Peer-to-peer payment services (P2P): What is it, how do they work, pros and cons

We have seen drastic changes caused by financial technologies in the last few years, one of which is definitely peer-to-peer payment services. Peer-to-peer payment services, or P2P, have brought about a more effective way to conduct transactions and thus become increasingly popular. Whatever kind of payment you need to make, P2P surely offers a much more secure and convenient way to do that.

Because of their popularity, more and more people are encouraged to try out this new method of transaction and opt for cashless payment. An overwhelming 60% of world consumers have actually reported carrying less cash on hand. Additionally, another 84% have used P2P payment solutions before. Indeed, popular P2P services like PayPal or Venmo have made it so easy for everyone to use such services.

As the field of financial technology continues to experience tremendous advancements, the market for peer-to-peer payment services will also develop. This market is expected to reach a total value of $2,598.6 million in 2022, and it will rise more in the years to come. Therefore, it’s safe to say that these services are gaining momentum, providing a safer and faster way of paying than traditional methods.

To help you catch up on all the information related to peer-to-peer payment services, we will dedicate this article to this very topic. We’ll explore how they work and what some pros and cons you need to know when using them.

Whether you’re a first-time user or want to explore different options, this article will definitely be useful for you! Let’s dive right into it!

I. Definition of peer-to-peer payment services

A peer-to-peer payment service is generally a kind of digital payment system. They enable you to transfer funds from your bank balance or any other source like credit/debit card or e-wallet balance to any other person instantly.

One major advantage of peer-to-peer payment services is how fast they are. Do you also recall the days when you could only use traditional cash transfer methods? It must have been very irritating to wait up to three business days as this depended on both the sending and receiving banks. Fortunately, we are now able to do that in a few seconds through the use of peer-to-peer payment apps.

Due to the advantages, there is much potential for using peer-to-peer payment services in daily life. For example, it can be handy when splitting the restaurant check, when paying the monthly rent, or even when returning a friend’s favor. They also contain features generally designed to ensure that individual transactions are more convenient than using banking facilities.

Modern developments in financial payments have indeed made peer-to-peer payment services one of the essential tools for users in transactions.

II. How do P2P payments work?

Peer-to-peer payment services have completely changed the way people send and receive money. To use a peer-to-peer payment service, the first step is just to register an account on an app of your choice. You would need to fill in some basic details like name, email ID, and phone number.

Once registering, they often have to go through Know Your Customer (KYC) processes. During this step, you have to provide proof of identity to sort of confirm who you are. It sounds a bit bizarre, but it is necessary for security reasons. After that, users can connect their own bank account or debit/credit card to easily transfer funds.

To make a transaction, users just need to fill in information like the amount of money and the recipient’s details. This information helps the P2P platform confirm the right account for money transfer. Then, money will be automatically moved from the sender’s account to that of the intended recipient within a few seconds. Because of this speed, many people prefer peer-to-peer payment services for most daily transactions.

Still, it is crucial to know that though most of the transfers are speedy, transferring money to a bank account can be kind of different. Through a peer-to-peer app, it can take several business days. Furthermore, only those people using the same P2P service can make transactions with each other. For instance, if a user is registered with PayPal, he cannot transfer money to another user who just uses Venmo.

Despite these limitations, the ease of use and quick access to funds have contributed to the rising popularity of peer-to-peer payment services.

III. Are P2P payment services secure?

Regarding the matter of security, rest assured that peer-to-peer payment services generally employ stringent measures to ensure users’ financial details. Popular peer-to-peer systems use data encryption, fraud detection, and two-factor authentication to protect the transactions.

However, no matter how hard developers try to impose these security features, P2P platforms are not immune to cyber threats. Therefore, you should always carefully read the security measures and the fraud prevention policy of the chosen provider.

Indeed, while P2P payments are safer, we must still be careful. That’s because once a payment is authorized, it can scarcely be retrieved. That’s the sad truth because banks and credit unions do not bear the burden of compensating for any P2P scams.

Also, the majority of the services protect users against fraud. For example, PayPal has a protection period of 180 days for fraudulent transactions.

All in all, it is vital to learn about how applications for P2P payment work. And it’s even more important to have specific layers of protection against possible fraudulent acts for effective and secure operations to be executed.

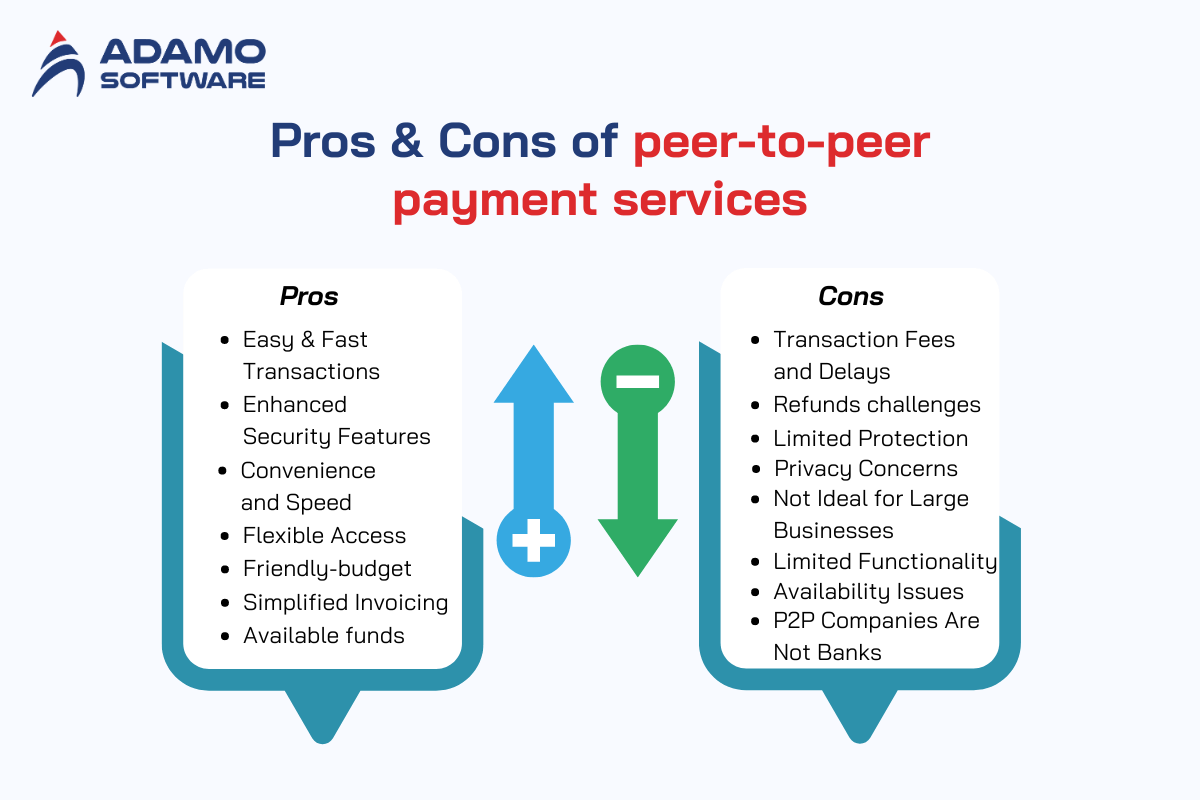

IV. Pros and cons of peer-to-peer payment services

It’s apparent that peer-to-peer payment services have become an efficient way through which we can send and receive money. However, like any type of financial instrument, they have their own benefits and drawbacks in terms of use. Knowledge of these advantages and disadvantages will help consumer decision-makers in making the right choices about payment solutions to adopt.

1. Pros

- Easy and Fast Transactions: Most peer-to-peer payment services enable customers to transfer money within a short period and with little further identification after account creation. This makes subsequent payments to the same contacts easy to accomplish.

- Enhanced Security Features: These services employ the encryption technique and two-factor authentication (2FA), thereby making it difficult for fraud to be perpetrated.

- Convenience and Speed: Peer-to-peer payment services are particularly convenient to use as they allow money transfers within minutes or even in seconds. Thus, it makes them suitable for use where there is a need to make funds transfer urgently.

- Flexible Access: Peer-to-peer payment services are often accessible via mobile applications or websites. Hence, it gives users considerable freedom regarding the space in which transactions are conducted. Additionally, it allows for the integration of different sources of funds, such as bank accounts, credit cards, or international payments, as provided by some vendors.

- Cost-Effectiveness: Peer-to-peer payment services are generally cheaper than the conventional ways of handling transactions in banks. Therefore, the use of peer-to-peer payment services is more affordable.

- Immediate Availability of Funds: In general, the money paid or transferred through peer-to-peer payment services is usually credited within an instant.

- Simplified Invoicing: Peer-to-peer payment services can enable electronic invoicing, thereby enabling businesses to easily receive payment. Even some invoicing platforms now come with built-in direct P2P payment options for customers to improve their payment journey.

2. Cons

- Transaction Fees and Delays: A few of these peer-to-peer payment services, for instance, have transaction fees for those transactions involving credit and debit cards. Though users receive payment confirmation at the time of purchase, the actual funds can take some business days to reach their bank accounts.

- Challenges with Refunds: Refunds can take a while, depending on P2P services. For instance, the average time can be up to 30 days.

- Limited Protection: In case of a false transfer or falling victim to a scam, it is not easy to get back the money.

- Privacy Concerns: Some of the peer-to-peer payment services gather user data for marketing reasons, making user privacy a concern. There is also the danger of a leakage of information that would be so dangerous for any business.

- Not Ideal for Large Businesses: Peer-to-peer payment services may not be convenient for large business entities or those that process many payments. That’s because of the limits that may be placed on payment and the challenge of managing records.

- Limited Functionality and Integrations: Most of the P2P platforms are quite basic when it comes to functionality, and while they are mainly aimed at payment transfer, they do not contain numerous features such as invoicing or statistical analysis.

- Availability Issues: Some countries do not offer peer-to-peer payment services. Therefore, businesses may have to look for other forms of payment to use for cross-border transactions.

- P2P Companies Are Not Banks: These services are not under the legal category of banks. Therefore, users of such services may not enjoy the same level of protection against fraud. Additionally, in the event that those funds get stolen, they are not protected by FDIC.

- Complementary, Not a Replacement: Although P2P is a useful tool, it cannot replace such forms of payment as credit card or ACH payments, particularly in the sphere of retail, where speed counts.

V. Top companies that offer P2P payment

P2P payment services are provided by several companies, each with a number of services that may possibly be unique. Let’s have a look at some of the most popular providers of peer-to-peer payment services:

1. PayPal

PayPal is one of the oldest and most famous peer-to-peer payment services at present. Currently, it operates in over 200 countries and enjoys over 277 million active customers. PayPal provides features such as sending and requesting money, making purchases, and transferring money to a bank.

PayPal is largely preferred over other apps due to its availability throughout the world. Additionally, the buyer and seller protection policies and their ability to act as a means of purchasing products online also contribute to their popularity.

However, though sending and receiving money is free, some transactions actually cost you money. For instance, you’ll need to pay once you want to transfer money to the bank account or if you’re paying for goods and services.

2. Venmo

Venmo is a peer-to-peer payment platform which belongs to PayPal. This is especially prevalent with young adults and is acknowledged for one of its features, which is social. Specifically, it has features like posting messages and emojis about the transaction, among others. Venmo is a service available exclusively in the United States and is not yet accessible in any other country.

The advantage of Venmo compared to other platforms is convenience, as well as its instant and social features. This is a big plus for the younger generation.

Both sending, requesting, and receiving money through the Venmo application are free. However, there are fees for some activities. For example, to transfer money from the Venmo account to the bank account or to use a debit card to purchase something.

3. Cash App

Cash App is another P2P payment application developed by Square mobile payment company. It is popular because of its usability and fee-free nature. Cash App also provides a cash card, which is a debit card used in connection with the app. Also, the Cash App is available only in limited locations, like the United States and the United Kingdom.

The advantage of this app is that there is no cost. It is possible to send, request, or receive money through the platform at no cost at all. The only charges that are incurred when using this service are a 3%t fee for using a credit card to make a payment. The Square Cash debit card also comes with no fees.

4. Zelle

Zelle is a P2P payment app developed by a group of US banks collaborating together. It is famous for its efficiency and is easy to find. Customers can use Zelle through a number of banks and credit unions that are supported within the United States. To use it, a user can sign up for Zelle by giving the application details of the bank account.

The advantage of Zelle is that it is built into several financial institutions’ apps. Thus, users can transfer money and receive it using Zelle without having to download the app.

As of now, transfers on Zelle do not incur any charge to the sender or the recipient. However, you may incur charges when you use your mobile banking application or mobile website.

5. Apple Pay & Google Pay

Google Pay and Apple Pay are P2P payment applications that make use of NFC technology to enable mobile payment. Depending on which kind of phone you own, you can choose one of these apps to use accordingly. Specifically, Android users can use Google Pay, while iPhone/iOS users can use Apple Pay.

Most consider Google and Apple Pay as platforms for making payments in stores. But surprise! They can also send and receive money from friends or family.

Google Pay or Apple Pay currently do not require any charges for their use. However, these transfers may be subjected to charges like swapping funds to a bank account or making international P2P purchases.

VI. How experts from Adamo Software help with P2P payment development

Looking for help with P2P solutions? Adamo Software will be your perfect partner for building successful peer-to-peer payment services.

Adamo Software is a software development company based in Vietnam with many years of experience in various sectors, including FinTech. Our qualified team works together to develop applications that allow easy transition of money from one user to another. We pay due diligence to data security by employing features such as encryption, multi-factor authentication, and blockchain technology to ensure the data is secure. Moreover, our specialists keep in mind the existing requirements of legislation, thus excluding the possibility of fraud and creating favorable conditions for the sale.

With Adamo Software, the development of P2P payment platforms is flexible, responsive to your needs, and packed with features your users need. We also provide you with post-implementation services to ensure that your system remains safe and optimally performing.

If you’re ready to improve your current P2P payment solution, get in touch with us and make the impossible possible!