How to use a digital wallet: Essential tips to optimize your spending management

More people worldwide are using a digital wallet or e-wallet. With a digital wallet, individuals or businesses can conduct online transactions. It stores users’ payment information on many different websites. Thanks to digital wallets, people can make any purchase without using cash. But how to use a digital wallet effectively? Let Adamo Software discuss essential tips to optimize your spending management with a digital wallet.

Reading this blog post, you will have an overall insight on how to use your e-wallet. You will learn key statistics on digital wallet adoption. Besides, the blog post will guide you on how to set up a digital wallet and use it to make transactions. In addition, we will delve into the way businesses accept digital wallet payments. Furthermore, Adamo Software also gives you some advice for making the most of digital wallets. All information is updated according to the latest data and trends. So, refer to our blog post and find some useful information for you!

I. The emergence of digital wallet: Notable statistics

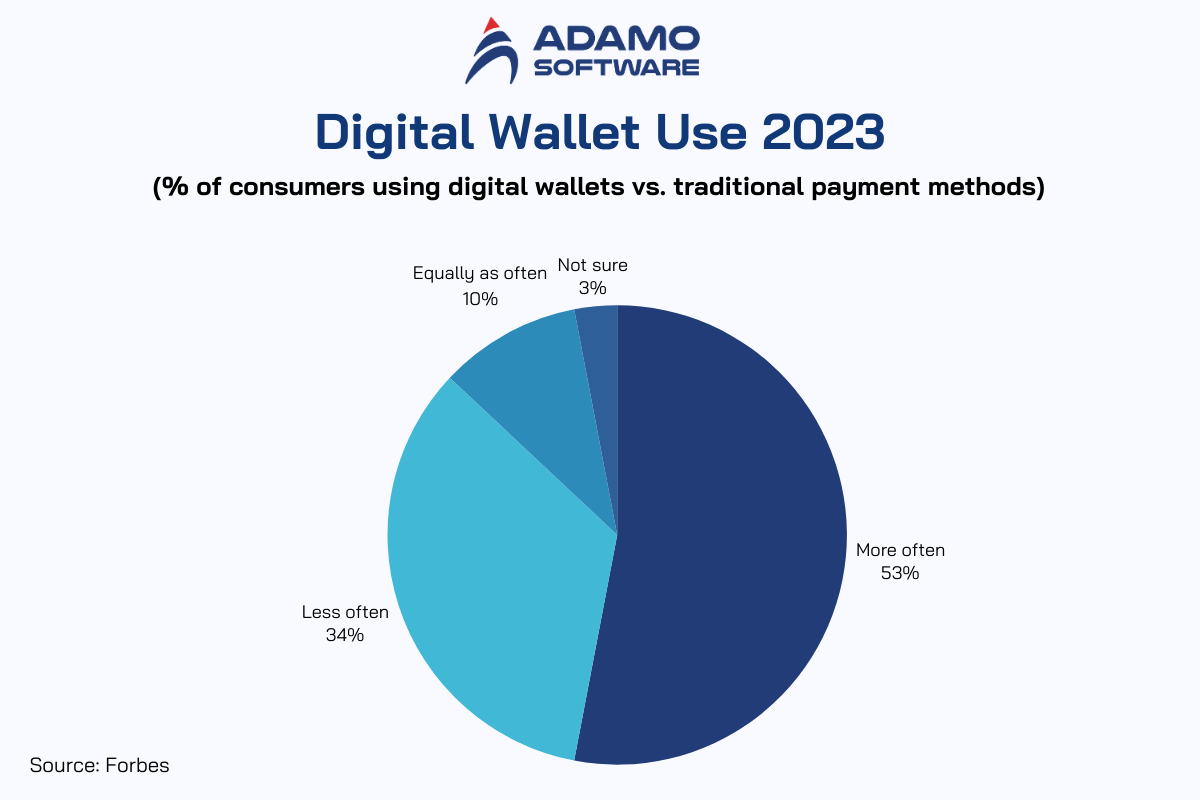

The emergence of digital wallets has created a huge step forward in finance. Users are increasingly interested in how to use a digital wallet to make quick transactions. According to the statistics from Juniper Research, digital wallets will see a 78% increase in transaction value from $9 trillion in 2023 to $16 trillion by 2028. Following the same report, North America will be the largest region using e-wallets for transactions in 2028, with a transaction amount of $8,566; followed by the Far East & China regions at $5,646, and West Europe at $5,646. Another research from Capital One Shopping shows that in 2022, there were 3.4 billion digital wallet users worldwide, accounting for 42.6% of the world population. This number is projected to reach 5.2 billion in 2026, representing more than 53% of the world’s population.

Data from Global Market Insights shows that the mobile wallet market is expected to grow from $318.5 billion in 2022 to $1.95 trillion by 2032, driven by smartphone and internet adoption. How to use a digital wallet is a question of interest to many ages. Gen Z is the most likely generation to use digital wallets, with nearly 80% adoption. This number is 66% for Millennials, 43.7%, and 25.7% respectively for Gen X and baby boomers.

From the data above, it can be seen that using a digital wallet is becoming more popular in e-commerce. Thus, knowing how to use a digital wallet is essential for everyone. Let’s keep reading for more detailed information about this.

II. How to use a digital wallet

Digital wallets have become a popular payment method due to their convenience and security. How to use a digital wallet involves grasping setting up the wallet process and how to use the wallet to make online transactions. Let Adamo Software discuss each part in detail.

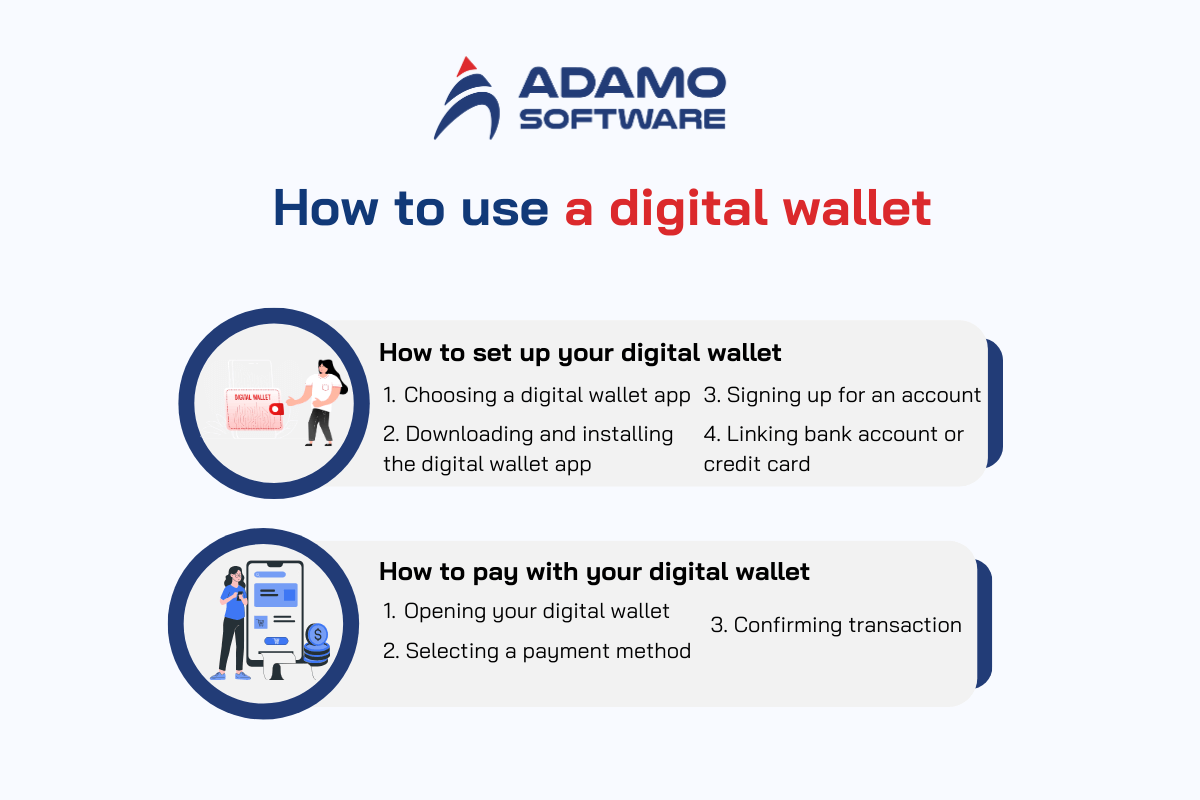

1. How to set up your digital wallet

Setting up the digital wallet is the first and foremost step in how to use a digital wallet efficiently. To set up your digital wallet, you may want to follow the steps below.

- Choosing a digital wallet app

When choosing a digital wallet app, you must consider the compatibility of the app with your device, features to suit your needs, and security level. You must identify what your digital wallet will be used for, online payments, transferring money, shopping in-store, etc. While some e-wallets support international payments, some only support domestic transactions. Let’s choose the app that best suits your needs and makes it easy to learn how to use a digital wallet.

Security is also an essential factor in choosing a digital wallet app. You must ensure that your digital wallet has strong security features like PIN codes, two-factor authentication (2FA), and fingerprint or facial recognition.

Before downloading the app, you must check if the digital wallet app is compatible with the device you are using (Android or iOS). Besides, the app must work well on your current operating system versions to optimize your learning experience.

There are many digital wallets you can refer to. For example, PayPal is famous for its online payment service with international payment and money transfer capabilities. Whereas Apple Pay provides a mobile payment solution built into Apple devices and Google Pay allows users to make payments via Android phones and manage credit or debit cards. These pieces of digital wallets have different interfaces and features. However, they all offer significant benefits when it comes to making payments, making the transaction process easier and more secure.

- Downloading and installing the digital wallet app

Downloading and installing the app is an indispensable step in learning how to use a digital wallet. This process is very simple. First, let’s access your app store which is the Google Play Store for devices using the Android operating system, or the App Store for the iOS operating system. Then, find yourself the digital wallet app you want to download.

Next, choose the appropriate search result on the store and install the app. The download and installation process will take a few minutes automatically, depending on your internet connection speed. After finishing downloading, you can open the app and start setting up your digital wallet account.

- Signing up for an account

How to use a digital wallet without signing up for an account? After installing your app, let’s start registering an account. Select “Register” on the app homepage, then enter the required personal information including name, phone number, and E-mail address, and set a password. After that, verify your identification with an ID card or passport. Once your account is verified, you can continue setting up other options in the app, like security or bank linking.

- Linking bank account or credit card

After logging into your account, let’s find the “Add card” options. Then, choose to add a debit or credit card to your digital wallet. Follow the on-screen instructions to enter your card details. You may need to fill in your card information like bank cardholder name, bank account or credit card number, expiration date, etc. Some apps may allow you to take a photo of your card for easier input. Once your information is successfully verified, your bank account or credit card will be linked to your digital wallet. Now you can start funding your wallet, making payments, or transferring funds.

2. How to pay with your digital wallet

When you finish all the steps above, you can start using your e-wallet. How to use a digital wallet also involves the way to pay with that wallet. Let’s find detailed steps with Adamo Software!

- Opening your digital wallet

Firstly, open your digital wallet installed on your mobile phone. Log in and check if the balance in your account or credit card limit is sufficient to make the transaction.

- Selecting a payment method

Go to the Payment section in your app. Depending on the service or store you’re shopping at; you may be asked to select a linked credit/debit card or use your wallet balance. If you buy items directly at stores, you only need to open your app and scan the store’s QR code. This lets shoppers know how to use a digital wallet easily and quickly at points of sale. When shopping online, you will choose a digital wallet as your payment method. Enter the required information and confirm the transaction by logging into your wallet or scanning a QR code.

- Confirming transaction

When you finish entering the amount and payment information, your digital wallet app will ask you to confirm your transaction. You may need to enter a PIN, fingerprint, or facial recognition depending on your security setting. This transaction confirmation is necessary to ensure that you are the one using the wallet to make the transaction, and to enhance the security of the app.

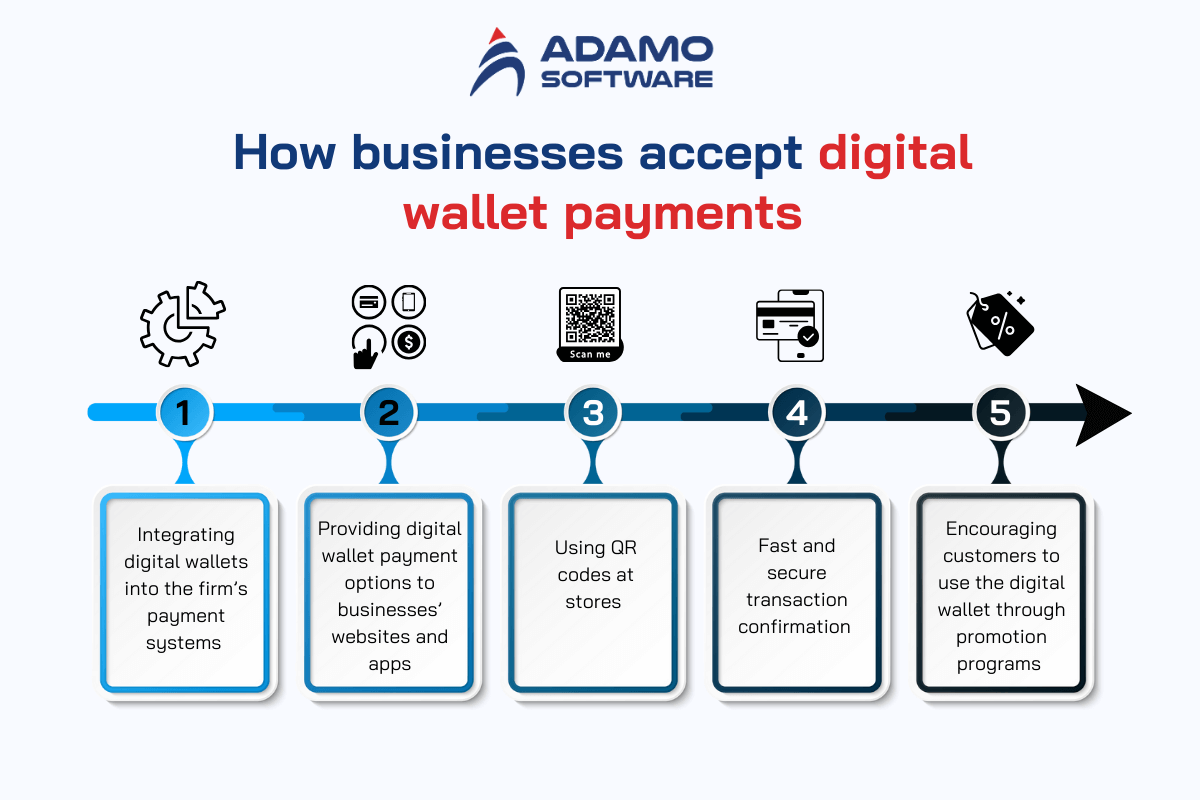

III. How businesses accept digital wallet payments

Currently, many companies have accepted digital wallet payments due to their convenience. Below are the steps and methods that a business can adopt to accept payments using e-wallets. Knowing these steps helps you better understand how to use a digital wallet from the business side.

1. Integrating digital wallets into the firm’s payment systems

Businesses must integrate popular digital wallets mentioned in the above section into their payment systems. This can be done via API or through payment solution partners. API is essential in integrating, renewing, extending, and maintaining the connection between the businesses’ digital wallets and payment systems.

2. Providing digital wallet payment options to businesses’ websites and apps

When businesses have finished integrating e-wallets into their payment systems, they may want to show the digital wallet payment on their homepage so that their customers can know this payment method. Digital wallet payment makes it easy for customers to choose the payment method they are familiar with and understand how to use a digital wallet to pay.

3. Using QR codes at stores

For retail businesses, providing QR codes for customers to scan and pay via e-wallets is a convenient solution. Thanks to the QR code, firms can speed up the payment process and improve user experience. Besides, their customers can know how to use a digital wallet at stores.

4. Fast and secure transaction confirmation

After the customer pays for the businesses’ services or products, the system will send a transaction confirmation notification immediately. Firms can use security methods like OTP or PIN codes to ensure the transaction’s safety. This helps customers feel secure when making payments and accessing how to use a digital wallet.

5. Encouraging customers to use the digital wallet through promotion programs

Businesses can launch promotions or discounts for customers who pay via e-wallets. This can promote business sales and encourage customers to learn how to use a digital wallet in their daily shopping.

Overall, by adopting the above ways, businesses can easily approach modern payment methods. Besides, they can help their customers know how to use a digital wallet.

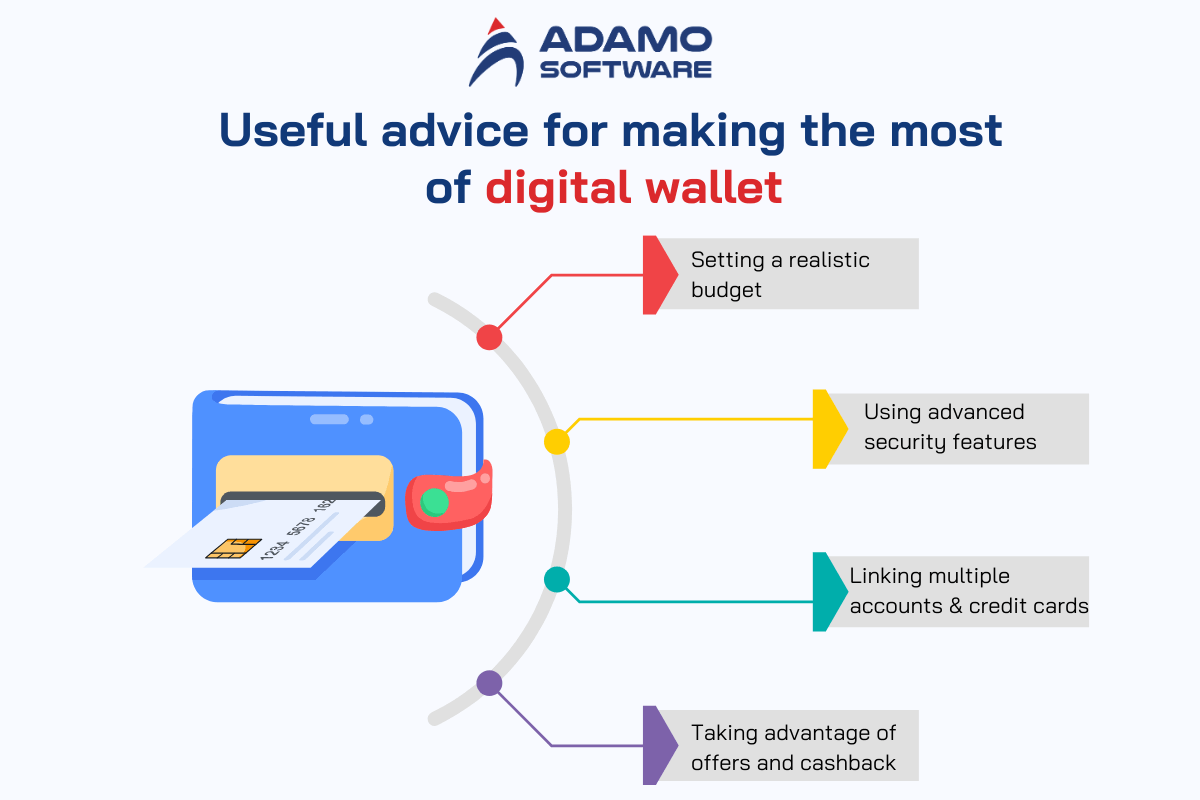

IV. Useful advice for making the most of digital wallets

Digital wallets can be beneficial to both users and businesses. But how to make the most use of digital wallets? Let Adamo Software discuss some useful advice on how to use a digital wallet successfully.

1. Setting a realistic budget

Setting a realistic budget is essential to make the most use of digital wallets. When getting familiar with how to use a digital wallet to make transactions, you must manage your finances and monitor your spending to avoid exceeding the set budget. Here are some reasons why you should set a realistic budget.

- Tracking your spending

- Avoiding unnecessary costs

- Financial optimization

By creating a spending plan, you can make the most of the benefits of a digital wallet without negatively impacting personal or business finances. You may want to carefully consider your income, recurring expenses, and desired savings to allocate your funds effectively.

2. Using advanced security features

Using advanced security features is also among the recommendations when using a digital wallet. Below are some security features that you should adopt to protect your digital wallet app account and online transactions.

- Two-factor authentication

Two-factor authentication provides an extra layer of security. Users must enter the verified code sent to their phones or Email after logging in. Thanks to the two-factor authentication, you can protect your accounts from unauthorized access, even if a password is compromised.

- Using a PIN code or biometric identification

Most digital wallets allow users to set a PIN code or use fingerprint/facial recognition technology. When learning how to use a digital wallet, you may want to learn to use this to prevent others from accessing your account if your phone is lost or stolen.

- Strange transaction warning

You must enable unusual transaction alerts to get notified as soon as suspicious transactions occur. Thanks to this function, you can check and respond promptly to account theft activities.

- Updating your digital wallet app regularly

You must ensure that your digital wallet app is updated regularly. Updates often come with improved data protection features.

By adopting robust security protocols, you can protect your digital wallet and make transactions safely and efficiently. Let’s consider this when using the e-wallet!

3. Linking multiple accounts and credit cards

Linking multiple accounts and credit cards brings many benefits, helping you manage your finances easily and optimize the payment experience while learning how to use a digital wallet. Here are some detailed benefits of this.

- Increasing the flexibility in payment

You can choose the appropriate funding source for each transaction when you link many bank accounts to your digital wallet. This gives you more flexibility in spending and easy control over payments.

- Backup in case your main account has problems

If your main bank account or credit card fails or becomes inactive, you can still use other linked accounts to make payments without worrying about transaction interruption. This further highlights the importance of how to use a digital wallet effectively.

- Managing personal finances more easily

Linking multiple accounts and credit cards to a digital wallet helps you centralize transactions in one place. Thanks to that, you can easily track transaction history and manage your finances more effectively.

4. Taking advantage of offers and cashback

Taking advantage of offers and cashback is a wonderful way to save money and know how to use a digital wallet smartly. Here’s how you can practice this.

- Monitoring promotion programs

Digital wallets often partner with retailers and services to offer special promotions. They can be discounts, cashback, or bonus points at checkout.

- Using a cash-back credit card

If your digital wallet is linked to a credit card that offers cash back, you can take advantage of this to recoup a portion of the cost of each transaction. This is a great benefit that helps maximize the value of each purchase.

- Participating in reward programs

When you make the transaction, you can accumulate reward points and redeem them for attractive gifts, from discount vouchers to useful products and services. Using this feature not only helps you save but also increases the value of how to use a digital wallet in managing daily expenses.

V. Simplify your digital payments with a dedicated development team from Adamo Software

Do you want to simplify complex payment processes, improve transaction speed, and ensure data security using an e-wallet? If yes, then you can trust Adamo Software, one of the leaders in technological solutions in Vietnam. With a professional and experienced team, Adamo Software can tailor payment solutions to suit your unique needs. We can help you understand how to use a digital wallet and integrate modern payment methods. We provide customized services that integrate digital wallets and other payment methods into your business operations seamlessly.

When partnering with Adamo, you will have a detailed guide on how to use a digital wallet. This helps simplify complex payment processes, improve transaction speed, and ensure data security. No matter whether you need mobile wallet integration, online payment gateways, or cryptocurrency options, we provide flexible and scalable finance software development solutions to suit your requirements.