Fintech trends 2025: Top trends will shape the future finance

The financial world evolves rapidly, driven by new technologies and new expectations. Therefore, industry professionals need to understand fintech trends 2025 in such a context. These trends will greatly influence how financial products are developed and delivered. As we look ahead, innovation will be a driving force in how the finance sector turns out.

Advancements in artificial intelligence and the emergence of digital banking will bring change to customer relationships and expectations as fintech trends 2025 kick in. And so, companies that adapt to these changes will have a competitive advantage.

In this article, we review the most tremendous fintech trends 2025 that will overhaul the industry. An increasingly complex market means businesses must be informed about these developments to succeed. Let’s discover with us the finance trends that will determine the future.

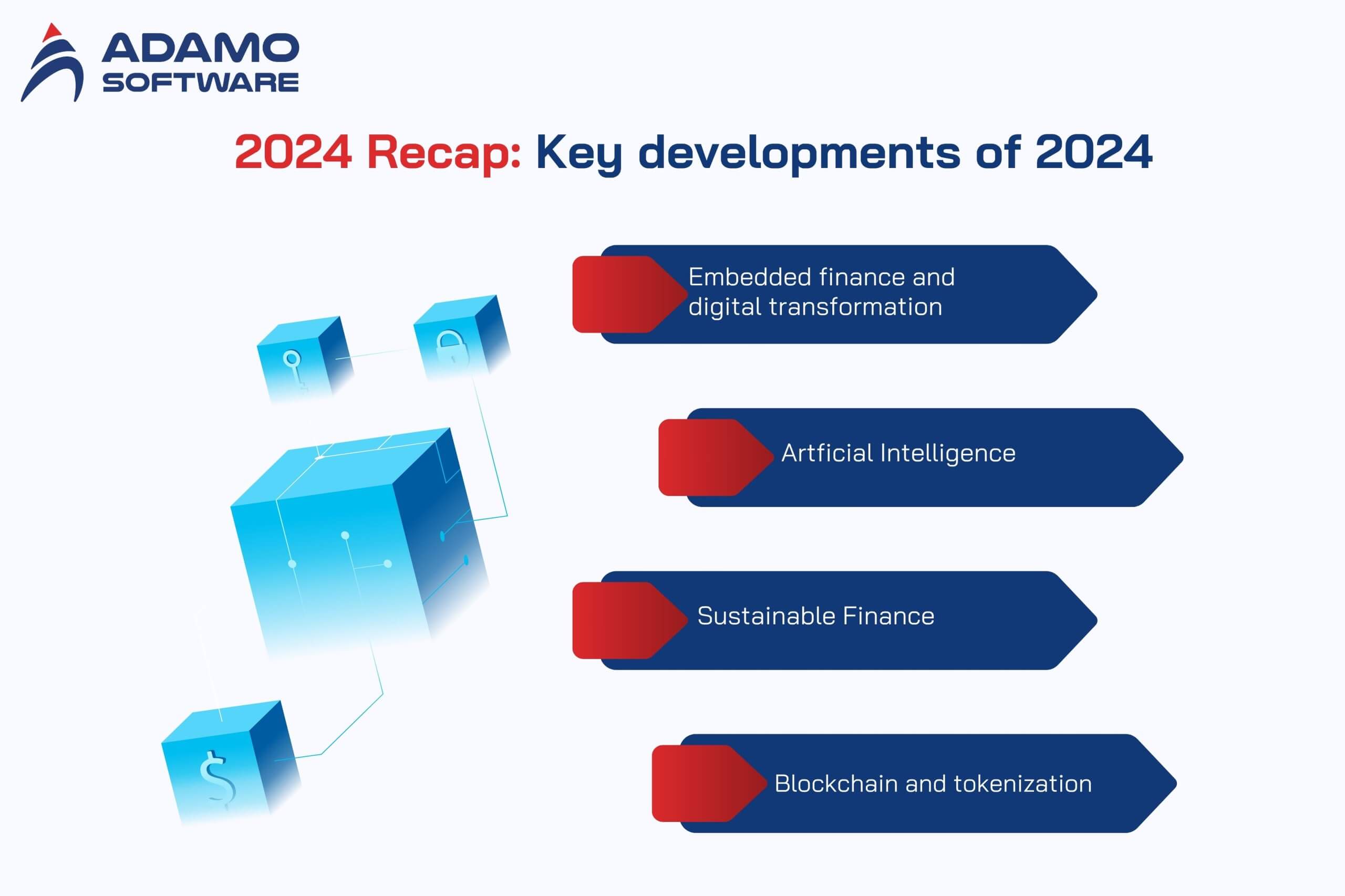

I. 2024 recap: Key developments of 2024

2025 promises a world of big change in finance, and that’s no surprise. These changes could make a difference in how businesses run and expand. AI is changing financial possibilities, sustainability is influencing financial practices, and blockchain is developing fast, as is embedded finance. These trends affect and will continue to drive fintech to remain adaptable and original.

Here’s a look at the key highlights from 2024:

1. Embedded finance and digital transformation

In 2024, embedded finance has been a big trend. Financial services are being integrated right into companies’ software platforms. It provides an integrated experience between the businesses and the consumers. eCommerce platforms now allow payment solutions without redirecting users to external sites. The trend makes users’ experience better by offering simplified transactions.

It also lets companies give customers products catering to their financial needs. As embedded finance develops, it will be a feature available across all types of industries. This will be among fintech trends 2025 that fuel companies to execute their efforts in boosting their digital transformation.

2. Artificial intelligence

In 2024, AI turned from a buzzword into something almost necessary in all fintech companies. Today, fraud detection and customer service enhancement all integrate AI technologies. Essentially, companies are now using AI to optimize their operations greatly. They make the customer support process more efficient and cheaper by automating part of the process.

AI can also analyze huge amounts of real-time data, helping decision-making processes. This capability enables fintech firms to offer personalized services to customers according to their preferences. With the evolution of AI, fintech trends 2025 will become even more promising.

3. Sustainable Finance

For sustainable finance, environmental, social, and governance (ESG) is now key considerations in 2024. More and more companies are seeking out B Corp certificates to demonstrate they operate a responsible business. It shifts the spotlight towards a burgeoning need for socially responsible financial products.

This is precisely when fintech firms start adapting and offering solutions to their clients, helping them track their carbon footprints and achieve sustainability goals. Now, we have advanced analytical tools for monitoring ESG performance on several investments. This trend signifies a movement towards responsible finance that is in line with consumer values. As these practices gain popularity, they will shape fintech trends in 2025.

4. Blockchain and tokenization

The institutional adoption of blockchain technology has been increasing already steadily since 2024. As products like Bitcoin ETF drive more interest in stablecoins and Central Bank Digital Currencies (CBDCs), so does this. Blockchain’s secure, transparent transactional abilities and fraction reduction capabilities are of great appeal to financial institutions.

Additionally, the technology covers smart contracts and digital identity verification, thus making it an even more useful technology in finance. Due to the adoption of blockchain solutions by more institutions, the ecosystem will grow and develop further. This growth is expected to be a key factor in determining fintech trends 2025. It’s expected that companies will use blockchain to improve their operations and provide new services.

Also read: Top innovative Travel App Ideas for startups and SMEs in 2025

Ready to Outsource?

Discover how we can transform your business with expert IT solutions.

II. Lessons learned to be ready for Fintech Trends 2025

2024 was a year full of innovation and, of course, challenges for the fintech world. Throughout the year, three major challenges companies should overcome came to light. These are the lessons you need to prepare your company to navigate fintech trends 2025.

1. Regulatory readiness

Fintech companies were pressured in 2024 to comply with regulations more seriously. The regulatory frameworks are so important that we can point to Payhawk, for example, as a clear example of how it can come. The company obtained its digital money institution (DMI) license. It’s a time when the regulatory environment is getting increasingly complex, with federal and state agencies setting rules for various parts of the industry. In this maze, companies had to manage their way through changing requirements.

To thrive in the fintech trends 2025, companies must proactively look at their compliance and risk management systems. Only then can they be fully prepared to reach full benefits. That includes strengthening internal processes, securing the appropriate licensing, and getting ahead of the development curve for evolving regulation. As more scrutiny mounts, the firms that offer a positive approach will be able to compete at the forefront.

2. Focus on profitability

The priority of fintech companies had been growing at all costs for years until 2024 when this started to change. Firms began to focus on profitability and scaled more balanced and more maturely. This has altered their business models, and they need to rethink them, introduce cost-cutting measures, and optimize their resources. That’s when companies began to prioritize long-term financial health over unchecked expansion.

As a result, fintech has emphasized profitability, fueling more resilience to economic uncertainty and market shifts. The trend shows that more and more people realize that sustainable growth matters the most for long-term success. Profitability is a key performance benchmark as fintech trends 2025 start to unfold.

3. Partnerships and collaboration

2024 was also a nice showcase for the power of collaboration in the fintech world. Strategic partnerships were a huge deal, with big companies like Payhawk forming partnerships with companies like Visa and JP Morgan. These collaborations allowed companies to play to their strengths, widen their market presence, and deliver improved services.

Working together also helped to innovate and made fintech more competitive by responding faster to consumer demands. Sharing resources and expertise created the environment for delivering better solutions to customers. Partnerships will continue to be essential for driving growth and staying ahead in the fast-moving fintech industry as we look ahead to fintech trends 2025.

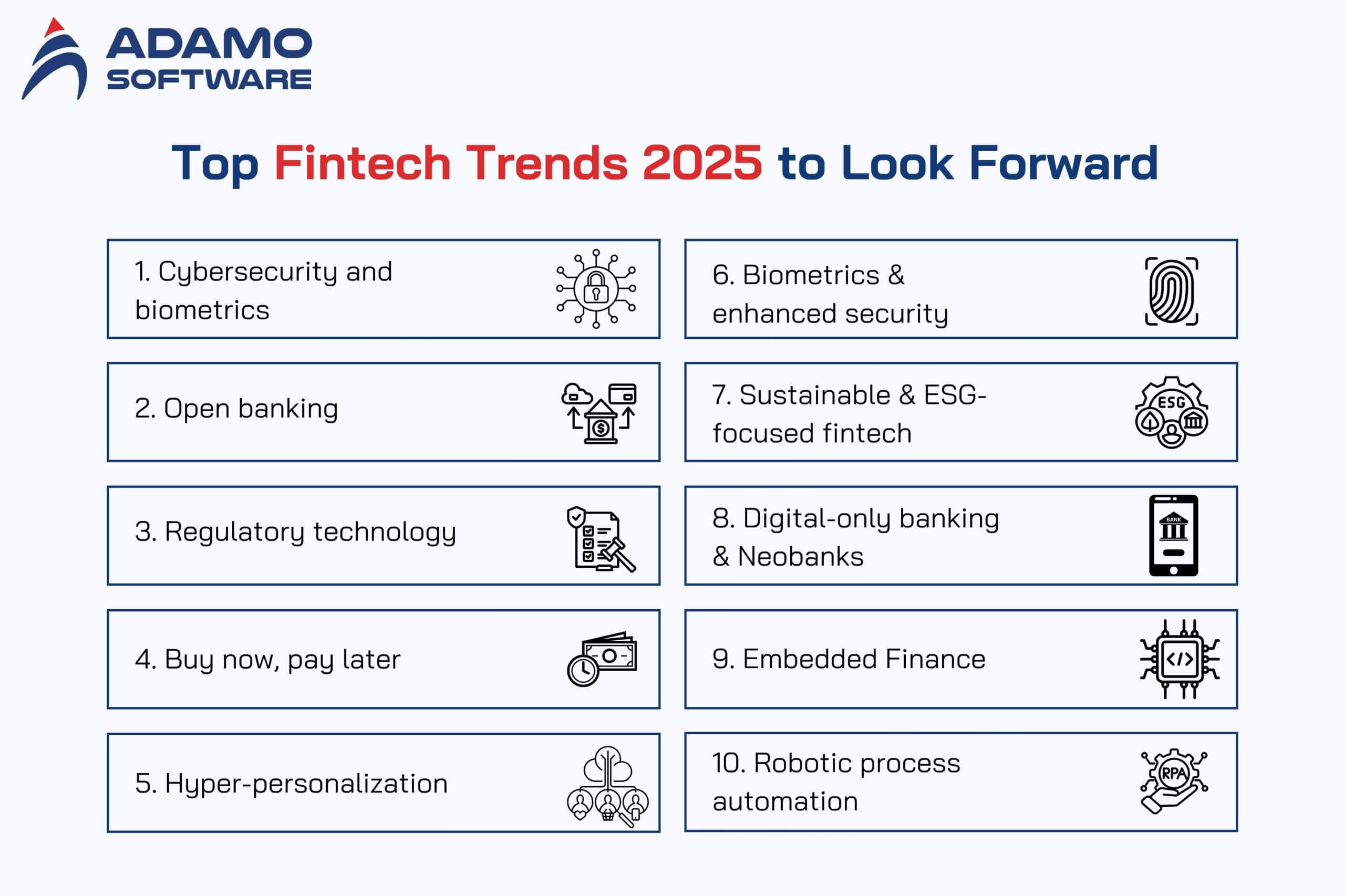

III. Top Fintech Trends 2025 to Look Forward

Several fintech trends 2025 will reshape the financial landscape as we look forward to this coming year. Let’s delve into these developments:

1. Cybersecurity and biometrics

As financial institutions are attacked by advanced cyber threats and fraud, cybersecurity, and biometric authentication will become even more important in 2025. Facial recognition and behavioral patterns will combine to form multi-modal biometrics providing secure access. Also, AI-powered threat detection systems will identify new attack methods for an additional layer of security. Companies like OneSpan are moving mobile security and authentication solutions forward, and BioCatch is building on its existing behavioral biometrics.

This focus on security is driven by cyber threats. Naturally, stricter regulatory requirements demand strong authentication, and consumers demand seamless and secure banking experiences. With digital transactions on the rise, it’s only a matter of time before cybersecurity becomes paramount in keeping customers’ sensitive financial data safe. Hence, the top fintech trends 2025 to watch for will be the evolution of cybersecurity.

2. Open banking

Open banking has also changed how financial data is accessed and shared. By 2025, this concept will mature into broader data sharing around financial products such as investments, pensions, insurance, and mortgages. This development will occur under the themes of Open Finance and Open Payments. The expansion aims to streamline payments by making the process faster and more efficient since there’s no need to go through so many steps.

According to the estimation, by 2026, the global payment transactions via Open Banking will hit $116 billion, a 2800 percent growth since 2021. Open banking pushes customer service and innovation and creates competition and risk, such as unauthorized access to sensitive data.

Doing it right will require robust security measures to be implemented and applied to regulatory standards. This approach will ensure that open banking can be adopted without compromising safety and effectiveness. Open Banking is one of the fintech trends 2025, opening financial ecosystems to integration and convenience.

3. Regulatory technology

Regulatory technology (RegTech) is one of the major fintech trends 2025 as institutions automate compliance processes to reduce burdens. The RegTech market is forecasted to grow steadily at 15.0% CAGR from 2024-2029.

AI-powered regulatory monitoring will enable real-time risk assessment across large amounts of AI-structured and unstructured data. Also, making regulatory reporting robotic automation processes will increase speed and accuracy. Additionally, know-your-customer (KYC) utilities offered on a blockchain will simplify onboarding using shared, tamper-proof records.

The growth is driven by the growing complexity of regulatory environments and the demand for better and more efficient compliance solutions. RegTech advancement is among fintech trends 2025 that will facilitate financial institutions’ navigation of ever more complex regulation with increased efficiency.

4. Buy now, pay later (BNPL)

In 2025, the Buy Now, Pay Later sector will continue to grow with credit assessment models for it. Those models are improving and more heavily regulated. The market is projected to jump from $24 billion in 2020 to $67 billion by 2025.

Integrating open banking will also improve the accuracy of affordability checks and responsible lending practices. Besides, AI-powered risk assessment tools can lend customer behavior and creditworthiness to decrease default rates. Industry leaders are learning from shopping super-apps, with Klarna being an example of that. Companies like Block are consolidating their market position through integrations with Afterpay and similar service partners.

As the sector matures, we can expect consolidation. Additionally, there will be a sharper emphasis on responsible lending standards due to financial regulators becoming increasingly critical of firms’ operations.

5. Hyper-personalization

Next up on the list of fintech trends 2025 is hyper-personalization. In 2025, there will be a rise in fintech companies using AI, machine learning, and predictive analytics. Personalized budgeting tips, spending alerts, and customized investment portfolios will help financial apps meet users’ goals and values. These features will anticipate users’ needs effectively. Within these apps, embedded nudges will improve financial habits in real-time.

Services will become more intuitive and user-centric because of the shift from generic products to highly relevant financial solutions. It reflects the consumers’ growing expectations for personalized interactions, and AI’s speed accuracy enables the making of loyal customers.

6. Biometrics and enhanced security

With more and more fraudsters becoming innovative in bypassing traditional security measures, behavioral biometrics will take the lead. This approach offers advantages over static manifestations such as facial and fingerprint scans. Continuous authentication, which looks at how a user types, grips their device, and navigates apps, helps identify account takeover before a transaction occurs.

Taking it further, banks plan to apply behavioral biometrics and AI-driven adaptive authentication to reduce friction for legitimate users and prevent malicious actors. Adopting zero-trust security models is one of the fintech trends 2025, and it will be standard practice to verify requests, regardless of what source.

Overall, the sophistication of cyber threats will drive enhanced security measures, which will be a cornerstone of fintech trends 2025.

7. Sustainable and ESG-focused fintech

Environmental, social, and governance (ESG) assets are expected to amount to over $50 trillion by 2025. This signals an enormous progressive step in sustainability investing. Given the growing concern for climate change, green financial services are also positioned to gain popularity, and many users will prefer green financial services.

Gamifying carbon footprint tracking and offsetting, the chief climate-focused fintech companies like Ant Forest are making sustainability efforts more exciting for users. New types of sustainability-linked loans will also offer new forms of sustainable investment stemming from ESG data analytics driven by AI.

Fintech trends in 2025 will see fintech platforms democratizing access to ESG investments. They will enable micro-contributions towards projects such as solar farms and carbon capture.

The combination of fintech, ESG principles, and the advent of new technologies will rewrite the rules of green finance. This ensures that green finance continues to be a significant part of fintech trends in 2025.

8. Digital-only banking and Neobanks

With internet-based financial services becoming a reality, the number of global digital banking users will grow to 2.5 billion people by 2024. This fully aligns with a movement towards internet-based financial services. In modernizing their infrastructure and attracting younger, tech-savvy customers, traditional banks are rolling out cloud-native digital branches. Neobanks are moving past digital-only banking and are now dishing out lending, wealth management, and crypto, amongst others as they grow. To boost profitability and market share, they are exploring various strategies.

As a part of fintech trends 2025, neobanks will prioritize convenience and innovation. They will provide comprehensive financial solutions on a single platform. This competitive landscape will cause traditional and digital-only banks to keep innovating with rising expectations.

9. Embedded Finance

In 2025, we’ll see embedded finance surge, with non-financial brands embedding banking, payments, and lending services into the hands of their customers. This integration allows consumers to use financial services within existing platforms while combining convenience and engagement.

Embedded finance is one of the fintech trends 2025, and it has the potential to change how people use financial products. Such a shift is being enabled by API-first infrastructure providers that make fast and inexpensive implementation easier. This supports the future of services like in-app insurance and contextual lending.

This phenomenon has resulted in companies like Stripe Treasury expanding their embedded finance offering and Plaid supplying its data connectivity solutions to aid this ecosystem. Apparently, embedded finance notably impacts fintech trends 2025, underscoring its essential role in the broader fintech landscape this year.

10. Robotic process automation

Robotic process automation is the last one on the list of fintech trends 2025. More complex decisions, such as claims processing and credit assessment, will be made by more capable AI-enhanced bots. Intelligent document processing would strengthen the accuracy of data extraction and validation from unstructured financial documents.

UiPath is leading the charge on cognitive automation alongside other RPA providers like Blue Prism, which is beefing up its cloud-native intelligent automation offerings. The need to reduce operational costs and processing speed is pushing forward the expansion of RPA as transaction volumes grow.

Striving to embrace RPA helps organizations manage their finances better and reduce costs. This approach also enables them to achieve growth in the business as the digital world becomes more accustomed.

v. Let Adamo Software be your partner to catch up on Fintech Trends

Adamo Software is your ideal partner if you want to stay ahead with fintech trends 2025. In financial technology, we’ve been there, done that, and are not afraid to say we understand the next waves, too. Therefore, we can design fintech software development solutions tailored to facilitate operations and deliver outstanding user experience.

Trust us to enhance your business and invest in the burgeoning fintech trends 2025 that will ensure continuous growth and success! Contact us now!