10 digital payment types explained – Safety tips for using

Currently, digital payment has become popular and indispensable. This payment method allows users to make financial transactions such as payments, money transfers, deposits, or withdrawals via the Internet. The convenience, speed, and safety that these methods bring have gradually replaced traditional forms of payment. Typically, these transactions are conducted through the user’s online payment gateway or online bank account. With digital payment services, customers experience more convenient, proactive, and faster payment services. So, what are some popular digital payment types that can replace payment by cash or check? Let Adamo Software answer this question.

Through this blog post, besides safety tips to be aware of when using different digital payment types, you will also learn detailed information about these types of electronic payment below.

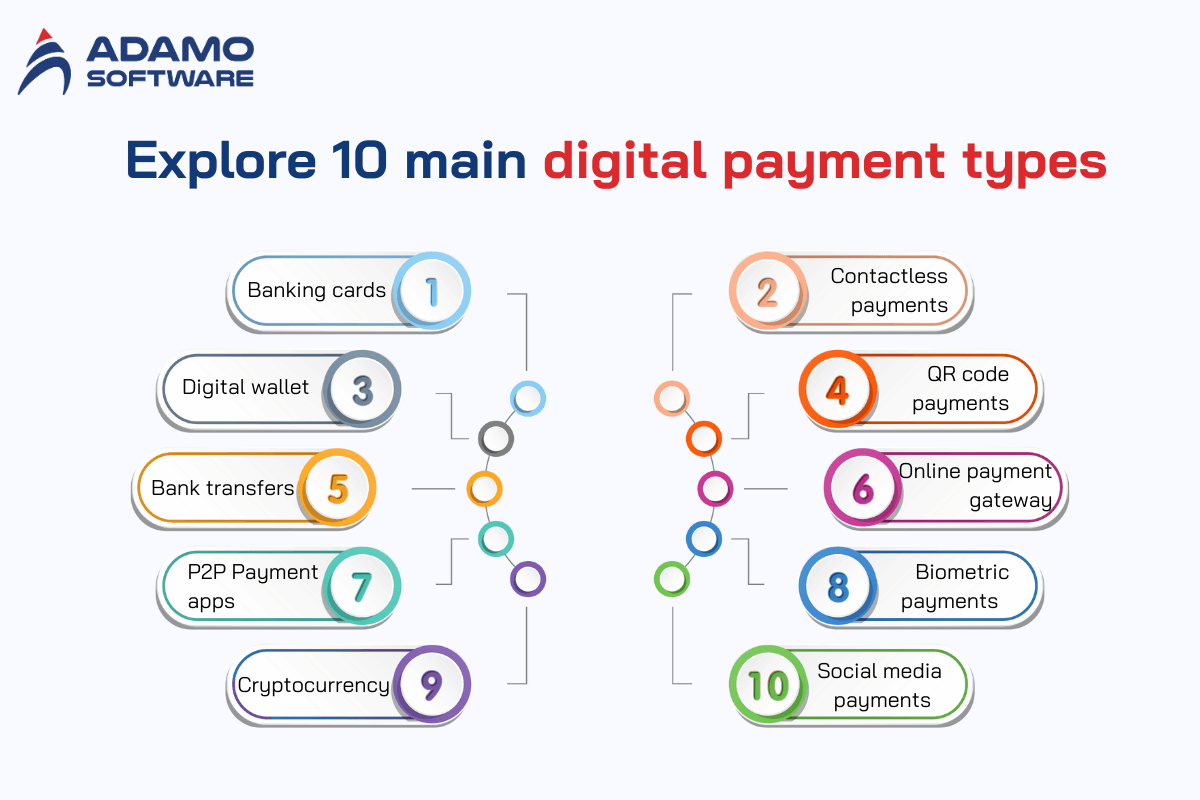

- Banking cards

- Digital wallet

- Bank transfers

- Peer-to-peer (P2P) payment apps

- Cryptocurrency

- Contactless payments

- QR code payments

- Online payment gateway

- Biometric payments

- Social media payments

Each type has its own characteristics. Let’s read our post for more detailed information.

I. Explore 10 main digital payment types

1. Banking cards

The banking card is one of the most popular digital payment types in the world. Many stores and other places where transactions may occur now accept banking cards. You can use cards such as credit cards, debit cards, or prepaid cards to make purchases online, through mail-order catalogs, over the phone, or in stores. Without cash or checks, you can still pay all the costs. Thanks to this, customers and merchants can save time and money and simplify the transaction process. VISA, MASTERCARD, RuPay, and AMEX are some popular card payment systems. Below are some features of banking cards.

- High security

High security is one of the outstanding features of banking cards. With the PIN codes, OTP, and EMV chip technology, you can make secure transactions and reduce the risk of fraud.

- Convenient and fast

Banking cards are convenient and fast to use, allowing you to make payments without cash. With just a few simple steps, you can pay instantly in-store or online.

- Incurring service fees

When using banking cards, you may want to care about the incurring service fees. You may incur card maintenance fees, international transaction fees, or interest when using a credit card.

2. Digital wallet

Among the digital payment types, the digital wallet is also notable. It has become a popular payment method due to its convenience and security. In terms of advantages, the payment method using an e-wallet helps users easily transfer money from their bank account to their e-wallet account. They can also deposit money into their wallet by depositing cash to make payment transactions. However, the disadvantage is that users can only make payments on websites that accept this e-wallet. PayPal, Apple Pay, and Google Pay are some digital wallets you can refer to.

To make the most of digital wallets, you may want to use advanced security features to keep your digital wallet secure. These features include two-factor authentication, using a PIN code or biometric identification, strange transaction warnings, and updating your digital wallet app regularly. Besides, linking your wallet to your bank account helps you deposit money quickly, withdraw money flexibly, and take advantage of promotional programs linked between banks and e-wallets.

3. Bank transfers

Bank transfer is one of the popular digital payment types that allow users to transfer money from their bank account to the receivers’ bank accounts. Users can make this transaction through Internet Banking, Mobile Banking, or ATMs. Let Adamo Software discuss the advantages and disadvantages of bank transfers.

- Advantages of bank transfers

Bank transfers are fairly safe and secure, as transactions are protected by strict security layers such as OTP codes, two-factor authentication (2FA), and PIN codes. Through Internet Banking or Mobile Banking, users can easily make transactions anytime, anywhere without going to the bank directly. Additionally, using bank transfers, you can also make international transactions. Bank transfers also help minimize the risk of carrying cash, especially in large transactions.

- Disadvantages of bank transfers

Some banks charge fees for transfers, especially when transferring money internationally or between different banks. Besides, transfers outside the banking system or international transfers can take from several hours to several days to complete. Another disadvantage of bank transfer is that to make transactions, you must have a stable Internet connection. Therefore, if the network is interrupted, you will have to find another way to pay for purchases. Additionally, if you enter the wrong recipient account information, money may be sent to the wrong person and refunds may be complicated or time-consuming.

4. Peer-to-peer (P2P) payment apps

Referring to the best digital payment, it cannot miss the peer-to-peer payment apps. Instead of going to the bank or make transactions through intermediaries, users can transfer money directly. There are many apps using this payment type, such as Venmo, PayPal, and Zelle. P2P payments are often used to share everyday expenses, such as paying for food, and bills, or sending money for friends and family.

P2P is fast and convenient. Thanks to this, you can make transactions anytime, anywhere with just a few steps on the phone. You can also make international money transfers with this system due to its lower fees. However, the disadvantage of P2P is that security and fraud risks can happen.

5. Cryptocurrency

Cryptocurrency, which is now accepted to use by many countries, is also one of the popular digital payment types you can refer to. Cryptocurrency is a digital asset based on blockchain technology. With this type of payment, you can make peer-to-peer electronic transactions without the need for intermediaries. Bitcoin, Ethereum, and Binance Coin are the most popular cryptocurrencies. No matter where you want to send money to, cryptocurrency can meet your need.

This payment type utilizes blockchain technology, a decentralized system where transactions are recorded and secured in a chain of blocks distributed across multiple computers. Through “mining” or validation by computers participating in the network, you can make cryptocurrency transaction. This process helps to ensure transparency and immutability for your transaction. Once verified, the transaction is permanently added to the blockchain, making it publicly accessible and verifiable.

Cryptocurrency transactions are often cheaper and faster compared to other digital payment types, especially when transacting internationally. Besides, this digital payment type is secure. However, disadvantages include high volatility in value, risk of fraud or loss of assets, and unclear regulations in many countries.

6. Contactless payments

Unlike other digital payment types, when using contactless payment, you will not have to swipe card or enter PIN when making payments. This is a type of digital payment using Near Field Communication or Radio Frequency Identification technology, enabling faster and more efficient and convenient payments.

Contactless payments allow customers to simply tap their chip card or smartphone over a reader. This payment method is faster and more secure than PIN technology because it transfers encrypted data to the point-of-sale device instantly, without exposing the PIN and card information. To make contactless payments in apps with mobile devices such as Samsung Pay, Apple Pay or Google Pay, you just need to download the app, add a card by entering the card information and place the phone on a compatible terminal to complete the transaction.

7. QR code payments

QR code payment is among the popular digital payment types in which users scan QR codes to make transactions. Banks and e-wallets both provide payment services using QR codes.

There are three forms of QR code payments, including Static QR code, Dynamic QR code, and Semi-dynamic QR code.

Static QR codes contain fixed information of 01 payment account (bank name, account number, and account holder name).

Dynamic QR codes are generated for each order, containing the payment information of the corresponding order.

Semi-dynamic QR codes contain the same information as static QR codes, however, the seller can pre-fill the payment amount and transfer content. Each type of QR code has different characteristics and applications to suit the needs of each user.

This type of digital payment benefits both payers and payees. Paying by QR code helps users not need to carry cash but can still pay quickly and conveniently with just a phone. Besides, the beneficiary account information has been integrated into the QR code, so the payer does not have to enter data themselves, limiting the possibility of entering incorrect information.

The recipient only needs to provide a QR code image to receive money. The transaction status is notified to the device as soon as the transaction is successful, and the recipient checks the amount right on the application, thereby helping to handle errors faster.

8. Biometric payments

Like other digital payment types, biometric payment also benefits users. Payment authentication using biometric sensors such as iris, fingerprint, face, hand, etc., is being deployed thanks to the convenience, confidentiality, and security that this method brings to digital payment transactions. This technology is integrated into mobile devices, payment cards, or POS machines that support biometric identification. With this digital payment type, customers can use fingerprints to make transactions more safely and conveniently without having to remember and use passwords.

The biometric authentication feature of the biometric payment provides an additional layer of security for contactless card payments, which could help the financial sector eliminate the limitations of the need to remember PINs and physically interact with PINs. Here are some advantages of biometric payment, one of the most secure digital payment types.

- High security: Biometric features such as fingerprints, faces, or irises are unique to each person, minimizing the risk of fraud and information theft.

- Convenient: Users do not need to carry cards, cash, or remember passwords, just use biometric features to make transactions.

- Fast speed: Authentication and payment are done almost instantly, saving time compared to traditional methods.

- Difficult to fake: The possibility of copying or forging biometric information is very low, providing high security for users in financial transactions.

Overall, biometric payments are gradually becoming a modern trend, bringing safety and convenience to users in daily transactions.

9. Online payment gateway

An online payment gateway is also among the excellent digital payment types. It is an intermediary system that helps process electronic payment transactions between buyers and sellers on online commerce platforms. A payment gateway ensures the safe and secure transfer of funds from the buyer’s account to the seller’s account.

This type of payment allows users to conduct electronic transactions globally. These gateways support a variety of payment methods and currencies, making it easy for buyers from different countries to pay for goods or services online. Popular international payment gateways include PayPal, Stripe, 2Checkout, and Worldpay.

The advantage of an online payment gateway is that it helps transactions take place quickly and conveniently. It supports many payment methods such as credit cards, debit cards, e-wallets, or bank accounts. In addition, a high-security system with data encryption and two-factor authentication (2FA) helps prevent fraud and protect user information.

10. Social media payments

Unlike other digital payment types, social media payments allow users to make transactions directly on social media platforms such as Facebook, Instagram, or WeChat. Instead of switching to other banking or e-wallet apps, users can make purchases, transfer money, or donate right within the social networking app. Let’s see how it is different from other digital payment types.

- Social integration

This type of e-payment is integrated directly into the applications that users are familiar with. It allows transactions to take place within the same environment without having to switch to other applications.

- Direct interaction with sellers

Users can easily communicate directly with sellers or brands via messages before making payments. This creates a sense of personalization and increasing convenience.

- In-post shopping

In-post shopping shows the ability to make transactions through posts, ads, or livestreams. This facilitates quick and instant shopping activities.

- Incorporating social elements

Users can share purchases or money transfers with friends and family directly on social networks, increasing interaction and connection between individuals. Social payments are not just financial transactions but also create a community-based shopping experience.

Compared to other digital payment types mentioned above, social network payments are mainly based on convenience in the social network environment and high interactivity between users and sellers.

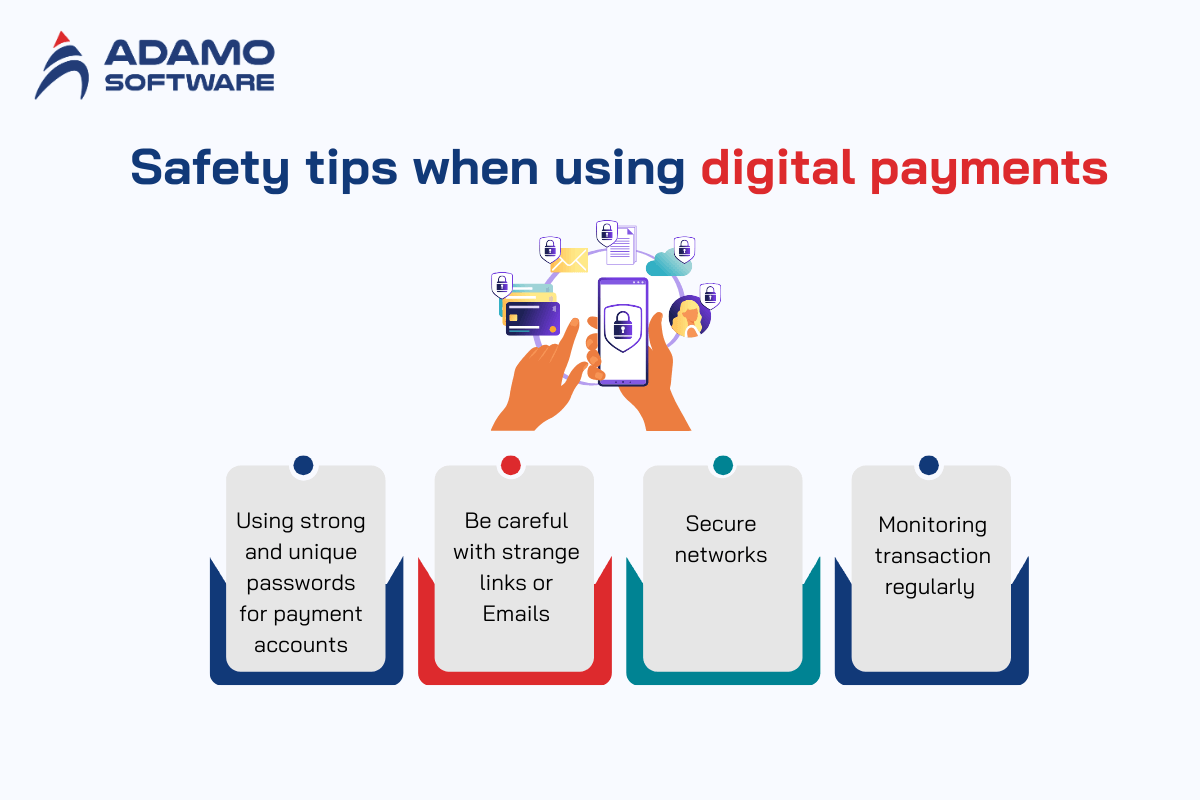

II. Safety Tips to be aware of when Using Digital Payments

Online payments have become a popular and convenient method. However, security risks and financial fraud may come with these conveniences. To protect accounts and personal information, users need to master safety measures when using digital payments. Here are some safety tips to be aware of when using different digital payment types.

1. Using strong and unique passwords for payment accounts

Even when you use different digital payment types, you must have robust and distinctive passwords for your payment account. Passwords should include letters, numbers, and special characters. Besides, avoid using easily guessable personal information such as birth dates or names. You can enable two-factor authentication (2FA) on your e-wallet or banking accounts for more security. This method enhances account security by requiring users to input a verification code alongside their password, thereby decreasing cyberattacks risks.

2. Be careful with strange links or Emails

Phishing messages are often designed to trick users into entering their account information on fake websites. Besides, don’t save credit card information on untrusted websites or apps. To be safe, only make payments on reputable platforms with high-security encryption.

Regularly check transaction history and bank accounts to detect unusual transactions early.

If you detect any unusual activity, contact your bank or service provider immediately for timely handling. At the same time, don’t forget to update security software and payment applications on your phone or computer to protect against new security vulnerabilities.

3. Secure networks

Use secure Wi-Fi, update firmware, set up a guest network, deactivate remote management, secure SSID, use strong encryption, hide SSID, monitor network activities, protect devices, and use a VPN to ensure network security. These precautions guarantee a secure home network, prevent unwanted access, and safeguard digital payments and personal data.

4. Monitoring transaction regularly

Monitoring transactions regularly when adopting different digital payment types is among the important solutions that help you protect your payment accounts and promptly detect unusual transactions. This includes regularly checking the transaction history in your bank account or e-wallet to ensure that all transactions are made by you. If you detect any transactions that you don’t recognize or didn’t make, contact your bank or service provider immediately to report them and ask for assistance. In addition, regular transaction tracking also helps you control your spending, thereby planning your finances more reasonably and effectively.

Overall, by considering the above tips when using various digital payment types, you can protect your digital payment account from potential risks. When you are attentive and careful in every transaction, you can make online payments safely and efficiently.

III. Explore the world of digital payment with Adamo Software

Adamo Software is one of the leading finance software development providers, helping businesses optimize payment processes and bring the best experience to users. Let’s explore the outstanding features that Adamo Software brings to the digital payments field.

- Comprehensive integrated solutions

We provide comprehensive integrated solutions for many digital payment types, helping businesses easily process transactions in the digital environment. With the ability to support a variety of electronic payment methods like bank transfers, digital wallets, etc., Adamo can meet customer needs. This can enhance the efficiency of transactions and user experience.

- Top-notch security

Adamo Software is committed to providing top-notch security for all transactions, ensuring the safety of customers’ financial information. With strong protection measures such as data encryption and two-factor authentication, we help prevent fraud related to various digital payment types.

- Reporting and analyzing

Adamo Software provides powerful analytics and reporting tools that allow businesses to track the performance of each payment type. By analyzing digital payment types, you can identify consumer trends and adjust your business strategy effectively. Through detailed reports, businesses can not only improve payment processes but also optimize customer experience.