Fintech software development services: Cost to build your own apps

The digital world of today’s economy is fast paced, which makes people constantly look for new and improved technologies in finance. Fintech software development services are central to the physical manifestation of financial concepts. They provide businesses with the arsenal they require to compete effectively. However, companies face some challenges when dealing with the idea of their own FinTech software development services.

It is therefore crucial for businesses to be well informed from the development steps to the factors that affect the general cost. Also, it is important to identify the various kinds of FinTech software development services in the market to choose the most suitable one.

This article will provide a brief overview of FinTech software development services and the prices for their implementation. No matter if you are a start-up company planning your first FinTech app or a well-developed company that wants to expand its services. This guide will help you understand how to create a successful FinTech app.

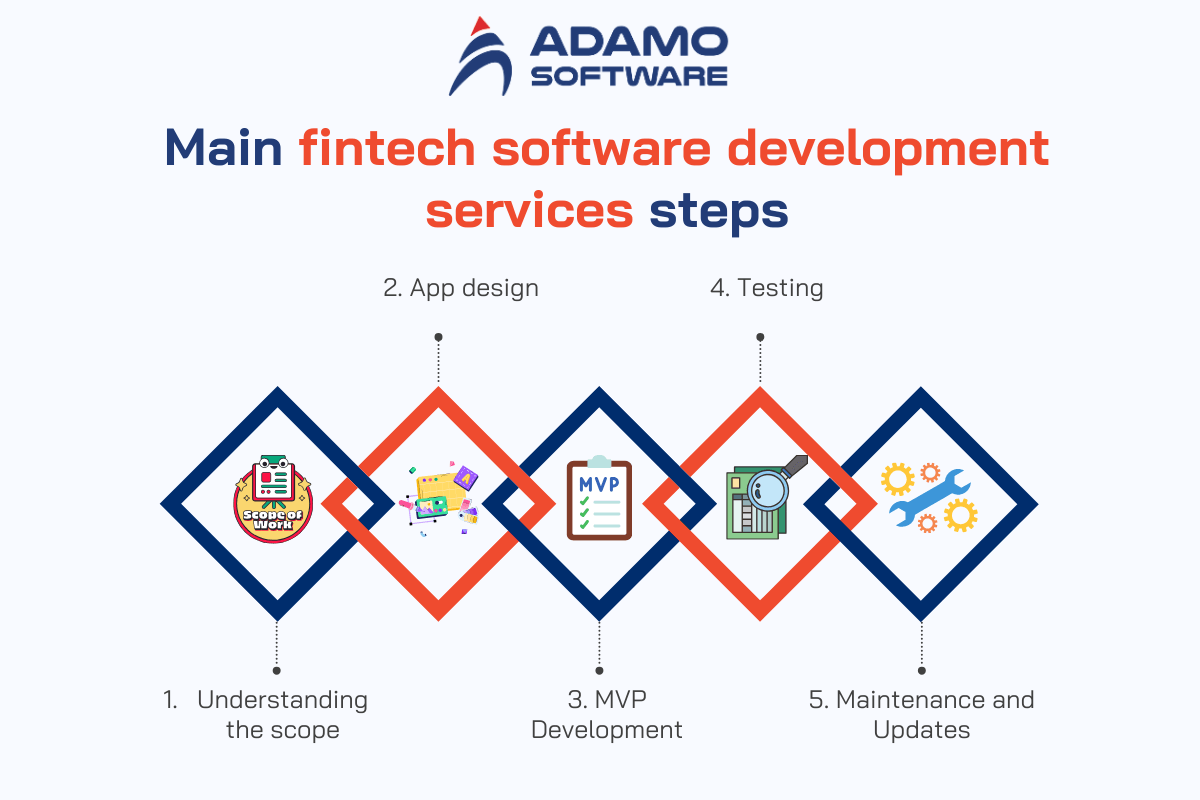

I. Fintech software development services steps

To define the cost of FinTech software development services, we must first understand the steps to build one. Such knowledge is important when setting budgets and making good decisions during the development phase.

1. Understanding the scope

Identifying the project’s scope and its level of difficulty is crucial for planning FinTech software development services. This allows you to assess the amount of effort and resources needed for each stage. It also helps you define the critical functionalities, the target market, and compliance for the FinTech product.

2. App Design

The app design stage involves creating an appealing interface and customer experience. This includes creating a design blueprint of the application, or the app skeleton, and the interface sketching and modeling. Usability is an important aspect of FinTech software development services achieved through quality design.

3. MVP Development

During MVP development, developers go through the specifications of both the technologies and frameworks to be used. Then, they need to put into practice the necessary features in the project. Security should be prioritized to preserve financial information which is rather vulnerable. The MVP is used for future development and is the core of the product/service which demonstrates the most essential characteristics.

4. Testing

The final stage of development is dedicated to quality assurance which has to confirm that MVP is bug-free and functional. Thorough testing allows those problems to be identified and fixed, contributing to better stability – a significant stage of FinTech software development services.

5. Deployment

Once testing is over, the application is ready to be deployed. This stage entails fine-tuning the app for iOS, Android, or both environments, setting up the app store listings and certification. The deployment process also includes servers and database configuration, and linking to other services, to make the process as smooth as possible.

6. Maintenance and Updates

After development, there is a need to update the app frequently so that it remains essential to the user. The development team collects the end users’ feedback and analyzes data to enhance the previous features and incorporate new features. These updates can help with periodic or constant fixing of performance problems, security issues, and scalability. These are all very important for FinTech software development services.

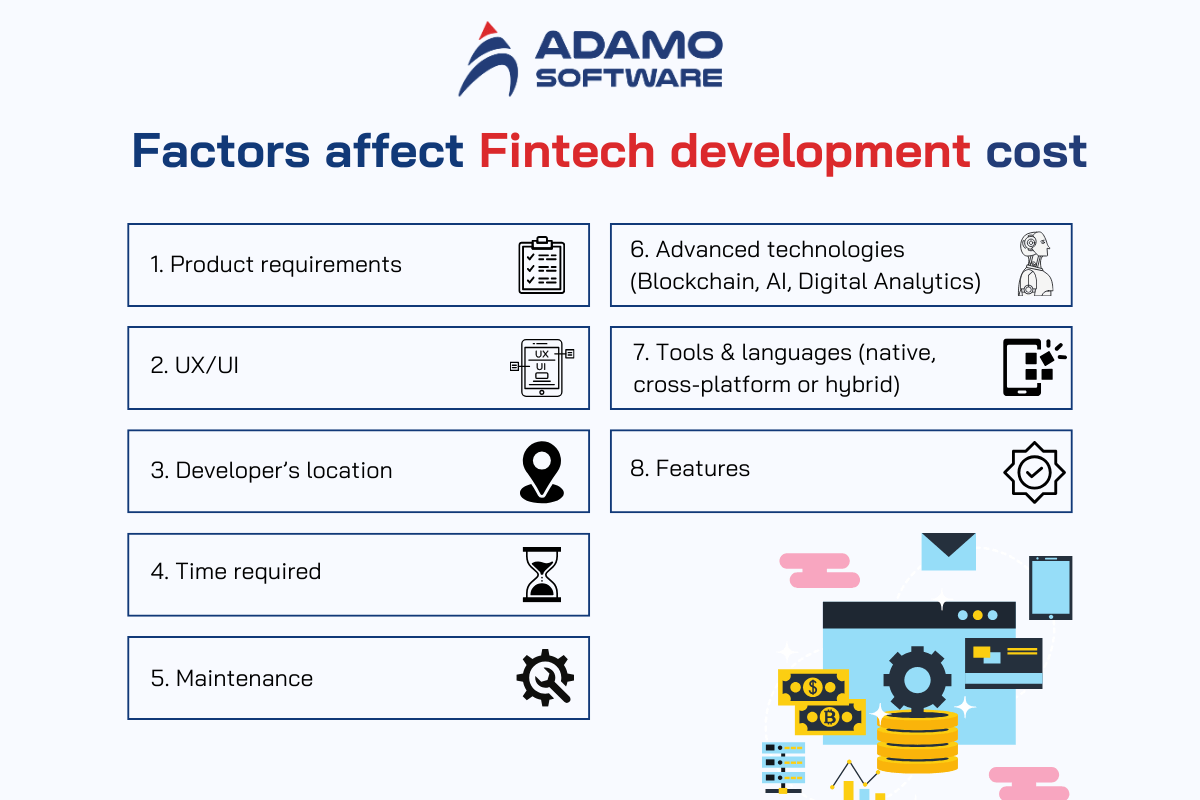

II. Factors affecting custom FinTech software development services cost

Determining the cost of FinTech app development is not easy since it involves several factors which can be seen below. When considering FinTech software development services, the following elements play a critical role:

1. Product requirements

The need for the app is a primary driver of the cost of FinTech software development services. These requirements can be broken down into two categories:

- Scope of work: The scope of a project is marked by the range of features and the amount of effort put into implementation. This means that when the scope of work is broader, the development hours will be more. Hence, the project cost will also be higher.

- Product complexity: The additional features and the software’s logic also have a direct correlation with the development, testing, and deployment processes. They all contribute to the budget of FinTech software development services.

2. UX/UI

The design of the user interface is critical for FinTech software development services. That’s because the user needs to have a smooth experience when using the app. In the creation of FinTech solutions, sufficient emphasis should be placed on the development of sophisticated and user-friendly UI/UX. They make it possible to design informative layouts and create efficient workflows. Professional UI/UX design increases the application’s value and the readiness of users to interact with the app.

Also read: Must-have features of Custom Fintech Applications for a stellar customer experience

3. Developer’s location

Another cost factor that affects FinTech software development services is the location of the development team. If the development team is in a different country, this will add to the development cost.

For instance, the hourly rate in North & Latin America and Africa is nearly the same, varying between $ 25- $ 35. This rate is a bit cheaper within Asian nations ranging from $20 -$25 and much more expensive in Europe, ranging from $35-$65.

4. Time required

The cost of FinTech software development services depends on the amount of time to be used in the project. The time of delivery also has a direct relation to the cost as more team efforts and the use of rapid prototypes and developments are expected when the time is short. Accordingly, projects with a shorter time horizon will be more expensive. Also, it is noteworthy that the total development time is influenced by the type of mobile application being developed.

For instance, banking, lending, and insurance applications will take at least 2000 hours to develop. However, this minimum time requirement for personal finance and investment apps is much less, at about 1,500 hours.

5. Maintenance

The cost of regular app maintenance also has to be considered. Custom FinTech software development services include constant improvements, new features, and maintenance, which are long-term expenses.

6. Advanced technologies

Digital Analytics

Digital analytics is among the powerful pillars of FinTech software development services. To understand consumer’s financial information, analyzing user data is crucial in helping track financial activities. Some of the other functionalities that are useful for the users include tracking purchases, savings, and investments, preparing reports, etc. However, advanced digital analytics enhances complexity, and therefore increases the development cost.

Blockchain

Blockchain is one of the significant components in FinTech software development services. Blockchain integration improves P2P payments and provides total transparency while allowing for fast transactions. It can also help in the swift flow of data across the platforms, in a similar manner as banks and other financial institutions. However, blockchain integration increases the application’s cost because it is complex and needs advanced development.

AI

Artificial intelligence is another key factor that affects the cost of FinTech software development services. AI provides features like chatbots, fraud prevention, budgeting, and fast and effective transactions. For instance, there’s an artificially intelligent budget application chatbot for Mudra. It assists the user in tracking their spending and notifying them when they are overspending. Despite the benefits and the improvement it brings, AI is a factor that will significantly increase the cost due to its complexity.

7. Tools & languages

The technological stack also plays a role in determining the cost of building a FinTech app. The programming language and tools that you want to use for your FinTech software development services have to be selected wisely:

- Native applications: The applications developed for a particular operating system like iOS or Android, are called native applications. Native iOS apps are built with the help of tools such as Apple Xcode, SWIFT, Objective C, and iOS SDK. Native Android apps are built with Android Studio, Java, and Kotlin, as well as the Android SDK.

- Cross-platform applications: The apps developed to work on multiple platforms are built using tools like Native, C#, and Flutter. These apps enable native apps on iOS and Android platforms, and web apps.

- Hybrid applications: Hybrid apps are created using tech stacks such as PhoneGap or HTML 5 and are operational on different platforms.

8. Features

Another crucial aspect that defines development costs is the number and the level of feature integration in a FinTech app. The features common to all are tracking and management of dashboards, MFA, identification, user profiles and wallets, payments and cards, admin panels, and notifications. As features become more complicated, they add both the time extent and the price.

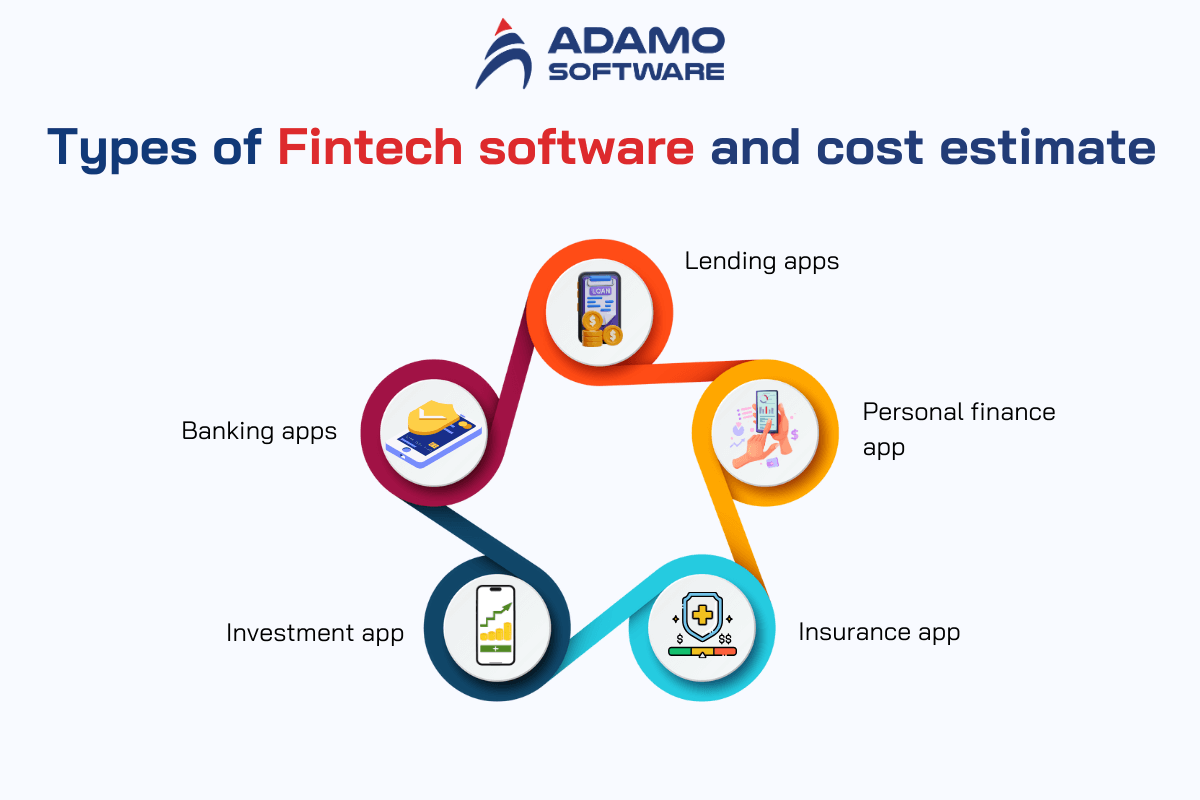

III. Types of Fintech software and cost estimate

1. Banking Apps

Online/internet banking is among the type of FinTech software development services that offer all the services at an online platform. Hence, it makes things convenient for people to access all the banking facilities. These include account opening and loan services without physically visiting the banking hall. These FinTech banking apps enable users to undertake every operation virtually and hence, avoid physical attendance.

For instance, an AI-based mobile application of a global bank cut manual efforts by a third and enhanced customer loyalty by a fifth. With the help of the chatbot, the app is now capable of handling more than 50% of customer service inquiries.

The cost of developing a FinTech banking app varies based on app functionality. It can cost as low as $30,000. If it gets more complicated, it can cost up to $300,000.

2. Lending apps

There is growth in the P2P lending industry where FinTech software development services allow users to apply for loans online. This process has been made easier and more efficient as organizations join hands to make loan applications easier and more convenient.

This sector has high risks involved. The use of technology has, however, made it easier. Through the use of AI and machine learning, lending apps can check and confirm the identity of the user. They can then estimate their past financial performance, forecast their income level and assess the value of the security offered for the loan. Thus, they help make the process of evaluating the loan application more efficient and precise.

The general cost of developing a FinTech lending app ranges from $50,000 to $150,000, depending on the app’s functionality and design.

3. Personal finance apps

Some financial applications allow users to track their activities such as income and expenditure and budgeting. These serve as an online diary that assists people with tracking their expenditures.

They help the users set up budgets and ensure the users do not deviate from such budgets, while also tracking the users’ spending patterns as well and reminding the users of their financial objectives.

The cost of creating a personal finance app mainly varies between $50,000 and $300,000 based on the app’s functionality.

Fintech software development services for personal finance applications enable users to have an efficient way of managing their finances. Thus, the demand for such services is high.

4. Insurance apps

With FinTech, businesses are now able to digitize insurance services through the use of special applications. Insurance apps provide more affordable and flexible policies with variable prices, and that’s why it is easier for customers to acquire them.

These apps can be used by both end-users and agents and help to provide faster interactions as well as faster claims process. Customers can enjoy faster claim processing times thus enabling timely closing of deals. Therefore, insurance apps improve customer satisfaction and organizational performance.

The cost of developing an insurance-oriented FinTech application is between $45,000 and $200,000, depending on the specific functionalities and services offered.

5. Investment apps

Investment apps enable users to invest in financial products like mutual funds, stocks, cryptocurrencies, and trading platforms. These apps are designed for certain users so that businesses can provide various investment opportunities with the help of FinTech software development services.

Examples of FinTech investment app solutions include trading platforms, cryptocurrency exchanges, and real-time stock trackers. Moreover, applications for investment have other utilities such as credit score tracking, EMI calculators, and others that play a major role in their development costs.

Creating an investment app is estimated to take $130, 000 on average, but it can differ depending on the country. For instance, it may be cheaper to build the app in Asia or Central Europe than in North America.

IV. How long does it take to build a custom FinTech application?

The time it takes to develop a custom FinTech application depends on the functionalities created and the application’s complexity. Here’s a breakdown:

- Basic (3-6 Months): Applications with fewer features usually need less effort and time to be developed. Such applications are known to integrate basic functionalities which can be very helpful in the development process.

- Average (6-12 Months): Mobile banking, account, bill payment, investment tracking, etc., are some of the features that may take a longer time in the development of the app. These features take more time to implement, and it also takes time to test them.

- Complex (12 Months or More): Applications that use elaborate technologies and complicated back-end systems require significant development work. Ensuring functionality, security, and scalability can extend the development timeline significantly.

These timeframes are provided to the best estimates. Actual development time can vary depending on the skills of the development team and compatibility with different platforms.

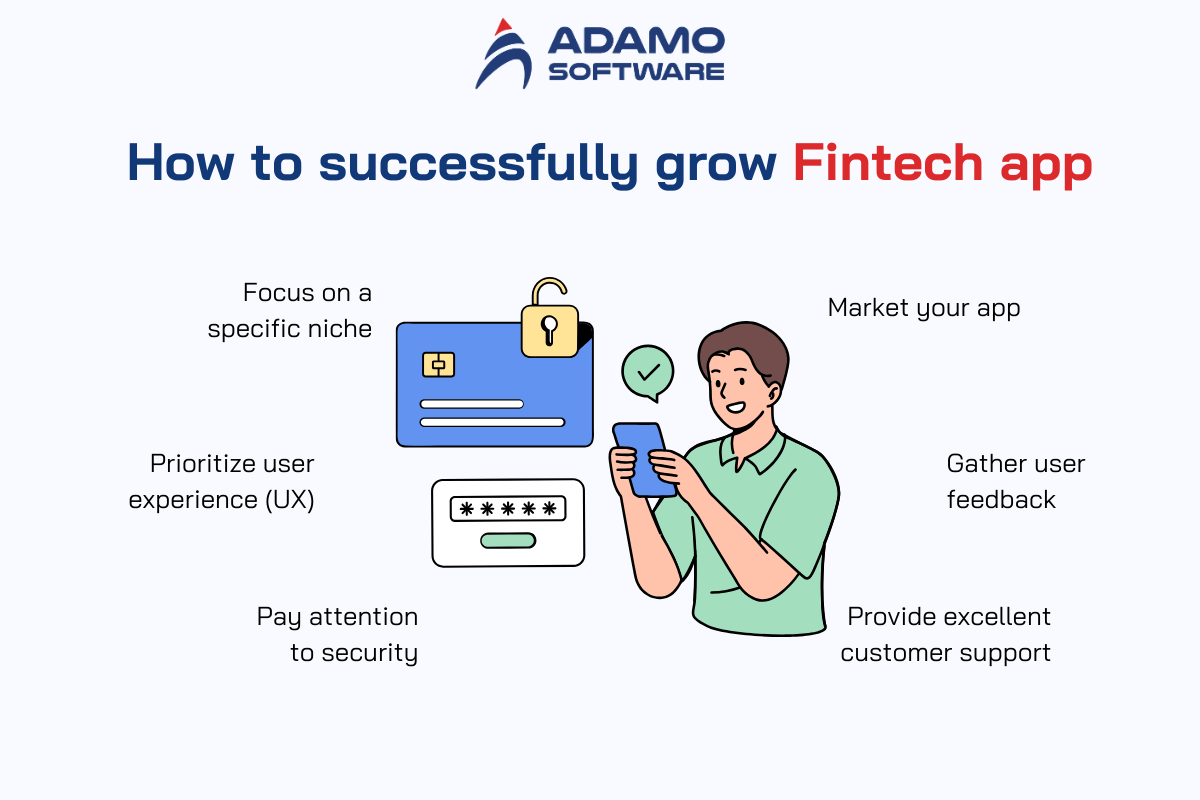

V. How to successfully grow your FinTech app?

Creating a FinTech application is one thing, but the real task lies in the app’s popularity among users. To ensure your FinTech app stands out and succeeds in a competitive market, consider the following strategies:

- Focus on a specific niche: Identify a niche problem or a gap in the financial services industry and ensure that your app solves the said problem. Choosing a target market segment also has many advantages in standing out from the competition.

- Prioritize user experience (UX): Design an interface that is easy to navigate, aesthetically pleasing, and easy on the eyes. For users to continue using the site or application, they must be taken through a smooth experience.

- Pay attention to security: Since the FinTech apps deal with the users’ financial information, it is imperative to enhance the security of the apps. Be transparent with your clients, partners, or employees about your data protection policies, and update your security measures regularly.

- Market your app: Use an effective marketing mix to cover the target audience. Use social media, influencer collaborations, and digital marketing to increase brand awareness and encourage more people to download the app.

- Gather user feedback: Encourage the users to give their opinions through feedback forms, app reviews, or in-app feedback sections. This feedback should be used to determine areas for improvements.

- Provide excellent customer support: Ensure customers receive timely and efficient support to increase loyalty. Including live support such as live chat or phone support can help in improving the user experience.

VI. Adamo Software will bring a budget-friendly FinTech software development solution

Adamo Software is your best choice for affordable FinTech software development services. Adamo provides cutting-edge and efficient mobile applications, web solutions, and innovative technologies with the best value for money and flexibility.

Our experienced team will help you develop unique FinTech applications that will fit your financial technology requirements but at a reasonable price. Over the years, we have accumulated great technical knowledge and follow the most efficient development procedures. Therefore, we are a perfect partner no matter if you are a start-up or a developed company.

Contact us today to start envisioning your ideal FinTech software solution!