Digital payment: What is it, how does it work, and more

Electronic payment has become a key characteristic nowadays. It is a part of extending the means of payment in the financial world. Electronic payment involves using electronic devices, including mobile phones, computers, or the Internet to transact cash-less business. Digital payment services enable faster, more convenient, secure, and efficient transactions.

Digital payments have risen over the past few years due to the increased need for technology and efficient service delivery. The statistics reveal that people worldwide are increasingly using payment forms that are in line with digital media. And the global digital payments market is predicted to be worth billions, as Entrust stressed.

Social, mobile, and digital payment systems have brought more changes to financial institutions. These players are not just nice additions but are crucial in commerce and transactions.

I. What is digital payment? Statistics and trends included

Digital payment is a form of technology to pay for goods and services or transfer funds from one account to another without cash. Digital payment refers to mobile applications phones, internet banking services, electronic wallets, and other online payment tools. It has the benefits of speed, security, and convenience. Digital payment makes it easier to overcome the challenge of transactions in real-time. The use of digital systems in payments is very crucial in the current economy. They facilitate easy and efficient transactions of business throughout the world.

Statistics and Trends:

- The digital payment market worldwide is expected to grow to $12 up to $ 55 trillion by 2027 (Entrust).

- Global digital payment usage has increased in 2020 and 79% of adults have used it.

- Digital payment users will reach more than 2.1 billion by 2023.

- A smartphone-based digital wallet was applied for 49% of the international e-commerce payment journey in 2021.

- Non-touched payments increased by more than 150% in 2020-2022. People prefer to reduce the number of contacts in the process of payment.

Such statistics demonstrate the emerging trend toward the increased use of digital payment as a means of carrying out normal.

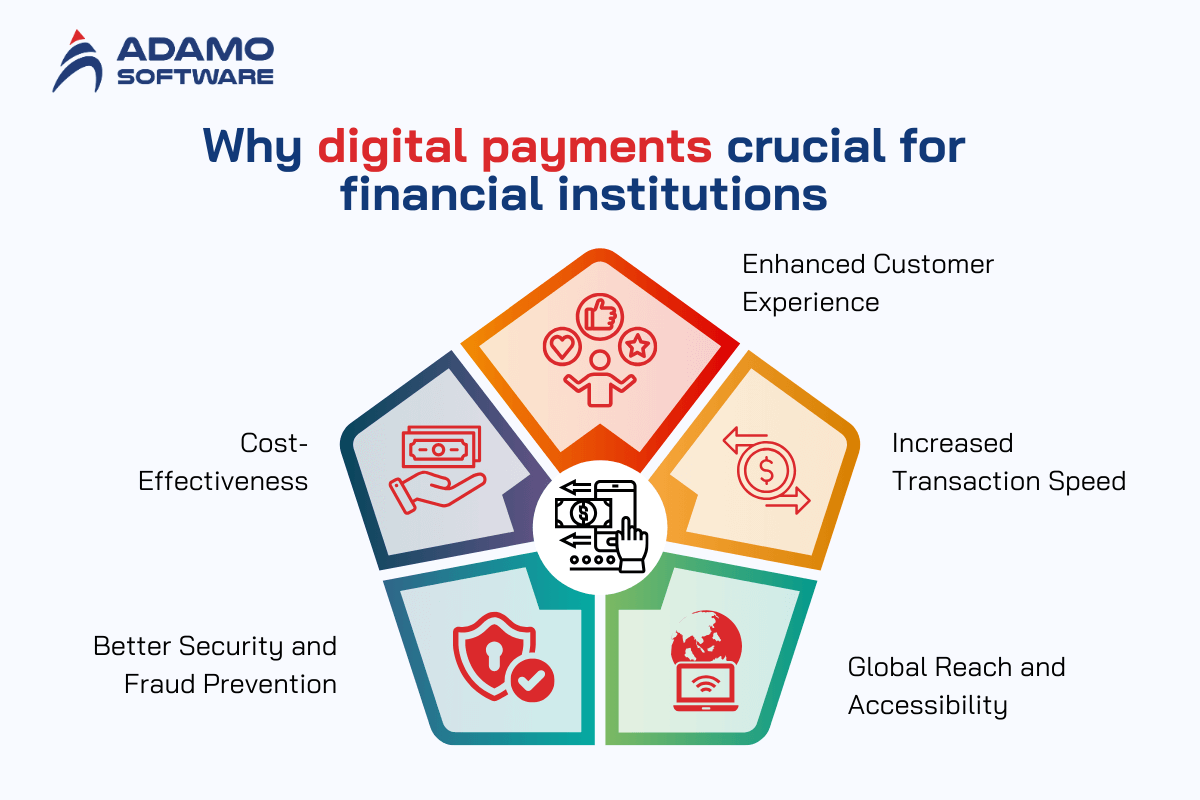

II. Why are digital payments growingly crucial for financial institutions?

Digital payment is highly significant as a result of a growing trend of cashless methods across the world. Currently, financial institutions are working towards increasing demand for faster, secure, and integrated payment solutions offered by digital payment solutions. Mobile banking, online money transfers, and digital wallets have influenced the banking systems and the financial services industries.

Here’s why digital payment is crucial for financial institutions:

- Enhanced Customer Experience: Mobile, internet-enabled payments and other cashless methods reduce the time and effort the customer must make to purchase. Hence, they increase the satisfaction level of the customer. A smooth digital payment solution maintains a competitive advantage for financial institutions in reaching out to tech-savvy customers.

- Increased Transaction Speed: Banking takes time but with digital payment, one can transact in real time. This comes as a relief for financial institutions. It supports cutting their operational costs besides enhancing transaction throughput.

- Global Reach and Accessibility: It eliminates geographical structure. It also allows financial institutions to serve people worldwide in terms of payments. This is important to sustain competition and cope with the digital economy operating environment.

- Better Security and Fraud Prevention: Since there are many options for digital payment methods banks can incorporate effective encryption and security measures. They would reduce cases of fraud and compromise secure data. This gains people’s trust and also improves the image of the institution.

- Cost-Effectiveness: Mobile banking enables physical structures to undertake banking operations, lowering operating expenses. This paper therefore finds that through the adoption of online payment systems, financial institutions will be able to conserve resources.

Thus, digital payment has defined the development and success of financial institutions.

Also read: 7 Advantages of digital payments & The future to look forward

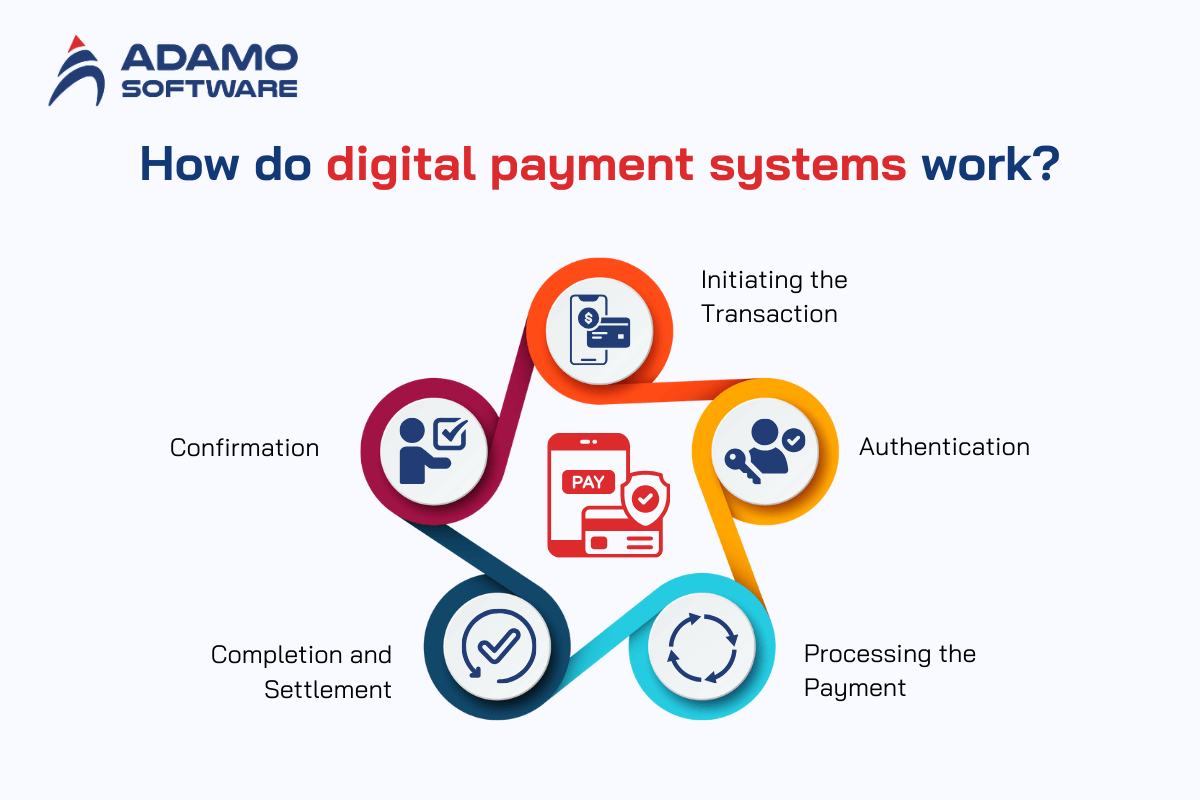

III. How do digital payment systems work?

Digital payment platforms are a process of paying money electronically through technology and channels between parties. These systems depend on the following factors to make the transactions faster, secure, and smooth. Here’s a breakdown of how digital payment systems work:

1. Initiating the Transaction

The procedure begins when a consumer triggers an electronic payment. This can be done through a mobile banking app, an e-wallet, or an online payment gateway. Payment information consists of the recipient’s information, amount to be paid, currency type, and payment options (which may be a credit card, bank transfer, or an E-wallet among others).

2. Authentication

Regarding customer security, the user will be asked to affirm the payment. This means the user has to type a PIN, scan his/her fingerprints or face recognition, or input an OTP received on his/her mobile phone or email. This step helps to safeguard a transaction from possible fraudulent users.

3. Processing the Payment

The digital payment platform sends payment details to the user’s bank when completed and validated. This will check whether the account has sufficient balance. In this process, there are normally several intermediaries. They can be payment processors, banks, and card networks that safely forward the payment information for transaction approval or rejection.

4. Completion and Settlement

When the payments are authorized, they are dispersed from the payer to the recipient. The transfer duration differs. Some digital payment services will provide the customer with an opportunity to transfer the sum immediately. However, others might take a few days depending on the types of transfer and the companies used.

5. Confirmation

The payer and the recipient notify the payer of the successful completion of the payer’s transaction. This makes a transaction more transparent, and the digital payment can be traced shortly.

For example, electronic payment solutions pave the way for several developments that don’t require physical currency for buying and selling. Digital payment has changed the way we manage money. It provides safe and secure authentication, fast transaction processing, and the ability to notify users in real time.

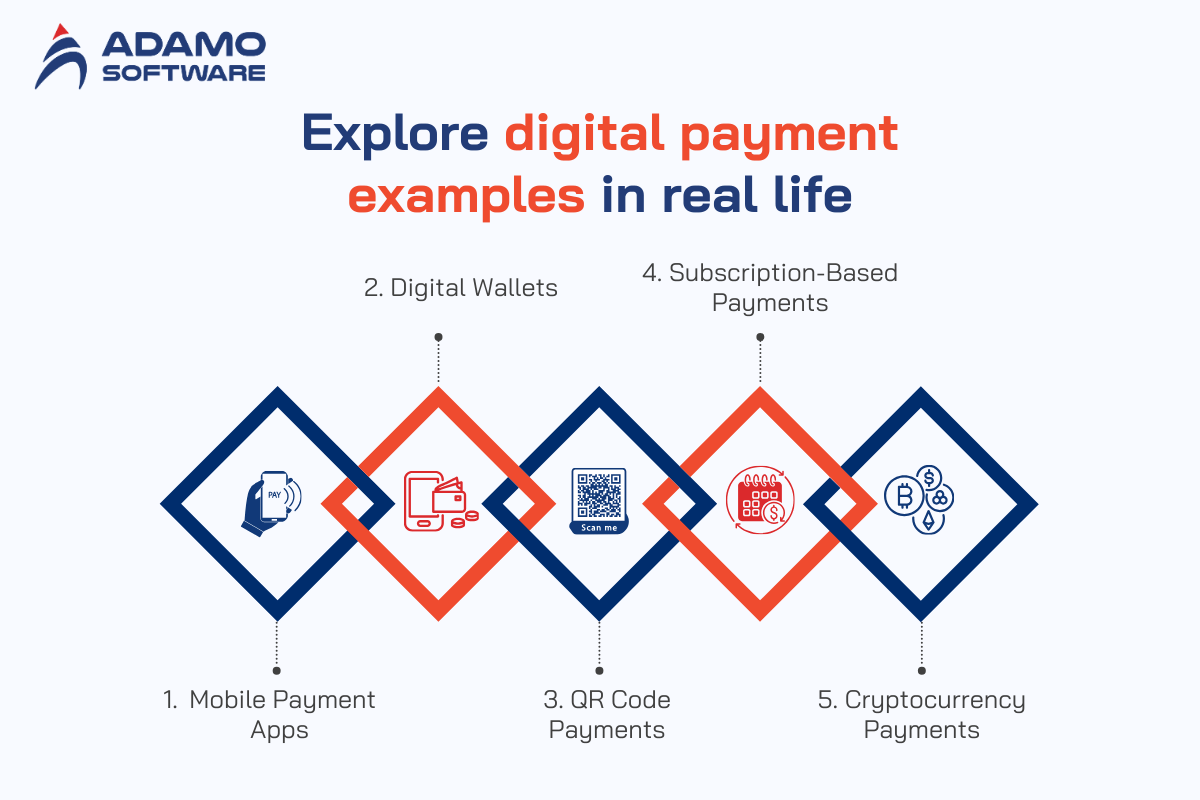

IV. Explore digital payment examples in real life

Digital payment systems work by moving money digitally from one party to another through electronic means and platforms. These systems are primarily based on several facets that help make transactions prompt, secure, and smooth.

1. Mobile Payment Apps

The process begins when a user activates a payment in a digital environment. It can be achieved through several methods, including a mobile banking application, an e-wallet, or an online payment interface. The user enters the payment details, the amount to be paid, and the mode of payment. The payment mode can be a credit card, bank transfer, or digital wallet.

2. Digital Wallets

As a measure of security, the digital payment system allows for the authorization of the transaction by the user. This may require the entry of a PIN, fingerprint, or facial recognition, or a one-way password (OTP) sent through the short message service (SMS) or email. This step ensures that only those allowed to proceed with the transaction can do so.

3. QR Code Payments

Upon creditworthiness confirmation, the digital payment system will check for funds availability. It will send an acknowledgment message to the financial institution where the user account is maintained. On average, this process involves the payment processor and other intermediaries like the bank and the card networks. This safely transmits the payment details to authorize or decline the transaction.

4. Subscription-Based Payments

Upon approval, the money is debited from the payer’s account and credited to the recipient’s account. Transfer times also differ in digital payment systems as compared to others. Original payment and transaction can take a day or two depending on the method or institutions.

5. Cryptocurrency Payments

The payer and the recipient will be notified of the transaction’s success. This helps transparency and keeps a payment record made through the digital mode for future reference if any dispute arises.

Electronic money allows transactions without cash, which enhances user satisfaction and organizational performance. Gone are the days when man used physical cash to transact. Digital payment has enabled secure authentication, instant processing time, and real-time notifications.

V. How Adamo Software brings your digital payment idea to the next level

Adamo Software is one of the premier fintech software development companies of bespoke digital payment solutions for organizations. We help our clients to design and implement sophisticated, easy-to-use payment solutions that transform financial processing.

From a start-up or a large business, with Adamo Software, your digital payment concept is developed into an optimized product. We are knowledgeable in mobile payment apps, e-wallets, and payment gateways. We provide businesses with the necessary solutions to survive in a society that’s becoming less dependent on cash.

Here’s how Adamo Software can elevate your digital payment idea:

1. Tailored Solutions

Adamo Software has expertise in designing and developing unique and tailored digital payment systems for your organization’s requirements. Starting with the front end and culminating with the back-end processes, we create a useful program that fits the brand aesthetics.

2. Advanced Security Features

Nowadays, especially with virtual payments, security must be emphasized. Adamo Software secures sensitive financial data using encryption and security protocols. It protects your digital payment platform from fraud, data breaches, and cyber-attacks.

3. Seamless Integration

Adamo Software enables organizations to integrate easy-to-use and implement digital payment solutions to their existing systems. Our solutions are beneficial when dealing with banking institutions, e-commerce platforms, or other third-party APIs. We ensure your clients’ transactions go through seamlessly.

4. Scalable Infrastructure

As the business expands, the digital payment system must expand too. The digital payment platforms developed by Adamo Software are capable of high flows of transactions and users and traffic growth.

5. Cross-Platform Support

Adamo Software has user experience in designing payment solutions for different interfaces of payment platforms. This enables users to make transactions using their devices, making it very flexible.

Partnering with Adamo guarantees you a digital payment system that is unique, safe, and will be fit for the future. We are also creating a strong digital payment platform. Therefore, your business has a competitive advantage in the current dynamism of the financial sector.