How to craft your own mobile payment app like Paypal digital wallet

Nowadays, as the world is moving towards the era of using digital wallets instead of physical cash and cards, making payments has become much easier. So, due to the higher demand for digital wallets, businesses are moving towards creating an application like PayPal digital wallet. PayPal digital wallet is one of the earliest digital wallets. It is used by consumers and businesses all over the world.

So, not just one but many industries are adopting this trend and benefiting from digital wallets. In this article, we will explore how to build a digital wallet like PayPal. And provide solutions to develop your digital wallet applications faster and more affordable.

I. Paypal digital wallet: What is it and why is it so popular?

Payment platforms primarily offer the back-end infrastructure for facilitating digital financial transactions between parties. Therefore, close coordination between engineering, design, compliance, and fraud prevention is important to build a secure platform. Leading platforms like PayPal’s digital wallet have invested years to solve these complex problems. One of the biggest advantages of PayPal digital wallet is the quick account setup. Anyone can create an account and use it in less than 10 minutes.

The PayPal digital wallet is very popular and widely used because of its convenience. Users no longer have to spend time and tons of paperwork to open a bank account at a traditional bank or financial institution. We just need to register and enter information online, no need to stand in long lines and do unnecessary administrative procedures. In addition to bill payments, PayPal digital wallets enable users to send and receive money instantly with just a few taps.

After setting up a PayPal digital wallet account, users can seamlessly use it wherever they shop. Instead of entering credit card information multiple times, we only need to log in to PayPal digital wallets to make purchases. This not only saves consumers time but also keeps their banking information safe during transactions.

In addition to convenience, the PayPal digital wallet is also very secure. One of the biggest concerns when making online payments is the security of consumer data and payment information. The solution of the digital wallet is to act as an intermediary between the buyer and the seller. So, it can resolve disputes and any discrepancies in orders. Although this process may take some time, the good thing is that there is an additional layer of security to prevent fraud.

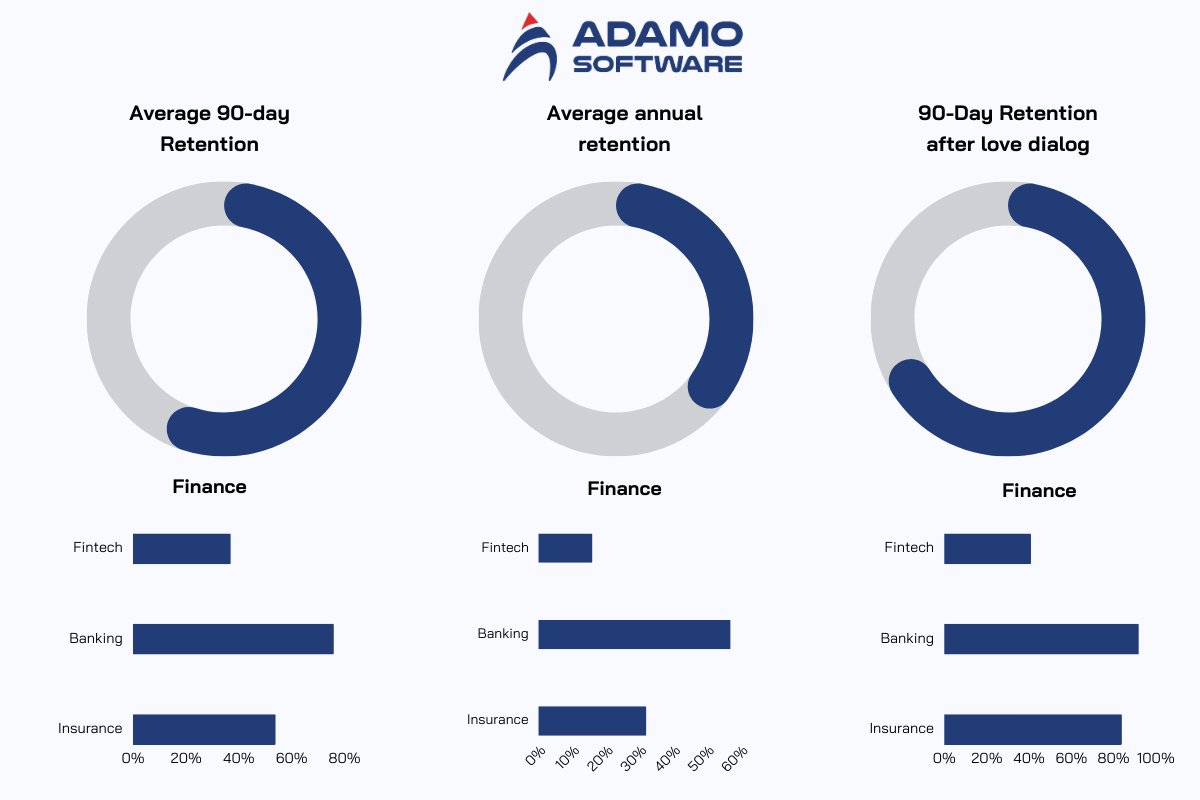

Let’s break down the digital wallet statistics:

- There are approximately 427 million active Paypal accounts as of Q1 2024

- By the end of 2023, there will be 29 million active merchant accounts

- Total Paypall revenue in 2023 is $29.9 billion, up about 7.9% year-over-year

- Net profit is $4.2 billion in 2023

- Transaction volume in 2023 is $1.52 trillion

- Up to 41 million transactions are made via PayPal every day

- Transaction support for over 100 currencies

From the above figures and information, it can be seen that these features make digital wallets like PayPal extremely attractive to customers. The convenience and user-friendliness all stem from the flexibility of PayPal’s core payment system.

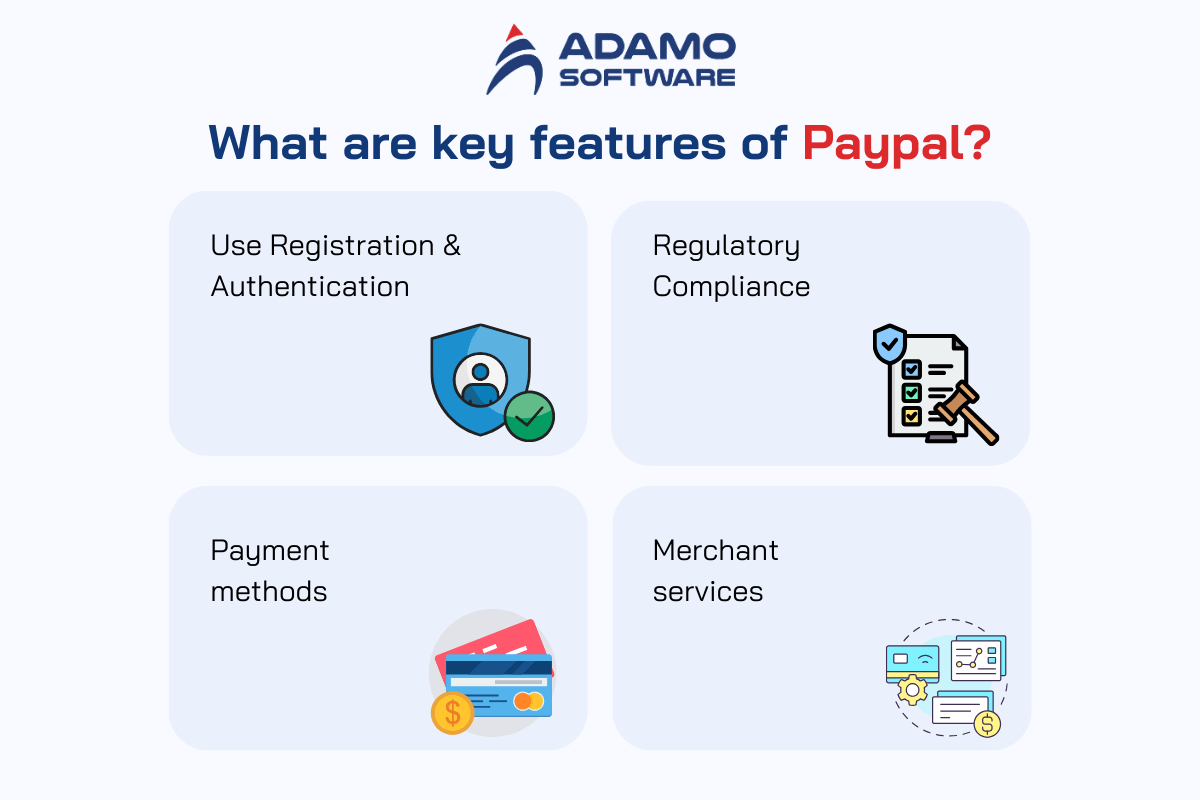

II. What are the key features of Paypal?

1. Use Registration and Authentication

An important feature of developing a PayPal digital wallet is allowing users to create an account. Additionally, users can create account information by selecting a social network account. This option simplifies login as users can access their accounts from their social network login information.

Next is the multi-factor authentication feature. This feature enhances the application’s security and advanced encryption standards can protect data transactions. Encryption can be used to secure sensitive card information. Developers can implement fraud detection and prevention using AI and machine learning algorithms. PCI DSS compliance helps keep cardholders safe. Additionally, biometric authentication features can be added such as facial recognition or fingerprints.

Session management features can also help in using user sessions and logging out when inactive. In case the user loses login credentials, an account recovery feature should also be implemented.

2. Regulatory Compliance

To verify user identity, you need to implement Know Your Customer (KYC) procedures. For anti-money laundering, you should implement preventive measures and activities. Ensure the application complies with the General Data Protection Regulation for processing Personal Data.

3. Payment methods

The next essential feature is to implement support for debit/credit card processing for all major card types. The digital wallet should allow the linking of bank accounts along with online payment transfers. Also, it allows integration with popular wallets like Google Pay, Apple Pay, and Samsung Pay or can integrate cryptocurrency transactions.

4. Merchant services

APIs and SDKs can help integrate payment gateways with mobile apps and websites. Commerce services enable invoicing directly from online payment apps and support subscriptions and recurring payments. You can also enable analytics and reporting to track sales, transactions, and consumer behavior.

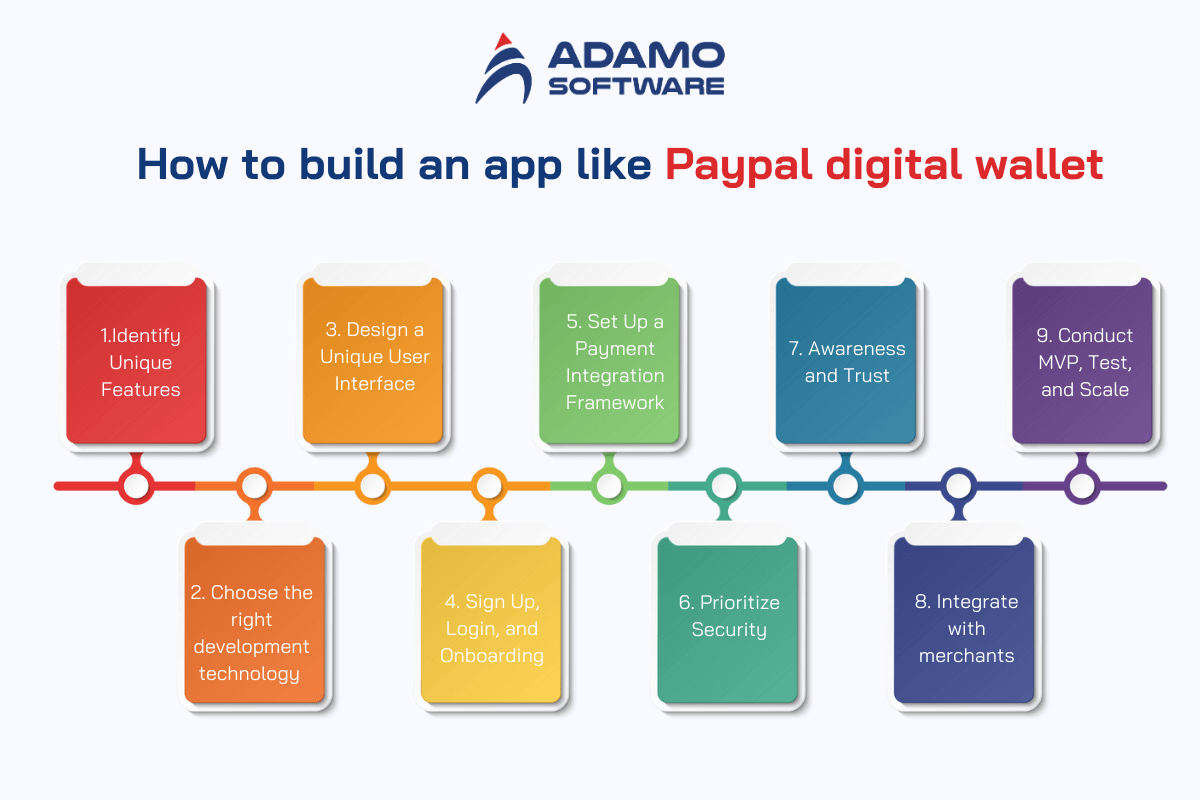

III. How to build an app like Paypal digital wallet

In this section, we will explore the entire process of creating a PayPal digital wallet step by step:

Step 1: Identify Unique Features

What to do: There are many digital wallet options on the market, so it is important to identify exactly what features make your app different. You need to identify the unique features of your app before you start developing.

How to do it: To do this, you need to make a distinct value proposition for your app to ensure success in the current market.

Practical recommendation: You should identify your unique features to increase your competitiveness against your competitors.

Step 2: Choose the right development technology

What to do: Choosing the right development technology is an important step for developing a PayPal digital wallet. Choosing the right technology will minimize errors and maximize performance to provide the best quality to users.

How to do it: Node.js is highly recommended for its scalability and cross-platform compatibility. It ensures reliable payments.

Practical recommendations: Besides Node.js, you can explore other modern technologies depending on the requirements of your project. For instance, React Native can be used for mobile app development, while Python is suitable for backend integration. Do thorough research and consider consulting with development experts. Make sure to make an informed choice for a robust and reliable digital wallet development process.

Step 3: Design a Unique User Interface

What to do: PayPal digital wallets need a high-quality user interface design. Make sure users feel comfortable using your digital wallet.

How to do it: User experience should be a priority, as a difficult or unfriendly interface can deter users. To design an effective UX, you need to understand your customers and prioritize a user-centric approach to design. To do this, the design team will conduct thorough persona interviews, research and competitive analysis, and wireframe and prototype.

Information to be interviewed includes Product definition, research, analysis, design, and validation.

Actual recommendation: You need to design an intuitive, easy-to-use, and user-friendly interface for a digital wallet app like PayPal.

Step 4: Sign Up, Login, and Onboarding

What to do: Ensure a seamless onboarding experience for new users. Your PayPal digital wallet must comply with KYC regulations. Prioritize user registration and login processes.

How to do it: Design an onboarding process that collects the necessary user information efficiently and complies with KYC requirements. Verify KYC to ensure user legitimacy and enhance user information security. Also, it allows users to register an account using a phone number. Simplify the registration process and serve as a foundation for two-factor authentication (2FA). 2FA adds an extra layer of security to their accounts.

A practical recommendation: Consider integrating social authentication methods, such as Facebook, to provide users with convenient registration options. However, you should also ensure that these methods comply with KYC regulations and provide full user identity verification.

Step 5: Set Up a Payment Integration Framework

What to Do: This is also an important step to ensure your service connects to multiple payment frameworks to maximize utility.

How to Do It: To do this, you need to partner with experts who are familiar with local laws and payment integration standards.

Practical Recommendation: In addition to partnering with external experts, you also need to develop expertise in various payment frameworks to expand the appeal of your digital wallet.

Step 6: Prioritize Security

What to do: Security is one of the most important things about PayPal digital wallets. You should emphasize security to protect users’ money and information and maintain trust.

How to do it: Implement comprehensive digital wallet security measures to prevent potential risks.

Practical recommendations: Secure digital wallets often use strong encryption techniques to protect sensitive payment data. Ensure users make safe transactions and prevent unauthorized access. Even if hackers or anyone breaks into the digital wallet database, this security measure ensures that they will not get any information.

Step 7: Awareness and Trust

What to do: You need to raise awareness among users and foster their trust in digital payment methods. Emphasize the benefits that digital wallets can bring to ensure users have confidence in this application.

How to do it: You must deploy user-friendly guides and informational content to raise awareness and understanding of digital wallets among users. However, you must apply transparent security measures and showcase the benefits of using your digital wallet.

Practical recommendations: You should develop engaging educational resources. Additionally, you should communicate the salient features and security advantages of your digital wallet to build trust and encourage users to adopt it.

Step 8: Integrate with merchants

What to do: Integrating with merchants is also an essential step. You can help businesses adapt to digital wallet payments to drive adoption.

How to do it: You need to work closely with businesses to integrate your digital wallet seamlessly into their payment systems. Additionally, build strong, mutually beneficial partnerships. Ensuring that businesses can reach a wider customer base will help your digital wallet gain wider acceptance.

A practical recommendation: You should provide comprehensive support to businesses throughout the partnership process. You can provide resources, training, and incentives to make the partnership as smooth as possible. You can encourage businesses to promote your digital wallet to their existing customers and offer them incentives. In short, building strong relationships with your merchant partners is essential for your digital wallet to be successful and popular.

Step 9: Conduct a Minimum Viable Product (MVP), Test, and Scale

What to do: As a final step, you need to create an MVP, and then move on to a full-scale product.

How to do it: Test, debug and run a pilot before launching it to the public.

A practical recommendation: Develop an MVP, conduct thorough testing, and then release the complete digital wallet solution to ensure success.

Also read: How to use a digital wallet: Essential tips to optimize your spending management

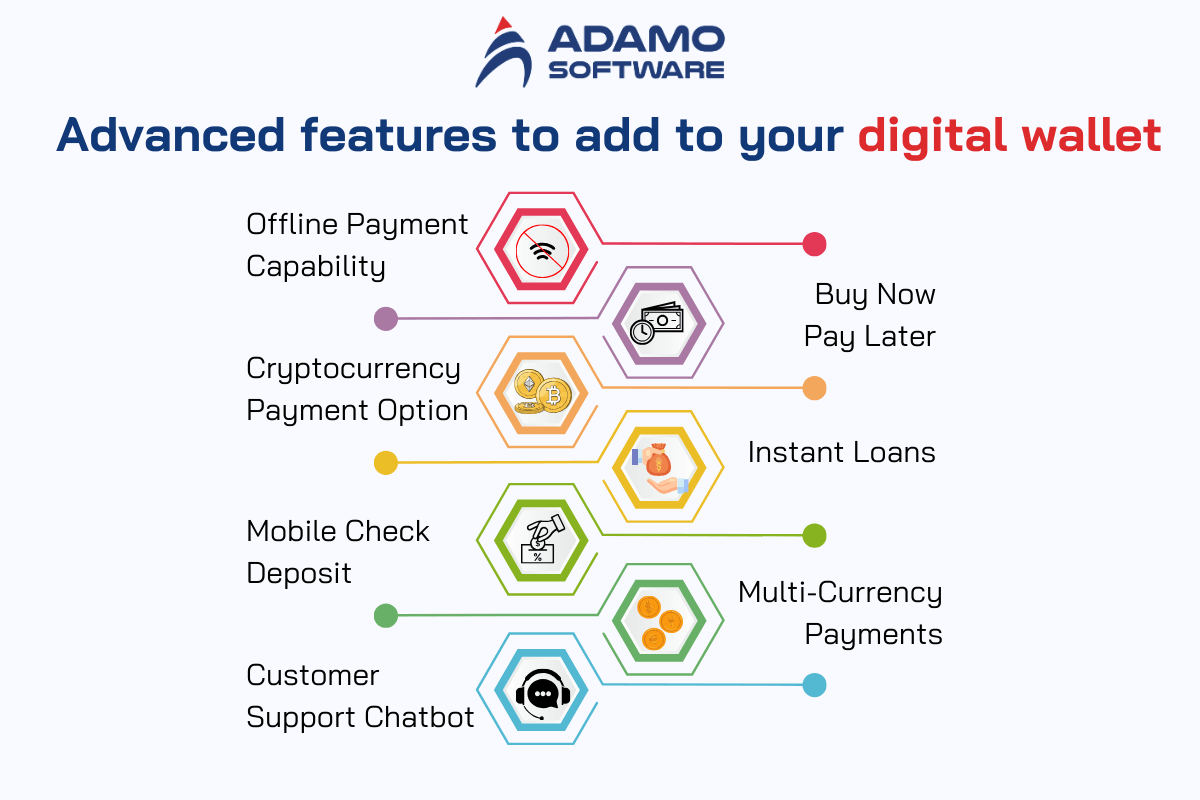

IV. Advanced features to add to your digital wallet

As you know, the market is flooded with various digital wallets. Therefore, to make your digital wallet stand out in the market, you need to develop a digital payment app with advanced features. Your app should grab the attention of the users and provide a convenient and user-friendly payment experience. In this way, your Digital Wallet App like PayPal can make a place for itself in a large market.

Here are some advanced features that you can add to your digital wallet like PayPal to gain a competitive edge.

1. Offline Payment Capability

Internet access is not always possible. By offering Offline Payments, you can allow your users to pay even when the Internet connection is unavailable or interrupted.

2. Buy Now Pay Later

This feature, combined with the AI-powered credit history screening feature in the PayPal digital wallet, can enable users to pay in installments in the future.

3. Cryptocurrency Payment Option

Today, in the digital payment space, cryptocurrencies have become an important payment option. Therefore, you can add Blockchain-enabled Cryptocurrency Payments to your digital wallet. It enables users and merchants to send and receive cryptocurrencies through their digital wallet, similar to how PayPal operates.

4. Instant Loans

This feature is a special feature that allows users to borrow money from the digital wallet. You can lend personal loans with an easy AI-powered credit history verification process. This feature can help users get money in case of an emergency. Additionally, increases revenue by collecting interest on the loan amount.

5. Mobile Check Deposit

Traditionally, users have to go to the bank to deposit checks into their accounts. You can add the encrypted Mobile Check Deposit feature to your digital wallet. This advanced feature can allow users and merchants to deposit digital checks by entering check information and a check image.

6. Multi-Currency Payments

To increase competitiveness, you can integrate Multi-Currency Payments into your digital wallet. This advanced feature can provide a cross-border payment experience to your users. With this feature, you can allow merchants and users to make international payments in different currencies without having to convert them in the first place.

7. Customer Support Chatbot

AI Customer Support Chatbot is an essential feature of an app. Especially the PayPal digital wallet app where users or merchants will need 24/7 support from a payment expert.

Therefore, integrating the AI Chatbot feature plays an integral role in providing 24/7 personalized customer support to your users. This can be tailored to their specific needs.

Integrating advanced features in your digital wallet similar to PayPal can provide an enhanced user experience. It helps you gain a competitive edge in the market and makes your app stand out from the competition.

V. How do your digital wallets make money?

The ultimate goal of developing a PayPal digital wallet for any business is to make a profit. Or we can say to generate more revenue than investment. Given this, developing a digital wallet similar to PayPal presents a lucrative opportunity, provided you can generate revenue from the application.

So, in this section, we have listed some ways for you to make money by building a PayPal digital wallet.

1. Interchange Fees

You can generate revenue by charging Interchange Fees for all debit or credit card payment transactions. However, keep the fees as per the market standards. Otherwise, your users may not use your digital wallet.

2. Payment Processing and Remittance Fees

While most of your competitors charge high or very low payment processing fees, you can waive the fees up to a certain limit to gain an advantage in the market.

Moreover, if a user pays or transfers more than the limit in 1 month, they have to pay the standard fee. This way, you can generate revenue from the transactions made by users or merchants using your digital wallet.

3. Cross-border Payment Fees

Usually, when making cross-border payments, users will be charged a fee. You can also generate additional revenue by charging cross-border payment fees to users and merchants for international transactions.

4. Instant Loan Interest

If your digital wallet has an instant loan feature, you can generate revenue from this feature. By lending money to users and merchants, you can generate revenue from the interest on the loans they have to repay.

5. Business Account Subscription Fees

Digital wallets like Paypal and other leading digital wallets offer Business Accounts to Merchants. They have additional features that merchants can access after paying a subscription fee. In the same way, you can also earn extra money by charging a subscription fee for Business accounts in your digital wallet.

6. Affiliate Commissions/Branding Fees

Last but certainly not least, you can generate a lot of revenue from affiliate commissions and brand partnerships with your partners. You can allow other brands to sell their products and services through your digital wallet and charge them affiliate commissions and partnership payments.

By the above-mentioned ways, you can generate a lot of profit and good revenue by developing a digital wallet like PayPal. However, keep the fees nominal and as per industry standards. Ensures your users or merchants stay with your digital wallet for a long time.

VI. Cost estimation to build an eWallet app like Paypal digital wallet

When discussing or estimating the cost of developing a digital wallet like PayPal, there are many factors to consider. These include the geographical location of the development team or the development company, basic and advanced features, complexity of the application, development price charged by the assigned development company, current market trends, time taken to complete the development process, and many more.

If you evaluate based on all these factors, the total cost of developing a digital wallet like PayPal will range from $25,000 to $50,000. If you integrate advanced and advanced features and functionalities, this estimated cost may increase.

VII. How e-wallet experts from Adamo can help

If you are looking for an experienced app developer to support you throughout your digital wallet development journey, Adamo Software is the right company. At Adamo, our experts develop cutting-edge solutions that meet both the technical and business needs of each client. With extensive experience in finance software development, we deliver e-wallets that are robust, secure, and enhance user experience.

Our team will support you throughout the development process, ensuring that the final product aligns with your business goals and delivers real value to your users. Schedule a free call with us today for the best support.