How to create a digital payment app: A step-by-step explanation

The projected revenue of the global digital payments market is on the rise. Isn’t that impressive? Additionally, the United States has a remarkable 89% utilization rate, while an impressive two-thirds of adults worldwide are now adopting digital payments. With the rise of digital payments, clients and businesses are seeking more convenient, secure, and efficient solutions than ever before.

PayPal, Samsung Pay, Google Pay, and Apple Pay are at the forefront of developing digital wallet apps and advancing the industry. Mobile shopping may account for a significant portion, potentially 80%, of all online shopping in the coming years. Let’s explore the secrets behind a successful digital payment app.

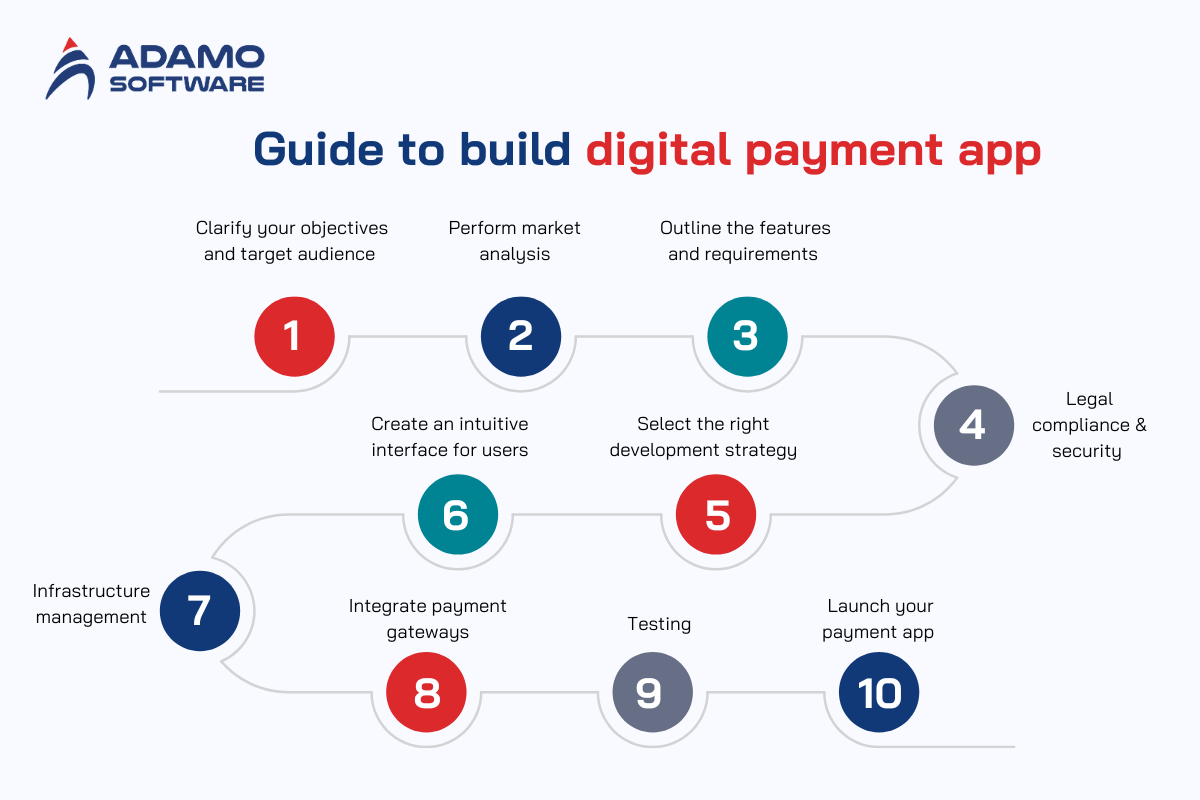

Key steps to follow when building a payment app:

1. Clarify your objectives and target audience

2. Perform market analysis

3. Outline the features and requirements

4. Legal compliance and security

5. Select the right development strategy

6. Create an intuitive interface for users

7. Infrastructure management

8. Integrate payment gateways

9. Testing

10. Launch your payment app

I. Clarify your objectives and target audience

To create a digital payment app, outline its purpose and identify the target audience clearly. Indicate if your payment app focuses on peer-to-peer transactions, improving in-store mobile payments, or simplifying online purchases.

Conduct surveys or user interviews to grasp the pain points and preferences of your target audience. For international transactions, consider multi-currency support and integration with global payment systems.

II. Perform market analysis

Market trends and thorough research are essential for creating a payment app that satisfies user needs. Analyze market trends, competitor applications, and user needs. Determine the distinct advantages and possible market deficiencies that your payment app can fulfill.

For example, researching popular payment apps such as Apple Pay, Google Pay, PayPal, and Cash App is crucial to understand user preferences. Consequently, it helps tailor your app to meet similar expectations.

III. Outline the features and requirements for the digital payment app

The third step is to identify the necessary functionalities and plan their integration into your app. Some essential features for the digital payment app that you can consider are:

- Peer-to-peer (P2P) transactions

- Bank to wallet or bank to bank transfer

- Transaction history

- Automated payments

- Third-party bill payments

- Bill splitting

- Multi-currency support

- Customer support

In addition to the essential features mentioned earlier, consider these advanced options for your payment app: contactless payments, biometric authentication, social payments, and cryptocurrency integration.

IV. Legal compliance and security

Digital payment apps are heavily regulated in numerous countries. Therefore, research thoroughly based on your app’s target region. Ensure your digital payment app complies with current legislation.

In addition to specific regulations, make sure your app meets all Payment Card Industry Data Security Standard or PCI-DSS requirements. This is an essential standard with 12 requirements for managing cardholder data and qualifying as a service provider for card payment transactions.

V. Select the right development strategy

Fintech software development is a complex task that demands technical skills and a thorough grasp of industry standards. There are two main methods to create a payment app:

1. Software development from scratch

Starting from the ground up enables total customization, guaranteeing the digital payment app fulfills your exact needs. You control the development process, enabling flexibility and necessary adjustments. However, the process can be lengthy and typically incurs higher upfront costs due to the significant time and resources needed.

2. Use a ready-made FinTech Platform

For quick deployment, opt for a pre-built software to cut down on development time and costs for your digital payment app.

VI. Create an intuitive interface for users

A visually appealing and modern user interface is essential for your product to compete and thrive. There are two reasons for this.

1. The interface is the initial key interaction with your end-users

A contemporary and striking design increases your chances of winning users’ hearts. Hence, make it unique and easy to discover the golden mean while engaging with customers.

2. Competitors are on the alert

Many similar offerings exist in the market. Your competitors are also aiming to keep up with the latest design trends and impress users with innovative interface features. Therefore, create an innovative, high-quality user interface and experience from the ground up.

You can explore Pinterest, Dribbble, and Designspiration to find inspiration and enhance your visual experience through the designs shared by various companies and specialists.

We suggest creating a clickable prototype, mockups, or wireframes that illustrate the final user flow. This will provide insights into how customers navigate your payment gateway app.

VII. Infrastructure management

Choose to use cloud-based solutions or oversee databases housed on your servers. Factors include scalability requirements, resource availability, and desired degree of control will determine which of the solutions best fit.

Using a self-managed strategy, you keep and run MySQL and Postgres on your servers, therefore controlling infrastructure and configurations.

Infrastructure management, backups, and scalability are handled by cloud-based database providers such as AWS or Azure. These services easily accommodate development and provide automated scaling depending on demand.

VIII. Integrate payment gateways

Choose a payment gateway that supports the payment methods you wish to provide—credit cards, bank transfers, digital wallets, etc.—and fits the criteria of your payment app.

It is important to pay attention to the following: the payment gateway’s features (for example, it should be able to support a variety of payment methods, such as credit/debit cards, mobile wallets, and bank transfers, to accommodate a wide range of users); its compliance; and its API documentation and security measures.

IX. Testing

QA engineers verify the digital payment app’s functionality to identify bugs, vulnerabilities, and opportunities for enhancement by executing test cases and scenarios. Before the release, code testing helps to improve the solution and increase its security. Furthermore, since the problems are discovered before they enter production, bug fixing significantly becomes less expensive.

X. Launch your digital payment app

After finalizing the app’s design and features, it is time to deploy the new version to production and officially launch your digital payment app. The primary objective is to confirm your project’s concept by gathering insights from initial users.

Gather and analyze user comments to maximize data collection. The collected information should reveal which features need to be changed, added, or possibly removed. Next, transform these notes into a comprehensive technical specification for developers of the money transfer app to enhance and expand upon.

Multiple test launches and MVP releases can be conducted. It is typical for your primary objective to be the transformation of the minimum viable product while understanding how to develop a mobile payment system that offers comprehensive functionality for end-users. It must be prepared to accommodate thousands of users while ensuring stability under load.

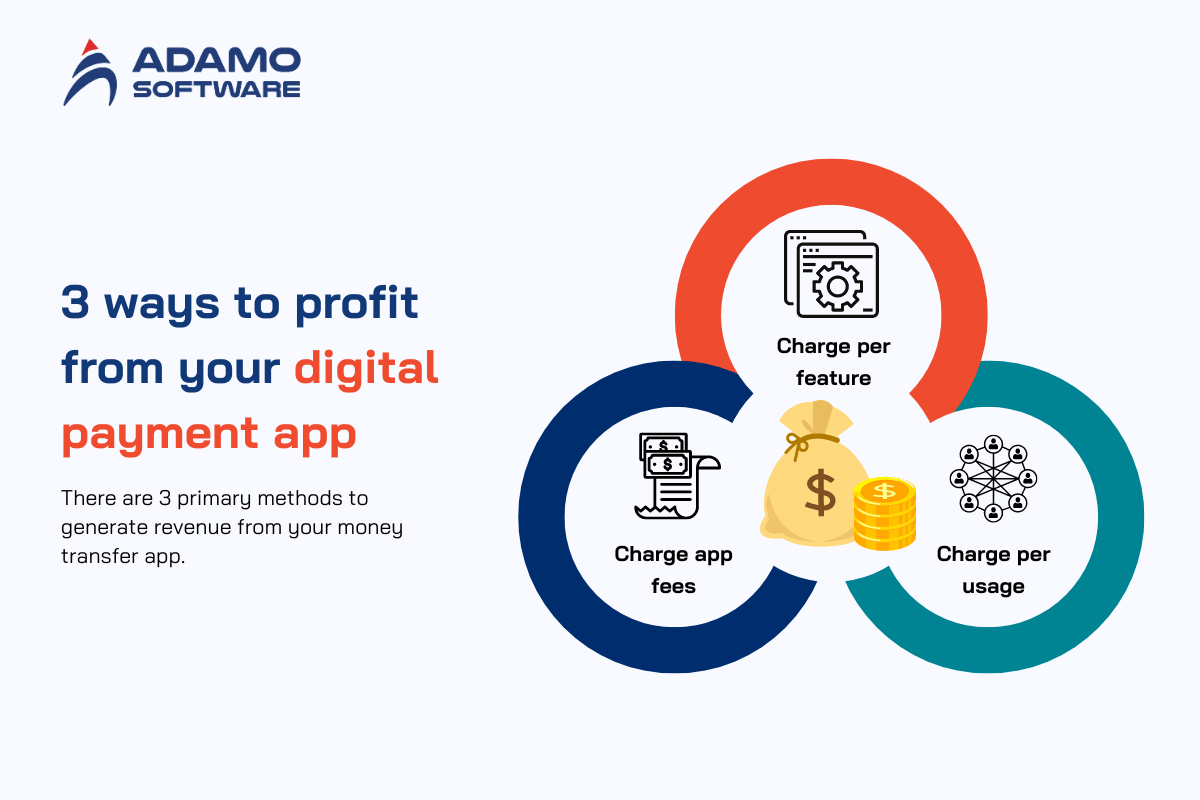

XI. 3 ways to profit from your digital payment app

As an entrepreneur, your primary objective is to achieve profitability through the launch and provision of a peer-to-peer payment application. There are 3 primary methods to generate revenue from your money transfer app.

1. Charge per feature

A fundamental business model involves charging users based on the features they utilize. This indicates that you offer essential basic features at no cost while providing paid pricing options. Additional features should be incorporated, as users are willing to invest in functionality that addresses their specific needs.

For instance, users can be equipped with advanced analytics tools and an intelligent balance moneybox that automatically rounds up approximately 0.1% of each transaction, saving it beyond the user’s balance.

2. Charge app fees

This monetization model entails charging a fixed amount for each transaction, ensuring that users receive net payments. This business model is impressive and assertive, but it may divert some users since they have already determined a specific amount to transfer.

Furthermore, refund and chargeback situations should not involve extra fees, as many users view this as unfair practice. However, you can establish adaptable payment gateway app fees that benefit both your business and your customers effectively.

3. Charge per usage

This approach resembles the revenue share and app fee models, yet it suggests that users are billed for high account activity without incurring charges for each transaction.

This method is effective when you assess and quantify the financial figures for each user over a designated timeframe. Subsequently, you have the ability to bill customers consistently. Utilizing a billing platform that automates per-usage charging for your business will simplify the process.

XII. Why collaborate with Adamo Software for digital payment app development?

Adamo Software has extensive experience in digital payment app development, which has instilled confidence in us. Our engineers and project managers possess deep expertise in circumventing all bottlenecks associated with mobile payment app development, guaranteeing both security and scalability.

We specialize in payment gateways, online payment systems, E-wallet mobile applications, and recurring billing solutions. Regardless of the app you decide to develop, we have probably already collaborated on it.

If this is not the situation, we have sufficient comparable expertise to create a digital payment app that is relatively new to us and ensures its perfection. We create a specialized finance software development team tailored to your unique requirements. Reach out to us to develop a mobile digital payment app that will excel in a competitive market.