Top Online Money Transfer Service Providers in 2026: Detailed Reviews

I. Why you should choose online money transfer service provider instead of local bank

Today, people have more options than traditional banks for transferring money, such as online money transfer service providers. It can be a more strategic choice for international transactions. These companies are increasingly evolving to offer superior efficiency and cost savings. This is mainly due to their centralized approach to international remittances.

Sending money internationally through banks can cost significantly more on average. This is because banks often add a surcharge to the interbank exchange rate, ranging from 1% to 3%. While online money transfer service providers tend to offer rates closer to the market rate, this can result in significant savings for large transfers.

Digital remittance services are fast, with transactions completed within 24 hours and, in some cases, instantly, according to a World Bank study. In contrast, traditional banks can take 2-5 business days to complete a transaction because their processes are often entangled in broader regulatory and operational frameworks.

Also read: Online money transfer services: An in-depth overview for beginners

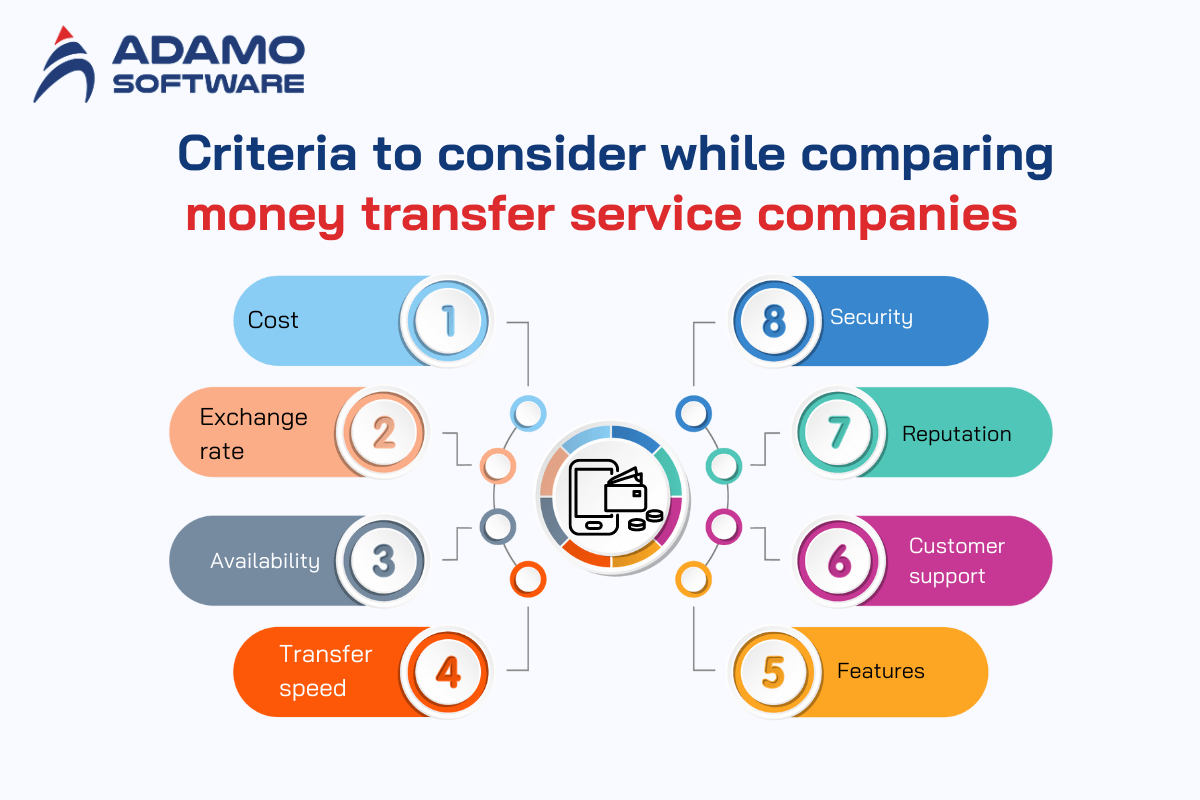

II. Criteria to consider while comparing money transfer service companies

Aside from cost, there are other factors you should consider when comparing online money transfer service providers. Many top providers have similar fees, but levels of customer service vary significantly, as well as transfer times depending on location.

The main factors you can focus on are:

- Cost: Compare flat fees, percentage fees, and other fees between providers.

- Exchange rate: The exchange rate determines how much money the recipient can receive.

- Availability: Not all providers can send money to the same location or handle issues like cash deposits.

- Transfer speed: Same-day or next-day transfers are possible.

- Security: Only use FCA-regulated providers as they have robust security features such as fraud protection, encryption, and segregated client funds.

- Reputation: Choose a provider that has been established for many years and has a solid track record of good customer service.

- Customer support: Compare availability and customer support.

- Features: Consider special features such as transferring money to multiple recipients or recurring payments.

III. Top 10 best online money transfer service provider in 2024

1. Wise

Wise is a great online money transfer service that offers low fees and no markup for foreign exchange transactions. But its service can be quite pricey, as it charges higher transfer fees than some competitors. If you’re sending small to medium amounts, it’s a good choice. However, Wise doesn’t offer cash delivery to homes or businesses and has fewer than 100 countries to send money to.

– Pros

- There are many options to send money

- Never increases exchange rate

- Fully transparent

- Fast transfer speeds

– Cons

- Higher transfer fees

- No cash-on-delivery option

- Limited customer support

- Comprehensive identity verification is required

- Limits on transfer amounts

– Best for: small to medium-sized bank transfers

2. Revolut

Revolut is low-cost and easy to use. It is a leading online money transfer service provider for frequent travelers and those sending money abroad, especially for popular currencies like the Euro. Revolut is safe, secure, and transparent about fees and exchange rates.

Revolut’s money transfer service can send money in over 40 currencies and to over 100 countries. If you send money to another Revolut account holder, there are no transfer fees, and the transfer is instant.

– Pros

- Free account

- Free transfers Monday to Friday (limited)

- Savings interest

- Budgeting tools available

– Cons

- Uncompetitive exchange rates

- Large transactions have higher fees

- No complete banking services (no overdraft)

– Best for: converting money to Euros in-app

3. Remitly

Remitly has consistently been one of the world’s cheapest online money transfer service providers. It offers several ways to receive money, including mobile or home delivery. Remitly charges low or no fees to send money to some countries. However, some transfer methods are limited, and costs for specific countries can be high.

– Pros

- Free or minimal fees when sending money to specific countries.

- Options to receive funds through a bank account, mobile device, cash pickup, or even home delivery.

- 24/7 customer service

– Cons

- High fees for transfers to certain countries

- Confusing array of transfer fees

- Limited availability of some transfer methods

– Best for: Send cash for pick-up to the Philippines, India, Turkey, and other destinations.

4. Currencies Direct

Currencies Direct was founded in 1996 by Mayank Patel and Peter Ellis. The company is a foreign exchange or currency exchange provider known as Europe’s first online money transfer service provider. Currencies Direct has won several major awards, such as MoneyAge’s ‘Money Transfer Provider of the Year’ award in 2016 and 2018.

Currencies Direct also has over 23 local offices worldwide today. One of its highlights is its customer service. Just call Currencies Direct, and customers will get the information they need. In addition, users can stay updated on their transfers via email and SMS alerts.

– Pros

- Fast customer service.

- There are no hidden fees or charges for most transactions.

- Can send exchange rate alerts via email and SMS.

- Get local expert advice and help with local regulations in 23 countries.

- Access to multi-currency accounts for online sellers.

- Various risk management services for businesses.

- Offers forward contracts and limit orders for individuals and businesses.

– Cons

- There is no cancellation policy, so all transactions are final.

- Transaction times vary by payment process and location.

- No cash pickup at local branches.

- Not available in the US states.

- Lower exchange rates for smaller transfers.

– Best for: sending large transfers to the US

5. Western Union

Western Union is a long-established and one of the biggest online money transfer service providers. It was founded in 1851 when money was sent on horseback. Western Union can send money to any of over 200 countries worldwide. Since then, its business has grown exponentially and expanded with online money transfers.

Today, the Western Union supports sending money in over 125 currencies using credit cards, bank accounts, debit cards, or online transfers. Moreover, Western Union is very popular worldwide with its cash transfer service through its agent network. Customers can go to any of its branches or locations and personally transfer money to any country.

– Pros

- A large, well-established, and reputable company.

- Can preview transfer fees to see how much will be charged.

- Low fees for transferring money between banks.

- User-friendly and easy-to-use website and app.

- Multiple ways to transfer money like online, app, phone, and in person.

- Transfer money by debit and credit card to the recipient within 1-2 business days.

- Western Union means Recipients can access cash faster due to its extensive network of Western Union locations

– Cons

- Western Union is a long-established and one of the biggest money transfer companies.

- If using the cheapest option, which is a bank-to-bank transfer, it can take the longest to reach the recipient.

- Lower daily transfer limits

– Best for: sending money from the US, UK, or EU to Türkiye, India, or Mexico.

6. TransferGo

TransferGo was founded in 2012 and has established itself as one of the best online money transfer service providers on the market. It is known for consistently offering the cheapest rates for international money transfers. The platform provides a variety of payment and withdrawal options. TransferGo is excellent for transfers from the UK to Poland and the US.

– Pros

- Offers the cheapest rates on the market.

- Standard transfers take just 1 day, and express transfers take 30 minutes.

- Fully regulated and reliable.

- Renowned for their helpful customer support team.

- Offers a wide range of funding and payment options.

– Cons

- It is only geared towards operations in Europe.

- It is limited to large transfers.

-Best for depositing money into debit and prepaid cards and sending bank transfers to Europe.

7. Paysend

Founded in Scotland in 2017, Paysend develops consumer-friendly financial products. The company offers digital wallet services and international money transfers via cards and bank accounts. Payment can be used to transfer money online to over 90 countries worldwide for as little as £1, $2, or €1.50.

– Pros

- Up to 84 countries worldwide are available for transfers.

- Offers various payment options, including bank accounts and cards.

- Offers fixed fees so senders know the price in advance.

- 24/7 customer support

- High level of payment security

- Regulated by government financial authorities

– Cons

- Countries where funds can be sent are limited, mainly Canada, the US, and Europe.

- Verification can take a long time, so it is not convenient

- No transparency on exchange rates.

- Transfers can be delayed if verification fails.

– Best for: depositing funds to debit and prepaid cards

8. OFX

OFX is widely recognized as one of the most trusted online money transfer service providers in the world. It enables international money transfers to over 170 countries in over 50 currencies. The platform effectively helps clients manage foreign exchange risk with features such as forward contracts, limit orders, and stop-loss orders. It also offers features such as recurring international transfers to help simplify payments.

– Pros

- Supports transfers to over 170 countries and over 50 currencies

- 24/7 customer support

- No transfer limit

– Cons

- High minimum transfer amount of £100

- No live chat feature

- The sender and recipient must have a bank account

– Best for: Specializes in sending money from the US or Mexico, particularly for B2B transactions.

9. XE Money Transfer

Xe Money Transfer is a very popular online money transfer service providers for sending money abroad. Customers can send money to over 200 countries in 100 currencies. There are three different ways to send money, such as direct debit, transfer, or by card, and three different ways to receive money into a bank account, such as in the wallet or by receiving the transfer in cash.

– Pros

- Fully transparent and average exchange rates

- Free transfers over $1,000

- Accessible customer service

– Cons

- No linked debit card like Wise or Revolut

- Some features not available to Australian senders

- Bank transfers may take up to 24 hours to complete.

– Best for: bank transfers to popular countries like India and Poland.

10. Atlantic Money

Atlantic Money is one of the best-designed services with a simple interface. The platform always provides a real mid-range exchange rate for money transfers. There are no hidden fees, and it charges a fixed, transparent fee for each transaction. Atlantic Money is a great way to send internationally at highly competitive rates. Assuming users are transferring over £250, they will save significantly compared to many other companies that charge a percentage fee. They can send up to £1 million for as little as £3.

– Pros

- Low, fixed fees of £3 for transfers up to £1 million, regardless of the amount being sent.

- It uses real exchange rates, meaning customers get the best transfer price.

- Open and transparent about fees and exchange rates. Customers will always know exactly how much they are sending and receiving.

– Cons

- Limited availability, only available in the UK and Europe.

- The standard transfer speed is 2 business days. There is an additional fee for faster transfers.

- App-based services, such as smartphones or tablet, to use the service.

- It offers no FX tools, such as rate alerts or locks.

– Best for: Bank transfers from Europe to Poland or the United States.

IV. Why trust Adamo Software in online money transfer service development?

When looking for an ideal partner to develop an online money transfer service, Adamo Software is a standout choice for this journey. We specialize in finance software development and have helped many companies establish effective digital solutions in today’s world.

Whether you choose native or cross-platform development, Adamo has the skills and knowledge to deliver a seamless, user-friendly application that fits your needs. If you need a top trusted partner for the best online money transfer service on the market, contact us today for free.