Fintech cybersecurity: How to construct safe Fintech solutions

High-profile cyber attacks on important economic infrastructures have shown that FinTech cybersecurity issues are serious enough to represent a systematic risk.

In recent years, fintech apps like Venmo, Robinhood, Chime, PayPal, MoneyLion, Mint, and Card Curator have disrupted and altered banking and financial services. As more people utilize contactless payments, mobile banking, micro-investing, online lending, travel hacking, and other fintech-powered financial services, up to 75% of worldwide consumers will use at least one.

Consumers love fintech, but others do too. Cybercriminals love fintech apps for stealing personal and financial data. Fintech cybersecurity is more important and harder than ever. It’s because more consumers adopt fintech and more money flows via its apps. Bad actors undertake increasingly creative attacks.

I. Fintech security statistic: The alarming stats of 2023

The Sixth Annual Bank Survey found that 70% of banks prioritize Fintech data protection. The Ponemon Institute Study found that capital market businesses and banks spend $18.5 million annually on cybercrime. Hacker assaults cost financial services providers up to $18.3 million annually.

These providers acquire large amounts of financial, contact, and health data from consumers, visitors, and workers.

Hackers can leverage system vulnerabilities to steal this data and commit financial fraud. The worst part – most companies don’t discover the attacks until it’s too late. Bitdefender found that 64% of firms are unaware of system data breaches.

II. The importance of cybersecurity in Fintech

Financial transactions are an obvious target for payday hackers. Traditional banks must comply with severe cybersecurity regulations. Fintech companies are less regulated than banks, thus they often neglect the security process, especially when applications are not required to be entirely secure.

Fintech companies should prioritize fintech cybersecurity for several reasons:

1. Types of data store

Because fintech companies manage the same categories of financial data as banks, they are an attractive target for cybercriminals. This sensitive information includes account information, account balances, financial flow information, budgets, and contact information.

Fintech companies have an incentive to store as much specific and useful data as feasible due to the value of this data, particularly for mining using AI/ML projects. However, there is a trade-off, as storing significant amounts of data makes them a more desirable target.

2. Cost of breaches

The cost of a data breach for conventional banks includes both direct and indirect expenses, such as reputational harm and sanctions. A single compromise could also result in the loss of thousands of customers.

Because fintech companies deal with the same type of data as banks, a breach can have the same negative effects. Loss of consumer trust and reputational damage may be the most expensive aspect of a breach, particularly for fintech startups or hyper-growing businesses. In addition to fines and litigation, violations may have legal repercussions.

3. Compliance

A fintech company is required to comply with Know Your Customer (KYC) and local regulations in all regions where its customers are located. These guidelines include:

_ For the EU: The General Data Protection Regulation (GDPR) governs the processing of personal data for EU residents, regardless of the organization’s location. eIDAS governs cross-border digital transactions and provides a unified framework for Fintech firms, consumer organizations, regulatory authorities, and end users. The Payment Services Directive 2 (PSD2) mandates security for electronic transactions. PSD2 and GDPR frequently overlap, so compliance may require expert consultations.

_ For the USA: The Payment Card Industry Data Security Standard (PCI DSS) governs the collection, processing, and use of credit card information.

_ For the state of California: The California Consumer Privacy Act (CCPA) is similar to the General Data Protection Regulation (GDPR), but there are a few differences, such as the definitions of legal terms. Yodlee confronted a class-action lawsuit for allegedly violating the CCPA with its data collection and utilization practices.

Also read: Fintech App Development Cost: How to Estimate

III. Challenges Fintech face around cybersecurity

It’s critical to recognize the challenges in the realm of fintech cybersecurity to understand how to make it impermeable to planned cyberattacks.

1. Cloud Computing Issues

Most online financial services, such as payment gateways, net banking, digital wallets, and form completion, are conducted via a cloud computing system. Although cloud computing offers benefits such as scalability, speed, and accessibility, the volume of data flowing into it makes it the ideal cover for intrusions. As a consequence, it necessitates a different set of fintech cybersecurity measures than local data centers. It is crucial to select a dependable and secure cloud service provider who can tailor the cloud to the client’s requirements.

2. Third-party access

Financial institutions (FIs) and banks frequently utilize third-party services and software for various purposes. Since these programs are connected to the organizations’ primary systems, they serve as entry points for hackers posing as authorized employees or third-party customers. Banks must use caution when selecting a dependable third-party solution to overcome fintech cybersecurity.

3. Malware attacks

Malware is the most common form of cyberattack. Malware has substantially evolved, making it more difficult to detect and eliminate. Unlike other attacks, malicious software can enter through various channels, such as emails, third-party software, suspicious websites, and pop-up windows. It is especially dangerous due to its lethal transmission and spread rates, which are capable of bringing down entire networks.

Therefore, it is essential to choose cybersecurity infrastructure providers with frequently updated malware detection software and capabilities such as automated real-time malware detection.

4. Money Laundering Risks

Since they have grown in popularity in recent years, cryptocurrencies have become one of the biggest fintech cybersecurity challenges. It is possible to conceal the origin of funds laundered with cryptocurrencies. Moreover, bitcoin transactions may be susceptible to fraud and criminal access points for data theft, resulting in substantial losses and law enforcement issues.

Therefore, banks and other FIs that deal with cryptocurrencies should exercise caution and only conduct transactions on secure platforms.

5. Identity theft and authentication

Banks and FIs utilize methods like one-time payments, biometrics, passwords, and other types of authentication to provide security and confirm identity. These fintech cybersecurity techniques have the disadvantages of being easily replicable, which allows hackers to steal substantial quantities of money.

Although these fintech cybersecurity techniques are beneficial, banks and FIs must implement various verification gateways based on different concepts to prevent intrusion.

6. Online Digital Platform

Most banks and FIs currently utilize internet-based platforms. This indicates that most users’ PCs and mobile devices, through which they access their accounts, are susceptible to hijacking. Therefore, even if the bank’s network is secure, it cannot detect a compromised user device. Customers must therefore complete significant transactions using computers and other devices that offer greater fintech cybersecurity. When using these devices for banking, it is also recommended to install antivirus software with real-time detection and secure browsing.

7. Compliance

Depending on the type of service, fintech cybersecurity must adhere to regulatory and compliance rules. In a similar vein, rules requiring businesses to “know their consumers” require them to keep an eye for illicit activity like tax evasion and money laundering.

The regulations focus on specific services, such as insurance, lending and borrowing, stock market trading, and financial consulting. Nonetheless, all institutions are required to adhere to certain standards. These regulations are in place to maintain a specific level of fintech cybersecurity for the money and personal information of customers. In addition, violating or failing to comply with these rules may result in penalties and government action.

In order to address the current fintech cybersecurity, businesses must adhere as closely as possible to the rules.

IV. Techniques to eliminate Fintech cybersecurity risks

In order to reduce fintech cybersecurity concerns, fintech companies have employed various methods, including:

1. Encryption

Encryption is an essential fintech cybersecurity strategy for safeguarding sensitive financial data. Fintech companies use encryption to safeguard data both in transit and at rest.

2. Multi-factor authentication

In order to access financial information, multi-factor authentication requires users to provide multiple forms of identification, such as a password and a biometric factor.

3. Fintech cybersecurity training

Fintech organizations provide training to educate employees about fintech cybersecurity threats and best practices. With the aid of this training, employees can identify and mitigate fintech cybersecurity risks.

4. Fast response procedures

Fintech companies have incident response procedures to immediately address fintech cybersecurity incidents. The actions to be taken in the event of a fintech cybersecurity incident are outlined as part of these plans.

5. Collaboration

Fintech companies collaborate with FIs and government entities to share information and mitigate fintech cybersecurity threats. This technique facilitates the early detection of cyberthreats and the development of effective mitigation measures.

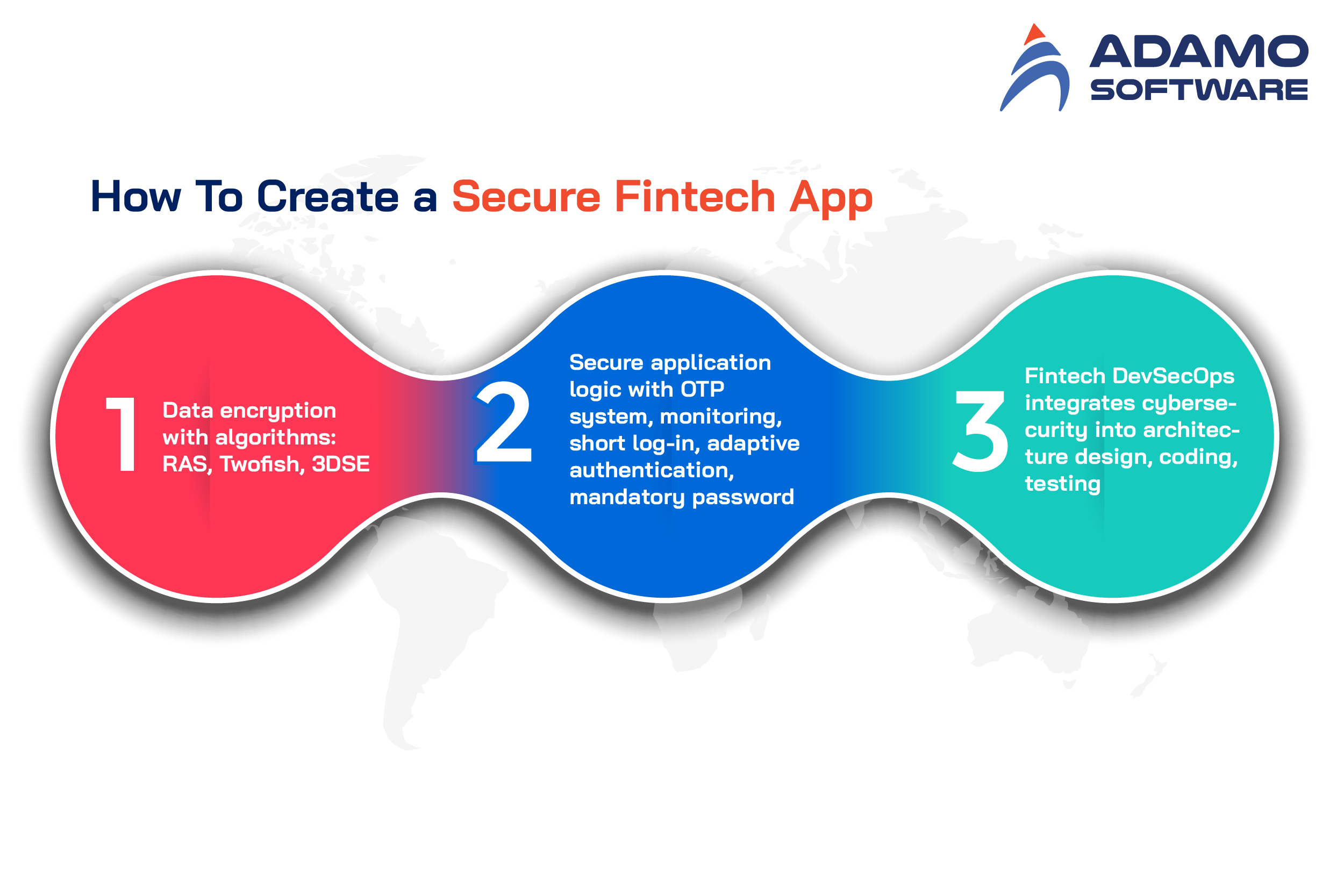

V. Fintech solutions – How to create a secure Fintech app

1. Data encryption

Encryption and tokenization are extremely effective solutions for fintech cybersecurity.

Encryption refers to the process of encoding information into a code that requires special keys to decipher. You can safeguard sensitive data with sophisticated encryption algorithms, such as:

_ RSA: A highly secure asymmetric algorithm with both a public and a private encryption key.

_ Twofish: A free algorithm for encrypting 128-bit data segments.

_ 3DES: The favored method of encrypting credit card PINs. Triple DES divides information into 64-bit blocks and encrypts each block three times.

Tokenization is the replacement of confidential information with a randomly generated number (token). Using one-of-a-kind databases (token archives), you can decrypt the original data into a readable format.

Want to proceed further? You can encrypt the token vault to increase the fintech cybersecurity of your application.

2. Secure application logic

Fintech cybersecurity requires a stringent password policy. However, this is insufficient to defend your application against targeted attacks.

Implement accurate authentication technologies, such as:

_ One-Time Password (OTP) system. Dynamic PINs serve as additional layers of fintech cybersecurity. How do they function? Each time a user attempts to log in to their account or conduct a transaction, the application generates a new, temporary password.

_ Mandatory password change. Over 80% of data leaks and breaches in 2019 were the result of compromised passwords. By mandating regular password changes for consumers and employees, FinTech companies can significantly reduce security risks. Many online banking applications, for instance, require users to alter their account passwords every three to six months.

_ Monitoring: Using a monitoring system, you can analyze suspicious activity (such as failed log-ins) to identify unauthorized access. In addition, this fintech cybersecurity can prevent data intrusions by blocking a user’s account following a series of suspicious transactions.

_ Short log-in sessions. The preservation of financial data benefits from a shortened session length. Why? Even if a hacker acquires access to the account, he will have limited time to steal sensitive information.

_ Adaptive authentication. Multiple-factor authentication is not a silver bullet. It can even increase the likelihood of data exposure (for instance, if a hacker manages to clone your smartphone). In contrast, adaptive authentication analyzes user behavior to identify suspicious activity. As a result, your platform will provide enhanced fintech cybersecurity for financial and personal data.

3. Fintech DevSecOps

Fintech cybersecurity is not a viable remedy. You should integrate it into the foundation of the SDLC (Software Development Life Cycle).

Every day, Internet security organizations register over 350,000 pernicious and potentially dangerous applications. Governmental FinTech regulations also continue to evolve. How can you keep up with the FinTech cybersecurity landscape’s evolution?

There is a solution. To create secure FinTech cybersecurity, you should use DevSecOps. DevSecOps methodology integrates cybersecurity into the architecture design, coding, and testing phases of the production pipeline.

VI. Adamo Software – Help You Create Secure Fintech Solutions

Recently, you have seen lots of security challenges and risks that you might face when developing financial software solutions. So how to help you develop a secure fintech app without thinking of those challenges, there’s an answer here to hire a green dedicated development team like Adamo Software. We are a premier software development company that helps you build a lucrative and secure fintech cybersecurity solution from scratch. Contact us to learn more about our secure FinTech Solutions and software development services as well.