Insurance Claim Management Software: Benefits and Top Tools in 2026

Learn how insurance claim management software boosts efficiency and customer satisfaction with the best tools of 2026.

The fast-moving insurance industry demands efficiency as its core value. Software for managing insurance claims is now a crucial element in today’s insurance industry. The system reduces operational complexity while boosting customer satisfaction rates.

Insurance claim management software provides revolutionary changes to the way claims are processed. Such software simplifies workload tasks and minimizes human errors in the process. This leads to a significant boost in data accuracy. These systems also integrate various functions. The system performs both document handling tasks and messaging functions.

Obviously, you need to make a well-informed decision when selecting insurance claim management software, as it will impact your productivity and profitability.

This guide will explore the top-level insurance claim management software systems available in the market, their benefits, all help you make a choice.

I. What is Insurance Claim Management Software?

Insurance claim management software provides a specialized digital platform that enables companies to manage insurance claims through their entire processing cycle. These software applications optimize the complete claims process through workflow automation, allowing users to reduce administrative tasks while ensuring improved precision.

Modern insurance claim management software contains document storage and capture solutions, allowing secure handling of essential policy documents, claim forms, and supporting documentation. The system tracks litigation actions, settlement negotiations, and detailed claim evaluations to meet transparency and regulatory compliance requirements.

A unified platform centralizes claim information, helping insurers speed up processing, reduce errors, and improve communication among adjusters and stakeholders. Companies achieve better customer service throughout the claims process through insurance claim management software, combined with operational efficiency and cost reduction.

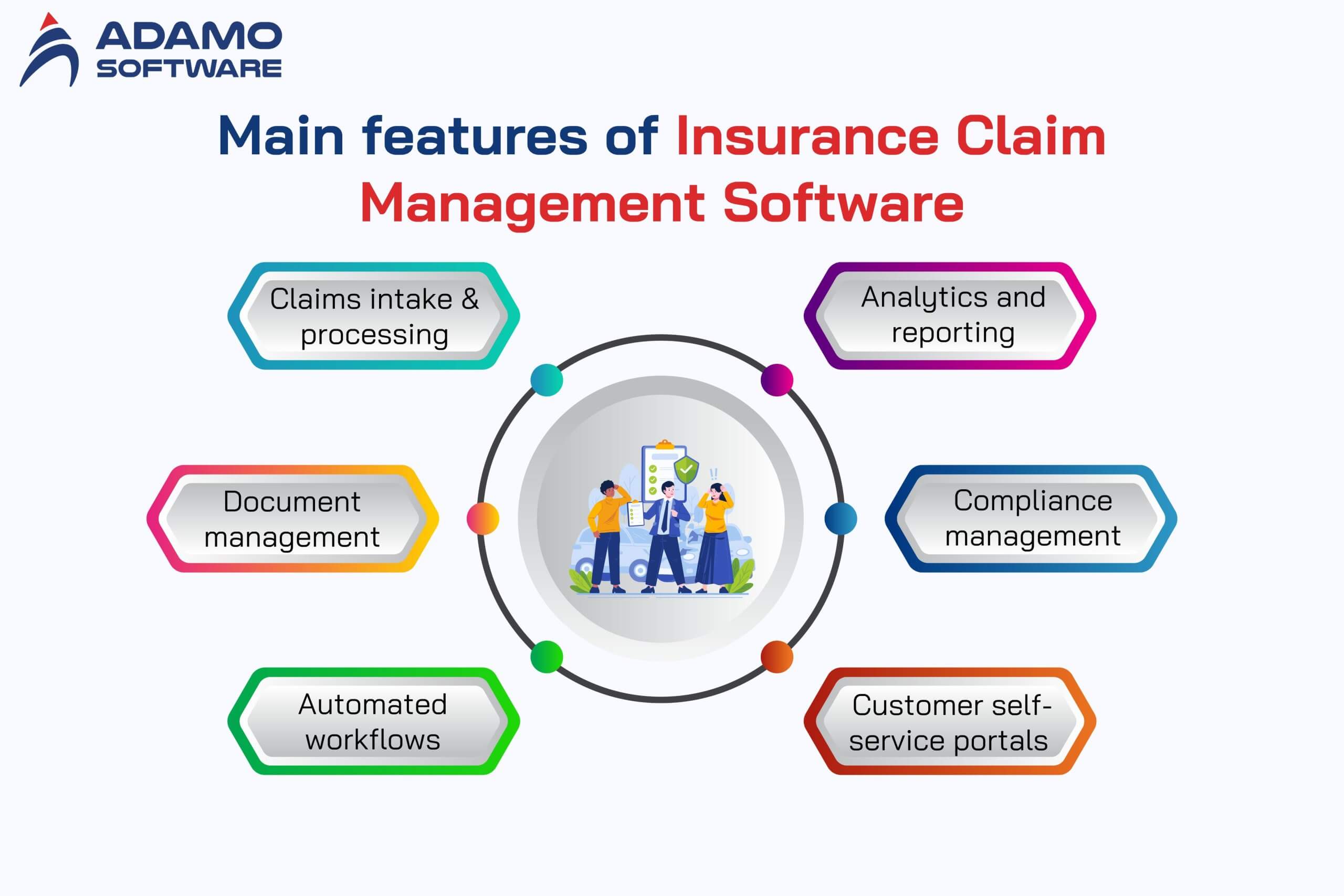

II. Main Features of Insurance Claim Management Software

Moving your business toward insurance claim management software will revolutionize your operational efficiency regardless of specialization. Insurance claim management systems eliminate data management issues through their ability to capture claims investigations essentials, including medical reports, repair estimates, and payment information.

Insurance claim management software provides several important features demonstrating its value in operations as follows:

Claims intake and processing

The integration of insurance claim management software allows insurers to handle claims intake and process management more efficiently across various sectors. This includes auto coverage and medical claims. By automating notifications, the system ensures all concerned parties are updated in real-time, minimizing delays in action.

Data validation is conducted instantly through cross-checking with established databases, which helps detect fraudulent patterns and eliminates errors during verification. A user-friendly mobile form interface further enhances the process by allowing remote data input from agents, adjusters, and claimants, increasing overall operational flexibility.

Real-time data availability ensures that claims teams, adjusters, and policyholders have access to the same up-to-date information. This not only makes the insurance claims process easier but also enhances communication between team members. Ultimately, this consolidated approach enables businesses to operate more quickly and safeguards them from the risks associated with traditional manual methods.

Document management

Insurance claim management software stands out because of its sophisticated document management capabilities. The system lets users find all claim-related documents by centralizing emails with records and reports.

Its seamless platform and integration software connects internal systems and third-party networks to maintain the accessibility of relevant data. The system enhances collaboration with operational efficiency improvements because users can directly link needed support documents to claims.

Healthcare claims processing benefits from patient record integration through streamlined workflows and reduced duplication. This leads to more precise claims cycle accuracy and ultimately supports faster and more reliable outcomes for insurers and policyholders.

Automated workflows

The central component of contemporary insurance claim management software is automation technology that removes extensive repetitive activities from insurer operations. The automated workflow system controls all stages of claims handling, beginning with submissions and continuing with analysis. It also includes payment distributions while performing fraud detection functions.

Actors in these workflows can access adjustable data entry screens that pair with customization rules and templates for individual business operations. The built-in financial authority controls and protects sensitive information while duplicate checking ensures that data stays intact.

Through its notification system, the software manages essential tasks so staff members can concentrate on strategic activities without neglecting important requirements. The insurer achieves quicker claim settlements, enhanced accuracy, and higher customer satisfaction, establishing its market leadership position in a competitive insurance sector.

Analytics and reporting

Insurance claim management software includes strong analytics features alongside reporting capabilities. This allows for instant access to claims data, which remains current throughout the claim processing period.

The system consists of user-friendly design tools that allow anyone to build customized reports without requiring specialized technology skills. This design provides team members with better access to relevant information. Through personalized self-service analysis, users can independently access data that fits their specific needs without needing help from IT support.

Through data visualization tools, complex datasets transform into simple visual representations that users can easily interpret. The features provide insurers with both analytical power and effective action prioritization capabilities.

Compliance management

Insurance claim management software provides essential help to insurers by streamlining their tasks related to industry regulatory compliance. The software tracks all state and federal regulations and performs automatic electronic reporting to maintain your business in regulatory compliance.

The system provides real-time regulatory change detection and regulatory compliance tracking to keep your business ready for all adjustments. It also connects to fraud detection models, enabling it to identify suspicious claims before they become fraudulent.

Insurers benefit from automated fraud assessment and regulatory tracking, which prevents price-liable errors and maintains solid reputation levels while upholding compliance requirements.

Customer self-service portals

When combined with insurance claim management software, users gain access to easy-to-use self-service portals. These portals allow them to file claims, track their status, and easily upload required documentation.

Customers experience easier service delivery and increased loyalty through personal incentives and product promotions encountered during self-service interactions. This is facilitated by features including image upload and online payment.

Policyholders can access quick support through integrated customer support channels that combine live chat operations with available agents. AI-driven agents enhance efficiency and customer satisfaction by delivering immediate, personalized replies that solve issues and answer common questions promptly.

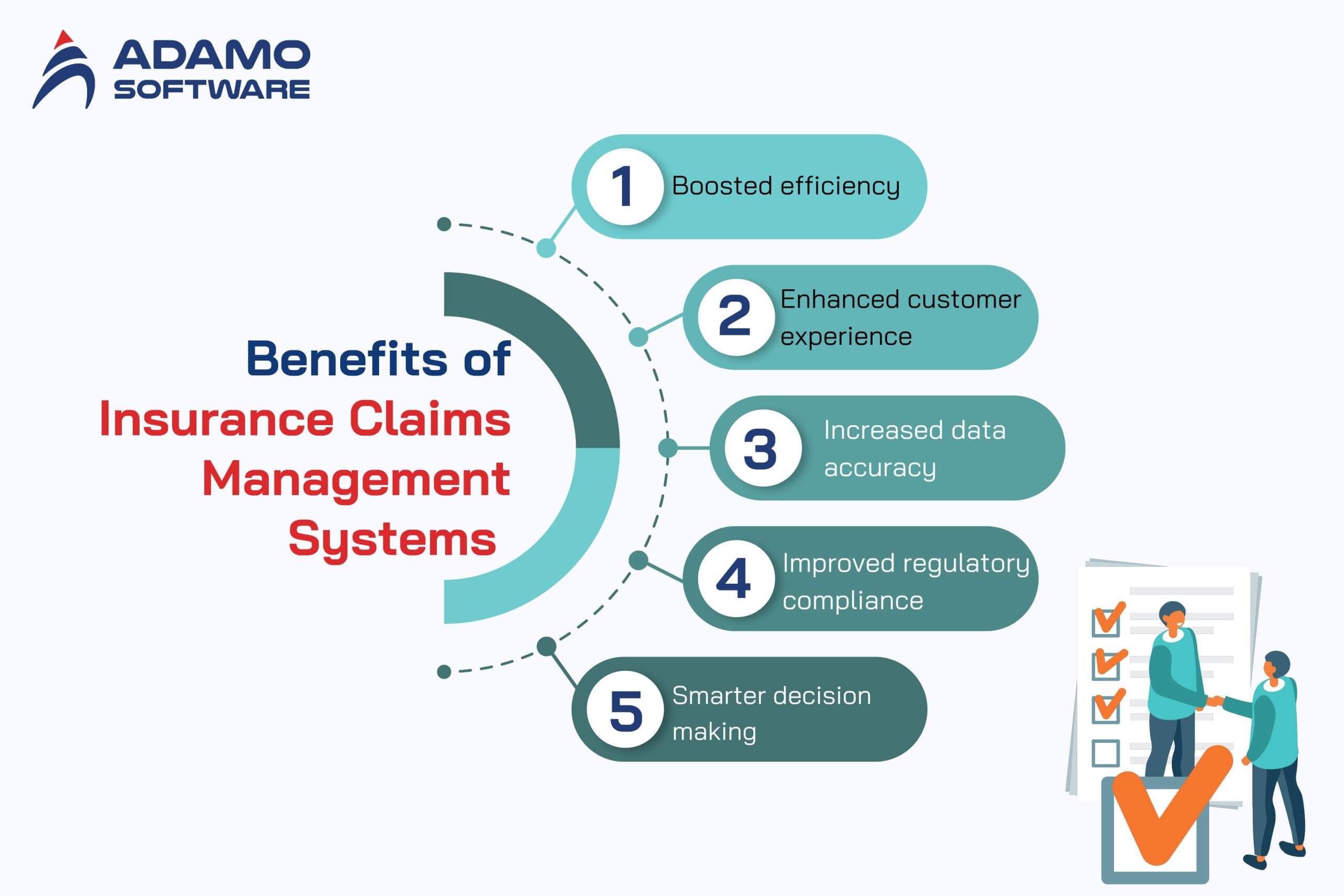

III. Benefits of Insurance Claims Management Systems

Insurance claim management software optimizes business processes while speeding up overall operations to produce three main advantages:

Boosted efficiency

The combination of manual data entry and document verification through traditional procedures results in lengthy claim settlement delays. This situation upsets customers and leads to your staff being involved in recurring support phone calls. Your team can handle claims quickly and efficiently through automation software because the system handles various processes.

By implementing this system, you will see quicker processing times and better resource utilization, creating better operational flow and customer service experiences.

Enhanced customer experience

Manual claim tracking systems create inadequate visibility because customers remain uninformed about their claims and experience extensive delays in processing. A claim management system delivers better customer experiences through a self-service portal that gives users real-time claim progress information.

The system’s proactive visibility generates customer confidence because people receive real-time status updates about their claims. This transparency helps maintain higher customer loyalty from start to finish.

Increased data accuracy

During a mass natural disaster claim surge, your team’s workload expands radically, resulting in heightened possibilities of mistakes. Automated systems maintain precise handling of data entry tasks, calculations, and documentation tasks, no matter how busy the period.

Such systems prevent disputes and improve regulatory compliance by increasing accuracy levels. They also minimize the need for second checks or extra resources, saving operational time.

Improved regulatory compliance

You must follow all industry rules to keep customers trusting your business and ensure legal compliance. Insurance claims management software achieves regulatory compliance through its ability to protect data reporting accuracy and integrity.

Insurance claim management systems provide efficient methods for generating and preserving claim documentation. This enables organizations to handle regulatory audits and physical inspections more easily. Your business will find protection from liabilities while enhancing its market standing.

Smarter decision making

Real-time access to structured data provides essential information, helping people make better choices. The software tools allow users to perform prompt analyses on unexpected claim patterns within specific geographical areas. Business policies become more effective through trend analysis and customized reporting. This approach helps assess risks, allowing you to improve outreach strategies that increase profitability by responding promptly to emerging market challenges.

The insurance industry can achieve long-term success and accelerate growth through strengthened efficiency because of these software benefits.

You can explore more about “Outsourcing Healthcare Software Development: When it works” here.

IV. Recommended Insurance Claims Management Software

The following list shows leading insurance claims management software solutions that assist insurers during claims handling and assessment. These systems provide three main functionalities: workflow automation and document management. They also include features for policy data capture, litigation monitoring, and settlement analysis for streamlined claims handling.

1. LexisNexis

The insurance claim management software industry leader, LexisNexis, delivers sophisticated analytics solutions and advanced claims tools that transform insurers’ operational models. For decades, the company has specialized in creating tools that help insurers identify fraudulent claims. These tools also enhance risk assessments and maximize claims handling efficiency.

The solution integrates without interrupting existing operational systems to provide efficient operations and better decision-making abilities. As a leading organization in fraud detection, LexisNexis stands as a respected industry standard within the legal and insurance fields.

The company offers end-to-end insurance solutions that embrace risk assessment technology and fraud detection capabilities. They also provide custom claims management platforms that serve various insurance domains, including property insurance, casualty insurance, and health insurance customers.

Through 40 years of analyzing legal and insurance data, LexisNexis provides insurers with modern data-driven solutions that help them stay competitive in today’s dynamic market.

2. Sapiens

Sapiens created revolutionary insurance claim management software by uniting modular system architecture with modern technology to simplify complicated processes. Their technological solutions enable insurers to address market changes and drive digital transformation within their organization.

Sapiens has demonstrated its expertise through 40 years of service to provide insurers with scalable tools that serve life, health, and property insurance needs. The claims management software developed by Sapiens stands out because it delivers simple user interfaces, streamlined processes for managing claims, and operational efficiency reductions.

Sapiens stands apart in the market through its modular platform design that enables businesses to select customized solutions for their changing market needs. Implementing CoreSuite for Property & Casualty and digital claims tools through Sapiens allows insurers to preserve their operational flexibility. This approach supports sustainable growth in increasingly competitive markets.

Explore Our Tailor-made Software Development Solutions

We are confident in providing end-to-end software development services from fully-functioned prototype to design, MVP development and deployment.

3. OneShield Software

The claim management software solutions from OneShield Software deliver dynamic capabilities and customization options to transform insurers whose operations need modernization. Through their innovative solution set, they create customizable policy administration, billing, and claims management systems that scale according to business requirements.

Insurance companies can expect a fast return on investment through OneShield’s low-code configuration system, which enables rapid deployment. The company reveals proficiency in serving niche market segments and captives and delivers flexible solutions incorporating powerful automated elements to boost operational effectiveness.

OneShield helps insurers build sleek claims pathways through the customer design method, resulting in more delighted policyholders. The Core Insurance Platform and its claims automation tools operate seamlessly to deliver a full-scale software package covering all aspects of claims management.

Insurance providers seeking innovative success should choose OneShield because of its exceptional customization abilities and automation features.

4. Insurity

Insurity is a market leader within cloud-based insurance claim management software that uses data to optimize operations and boost customer satisfaction. The insurance industry recognizes Insurity by operating platforms that power 35 out of the top 40 U.S. insurers, indicating durability and market-wide usage.

Their specialized solutions focus on complex claims processing by delivering SaaS tools that embed data-driven insights into all processing stages. The software applications from Insurity maximize underwriting and claims management operations through efficient process optimization for lower operational expense.

Customers achieve timely, important decisions through the Cloud Insurance Suite, combined with Claims Analytics tools from the company. Insurity has cemented its role as a critical insurance industry partner. It uses innovative technology to enhance customer outcomes for insurers who want to outpace market competition.

5. Riskonnect

Riskonnect delivers a unified claim management platform that seamlessly blends advanced risk management capabilities with optimized claims handling processes. Through their position as a leading enterprise risk management solutions provider, Riskonnect delivers powerful analytics. This helps insurer clients successfully reduce their risk exposure and improve their claims results.

Riskonnect developed software that streamlines every stage of the claims process, from intake to resolution, boosting efficiency and providing clearer, faster operations. The Risk Management Suite and Claims Analytics capabilities at Riskonnect provide insurers the means to take active action against possible challenges. This enables them to maximize their results.

Riskonnect offers unique capabilities that combine risk management features with superior analytics tools to help insurers perform better risk mitigation while driving operational improvements. Riskonnect establishes trust as an industry-leading partner through its dynamic integration capabilities and friendly user interfaces. These features guide healthcare, risk management, and insurance industries across complex environments.

V. How Adamo helps you with custom Insurance Claim Management Software

Adamo Software is a top Vietnamese healthcare software development company specializing in building customized insurance claim management software that meets your enterprise needs. Adamo employs expert knowledge of artificial intelligence and blockchain techniques alongside agile approaches. This combination allows us to develop solutions for claims processing operations that scale up easily while maintaining system security. As a result, claims become more efficient, leading to higher customer satisfaction levels.

Through end-to-end service, Adamo Software creates integrated solutions that enable insurers to achieve rapid deployment for operational optimization and market competitiveness.

Is your organization ready to start transforming its claims processing system? Contact Adamo today!

FAQs

1. Why is insurance claim management software essential in the insurance industry?

Today’s insurance industry relies heavily on insurance claim management software as its foundation for modern operational needs. The software system automatically reduces operational expenses while enhancing operational workflow effectiveness. The software drives customer satisfaction by fast-tracking processing and speeding up resolution times. It ensures that both records remain accurate, and businesses stay compliant while supporting better customer interactions to deliver superior operational outcomes.

2. What factors should I consider when selecting insurance claim management software for my business?

Consider software scalability when choosing an insurance claim management platform, as it aligns with your business expansion. Additionally, seamless integration with existing platforms like CRM and policy administration systems is crucial. Businesses need software that provides complete compliance capabilities to fulfill regulatory demands. Choose solutions that provide adaptable workflows to meet your company’s notable requirements and bring enduring operational achievement with enhanced efficiency.

3. Is it possible for insurance claim management software to integrate with current systems?

Current modern software solutions for insurance claims management exist to connect effortlessly with CRM systems and underwriting tools. They also integrate with policy administration applications. Such platform integration leads to successful data exchange between systems, eliminating duplicate entries while providing enhanced operational efficiency. The system’s built-in features enable businesses to optimize operations while improving decision quality and speeding up claim settlement procedures.

4. What advantages does cloud-based insurance claim management software offer over traditional systems?

Cloud-based insurance claim management software provides unparalleled flexibility by allowing organizations to scale their operations when demands grow. The system enables staff to perform claim processing tasks remotely from any location. Software updates run automatically to maintain system freshness, alongside several advanced security methods that defend crucial information. The software integrates seamlessly with cloud-based tools to drive efficiency and reduce system downtime.

5. How does automation improve processes in insurance claim management software?

Automated claim management software tools remove manual duties, saving time and reducing mistakes. The system expedites claim handling through standardized work pathways and correct data management. Insurance organizations achieve better efficiency and lower costs while improving customer satisfaction. They accomplish this by having staff tackle challenging cases and essential tasks after routine tasks are automated.

6. Are there specialized insurance claim management software options for niche industries?

Several companies market customized insurance claim management software that aligns with life and health coverage and disability and property and casualty requirements. The software solutions provide a variable configuration that helps insurers create solutions that adapt to their particular market requirements. The insurance industry benefits from customized features that help niche insurers boost operational performance while giving superior service tailored to their specialized market requirements.