Payment Gateway Integration: How to Integrate into Website (2026 Guide)

In today’s digital age, a seamless online payment experience is crucial for business success. Customers expect a smooth checkout process, and that’s where payment gateway integration comes in. It allows you to securely accept online payments directly on your website, eliminating friction and boosting conversions.

But what exactly is a payment gateway, and how do you integrate it? This comprehensive guide will answer all your questions. We’ll delve into the world of payment gateways, explore the integration process, and equip you with the knowledge to confidently accept online payments on your website.

I. What is Payment Gateway?

In the world of online commerce, a payment gateway acts as a secure intermediary between your website and various payment processors (like Visa or Mastercard). It plays a critical role in facilitating smooth and trustworthy online transactions. Here’s a closer look at how it functions:

1. Secure Bridge: Imagine a secure bridge. The payment gateway acts as this bridge, connecting your website’s shopping cart or checkout system to the payment processors behind the scenes.

2. Information Encryption: When a customer enters their payment details (credit card number, etc.) on your website, the payment gateway plays a vital role. It encrypts this sensitive financial information using sophisticated algorithms. This encryption scrambles the data, making it unreadable by anyone who might try to intercept it.

3. Sending for Authorization: Once the information is encrypted, the payment gateway securely transmits it to the relevant payment processor (e.g., Visa or Mastercard) for authorization.

4. Relaying the Status: The payment processor verifies the customer’s information (ensuring sufficient funds, valid card details, etc.). The processor then sends an approval or decline response back to the payment gateway.

5. Facilitating Transactions: If the payment is approved, the payment gateway acts as a facilitator. It works with the processor to transfer the funds from the customer’s account to yours.

6. Order Completion: Upon successful authorization and transaction processing, your website receives a confirmation message. This allows you to complete the order process and fulfill the customer’s purchase. The customer typically receives a confirmation email as well.

In essence, the payment gateway streamlines the online payment process, ensuring a secure and efficient experience for both you and your customers. By encrypting data and handling communication with the payment processors, it creates a safe environment for online transactions.

II. What is Payment Gateway Integration?

Now that you understand the magic behind payment gateways, let’s delve into payment gateway integration. This refers to the process of connecting your website’s shopping cart or checkout system with a chosen payment gateway. Here’s a breakdown of what it entails:

1. Bridging the Gap: Imagine you’ve built a beautiful storefront (your website) and stocked it with amazing products. But how do customers pay for their purchases? Payment gateway integration acts as the bridge between your storefront and the secure payment processing system.

2. Seamless Checkout Experience: By integrating a payment gateway, you empower customers to enter their payment information directly on your website during checkout. This eliminates the need for them to be redirected to a separate payment processor page, creating a smoother and more convenient checkout experience.

3. Technical Connection: The integration process involves establishing a technical connection between your website’s code and the payment gateway’s API (Application Programming Interface). This API provides a set of instructions and tools that allow your website to communicate securely with the gateway.

4. Tailored Integration Options: Depending on your website’s technology and the chosen payment gateway, there might be different integration methods available. Some gateways offer hosted payment pages, where customers are briefly redirected for checkout, while others provide server-to-server integrations for a completely seamless experience within your website.

5. Developer Expertise: The complexity of the integration process can vary. For simpler solutions, some website builders offer built-in integration with popular payment gateways. However, for more complex integrations or customization, developer expertise might be required.

In essence, payment gateway integration allows you to accept online payments directly on your website, enhancing customer convenience and streamlining your business operations.

Also read: What is a Payment Gateway? Create Your Payment Gateway: Need to Build or Just Buy?

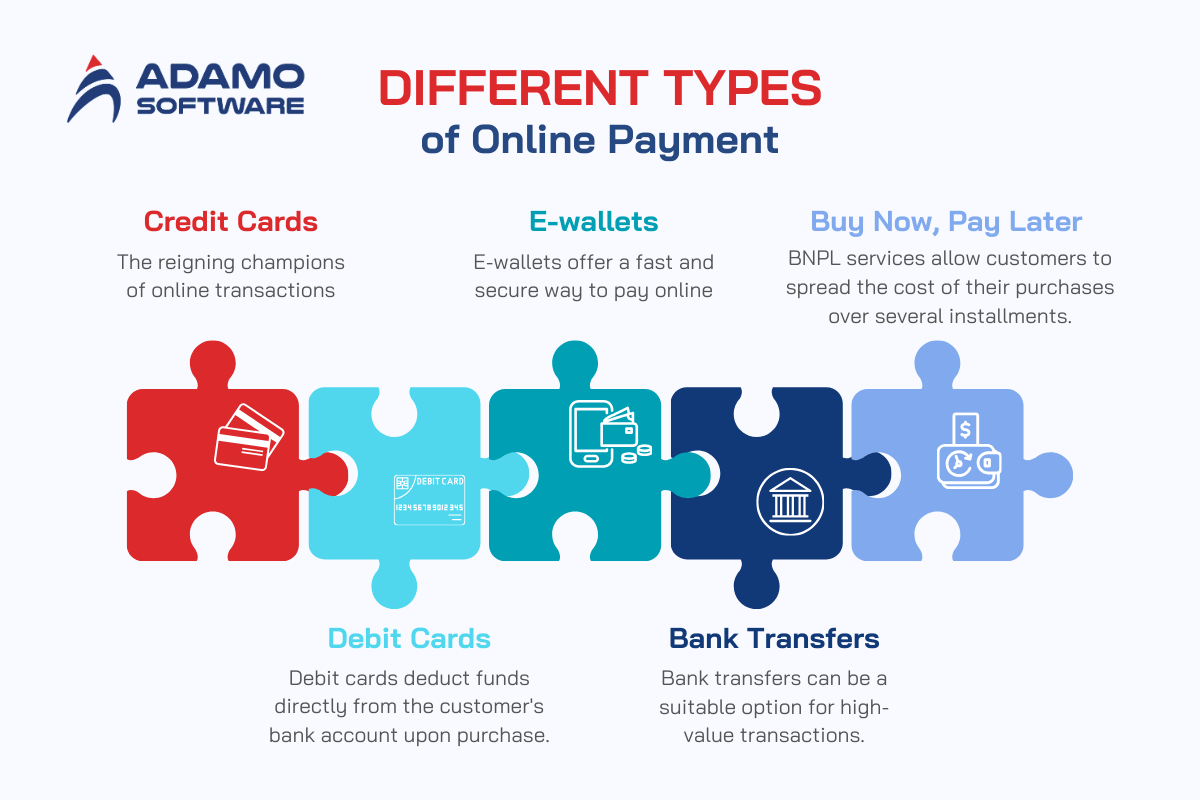

III. Different Types of Online Payment

In today’s digital marketplace, customers expect a variety of payment options to suit their preferences. Payment gateway integration allows you to offer a wider range of online payment methods, increasing your customer base and boosting sales. Here’s a glimpse into some of the most popular online payment options:

1. Credit Cards

– The reigning champions of online transactions, credit cards offer a convenient and secure way for customers to pay.

– Major credit card networks like Visa, Mastercard, and American Express are widely accepted across various online platforms.

– When a customer uses a credit card, the payment gateway facilitates the authorization process, verifying available credit and ensuring sufficient funds for the purchase.

2. Debit Cards

– Similar to credit cards in functionality, debit cards deduct funds directly from the customer’s bank account upon purchase.

– Debit cards provide a secure way for customers to manage their spending and stay within their budget.

3. E-wallets (Electronic Wallets)

– Gaining immense popularity, e-wallets offer a fast and secure way to pay online without manually entering card details every time.

– Popular options like PayPal, Apple Pay, Google Pay, and Venmo allow customers to store their payment information securely in a digital wallet.

– During checkout, customers can simply choose their preferred e-wallet and confirm the payment with a PIN or fingerprint scan.

4. Bank Transfers

– While less common for smaller purchases, bank transfers can be a suitable option for high-value transactions.

– Customers initiate bank transfers from their online banking platform, transferring funds directly to your business account.

– The processing time for bank transfers can be slightly longer compared to other methods.

5. Buy Now, Pay Later (BNPL) Options

– A growing trend, BNPL services allow customers to spread the cost of their purchases over several installments.

– Popular BNPL providers like Klarna and Afterpay handle the financing aspect, while the payment gateway facilitates the initial authorization and processes the installment payments.

Choosing the Right Mix

The ideal combination of online payment methods for your website depends on your target audience, industry, and average transaction value. Consider offering a variety of options to cater to different customer preferences and encourage seamless online transactions.

IV. How Does Payment Gateway Work?

Understanding how a payment gateway operates is essential for businesses venturing into the world of online transactions. Here’s a breakdown of the key steps involved in a typical payment gateway process:

1. Customer Checkout: Imagine a customer browsing your website and adding their desired products to the shopping cart. Once they proceed to checkout, they’ll encounter the payment gateway in action.

2. Secure Information Entry: On your website’s checkout page, the customer enters their payment details. This might include their credit card number, expiration date, CVV code, and billing address.

3. Encryption for Safeguarding Data: The payment gateway plays a crucial role here. It encrypts the customer’s sensitive financial information using sophisticated algorithms. This encryption scrambles the data, making it unreadable by anyone who might try to intercept it during transmission.

4. Sending for Authorization: Once the information is securely encrypted, the payment gateway transmits it to the relevant payment processor (e.g., Visa or Mastercard) for authorization. The processor acts as a gatekeeper, verifying the customer’s information and ensuring sufficient funds are available.

5. Receiving the Verdict: The payment processor meticulously examines the information. It checks factors like card validity, account status, and available credit limit. The processor then sends an approval or decline response back to the payment gateway.

6. Transaction Processing (Upon Approval): If the payment is approved, the payment gateway acts as a facilitator. It works with the processor to securely transfer the funds from the customer’s account to yours. This transfer typically happens within a few business days.

7. Order Confirmation and Completion: Upon successful authorization and transaction processing, your website receives a confirmation message from the payment gateway. This allows you to finalize the order process, fulfill the customer’s purchase, and potentially send them a confirmation email.

8. Communication is Key: Throughout this process, the payment gateway acts as a communication bridge. It relays information securely between your website, the payment processor, and your bank account, ensuring a smooth and efficient transaction flow.

Additional Considerations:

– Fraud Prevention: Reputable payment gateways incorporate fraud prevention measures to minimize the risk of unauthorized transactions. These measures may involve additional verification steps or real-time fraud checks.

– Chargebacks: In rare cases, a customer might dispute a transaction and initiate a chargeback. The payment gateway facilitates the communication and resolution process for chargebacks.

By understanding these steps, you can gain a deeper appreciation for the role payment gateways play in securing online transactions and streamlining your business operations.

V. Understand Payment Gateway Provider and How to Choose The Right Provider

1. Overview of Payment Gateway Provider

Now that you’ve grasped the inner workings of payment gateways, let’s meet the key players: payment gateway providers. These are the companies that offer the technology and services necessary to integrate a payment gateway into your website. They act as intermediaries between your business and the payment processors (like Visa or Mastercard) that handle the actual authorization and transfer of funds.

Payment gateway providers essentially provide you with the tools and support to:

– Connect your website to various payment processors.

– Securely accept online payments.

– Manage your transactions efficiently.

– Comply with industry security standards.

2. How to Select the Right Payment Gateway Provider for Your Business Solutions

Choosing the right payment gateway provider is a crucial decision for your payment gateway integration. Here are some key factors to consider when making your selection:

– Transaction Fees: Compare the processing fees and any additional charges associated with different providers. These fees may include per-transaction fees, monthly fees, and chargeback fees.

– Supported Payment Methods: Ensure the provider offers the payment methods most relevant to your target audience. Consider factors like regional preferences and popular e-wallet options.

– Security Features: Security is paramount. Choose a provider with robust security measures to protect customer data and prevent fraud. Look for certifications like PCI DSS compliance, which indicates adherence to stringent security standards.

– Integration Ease: Evaluate the integration process offered by different providers. Consider your technical expertise or the resources available for integration. Some providers offer user-friendly plugins or APIs, while others might require more complex coding.

– Global Reach: If you plan to expand internationally, choose a provider with global capabilities to support transactions in different currencies and comply with regional regulations.

– Customer Support: Reliable customer support is essential. Look for providers offering timely and helpful assistance, especially during the integration process or troubleshooting any payment-related issues.

Additional Considerations:

– Reputation and Reviews: Research the reputation of different payment gateway providers. Read online reviews from other businesses to get a sense of their customer service, reliability, and overall user experience.

– Scalability: Consider your future growth plans. Choose a provider that can scale with your business and accommodate increasing transaction volumes.

By carefully evaluating these factors and considering your specific needs, you can select a payment gateway provider that empowers your business to accept online payments securely, conveniently, and efficiently.

VI. Define Payment Processing Flow

The payment processing flow refers to the intricate sequence of steps involved in authorizing and settling an online transaction. Understanding this flow is essential for businesses to have payment gateway integration and want to ensure smooth and secure transactions. Here’s a breakdown of the key stages:

1. Customer Initiation: The journey begins with the customer. They browse your website, add items to their cart, and proceed to checkout.

2. Payment Information Entry: On the checkout page, the customer enters their payment details securely through the payment gateway. This might include credit card information, debit card details, or e-wallet credentials.

3. Encryption and Transmission: The payment gateway plays a vital role here. It encrypts the sensitive financial data using sophisticated algorithms, safeguarding it from potential interception. The encrypted information is then securely transmitted to the relevant payment processor (e.g., Visa or Mastercard).

4. Authorization Request: The payment processor receives the encrypted data and initiates the authorization process. This involves verifying various aspects of the customer’s information:

– Card Validity: Is the card number valid and not expired?

– Account Status: Is the card account active and in good standing?

– Available Funds: Are there sufficient funds in the account to cover the purchase amount?

5. Authorization Response: Based on the verification results, the payment processor sends an approval or decline response back to the payment gateway. This response is also encrypted for security.

6. Transaction Processing (Upon Approval):

– Approval Received: If the transaction is approved, the payment gateway facilitates the transfer of funds. It works with the processor to securely debit the customer’s account.

– Funds Transfer: The authorized funds are transferred from the customer’s bank account to a merchant account held by the payment processor or your business bank (depending on the specific flow). This transfer typically takes a few business days.

7. Communication and Order Fulfillment:

– Confirmation to Website: The payment gateway relays a confirmation message to your website, indicating a successful transaction.

– Order Fulfillment: Upon receiving confirmation, you can process the order, fulfill the customer’s purchase, and potentially send them a confirmation email.

8. Settlement (Optional):

– Settlement with Merchant: Depending on the payment gateway provider and your chosen settlement options, the funds may be held by the processor for a short period before being deposited into your merchant account. This timeframe varies but typically occurs within 1-3 business days.

Additional Considerations:

– Fraud Prevention: Throughout the process, the payment processor and gateway may employ various fraud prevention measures to minimize the risk of unauthorized transactions. These might involve additional verification steps or real-time fraud checks.

– Chargebacks: In rare cases, a customer might dispute a transaction and initiate a chargeback. The payment processor and gateway would then facilitate the communication and resolution process for such disputes.

By understanding the payment processing flow, you gain a deeper appreciation for the intricate steps involved in online transactions. This knowledge empowers you to effectively manage your online payment system and ensure a smooth experience for both you and your customers.

VII. 7 Reasons Why Need to Switch into Integrated Payment Solutions

In today’s competitive online marketplace, a seamless and secure payment experience is crucial for business success. Traditional methods might involve redirecting customers to separate payment processor pages, creating friction and potentially leading to cart abandonment. Payment gateway integration solutions offer a superior alternative, streamlining the checkout process and boosting your bottom line. Here are 7 compelling reasons to make the switch:

1. Enhanced Customer Experience: Frictionless checkout is king. Payment gateway integration allow customers to enter their payment information directly on your website, eliminating the need to be redirected to a separate page. This creates a smoother, faster, and more convenient checkout experience, increasing customer satisfaction and loyalty.

2. Reduced Cart Abandonment: Imagine a customer reaching the checkout stage, only to be met with a complex or lengthy process. Cart abandonment rates soar in such scenarios. Integrated payment solutions eliminate this hurdle, keeping customers engaged and more likely to complete their purchases.

3. Increased Security: Security is paramount when dealing with online transactions. Payment gateway integration leverage robust encryption measures to safeguard sensitive customer data throughout the checkout process. This protects your business from fraud and fosters trust with your customers.

4. Faster Payment Processing: Integrated solutions eliminate the need for manual processing or delays associated with traditional methods. Transactions are authorized and settled more efficiently, leading to faster access to your funds and improved cash flow.

5. Seamless Integration with Existing Systems: Payment gateway integration can connect seamlessly with your existing shopping cart, inventory management system, and other business tools. This eliminates the need for complex data entry and ensures all your business systems work together in harmony.

6. Improved Operational Efficiency: By streamlining the checkout process and automating tasks, integrated payment solutions can save you valuable time and resources. This allows your team to focus on other strategic initiatives that drive business growth.

7. Scalability and Future-Proofing: As your business grows, your payment processing needs will evolve. Integrated solutions are designed to scale with your business, accommodating increasing transaction volumes and adapting to future payment technologies.

By embracing integrated payment solutions, you can create a more secure, efficient, and customer-centric online payment experience. This translates to increased sales, improved customer satisfaction, and a solid foundation for future business growth.

VIII. Steps to Integrate Payment Gateway into Website

Now that you understand the benefits of integrated payment solutions, let’s delve into the process of payment gateway integration for your website. Here’s a roadmap to guide you through the key steps:

1. Choose Your Payment Gateway Provider

This is a crucial decision. Carefully evaluate different providers based on factors like transaction fees, supported payment methods, security features, integration ease, and customer support (refer to Section V for a detailed breakdown of selection criteria).

2. Sign Up for a Merchant Account

Most payment gateway providers require a merchant account to process online transactions. This account acts as a holding point for your received payments before they are deposited into your business bank account.

3. Obtain API Credentials

Once you have a merchant account, the payment gateway provider will provide you with unique API (Application Programming Interface) credentials. These credentials act like secret keys, allowing your website to communicate securely with the payment gateway’s system.

4. Prepare Your Website for Integration

The technical integration process will vary depending on your website platform and the chosen payment gateway. Here are some general steps:

– Identify the Integration Method: Some payment gateways offer pre-built plugins or modules for popular website platforms (e.g., WordPress, Shopify). Alternatively, you might need to implement custom code using the provider’s API.

– Gather Technical Resources: Depending on the chosen integration method, you might need basic coding knowledge or the assistance of a developer to integrate the payment gateway with your website.

5. Configure the Payment Gateway Settings

Once you’ve prepared your website, you’ll need to configure the payment gateway settings within your website’s administration panel or through the provider’s platform. This typically involves:

– Entering API Credentials: Input the unique API credentials provided by the payment gateway provider.

– Specifying Payment Methods: Select the payment methods you want to offer to your customers (e.g., credit cards, debit cards, e-wallets).

– Setting Up Tax and Shipping Rules: Define any tax rates and shipping costs that apply to your products or services.

6. Testing the Integration Thoroughly

Before launching your payment gateway integration, rigorous testing is crucial. Simulate various payment scenarios using test accounts provided by the payment gateway to ensure everything functions smoothly. Test successful transactions, declined transactions, and different payment methods.

7. Go Live and Start Accepting Payments!

Once you’re confident about the integration’s functionality and security, you can launch your integrated payment solution. Now, customers can seamlessly enter their payment information on your website, and you can start accepting online payments securely and efficiently.

Additional Tips:

– Consult the Payment Gateway Provider’s Documentation: Most providers offer comprehensive documentation and tutorials to guide you through the integration process.

– Seek Support if Needed: Don’t hesitate to reach out to the payment gateway provider’s customer support team if you encounter any technical challenges during integration.

By following these steps and considering the additional tips, you can successfully have payment gateway integration for your website and unlock the numerous benefits of integrated payment solutions for your online business.

IX. Why Choose Adamo as Your Trusted Fintech Software Solutions?

Payment gateway integration can be a complex process, and choosing the right partner is essential for a smooth and successful implementation. Here’s why partnering with a reputable Fintech software solutions provider like Adamo can be advantageous:

1. Expertise and Experience

– A qualified Fintech software solution provider possesses in-depth knowledge of payment gateway technologies, integration processes, and industry best practices.

– Our team of experienced developers can handle the technical aspects of integration, ensuring a secure and efficient connection between your website and the chosen payment gateway.

2. Tailored Solutions and Scalability

– A trusted partner doesn’t offer a one-size-fits-all solution. Adamo take the time to understand your specific business needs and recommend the most suitable payment gateway based on your transaction volume, target audience, and budget.

– We can also design a scalable solution that can adapt to your future growth, accommodating increasing transaction volumes and evolving payment technologies.

3. Streamlined Integration Process

– Partnering with a Fintech software solutions provider can save you valuable time and resources. We handle the complexities of integration, freeing you to focus on other aspects of your business.

– Our experience can ensure a smoother and faster integration process, minimizing downtime and disruption to your website operations.

4. Ongoing Support and Maintenance:

– A reliable partner doesn’t just integrate the payment gateway and walk away. We offer ongoing support and maintenance services to ensure your system remains secure, up-to-date, and functioning optimally.

– We can also provide assistance with troubleshooting any payment-related issues that might arise after integration.

5. Security and Compliance

– Security is paramount in the world of online transactions. A Fintech software solutions provider prioritizes robust security measures to safeguard your customer data and prevent fraud.

– We stay informed about the latest security regulations and ensure your payment gateway integration adheres to industry compliance standards.

By partnering with a reputable Fintech software solutions provider, you gain access to the expertise, experience, and resources necessary to possess seamless payment gateway integration. This allows you to accept online payments securely, efficiently, and focus on growing your business.