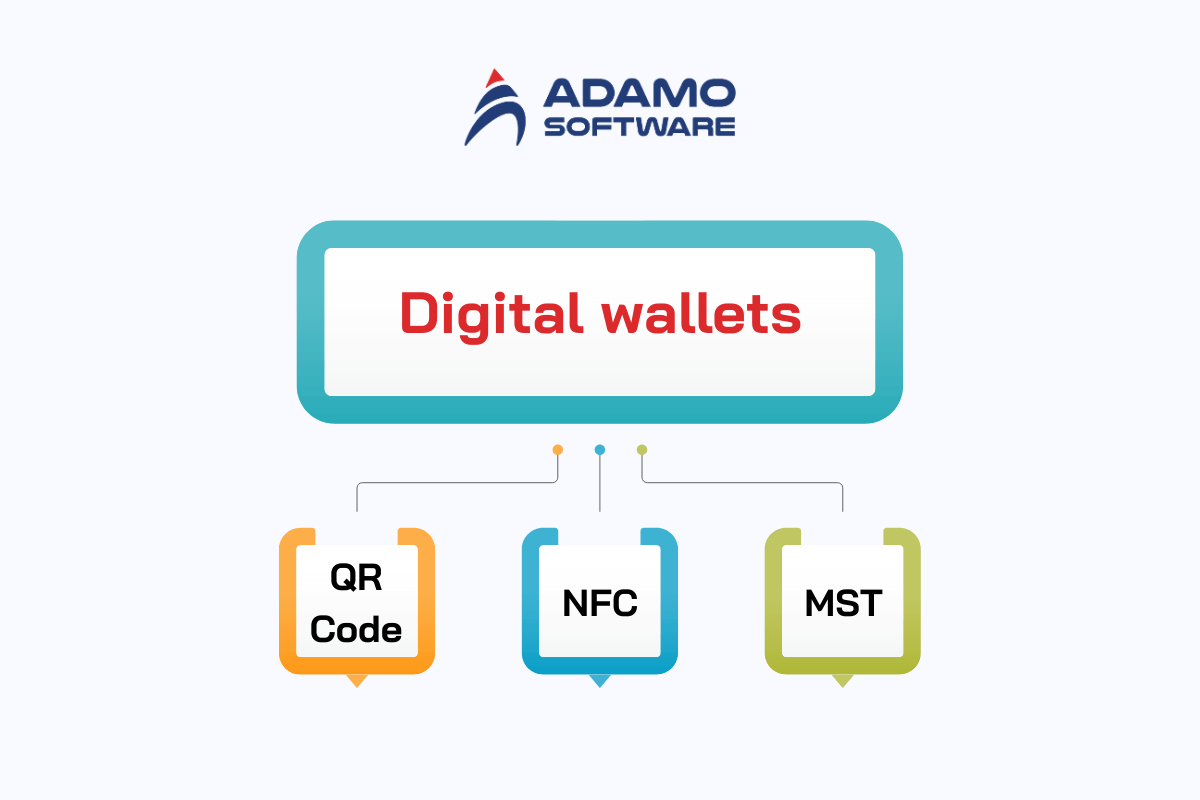

Current technologies used by mobile devices and digital wallets are:

- QR Code: Quick Response Code is an encoded matrix barcode that stores information. You use your device’s camera and the wallet’s scanning system to initiate a payment.

- Near Field Communication (NFC): NFC is a technology that allows two smart devices to connect and read information using electronic signals. Requires two devices to be near connect.

- Magnetic Secure Transmission (MST): This technology is primarily for Samsung mobile phone users. It is the same technology used by magnetic stripe card readers, which read your card when you swipe it through a slot at a point of sale. Your phone creates this encrypted field that the point of sale can read. Samsung has been phasing out MST capabilities for Samsung phones since 2021 to focus on NFC, which is more common.

The card information you have stored in your digital wallet and have chosen to use for a transaction is transmitted from your device to the point-of-sale terminal, which is connected to the payment processor. Then, through the processor, payment gateway, acquirer, or any other third party involved in credit and debit card transactions, the payment is routed through the credit card and banking network to make the payment.

As cryptocurrencies become part of the financial system, companies like Coinbase offer cards that allow you to pay with cryptocurrency. Coinbase’s card is issued by Visa. Digital wallets like Apple Pay allow you to add a cryptocurrency debit card. The app will convert cryptocurrency into dollars at current market value, which the user’s digital wallet will then use to pay for their purchases.

III. Pros and cons of using a digital wallet

1. Pros:

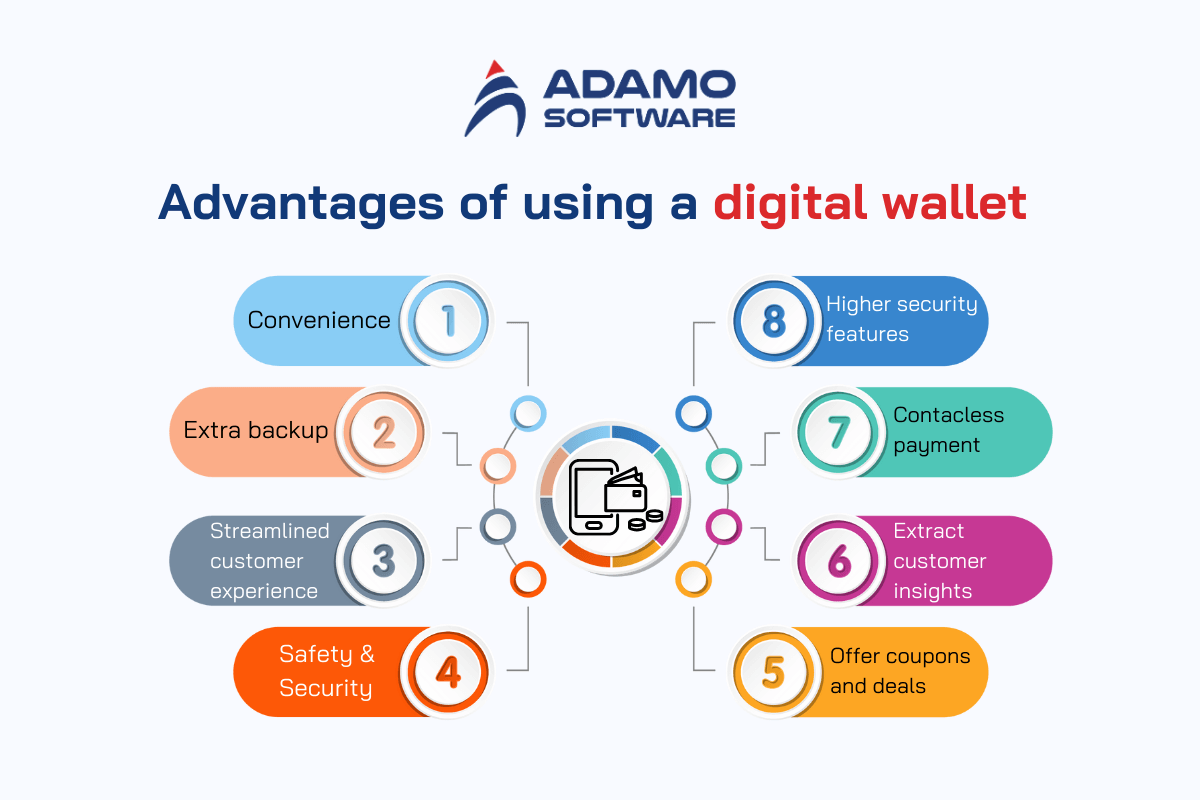

There are the following main pros of using digital wallets:

- Convenience: Payments are convenient and fast. It is more convenient than carrying cash or physical cards with you and saves pocket space because it is accessible from a mobile device. Plus, you can store multiple cards in a digital wallet.

- Extra backup: Users don’t need to worry about carrying a wallet, as they can still pay at most retailers if they forget their wallet.

- Streamlined customer experience: Digital wallets can streamline and speed up the checkout process. Because customers don’t need to fill out lengthy checkout pages or forms like traditional ones. This is a win-win because faster checkout saves cashier’s time. Or prevents customers from abandoning their shopping carts, which increases conversion rates for businesses.

- Safety and Security: Digital wallets have additional protection features such as data encryption and tokenization. They help keep users safer in many ways than traditional debit or credit card transactions. For example, digital wallet providers such as Apple Pay and Google Wallet use tokenization. This tokenization helps hide credit card details specific to each transaction to prevent hackers from accessing the user’s data.

- Digital wallets can also use higher security features like biometric technology, including fingerprint and facial recognition technology, to help prevent account information or devices from being stolen. For example, if a user drops a physical wallet or card, their personal information can easily be stolen. While digital wallets have additional layers of security through features such as Face ID or two-factor authentication, no one can access the stolen information.

- Contactless payments: Paying with a digital wallet allows consumers to avoid carrying a physical card or spending time searching for their card inside a physical wallet. When paying, users simply use their phone’s touch or Face ID to confirm the transaction during checkout.

- Extract customer insights: Digital wallets can help extract real-time data to gain valuable insights into customers’ shopping habits. The information extracted includes their shopping history and preferences. This helps businesses create marketing campaigns to help with inventory management and budgeting.

- Offer coupons and deals: Digital wallets often offer coupons or special promotions and offers. Such as shopping points, cashback, coupons and loyalty programs from their favorite brands and retailers.

2. Cons

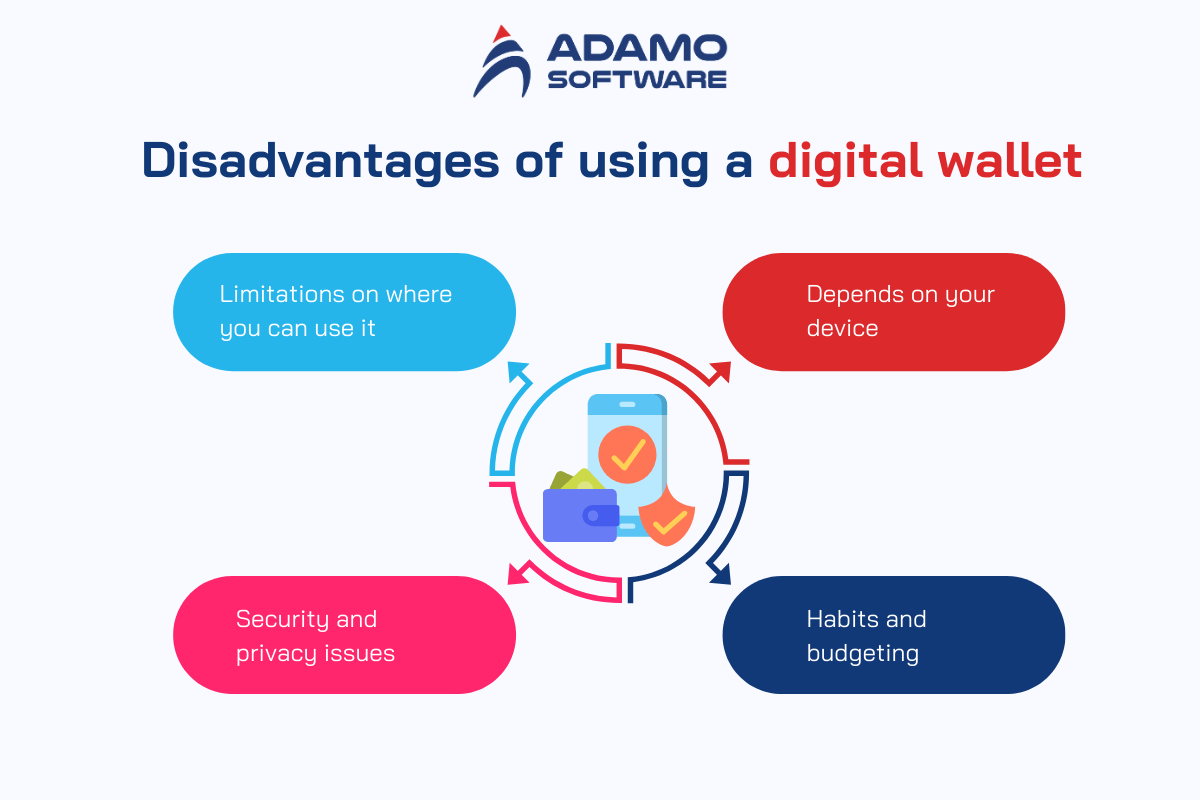

Digital wallets offer many great benefits and conveniences, but they also come with some inherent disadvantages. Here are some of the disadvantages of using digital wallets:

- There are limitations on where you can use it: Not all retailers support digital wallets. Some small stores with older merchants who don’t use smartphones won’t be able to use digital wallets. This means that to avoid this, people still need to carry physical cash and credit cards for certain transactions.

- Depends on your device: Digital wallets can only work and be supported on accessible devices. In some cases, if a person loses their device or the battery runs out, they won’t be able to access the digital wallet to make a payment. Also, if the device that stores the digital wallet runs out of battery or access to the device is lost for any reason. This also means that the user will lose access to the digital wallet.

- Security and privacy issues: While digital wallets provide transaction security, there is always a risk of being hacked if the device is lost or stolen. If someone or a hacker accesses the device using a digital wallet app, the device owner will have their account and transaction history compromised.

- Habits and budgeting: Many people are used to using cash and credit cards to make transactions. Because their phones do not always have an internet connection or enough battery. Therefore, they will not often use contactless payment methods. Some people even believe that carrying cash is safer or that paying in cash can help them control their spending habits.

Also read: Types of digital wallets: Explore some main players in the realm of e-wallets

IV. Can I use my digital wallet for online purchases?

Of course, you can use a digital wallet to make online purchases. Using a digital wallet to make online purchases is becoming more and more popular these days. It is also a seamless and secure process for consumers. Digital wallets offer robust security features to protect user data, making them a reliable option for making payments.

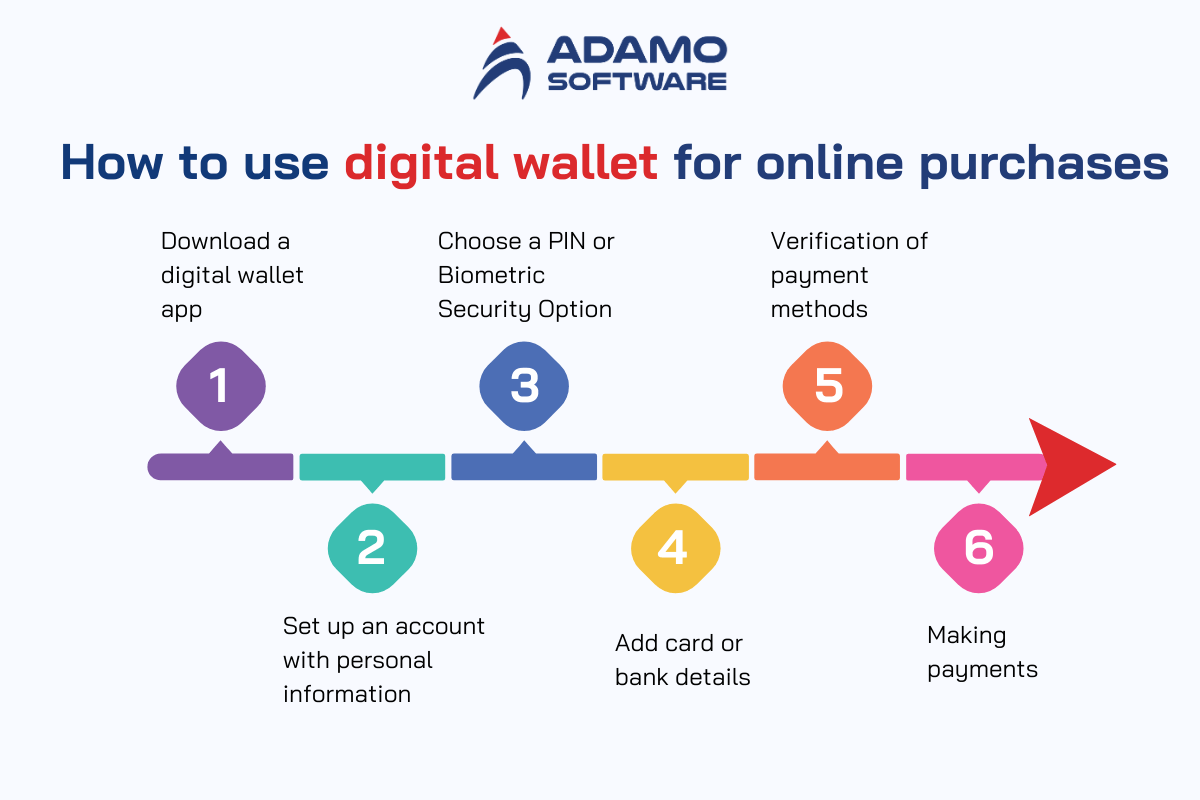

Setting up and using a digital wallet is simple, here is a detailed breakdown of the steps required to use it:

1. Download a digital wallet app

To use a digital wallet, the first step is to download a compatible app to your smartphone. Users have many options to download, such as Google Pay, the Apple Store, or often built into many smartphones. However, if you do not use a built-in wallet, third-party apps such as PayPal or Venmo are also often available for download in app stores. The advantage of these digital wallet apps is that they are geared towards user convenience and security, providing seamless integration with the device.

2. Set Up an Account with Personal Information

After downloading the app, you will need to set up an account. Creating an account usually involves entering personal information such as your name, email address, and phone number.

Some digital wallet apps may require more specific verification steps such as Know Your Customer (KYC) information. KYC often involves submitting additional documents such as ID. Make sure the app can confirm your identity and enhance security capabilities. This step is important because it adds an extra layer of protection against unauthorized access.

3. Choose a PIN or Biometric Security Option

The next step after completing account creation is to create a PIN or use a biometric option for authentication. A PIN acts as an additional level of security in addition to a password, which is used to approve transactions.

In addition to using a PIN, many apps today offer fingerprint or facial recognition as an alternative to entering a PIN. These options help users to transact faster and more securely. The biometric option is a favorite feature for those who prioritize security and ease of use.

4. Add Card or Bank Details

After verifying your identity and applying security measures, you can link your payment method to your digital wallet. Most e-wallets allow users to use multiple payment sources such as credit cards, debit cards, or regular bank accounts. In this step, users will enter their card information or link to their bank account. This step ensures that the app has a valid source of funds to make transactions.

5. Verification of Payment Methods

The next step is for the user to verify the payment method. The user will enter a one-time password (OTP) sent to an SMS or email to confirm the payment method setup. Entering the OTP helps the e-wallet application confirm that the payment information the user provided is correct and valid.

This verification process is a very important security step, ensuring that only authorized users or those who receive the OTP can add payment methods to their accounts. However, users need to ensure that the OTP code is not allowed to be known to anyone else.

6. Making Payments

After downloading, setting up an account, linking to a bank, and verifying the payment method, users can start using the digital wallet for online transactions. To make a payment, users simply select the wallet option when checking out on an e-commerce site. The app will prompt you to select a funding source and confirm the transaction with a PIN or OTP authentication. Once the payment is processed, users will receive a confirmation message.

Digital wallets not only make online payments faster but also allow seamless transactions across multiple platforms. Such as in-app purchases, sending money to friends, paying utility bills, buying movie tickets, and plane tickets. The multifunctionality of these e-wallets makes them ideal for everyday use. Replacing traditional payment methods such as cash or physical cards.

V. How Adamo Software can help with digital wallet development

As a leading technology company in Vietnam, Adamo Software provides tailored solutions for digital wallet development. We combine our expertise in financial technology with a customer-centric approach. Using cutting-edge technologies, we ensure secure and scalable digital wallet systems that meet the modern business requirements of your business.

Our development experts ensure compliance with security standards and provide ongoing support to maintain performance. Additionally, Adamo’s extensive experience in mobile application development enables businesses to seamlessly integrate digital wallet features. Delivering enhanced user experience and driving operational efficiency across a variety of industries.

FAQs

1. Should I use an e-wallet?

You don’t necessarily have to use an e-wallet. However, e-wallets can be convenient and provide you with many benefits. For example, paying for transactions without having to carry your credit card and cash. Instead, that information is stored in the cloud. You don’t have to worry about forgetting to bring your wallet or card.

2. What is a mobile wallet?

A mobile wallet is another term or name for a digital wallet. Simply put, it is a virtual wallet on a smartphone. This is where virtual cards and payment information are stored and kept. Thanks to a digital wallet, you can make electronic payments quickly and conveniently. In addition, you can make other transactions such as paying bills, buying airline tickets, booking hotels, etc.

3. What is the difference between an e-wallet and a digital wallet?

While they are very similar, some elements differ digital wallets store virtual versions of your debit and credit cards on your mobile device. An e-wallet is an online prepaid account that allows you to deposit and withdraw funds as well as make transactions.

4. Which digital wallet app is the best for me?

There are a lot of digital wallets out there today, so choosing the right one depends on your preferences. For example, if you use an iPhone, Apple Pay might be right for you. If you use Android, Google Pay might be your best bet. However, you should also consider your geographic location, as some wallet apps don’t work in certain areas.