- It is a fundamental of digital payment process and helps enable automated process of virtual and point-of-sale online payment transactions, along with instant transfer to finalize money transferring among parties.

Fintech Software Development

Payment-as-a-service (PaaS)

Adamo’s payment software development services are cloud-based delivery models in which financial institutions outsource payment processing infrastructure and expertise to our developers.

Inspect Payment Software Development Services For Enterprises

Our services will help your business address a wide range of challenges, including evolving regulations, cybersecurity threats, consumer demands for new products and services, rapid technological advancements, and outdated legacy systems.

Our payment software development services authenticate and approve B2B and B2C transactions. Our service acts as a medium to process payments and ensures the secure transfer of funds.

We will host applications and data on our servers and databases. We also use our networking and computing resources. After that, we will make those applications and data available to financial institutions over the Internet through a cloud-based delivery model.

How Payment Software Development Services Help Accelerate Your Business Operations

Our payment software development services involve the creation and implementation of applications that facilitate secure and efficient payment processing. First, Adamo team identifies the types of payments to be processed, which desired features and functionalities your business needs, and any regulatory or compliance considerations.

Our payment software development services team will design a user-friendly interface for the payment application. We also focus on implementing secure payment processing mechanisms and ensuring compliance with every regulation, such as the Payment Card Industry Data Security Standard (PCI DSS).

After the payment software is developed and tested, we provide ongoing maintenance and support to address any issues, and updates, and ensure the software remains secure.

Why Businesses Can Get Merits from Adamo's Lucrative Payment-as-a-service (PaaS)

As a premium software development company in fintech solutions, Adamo Software helps you transform complex business ideas of financial services to innovative and lucrative payment-as-a-service solutions.

Greater speed and agility

Adamo’s payment software development services enable your business to streamline payment processes with faster and more efficient transactions. With advanced technologies and optimized workflows, our services can significantly reduce the time it takes to process payments.

Lower operating costs

By automating and optimizing payment processes, our payment software development services can help businesses reduce operating costs. Manual payment handling tasks can be replaced with automated systems, reducing the need for manual intervention and minimizing the risk of errors.

Shorter time-to-market new products and services

With the right payment software development services, your business can rapidly integrate new mobile payment options, or other innovative payment solutions. Besides, this shorter time-to-market allows your business to capture new revenue opportunities and adapt to changing customer demands more quickly.

On-demand scalability

Whether your business is trying to handle a high volume of transactions during peak periods or want to expand into a new market, you can easily scale your payment systems to accommodate increasing transaction volumes. This on-demand scalability makes sure that your businesses can easily handle growth without any experiencing performance or reliability issues.

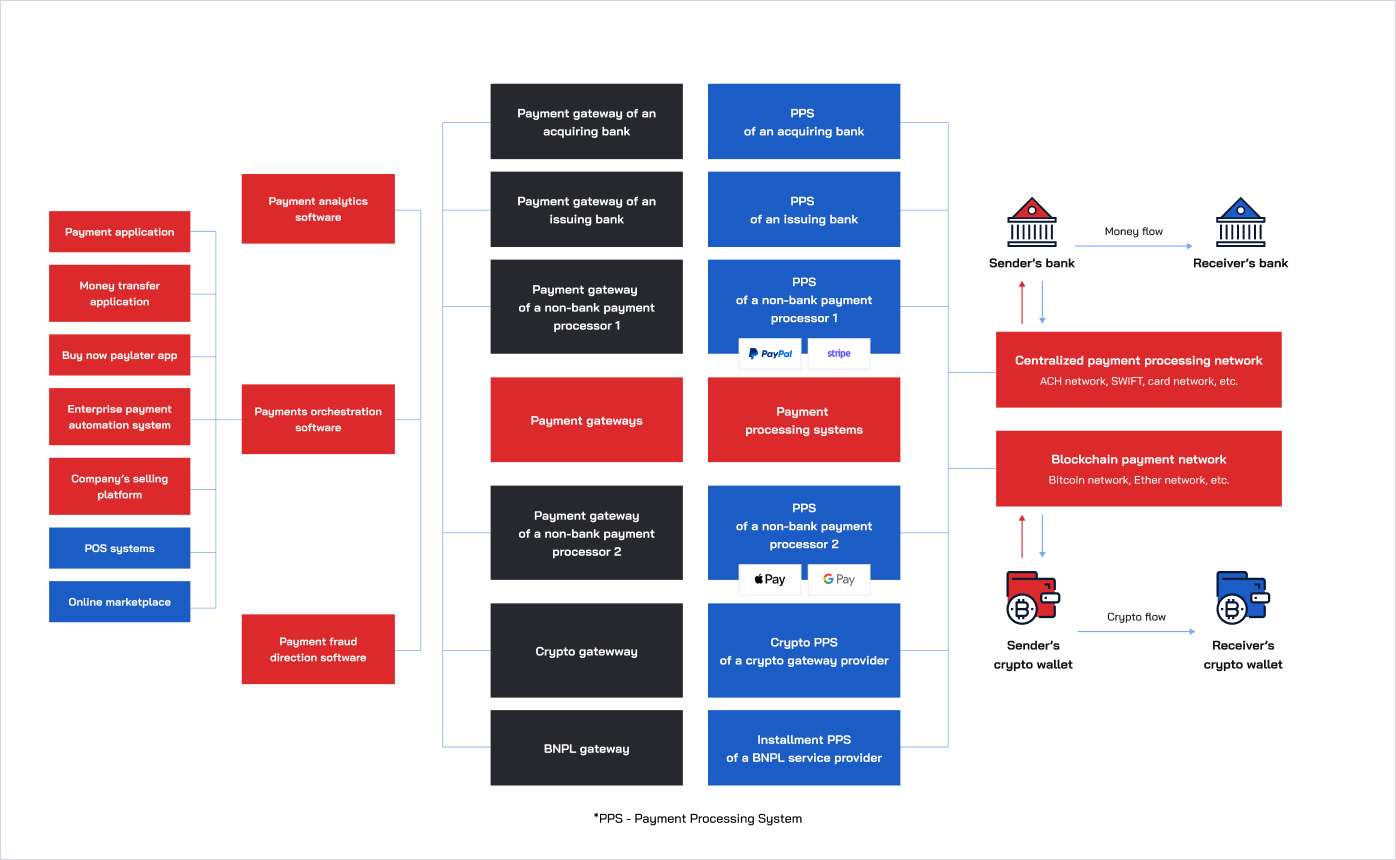

Understand Adamo Secure

Payment Software Solutions

This map will guide you to see and understand how Adamo team secures custom payment software solutions through concrete processes including payment analytic software, payment orchestration software, payment gateway, and blockchain payment systems.

Highlight Outstanding

Functions of Payment Process

Specialized payment processing

Money transferring applications

- Payment apps provide a prompt and secure approach to implement domestic and cross-border peer-to-peer P2P money transfers. Acting as digital wallets, it shows enriching functionalities for money transferring and monitoring.

Buy Now, Pay Later (BNPL)

- Payment solutions combine this feature of loan management functionality featuring a set of consumer-based features for online and in-store payment processes. BNPL aids merchants stimulate orders and frequently allows consumers to pay off in a small amount of money.

Payment Gateway

- This payment gateway helps integrate diverse payment functionality into clients-facing apps. It also helps collect buying details (e.g. billing and payment data offered by customers, encrypting data and more).

Payment fraud detecting system

- This payment fraud detecting system which account on Artificial Intelligence to investigate payment transactions and payers’ behaviors to avoid instantly fraud. Also, it endorses prevent financial losses related to employees’ activities and external stakeholders.

Blockchain payment system

- The decentralized app networks stimulate cost-effective and instant process of domestic, along with cross-border payment platforms without wasting time and consistent involvement of third-parties.

Adamo Recommends Must-have Features of Payment Software Solutions

Peer-to-peer domestic and foreign money transfers

Multi-currency payment transactions, including crypto wallets

AI-based budgets, savings and payment processes

QR-code-oriented payments for both online and offline

NFC-related with mobile payments

Monitoring virtual payment processes through cards

Biometric-empowered authentication

Voice-based commands and text-to-speech

F.A.Qs about Payment-as-a-Service offered by Adamo Software

Discover concerns related to fintech software development ranging from mobile and digital wallet solutions, payment gateway to payment-as-a-Service solutions by Adamo Team.

What is Payment as a Service?

- Payment as a service, also refers to PaaS, is a cloud-based delivery model that financial organizations outsource innovative payment processing infrastructure and experienced expertise to third-party service providers, making it more efficient to create and deploy a payment system.

How can payment as a service work in business landscapes?

To answer this, PaaS looks like software as a service (SaaS) in which third-party providers will host applications and data storage in their servers and database through the networking and computing-based resources. Then it makes applications and data available to selected financial organizations via cloud-based delivery model.

Why is Payment as a Service become popular currently?

This payment as a service has been more and more poplar as an ideal delivery approach as it enables financial organizations to transform company’s services and products into a faster speed without ensuring service quality and data-based security. It helps accelerate speed-to-market, particularly banks and others financial institutions to encounter their expectations, adapt to market changes and leverage emerging trends and more.

What problems does Payment as a Service handle?

The payment as a service helps resolve many challenges in various fields such as constantly-changing regulations, increasingly-complex cybersecurity threats, and demands’ customers for new products and more.

What are benefits of payment as a service?

Payment as a Services gives tremendous benefits such as a greater level of speed and agility, lower-operating costs for firms, promptly time-to-market with innovative services and products, on-demand and flexible scalability, less complicated to control and easy-to-access to qualified IT experts.