Must-have features of Custom Fintech Applications for a stellar customer experience

In today’s digital world, fintech, which combines finance and technology, has become an important part of everyday life. The emergence and development of fintech has changed the way everyone manages and interacts with finances. Fintech apps, which provide online and mobile financial services, have received more attention. Using fintech apps, users can approach investment knowledge and the business market easily, quickly, and completely automatically. If you are working in the financial field, you may want to invest in fintech apps. Let’s find out more detailed information about custom fintech applications with Adamo Software!

Through this blog post, you will learn the most popular types of fintech apps and the fundamental features of custom fintech applications. Besides, this blog post shows you the most recent trends in developing fintech app products. In addition, if you want to know how to build a personalized fintech app successfully, read this article for extensive details.

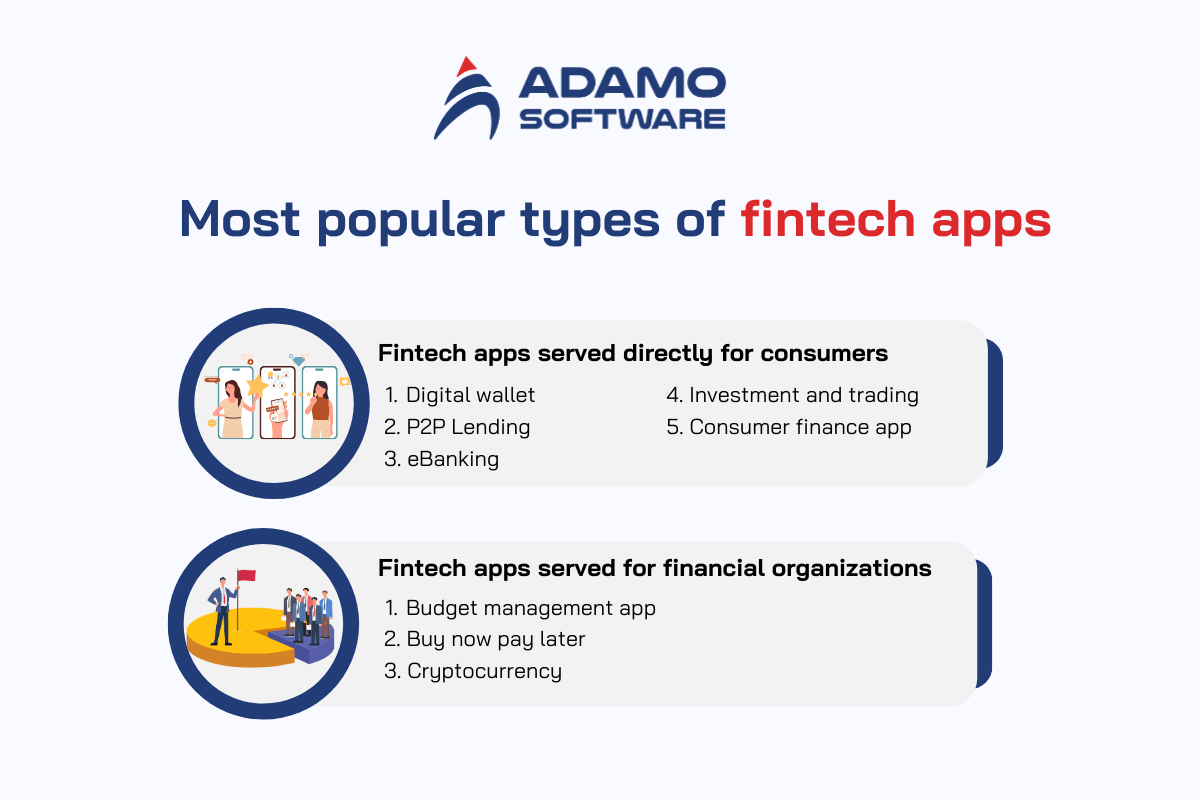

I. What are the most popular types of fintech apps?

Fintech is used in many different business areas. Therefore, fintech solutions are also classified into various groups. Fintech apps offer a diverse range of designs, security protocols, and features. These apps can target directly to consumers or serve as a tool for financial organizations. Let Adamo Software discuss the most popular types of fintech apps corresponding to two groups of objects.

1. Types of custom fintech applications served directly for consumers

Custom fintech applications for consumers have brought convenience, speed, and high security to daily transactions. Below are some types of fintech apps widely used for individual users.

- Digital wallet

A digital wallet, which allows individuals or businesses to conduct online transactions, is a typical type of fintech application. E-wallets have become a popular payment method due to their convenience and security. They not only help transfer and receive money quickly but also perform other transactions such as paying bills and shopping online. PayPal, Apple Pay, Google Pay, and Alipay are outstanding digital wallet apps.

Custom fintech applications in the digital wallet are often integrated with various systems. It makes interbank or multi-currency money transfers easier.

- Peer-To-Peer Lending – P2P

P2P Lending is also among the featured fintech app types. This model connects borrowers and lenders directly without going through traditional banks. Lenders here are usually investors looking to earn higher returns than what the traditional market can offer. With just 1 million VND in capital, you can participate in investing through the P2P lending model and receive interest rates ranging from 15% to 20%/year.

P2P lending apps often incorporate automated credit scoring tools and data security systems to ensure the safety of financial transactions. Besides, they focus on security, which can partly be shown through the fact that these apps do background checks on borrowers so that lenders are sure about their investments. Upstart, SoFi, Finzy, and Zirtue are some popular P2P apps.

- E-Banking

Custom fintech applications are perfect solutions for people who want to manage their finances and bank accounts and make quick transactions without interacting with other people. Web and mobile banking emerged to meet these needs. E-banking is a set of smart financial management tools, including mobile banking, internet banking, and SMS banking. The E-banking apps allow users to manage their bank accounts, transfer money, and pay directly from their phones. Besides, other features like checking balance, investment, and insurance are also integrated into E-banking apps to provide users with a comprehensive experience.

- Investment and trading

Investment and trading apps can be used in various markets, including stock, foreign exchange, and capital markets. Custom fintech applications in the investment and trading sectors can help users manage investments, monitor market movements, and make investment decisions on their phones. With the help of the apps, you can manage your investments. You can also participate in the trading process.

Investment and trading apps’ common features include real-time data updates, technical chart analysis, and alerts when there are major changes in the market. Furthermore, investing and trading apps can integrate personalized financial advisory tools, helping users make smarter and more effective investment decisions.

- Consumer finance app

Consumer finance apps in custom fintech applications may not include payment or transaction features. The main goal of such solutions is to help users save money and control their spending. Moreover, users can create a spending plan in advance so as not to overspend.

2. Types of custom fintech applications served for financial organizations

Custom fintech applications help financial organizations optimize operations and enhance security and customer services. These applications allow each firm to manage its budget, process loans, monitor investments, and comply with legal regulations. Here are some types of fintech apps that organizations can use.

- Budget management app

A budget management app is an important tool supporting organizations in financial optimization, budgeting, and cash flow control. Instead of manually recording documents, custom fintech applications in budget management help financial organizations easily track daily and monthly income and expenses. Simultaneously, firms can plan spending and allocate finances appropriately. These apps are often integrated with features like automated budget planning, real-time financial report analysis, and future spending forecasting.

In addition, these apps also support high-security features. This allows for access authorization, ensuring the safety of important financial data. Besides, the app system can connect with other Enterprise Resource Planning software, which helps to advance the financial management processes.

- Buy Now Pay Later (BNPL)

Financial organizations are getting familiar with using the BNPL apps to provide customers with flexible payment methods. Integrating this function into custom fintech applications, organizations can allow their users to buy now and pay in installments in the future. The BNPL apps typically feature risk management, automated interest rate calculations, and integrated credit analysis tools. Thanks to these features, firms can know if their customers meet financial requirements.

- Cryptocurrency

Cryptocurrency is a decentralized form of electronic money, not controlled by any central authority. It is stored and traded through specialized software and mobile applications. All transactions are carried out on tablets and smartphones. Thanks to cryptocurrency’s security and convenience, it is being exploited as a means of exchange, storage, and measurement of value. Businesses can monitor transaction history, financial reports, and integrate direct cryptocurrency payment functions for customers. Some popular cryptocurrency apps include Binance, Coinbase, Robinhood, Kraken, etc.

In general, each type of fintech app has its featured characteristics. Thus, businesses need to develop custom fintech applications based on specific user needs.

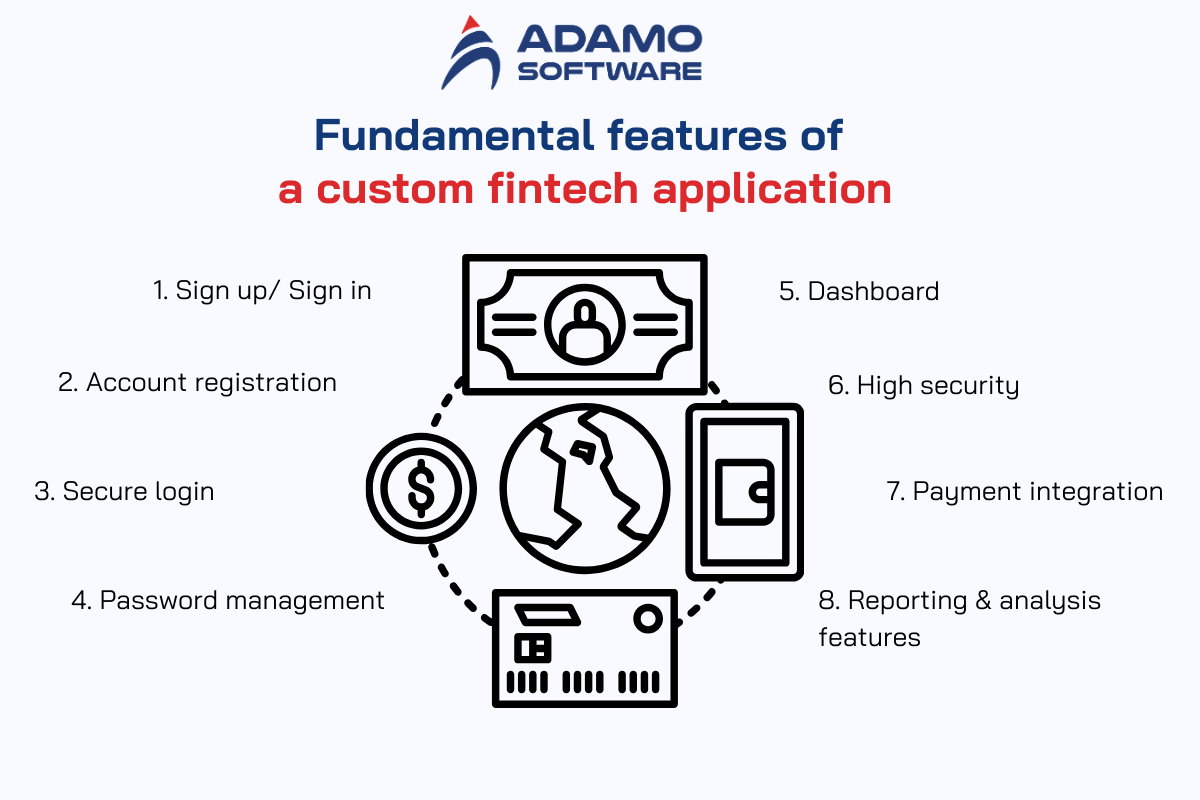

II. Fundamental features of a custom fintech application

Although there are many types of fintech apps aiming at different goals and serving different customers, they have many features in common. If you want to have a fintech app that can meet the needs of customers, you need to integrate the necessary features into your app. Let Adamo Software discuss more about this.

1. Sign up/ sign in

Sign up/ sign in is among the required features for custom fintech applications. This feature enables your customers to access your service conveniently. Besides, the requirement to fill in username and password information helps ensure the safety of customer information.

2. Account Registration

To register an account for custom fintech apps, users can use their phone number, Email, or integrate with a social network account. After you have registered, there will be an OTP code sent to your phone number or Email. This helps to ensure the accuracy and security of information.

3. Secure Login

Once users have finished registering their account, they can log in to their account. Custom fintech applications support secure login methods such as two-factor authentication, using fingerprints, facial recognition, or authentication via third-party apps.

4. Password management

If users forget the password, they can use the forget password feature which allows them to easily recover their accounts via OTP code, email, or security questions. In addition, the application can also support automatic login when the user trusts the device.

5. Dashboard

The dashboard is also an important feature of custom fintech applications. When users log in to the app, they will see all information displayed on one page. They can easily track and manage their financial condition following the information displayed. An effective dashboard has the following factors.

- Financial overall

This sector shows users summary information on account balances, expenses, income, and current debts. Once they log in to the app, they will have a comprehensive view of their financial status.

- Chart and data analysis

The chart and data analysis section of the dashboard provides visual charts of financial trends, monthly spending, cash flow, and investments. These analytical tools make it easy for users to track changes and make informed financial decisions.

- Quick access to important features

Dashboards often include shortcuts for users to quickly access important functions. They can be transferring money, paying bills, managing investments, taking out loans, etc.

- Notifications and updates

Custom fintech applications’ dashboards usually display important notifications such as payment schedules, market fluctuations, or recent transactions. This helps users stay updated and promptly handle financial situations.

Overall, the dashboard feature can help enhance user experience and satisfaction. With the necessary financial information shown in the dashboard, users can grasp their financial conditions and customize the dashboard to their needs.

6. High security

Custom fintech applications need high-security features to protect user information and financial transactions. Some important security elements include data encryption, two-factor authentication, and biometric authentication measures.

- Data encryption

All sensitive data, including account and transaction information, is encrypted to ensure that only authorized parties can access it. End-to-end encryption is often used to protect data during transmission.

- Two-factor authentication

Two-factor authentication requires users to confirm login and transaction again. This reduces the risk of being hacked by common password attacks.

- Biometric authentication measures

This function supports login by fingerprint and facial recognition. This provides increased security and convenience for users without the need to enter traditional passwords.

Besides, access control and security alerts also help to enhance security for user accounts.

7. Payment integration

Payment integration is also one of the features that custom FinTech applications need. This feature helps users make financial transactions quickly and seamlessly. Below are some highlights of this feature.

- Supporting multiple payment methods

- Automatic and recurring payments

- Linking with third-party payment gateways

- High transaction security

- Transaction tracking and history

- QR Code and Near-Field Communication integration

In general, the payment integration feature helps custom fintech applications provide a secure and convenient payment experience, increasing user satisfaction and engagement.

8. Reporting and analysis features

Reporting and analytics feature in custom fintech applications provide users with insights into their financial health and performance. This feature automatically generates reports on a user or business’s income, expenses, debt, and cash flow. Besides, it also analyzes real-time financial data. Users can customize reports by specific criteria such as portfolio, spending type, or time, ensuring they receive information that best suits their financial management needs.

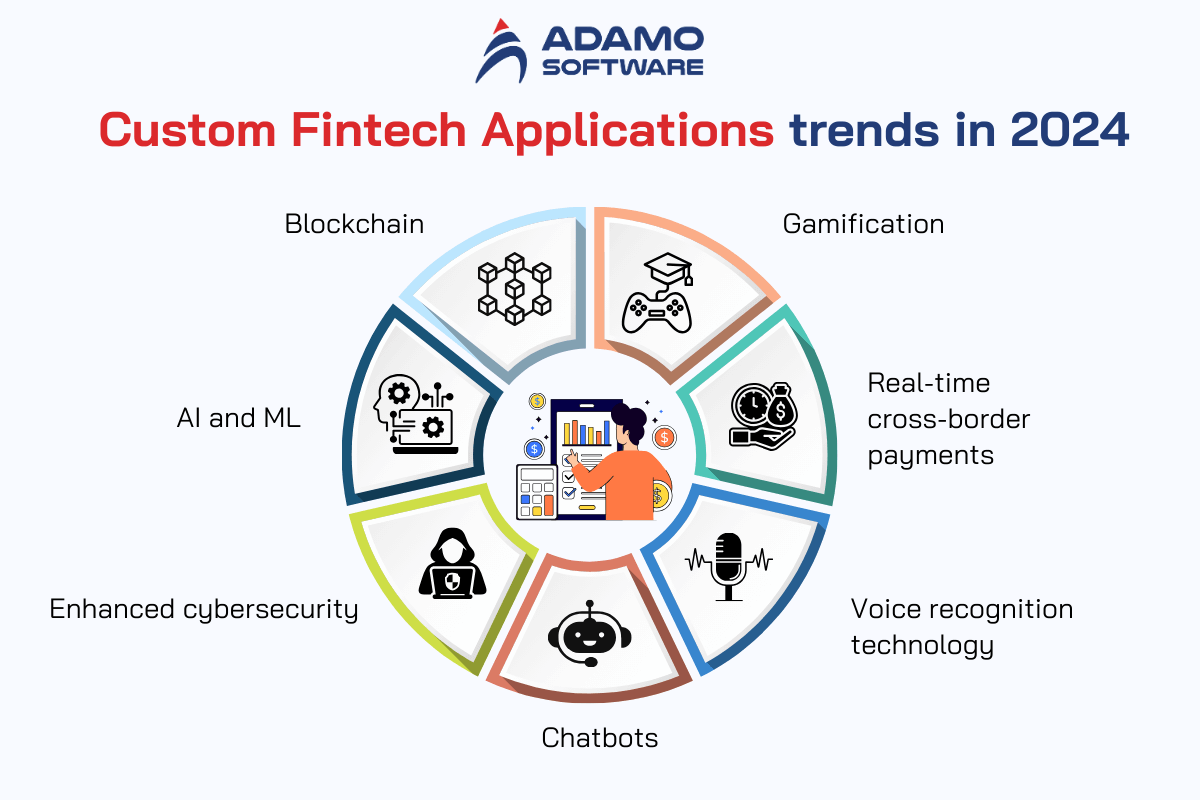

III. Top custom fintech applications trends in 2024

The fintech market is growing strongly and the idea of building a fintech app will bring you a potential business opportunity. Let’s explore the top custom fintech application trends in 2024 with Adamo Software.

1. Blockchain

Blockchain is one of the latest trends in custom fintech applications. This technology is rapidly taking over the financial world. The potential of Blockchain is immense. You can transfer important files across the chain and ensure that they are not tampered with or altered in any way. The most talked about blockchain topic is non-fungible tokens (NFTs). Although this technology is still quite new and controversial, it is becoming more and more popular.

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI/ML fintech solutions for custom fintech applications offer several advantages to businesses. For example, your data analysts don’t need to be present all the time to ensure the process is running because everything is automated. Additionally, AI services can work with unsystematic data and still gain insights that your company’s departments can use.

3. Enhanced cybersecurity

Security is an absolute priority for any fintech application, there is no doubt about it. Any solution that deals with personal and business finance will need to handle some sensitive data. Third parties should not have access to user profiles that do not belong to them. Furthermore, fraudulent and suspicious activities should be detected and stopped as quickly as possible.

4. Chatbots

Responding quickly to customer queries is one of the deciding factors in users choosing fintech services. To provide your customers with the fastest possible response, you can deploy AI-based chatbots. They will work 24/7 to answer the most frequently asked questions and provide users with the information they need.

5. Voice recognition technology

Although entering information on a computer or mobile device is no longer a difficult problem, users are still looking for ways to query more efficiently. Currently, the most efficient way is to use your voice. Voice recognition is already a default feature of most smartphones and other smart devices.

Fintech startups can take advantage of this opportunity and create voice-based solutions. For example, they can implement voice payments or integrate voice assistant support to remind people about payments and bills.

6. Real-time cross-border payments

Custom fintech applications can conduct international financial transactions with the real-time cross-border payments trend. A person in any part of the world can make a transaction quickly to another part of the world without any delay. Many banks and financial services have automated currency exchanges, meaning you can make a payment in your local currency, and it will be converted into another currency in seconds.

7. Gamification

Gamification is also among the trends in custom fintech applications. This is a way to retain your users with your app. By adding games to the fintech app, you can encourage users to open and interact with your app.

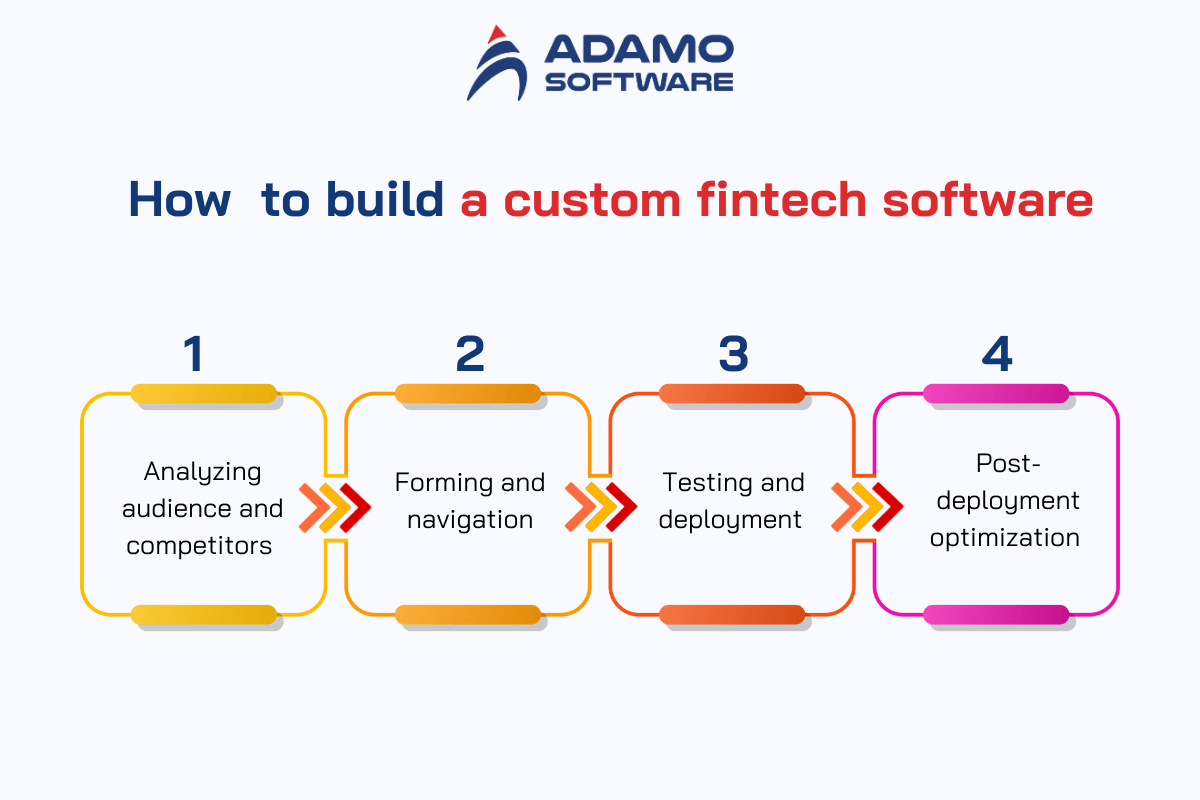

IV. How to build a custom fintech software that stands out in the market

Building custom fintech apps requires a thorough understanding of financial markets and user needs. With a well-structured development process, businesses can create high-quality, secure, and user-friendly custom fintech applications. Below are some steps to develop a custom fintech app.

1. Analyzing audience and competitors

When you decide to develop custom fintech applications, you will first want to focus on solving user problems and standing out from the crowd of competitors. At this stage, you should thoroughly research the market and decide what you will offer. This helps you to identify new trends and unmet needs, thereby differentiating the application.

2. Forming and navigation

Forming and navigation is the second important step in building custom fintech applications. In this step, you may want to focus on User interface (UI) design and navigation structure to ensure a smooth and easy-to-use experience. Here’s detailed information on this step.

- Wireframing

Designers will develop simple prototypes that show the app’s layout and key interface elements like buttons, financial charts, and navigation menus. This helps define the basic structure and determine how different components will appear and interact.

- User navigation

User navigation allows users to quick access key features such as viewing account balances, making payments, or checking transaction history. Obviously, clear and intuitive navigation increases user engagement and shortens the learning process for the application.

- User experience (UX) design

The goal of UX design is to ensure that every user can interact with the application smoothly. This includes optimizing page load speed, minimizing clicks, and using simple yet effective design principles to make it easy for users to complete tasks.

- Testing the prototype and navigation

After creating the prototype and navigation, the app needs to be tested with real users to get feedback and make adjustments. This helps to detect any inconsistencies in the structure and navigation, thereby optimizing the experience before moving on to the detailed development phase.

3. Testing and deployment

After development, custom Finch applications need to undergo thorough testing to ensure stability, security, and scalability. Testing with various real-world scenarios will help detect and fix potential bugs. The application can then be deployed on platforms such as iOS, Android, or the web depending on the target audience.

4. Post-deployment optimization

After deployment, continuous technical support and optimization are essential to ensure that the application is stable and meets the changing needs of users. Adding new features or upgrading security according to technological trends is also a way to stay competitive in the market.

In general, by following the above steps, you can bring modern digital financial experiences to users, contributing to sustainable development in the fintech field. Let’s follow them and make your fintech app stand out from other competitors!

Also read: Tips for selecting the perfect partner for fintech software development outsourcing

V. Adamo Software – trusted partner for developing custom fintech applications

If you are looking for a trustworthy partner who can help you develop custom fintech applications, Adamo Software can be your choice. As one of Vietnam’s top leaders in technology solutions, we are confident to help you with your app. Adamo empowers enterprises to modernize financial services using cutting-edge technology, enhancing operational efficiency, transparency, response times, and customer experiences. Below are some of our Fintech software development services.

- Digital wallet & payments

- Blockchain & Cryptocurrencies

- Payment-as-a-service (PaaS)

- Payment gateways

Let’s choose our service to help you with your custom fintech software development!