PaaS: A Boom of Payment as a Service in Outsourcing Payment Market

Explore how Payment as a Service (PaaS) is transforming the outsourcing payment landscape and efficient payment system.

The way we pay is undergoing a revolution. Cash is slowly fading, replaced by a surge in digital transactions. This digital wave has propelled the payment industry to new heights, but also presented unique challenges. Businesses of all sizes are grappling with keeping up with evolving customer demands for secure, seamless online payment options.

Enter Payment as a Service (PaaS), a game-changer in the world of outsourced payment solutions. PaaS offers businesses a powerful alternative to traditional payment processing methods. By leveraging PaaS technology, businesses can gain access to a robust and secure payment infrastructure without the hassle of managing complex in-house systems.

I. An Overview of Payment Industry: Trends & Challenges

The landscape of how we pay for goods and services is constantly evolving. The rise of e-commerce and mobile technology has fueled a surge in online payments, fundamentally changing the way businesses operate and customers interact. Here, we’ll delve into the exciting trends shaping the payment industry, along with the challenges businesses face in this dynamic environment.

1. Trends of Online Payment

The online payment landscape is experiencing a wave of innovation, with several key trends emerging:

_ The Cashless Revolution: Cash is slowly becoming a relic of the past. Consumers are increasingly embracing cashless payment methods like credit cards, debit cards, and mobile wallets. The global cashless payment market is estimated to reach a staggering USD 21.3 trillion by 2029, reflecting this significant shift in consumer behavior.

_ Rise of Mobile Wallets and Contactless Payments: The convenience and security of mobile wallets like Apple Pay and Google Pay are fueling their rapid adoption. Similarly, contactless payment methods using near-field communication (NFC) technology are gaining traction, allowing for quick and touch-free transactions.

_ Focus on Frictionless Checkout: Customers today expect a seamless and effortless checkout experience. Businesses are integrating features like one-click payments and guest checkout options to minimize friction and cart abandonment rates.

_ Growing Demand for Security: As online transactions become more prevalent, security concerns remain paramount. Businesses are implementing robust security measures to protect sensitive customer data, such as tokenization and advanced fraud prevention tools.

_ Emergence of New Payment Technologies: The world of online payments is constantly innovating. Blockchain technology, cryptocurrencies, and alternative payment methods like buy now, pay later (BNPL) solutions are emerging and impacting the industry.

2. Challenges of Payment Industry and Solutions

While these trends offer exciting opportunities, the payment industry also faces several challenges:

_ Security Threats: Fraudulent activities and data breaches are a constant concern. Businesses need to invest in robust security measures to safeguard customer data and ensure the integrity of transactions.

_ Integration Complexities: Offering a variety of payment options can be complex. Integrating multiple payment gateways and managing different systems can be resource-intensive for businesses.

_ Compliance Issues: The regulatory landscape surrounding online payments is constantly evolving. Businesses need to stay compliant with industry standards like PCI DSS to avoid hefty fines and reputational damage.

_ Keeping Up with Innovation: The rapid pace of technological advancements can make it challenging for businesses to keep their payment infrastructure up-to-date and secure.

Payment as a service solutions offer a compelling answer to these challenges. By leveraging PaaS, businesses can benefit from enhanced security, simplified integration, compliance support, and access to the latest payment technologies – all without the burden of managing complex in-house systems. Explore further sections to understand how PaaS empowers businesses to navigate the exciting and ever-changing world of online payments.

Also read: Payment Gateway Integration: How to Integrate into Website (2024 Guide)

II. Understand Payment as a Service Market: Statistics & Facts

The Payment as a Service (PaaS) market is experiencing explosive growth, solidifying its position as a game-changer in the online payment landscape. Let’s delve into some key statistics and facts that showcase the rising popularity of PaaS solutions:

_ Market Growth Trajectory: The PaaS market boasts a projected Compound Annual Growth Rate (CAGR) of 23.7% between 2021 and 2026. This significant growth rate reflects the increasing adoption of PaaS by businesses of all sizes.

_ Global Market Value: The global PaaS market size is estimated to reach a staggering USD 44.44 billion by 2029. This exponential growth signifies the immense potential of PaaS in streamlining and securing online payment processing.

_ Driving Factors: Several factors are fueling the growth of the PaaS market:

_ Reduced Costs: PaaS eliminates the need for expensive upfront investments in hardware and software, making it a cost-effective solution for businesses.

_ Scalability and Flexibility: PaaS solutions can easily adapt to meet the evolving needs of a growing business, allowing for increased transaction volumes without technical hurdles.

_ Enhanced Security: PaaS providers prioritize robust security features and fraud prevention tools, offering businesses peace of mind.

_ Faster Time to Market: Businesses can implement a secure payment system quickly and efficiently using PaaS, accelerating their time to market.

_ Compliance Support: PaaS providers ensure adherence to industry regulations, taking the burden off businesses to navigate complex compliance requirements.

These statistics paint a clear picture: PaaS is not just a trend; it’s a rapidly growing market transforming how businesses manage online payments. By understanding the benefits of PaaS, businesses can unlock a world of opportunities in the ever-evolving world of e-commerce.

III. What is Payment as a Service?

In today’s digital age, a seamless and secure online payment system is no longer a luxury; it’s a necessity. Enter Payment as a Service, a revolutionary approach that empowers businesses to accept and process online payments with ease. But what exactly is PaaS, and how does it function?

Imagine PaaS as a one-stop shop for all your online payment needs. It’s a cloud-based model that eliminates the need for businesses to invest in and manage complex in-house payment infrastructure. PaaS providers offer a comprehensive suite of tools and functionalities, allowing businesses to:

_ Accept a Wide Range of Payment Methods: Offer your customers the flexibility to pay using credit cards, debit cards, e-wallets, and other popular payment options.

_ Securely Process Transactions: Benefit from robust security features like encryption and fraud prevention tools to safeguard sensitive customer data.

_ Simplify Integration: Seamlessly integrate the PaaS solution with your existing website or shopping cart platform.

_ Gain Real-Time Insights: Access valuable data and reports on your transactions, providing valuable insights into customer behavior and spending patterns.

Here’s a simple analogy: Think of traditional payment processing like owning your own power plant to light your home. It requires significant upfront investment, ongoing maintenance, and expertise to manage. PaaS, on the other hand, is like subscribing to a reliable power grid. You simply pay for the service you use, eliminating the burden of managing the complex infrastructure behind the scenes.

In essence, PaaS offers businesses several key advantages:

_ Cost-Effectiveness: Reduced upfront costs and simplified management translate to significant savings for businesses.

_ Scalability: PaaS solutions can adapt to accommodate your growth, handling increasing transaction volumes without technical challenges.

_ Enhanced Security: PaaS providers prioritize robust security measures, giving you peace of mind when processing customer payments.

_ Faster Time to Market: Implement a secure payment system quickly and efficiently, accelerating your online business launch.

_ Compliance Support: Stay compliant with industry regulations by leveraging the expertise of your PaaS provider.

By embracing PaaS, businesses can unlock a world of benefits and streamline their online payment operations. The next sections will delve deeper into the functionalities of PaaS and how it empowers businesses to thrive in the ever-evolving landscape of online payments.

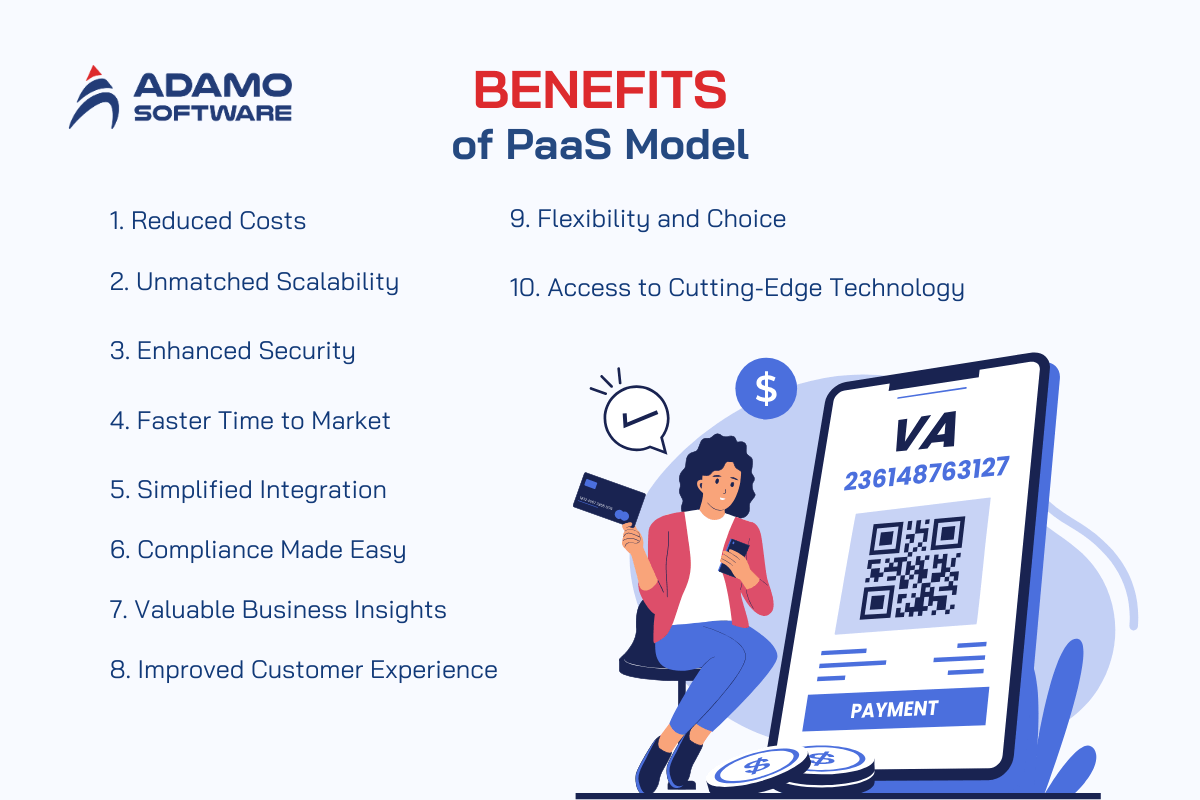

IV. Benefits of Payment as a Service Model

In today’s competitive online marketplace, a smooth and secure payment experience is paramount for business success. Traditional payment processing methods can be complex, expensive, and time-consuming. Thankfully, Payment as a Service (PaaS) offers a compelling alternative, packed with advantages that empower businesses of all sizes. Let’s explore the key benefits of adopting the PaaS model:

1. Reduced Costs: PaaS eliminates the need for significant upfront investments in hardware, software, and IT staff dedicated to managing an in-house payment system. Businesses simply pay a subscription fee or a per-transaction fee, making PaaS a cost-effective solution.

2. Unmatched Scalability: As your business grows, your payment processing needs will evolve. PaaS solutions are designed to scale seamlessly, accommodating increasing transaction volumes without technical roadblocks. This ensures your payment system can keep pace with your success.

3. Enhanced Security: Security is a top priority when dealing with online transactions. PaaS providers prioritize robust security measures, including encryption, fraud prevention tools, and compliance with industry standards. This gives you peace of mind and protects your customers’ sensitive data.

4. Faster Time to Market: Launching a secure and functional payment system can be a lengthy process with traditional methods. PaaS streamlines the process, allowing you to integrate a secure payment system quickly and efficiently. This translates to faster time to market and quicker revenue generation.

5. Simplified Integration: Integrating multiple payment gateways and managing them in-house can be a complex task. PaaS solutions offer seamless integration with your existing website or shopping cart platform, minimizing technical challenges and saving you valuable time and resources.\

6. Compliance Made Easy: The world of online payments is governed by a complex set of regulations. PaaS providers stay up-to-date on industry standards like PCI DSS and ensure their solutions are compliant. This frees you from the burden of navigating these regulations, allowing you to focus on running your business.

7. Valuable Business Insights: PaaS solutions often provide real-time data and reports on your transactions. This valuable business intelligence can help you understand customer behavior, identify spending patterns, and make data-driven decisions to optimize your online sales strategy.

8. Improved Customer Experience: A seamless and secure checkout process is crucial for customer satisfaction. PaaS ensures a smooth payment experience for your customers, reducing friction and cart abandonment rates. This translates to increased customer loyalty and repeat business.

9. Flexibility and Choice: PaaS providers offer a variety of plans and features to suit your specific business needs and budget. You can choose a solution that caters to your transaction volume, industry, and desired functionalities.

10. Access to Cutting-Edge Technology: PaaS providers are constantly innovating and integrating the latest payment technologies into their solutions. By leveraging PaaS, you gain access to these advancements without the need to invest in expensive upgrades or manage complex integrations yourself.

The PaaS model offers a multitude of benefits for businesses seeking to streamline their online payment operations. From cost savings and enhanced security to faster time to market and valuable business insights, PaaS equips you with the tools and functionalities needed to thrive in the ever-evolving world of e-commerce.

PaaS is one of the biggest trends of finance market, explore more in our blog Unlock next-gen fintech solutions: Top 15 opportunities to transform finance industry

V. Capture of PaaS Business Model

Payment as a Service providers offer a convenient and cost-effective way for businesses to manage online payments. But how do these providers generate revenue themselves? Let’s explore the different ways PaaS companies capture value:

1. Subscription Fees: This is the most common model. Businesses pay a recurring monthly or annual fee to access the PaaS platform and its core functionalities. The fee structure may vary based on the chosen plan, with higher tiers offering additional features, transaction volume capacity, or dedicated customer support.

2. Transaction Fees: In addition to subscription fees, some PaaS providers charge a small fee per transaction processed. This fee typically represents a percentage of the transaction amount. This model incentivizes PaaS providers to ensure smooth and efficient transaction processing.

3. Value-Added Services: PaaS providers may offer additional services beyond the core platform functionalities. These might include:

_ Advanced fraud prevention tools

_ Real-time analytics dashboards

_ Subscription management services

_ Integration with specific accounting or CRM software

These value-added services typically come at an extra cost, allowing businesses to customize their PaaS experience based on their specific needs.

It’s important to note that PaaS providers may employ a combination of these revenue streams to create a comprehensive pricing strategy.

Additional Considerations:

_ Freemium Model: Some PaaS providers offer a limited free tier with basic functionalities to attract new customers. Businesses can then upgrade to paid plans for more advanced features and transaction volume capacity.

_ Contract Length: Subscription fees may be discounted for longer contract terms, encouraging businesses to commit to the PaaS platform for a set period.

By understanding the PaaS revenue model, businesses can make informed decisions when choosing a provider. Consider the features offered, pricing structure, and scalability options to find a PaaS solution that aligns perfectly with your business needs and budget.

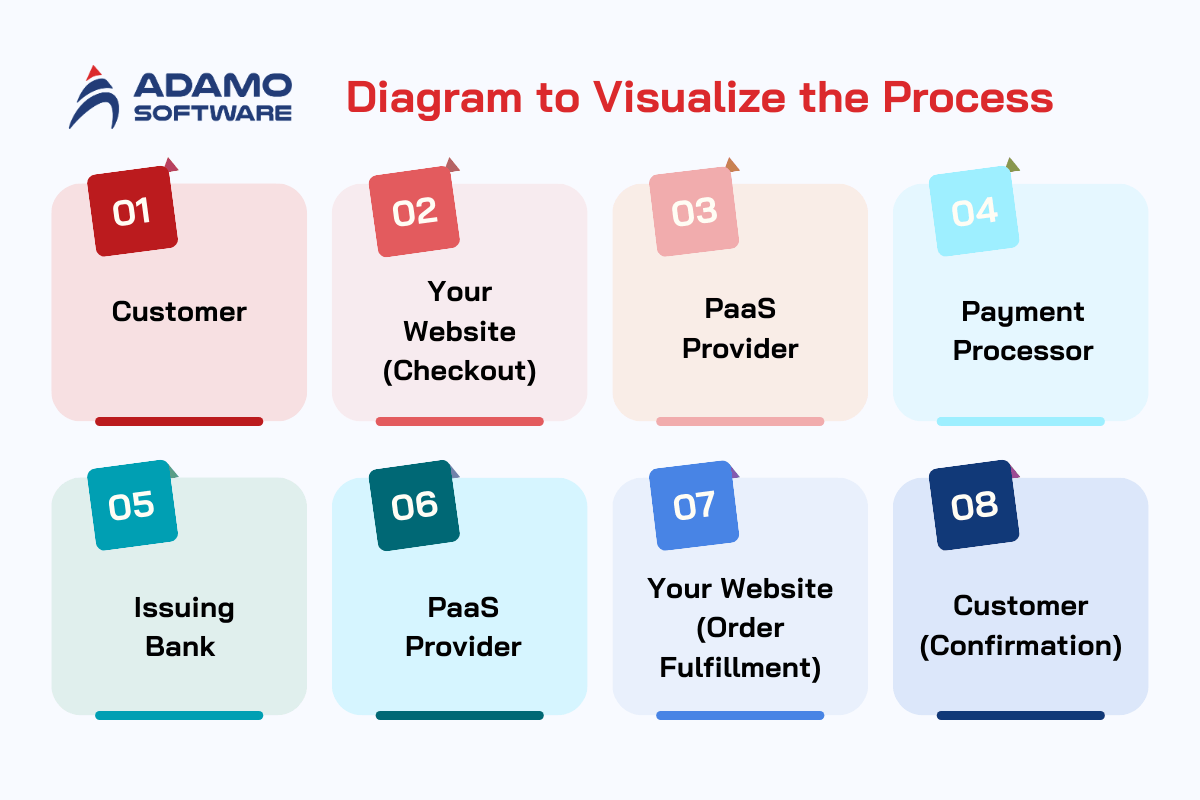

VI. How Does Payment as a Service Work?

Payment as a Service simplifies online payment processing for businesses. But how exactly does it work behind the scenes? Let’s break down the typical workflow of a PaaS transaction:

1. Customer Initiates Payment: A customer places an order on your website and reaches the checkout stage. They select their preferred payment method, such as a credit card, debit card, or e-wallet.

2. Secure Redirection: The customer is redirected to a secure payment gateway hosted by the PaaS provider. This ensures sensitive payment information is never stored on your website, minimizing security risks.

3. Payment Information Entry: On the secure payment gateway page, the customer enters their payment details like card number, expiration date, and CVV code.

4. Encryption and Transmission: The payment gateway encrypts the customer’s sensitive information using robust security protocols. This encrypted data is then securely transmitted to the payment processor.

5. Authorization and Settlement: The payment processor verifies the customer’s payment information with the issuing bank. If the transaction is authorized, funds are reserved from the customer’s account. The payment processor then sends a confirmation message to the PaaS provider.

6. Order Confirmation and Fulfillment: Upon receiving confirmation from the payment processor, the PaaS provider sends a successful transaction notification to you. You can then fulfill the customer’s order with peace of mind, knowing the payment has been secured.

Here’s a simplified diagram to visualize the process:

Customer -> Your Website (Checkout) -> PaaS Provider (Secure Payment Gateway) -> Payment Processor (Verification & Authorization) -> Issuing Bank (Funds) -> PaaS Provider (Confirmation) -> Your Website (Order Fulfillment) -> Customer (Confirmation)

Benefits of the PaaS Workflow for Businesses:

_ Enhanced Security: Data encryption and secure payment gateways minimize the risk of fraud and data breaches.

_ Streamlined Integration: PaaS seamlessly integrates with your existing systems, eliminating complex technical configurations.

_ Reduced Operational Costs: Eliminate the need for managing your own payment infrastructure, saving you time and resources.

_ Real-Time Processing: Get instant confirmation of successful transactions, allowing for faster order fulfillment.

By leveraging the secure and efficient workflow of PaaS, businesses can focus on what they do best – selling products and services – while leaving the complexities of online payment processing to the experts.

VII. Roles of PaaS Provider

In the ever-evolving world of online payments, Payment as a Service providers play a crucial role in empowering businesses to accept and process payments securely and efficiently. But what exactly does a PaaS provider do? Let’s explore the key responsibilities shouldered by these valuable partners:

1. Providing the Payment Infrastructure

_ Secure Payment Gateways: PaaS providers offer secure payment gateways that act as the bridge between your website and the payment processor. These gateways handle sensitive customer information with robust encryption protocols.

_ Fraud Prevention Tools: They implement advanced fraud prevention tools to identify and block suspicious transactions, protecting your business from financial losses.

_ Compliance Management: PaaS providers stay up-to-date on industry regulations like PCI DSS and ensure their solutions adhere to these standards. This minimizes the risk of compliance issues and hefty fines for your business.

2. Handling Integration

_ Seamless Integration: PaaS solutions integrate seamlessly with your existing website or shopping cart platform. This eliminates the need for complex technical configurations and saves you valuable development resources.

_ Customization Options: Some PaaS providers offer customization options to tailor the checkout experience to your brand and customer preferences.

3. Ongoing Maintenance and Support

_ System Uptime and Security: PaaS providers ensure the platform functions smoothly and maintains the highest levels of security around the clock.

_ Technical Support: They offer dedicated customer support to answer your questions, troubleshoot any technical issues related to payment processing, and ensure a smooth user experience.

_ Regular Updates: PaaS providers continuously update their platform with the latest security patches, features, and integrations to keep your payment system functioning optimally.

In essence, a PaaS provider acts as your one-stop shop for all your online payment processing needs. They take care of the complex backend infrastructure, allowing you to focus on managing your business and growing your customer base.

Here’s an analogy: Think of a PaaS provider like a reliable power company. They ensure a steady flow of electricity (secure payments) to your online store, so you can focus on running your business (providing excellent products and services) without worrying about the intricate power generation process.

VIII. How PaaS Transforms Online Payment Approaches for Business

In today’s competitive online marketplace, a seamless and secure payment experience is no longer just an option; it’s a necessity for business success. Traditional payment processing methods can be complex, expensive, and hinder your ability to adapt to evolving customer demands. Thankfully, Payment as a Service (PaaS) offers a revolutionary approach, transforming how businesses handle online payments. Here’s how PaaS empowers businesses to thrive in the digital age:

1. Enhanced Security and Reduced Fraud

_ Robust Security Features: PaaS providers prioritize robust security measures, including data encryption, fraud prevention tools, and compliance with industry standards. This mitigates the risk of data breaches and fraudulent transactions, protecting your business and your customers’ sensitive information.

_ Peace of Mind: By outsourcing payment processing to a secure PaaS platform, you can focus on running your business with the confidence that your customer data is safeguarded.

2. Streamlined Integration and Scalability

_ Simplified Setup: PaaS solutions offer seamless integration with your existing website or shopping cart platform. This eliminates the need for complex technical configurations and saves you valuable time and development resources.

_ Effortless Scaling: PaaS solutions are designed to scale with your business. As your transaction volume increases, the PaaS infrastructure can adapt to handle the growing demand without technical roadblocks. This ensures your payment system can keep pace with your success.

3. Increased Flexibility and Choice

_ Wider Range of Payment Options: Payment as a Service solutions allow you to offer your customers a wider range of popular payment methods, including credit cards, debit cards, e-wallets, and alternative payment options like buy now, pay later (BNPL). This caters to diverse customer preferences and increases the likelihood of successful transactions.

_ Customization Options: Some PaaS providers offer customization capabilities, allowing you to tailor the checkout experience to your brand and customer preferences. This creates a more seamless and user-friendly experience for your customers.

4. Faster Time to Market and Reduced Costs

_ Quick Implementation: PaaS solutions offer a faster and more cost-effective way to implement a secure payment system compared to traditional methods. This allows you to launch your online store or service quickly and start generating revenue sooner.

_ Cost Savings: Payment as a Service eliminates the need for upfront investments in expensive hardware, software, and IT staff for managing in-house payment systems. Subscription-based pricing models allow for predictable costs, making PaaS a budget-friendly option for businesses of all sizes.

5. Valuable Business Insights and Improved Customer Experience

_ Real-Time Data and Analytics: PaaS solutions often provide real-time data and analytics on your transactions. This valuable business intelligence can help you identify trends, understand customer behavior, and optimize your pricing and sales strategies.

_ Frictionless Checkout: PaaS ensures a smooth and secure checkout process for your customers. This minimizes cart abandonment rates and leads to increased customer satisfaction and repeat business.

By embracing PaaS, businesses gain access to a powerful suite of tools and functionalities that streamline online payment processing, enhance security, and empower them to adapt to the ever-evolving needs of their customers. This translates to a significant competitive advantage in the digital marketplace.

Payment as a Service is not just a trend; it’s a fundamental shift in online payment processing. As businesses move towards a more digital future, PaaS offers a secure, scalable, and cost-effective solution for businesses of all sizes to thrive in the competitive landscape of e-commerce.

IX. Explore Application of Payment as a Service

PaaS offers a range of benefits that can be applied in various ways:

1. Fast Connections – Fast Payments: PaaS leverages cloud-based infrastructure, enabling near-instantaneous connections between payers and payees. This translates to faster processing times for transactions, improving efficiency and user experience.

2. New Business Opportunities: Payment as a Service allows businesses, especially startups or those without extensive resources, to easily integrate secure payment functionalities into their offerings. This opens doors to new revenue streams and fosters innovation in the financial technology (fintech) space.

3. Regulations and Rules: Challenges for Payments: The financial sector is heavily regulated. PaaS providers handle compliance with these regulations, allowing businesses to focus on their core operations without getting bogged down in complex legalities.

However, Payment as a Service also comes with its own set of challenges:

1. Fraud: Price of Digital-based Convenience: The ease and speed of PaaS transactions can also make them more vulnerable to fraud. PaaS providers need to implement robust security measures to mitigate this risk. Businesses utilizing PaaS should also be aware of their own security responsibilities.

2. Data Privacy: PaaS transactions involve sensitive financial data. Strong data privacy practices are essential to ensure user trust and compliance with data protection regulations.

Overall, PaaS offers a powerful tool for businesses to streamline payments and explore new opportunities. By being aware of the potential challenges and implementing appropriate safeguards, businesses can leverage the advantages of PaaS for secure and efficient financial transactions.

X. Adamo Software – Your Trusted Payment as a Service Development Solutions Partner

Adamo Software, a premier software development company based in Vietnam, offers a solution that streamlines payment collection, minimizing the administrative tasks required for payment as a service solutions. Discover how Adamo Software can support you with their software development services. Get in touch with us right away to learn more!