Online money transfer services: An in-depth overview for beginners

Finances have been easier to handle because of the advancement in technology. The most popular innovation is the ability to send money online through a particular company. This service enables money transfers from one to another without ideally involving money or physically going to a bank. An online money transfer service facilitates funds transfer worldwide. Whether remitting money to your loved ones or paying bills, goods, or services.

Making transfers as easy as possible is the goal. Thus, with a few clicks, all the money can be transferred utilizing different techniques. It’s important to know more about these services. Learn about how they operate, what they offer, and how to use them securely. People continue to enroll with them. This article is dedicated to online money transfer services. You’ll find everything about online money transfer services.

I. What is an online money transfer service?

An online money transfer service enables an individual or company to transfer cash online. This procedure saves one from carrying cash or physically visiting banking premises. Hence, it’s secure and fast. An online money transfer service allows funds to be transferred to an account, a local or international account, within a few minutes. The transfer time will depend on the transfer type.

These services apply various forms of technology, including online money transfer, also known as wire transfer. This facilitates the safe transfer of cash. When using the online money transfer service, one makes payments, transfers cash to family or friends and makes business dealings. Their basic design makes for both individual usage and office work.

With an online money transfer service, all person-to-person transactions are done through applications or websites. Therefore, users can send money in the comfort of their homes or via the streets. With online payments increasing regularly, it is easy to understand how services operate to maintain our financial resources.

II. Notable statistics about online money transfer services

Payments using Internet money transfer firms have become more popular in recent years owing to the advantages associated with them. These services have changed how people transfer funds internally and internationally in inefficient and cheaper ways.

- The global digital remittance market is currently at $17 billion. According to the research institute, this sector develops at an average of 13.3% CAGR up to 2030.

- In 2021, cross-border money transfer services provided by the online platform were utilized by over 1.6 billion people. Their use is likely to increase because of the changing trend of embracing digital services.

- A similar example of remittance mobile and online money transfer services is realized in Sub-Saharan Africa. The figure stood at 82%, highlighting their importance in areas of low formal financial services.

- The global fintech market with the relevance of money transfer services online is expected to achieve $324 billion in 2026. This is an articulated growth of the industry.

- More than 1.6 billion people worldwide used online money transfer services in 2021. This number is expected to rise as more people adopt digital solutions.

- In Sub-Saharan Africa alone, 82% of international remittances are processed through mobile and online money transfer services. This shows their importance in regions with limited access to traditional banking.

- The global fintech market, including online money transfer services, is expected to reach $324 billion by 2026. This increase reflects the industry’s rapid expansion.

These statistics shift focus on the increased use of online money transfer services in the financial market. With time, more people are aware of their advantage. Hence, the rapid growth of this service makes them vital components of the current financial structure.

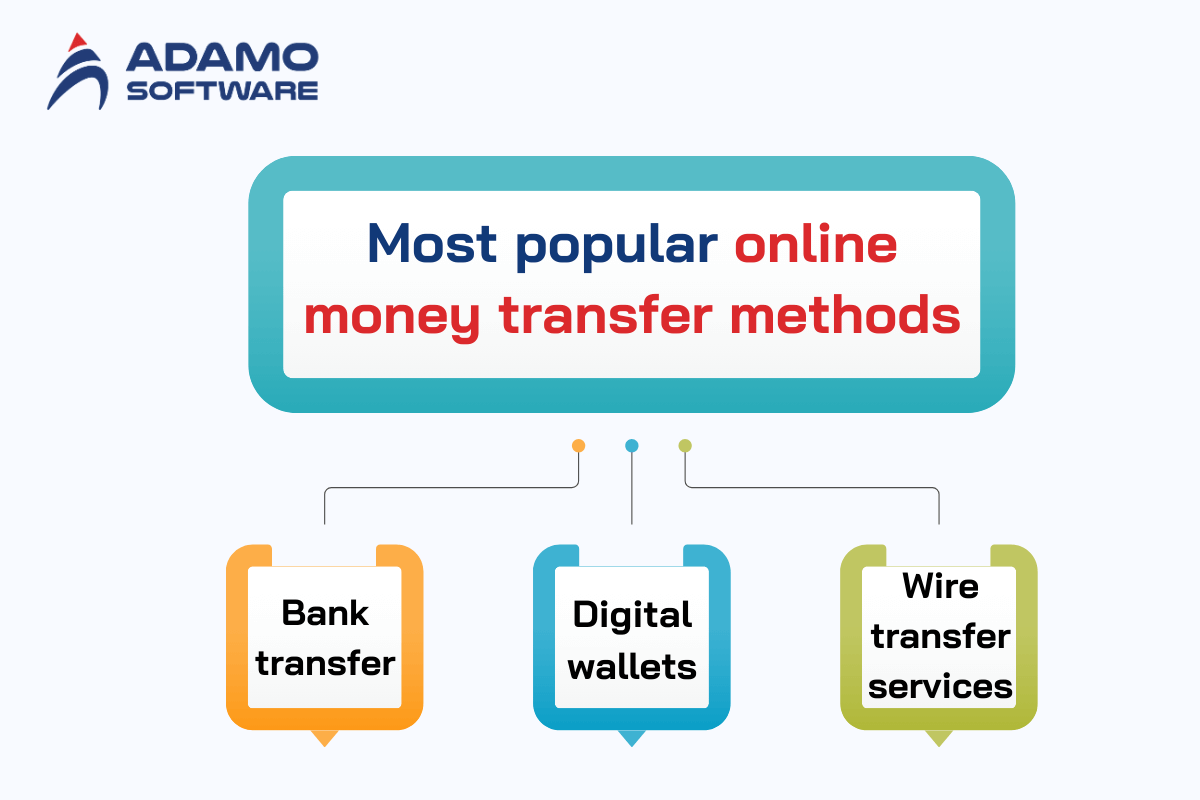

III. Most popular online money transfer methods

Some dependable online money transfer methods are based on their availability in the market. The following are descriptions of the strategies. The online money transfer service you opt for depends on your requirements. By knowing the methods that will be explained below, you will be in a position to choose the best method.

1. Bank Transfer

Bank transfers remain one of the oldest and most reliable methods of online money transfer service. They enable people to do business electronically by transferring money from one account to another on the bank’s secure site.

Key features:

- Secure methods of payment.

- Often relatively small amounts for transfers within the same country.

- It may take one to five business days, especially where a transfer involves overseas banks.

2. Digital Wallets (e-Wallets)

Such wallets as Paytm, PayPal, and Google Pay are becoming famous because of their usefulness. These services create a digital purse in which a user can store funds and transfer them to other users.

Key features:

- Immediate user-to-user transfers within their given social media platform.

- It can be linked with a bank account or credit card for further flexibility.

- It is used by most online merchants and service companies.

3. Wire Transfer Services (Western Union, MoneyGram)

Online money transfer services are best employed in cross-border transactions. They can be completed online or offline. These services enable the realization of cross-border fund transfers within short periods.

Key features:

- Instant cross-border FX transfers.

- It can be purchased in more than one currency.

- Highly charged than most online money-transfer solution providers.

- Higher fees compared to other online money transfer services.

These are just some popular online money transfer services. Every method is good, as it provides instant transfers like e-wallets and secure bank transfer methods. It is crucial to know the basic characteristics to select the most appropriate approach to the financial problem.

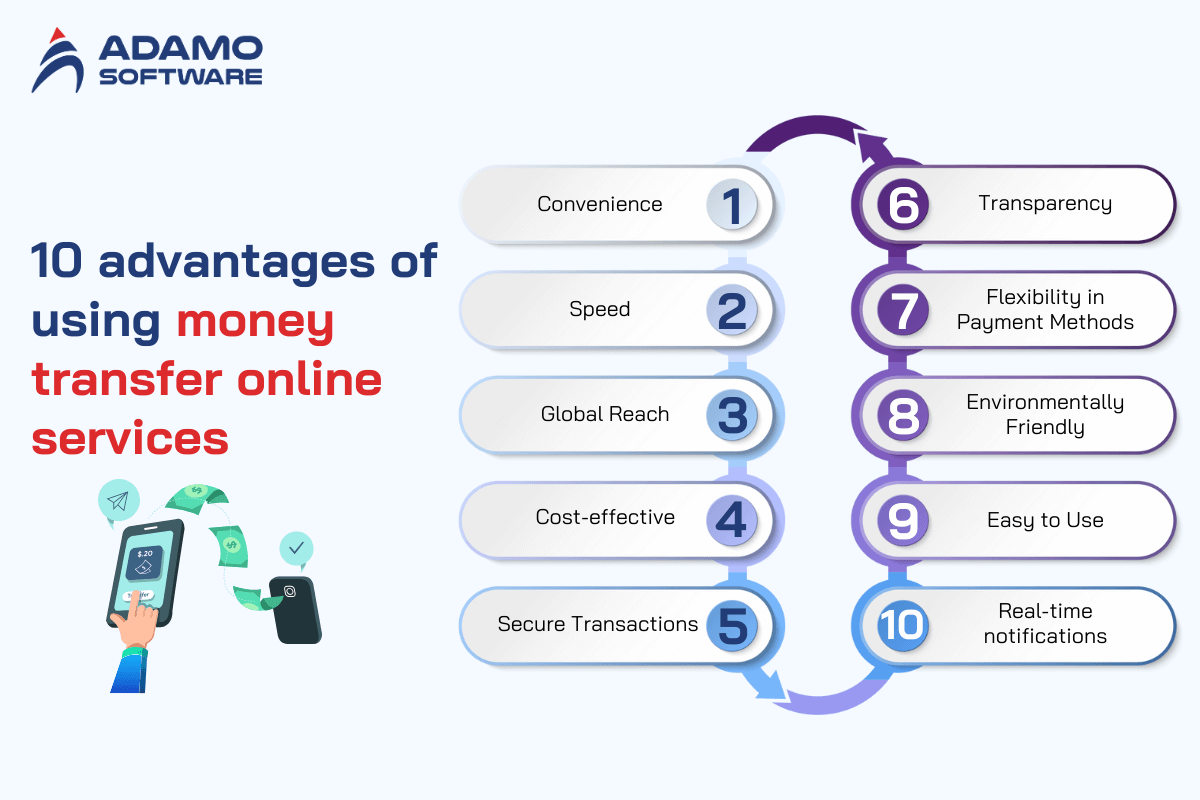

IV. Top 10 advantages of using money transfer online services

A fast online money transfer service has also emerged as the ultimate solution for most money transfers in an individual’s or company’s life. These services give several comparative advantages that make them preferable to conventional approaches to transferring funds.

1. Convenience

Another major plus of money transfer services online is that transferring money using the Internet is very convenient. You can send funds without walking to the bank or financial institution. All one requires is internet connectivity and any device compatible with the internet, including a smartphone or computer.

- You can access it at any time. Hence, you do not have to consider the business hours.

- Transactions can be completed with the help of installed applications on a smartphone or a website. This makes transactions smooth and fast.

- The facility allows you to transact via mobile phone. You don’t need to move around and spend several hours domestically and internationally.

2. Speed

An online money transfer service is much quicker than other bank wire transfer methods. Domestic transfers can be done within the blink of an eye, while international transfers take a few hours up to one day.

- Most services provide real-time transfers that guarantee the recipient the money at that moment.

- Cross-border payments usually take a lot of time and are finalized faster than the traditional platform, making it suitable for emergency money transfers.

- There are no further delays resulting from checks taking time to clear or processing times. You can send money securely and quickly, both domestically and internationally.

3. Global Reach

An online money transfer service enables a client to transfer money worldwide. This is a benefit to transferring cash globally.

- The ability to employ multiple currencies to ensure that transactions, within or across borders, are featured.

- Online money transfer service provides an opportunity to reach locations and states that have an undeveloped financial services market.

- Minimizes the challenge of undertaking foreign exchange and international money transfers thoroughly and quickly, both domestically and internationally.

4. Cost-Effective

The benefits of using an online money transfer service include that, compared to banking or money transfers, the rates are relatively lower. Most platforms take relatively low commissions and sell and buy currencies near interbank rates.

- Lower cost than traditional forms of transferring money like wire transfer or any agency like Western Union.

- However, the service is also inexpensive, and many platforms have particular offers for frequent clients to minimize hazards even further.

- Flexibility entails more favorable exchange rates and increased cost savings, particularly for money transfers internationally.

5. Secure Transactions

There are never any compromises made on security regarding money transfers, and any legitimate online money transfer service should emphasize this. They employ the best technological tools to secure your identity: fraud prevention and verification procedures.

- Encryption during transactions helps prevent releasing information to fraudsters and hackers.

- Two-factor authentication means you must provide a code received through a phone call or an email.

- Almost all the platforms being developed today come with features that alert the user of fraudulent activities and also provide protection against such incidents

6. Transparency

An online money transfer service provider displays the amount of money to be charged, the current exchange rate, and the time required to make the transfer. This way, there are no extra charges, and the procedure is transparent. Therefore, you can monitor everything.

- Explain the cost splits and the exchange rate charges before executing the transaction.

- Ability to track the progress of your transfer in real-time so that you can observe the time money gets to the recipient’s account.

- Offers notices and alerts, which guide you in case you need assistance compared to traditional banking or money transfer services.

7. Flexibility in Payment Methods

An online money transfer service will always allow you to select from several options, which makes it more convenient. The transfer can be paid through a bank account, a credit card, a debit card, or even through PayPal.

- Convenience also allows users to use their preferred payment system.

- The cases include digital wallets and other choices when individuals don’t have a traditional bank account.

- It makes it easier for those who use it – both the senders and the receivers – to provide different ways of doing so.

8. Environmentally Friendly

An aspect that most people may forget when deciding to carry out an online money transfer service is that it is eco-friendly. Online transfers have become another way through which paper, travel, and physical receipts become redundant. Hence reducing the case of carbon emissions.

- No paper documents at all, making their contribution to the conservation of the environment minimal.

- It will also save on fuel since people will not have to go to a bank or a money transfer center to transfer money.

- It takes less resource utilization to process transfers. Thus, it leads to overall sustainability and other options to help people who may not have traditional bank accounts.

- It simplifies the process for both senders and recipients, providing various options.

9. Easy to Use

An online money transfer service is simply created and can be easily understood. It can be used by even those with little or no knowledge of computers. The platforms are easy to use and well-designed. They come with clear, detailed, easy-to-follow instructions.

- It also comes with clean designs of the interfaces that will enable anybody to send money easily.

- Fast processes for registration, and minimum documentation procedures required.

- Anyone on the site can move around and transact, and other options help people who may not have traditional bank accounts.

- It simplifies the process for both senders and recipients, providing various options.

10. Real-Time Notifications

The other major benefit of an online money transfer service is that it sends updates in real-time concerning the transactions you undertake. This is comforting, as one always knows where the money is and when it will get to the intended recipient.

- You also receive information concerning your transfer through SMS or email.

- Confirmation messages of transfer mean that both you and the recipient can know that the money has been received.

- You can monitor the status of your transfer 24/7. Therefore, enjoy total transparency. Other options help people who may not have traditional bank accounts.

- It simplifies the process for both senders and recipients, providing various options.

By and large, the advantages of the online money transfer service are numerous. Thus, an online money transfer service is preferable for sending money with speed, security, and low cost. These services make it easy for users to save time and money and to have a very satisfactory experience, whether dealing with matters within the country or across borders.

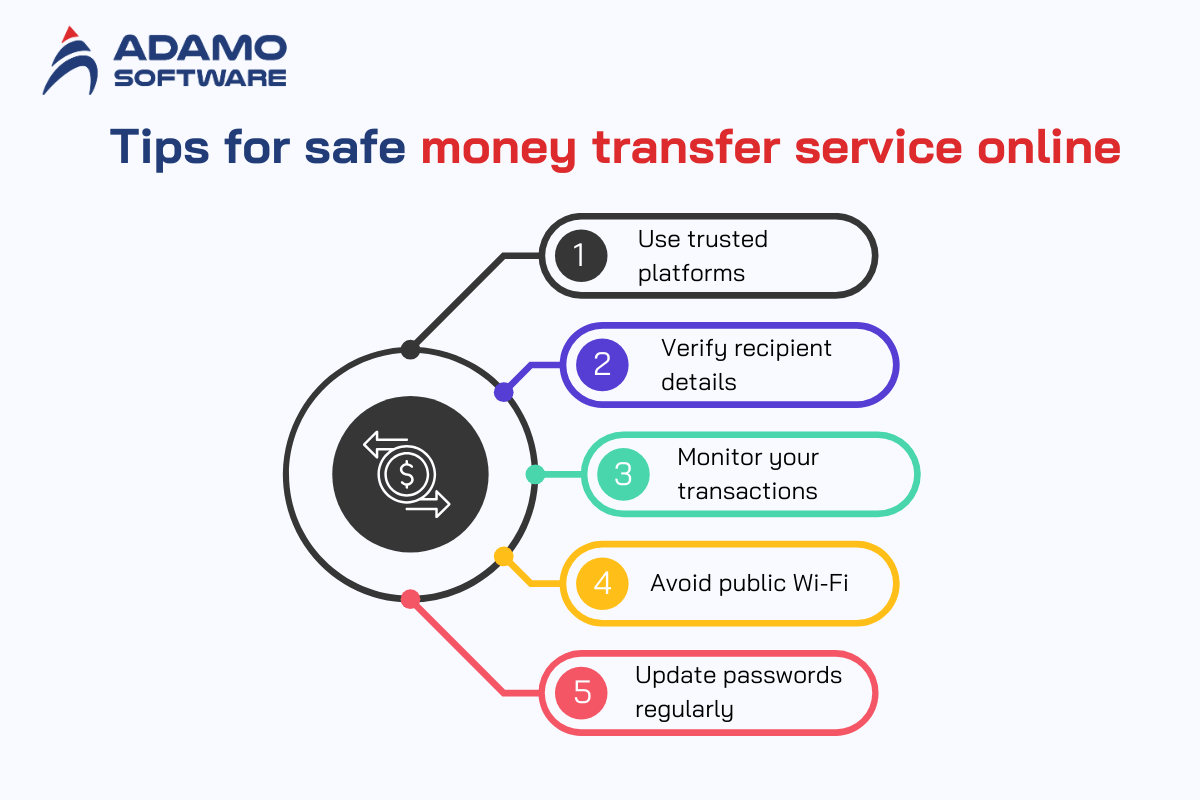

V. Tips for safe money transfer services online

It is safe to make transactions through online money transfer service providers. However, certain measures should be taken while conducting the transfers. That way, you can avoid those loopholes and help reduce the odds of transferring money online.

- Use trusted platforms: No matter which company you wish to use for online money transfers, always select a reliable firm. They should use procedures including encryption and two-phase login details to protect your account.

- Verify recipient details: Always cross-validate the recipient’s account details to avoid any hassle of sending the amount to the wrong person. The incorrect recipient’s account number or information would result in further time delay or money loss.

- Monitor your transactions: Check your records frequently to identify abnormal or other suspicious activities. Many online money transfer services offer alerts and your transfer details in real-time. In addition, there are easy ways you can access your records.

- Avoid public Wi-Fi: Never transfer through an online money transfer service while connected to public Wi-Fi. These networks are mostly open, and you leave your identity open to be hacked.

- Update passwords regularly: Use a strong and different password to improve the account’s security and keep changing it.

Thus, if the strategies mentioned above are followed when using an online money transfer service, fraud or mistakes will be minimized. Preventive measures and precautions will help make all the transactions conclusive and safer.

Also read: Is International Online Money Transfer Service safe? Tips for secured transaction

VI. Adamo Software: Your trusted solution for developing the best online money transfer service

Having a stable and efficient online money transfer service, Adamo is the ideal software development company. Adamo Software offers full-cycle services for companies interested in providing safe and easily scalable online financial services. We specialize in fintech and assist companies in establishing effective digital solutions in today’s world.

Why Choose Adamo Software?

These are the areas where Adamo Software shines and aims to provide the most effective and secure online money transfer service ever. We help in ensuring that your customers can move cash without fuss, securely, and fast.

Key advantages of working with Adamo Software include:

- Custom Solutions: Filled with software designed for your business regardless of its complexity and size.

- Scalability: A solution that scales with your business needs.

- Security: Technological solutions on secure payment for safe transactions.

- User-Friendly Interfaces: responsive designs by creating brilliant and easy steps suitable for class migration.

When you need a premier collaborator for your internationally recognized online money transfer service, look no further than Adamo Software.

FAQs

1. How long does an online money transfer take?

The duration taken to finish an online money transfer service will depend on the selected process and the chosen service type. Normally, interbank transfers within the same country happen within minutes or at most a few hours. International transfers may take between 1 and 3 business days. Some services have the option of booking an express transfer at an extra cost and doing cross-border transfers in real-time. There are, however, some occasions that you can register, such as on weekends and public holidays, and sometimes the recipient’s bank may also affect the registration time.

2. Is it a good idea to send money via the Internet?

Indeed, online money transfer services are generally safe, but using secure platforms is recommended. Almost all services employ encryption, two-factor authentication, and fraud detection measures to safeguard your information. But you must learn whether the service provider meets the legal requirements of the financial markets where it operates and adopts proper measures to protect Internet connections. Never use your name, your relative’s name, or your organization’s name when searching online. Don’t use your password or any account details. And don’t use any computers that are not secure.

3. What are the potential risks of online money transfers?

As much as using the internet to transfer money is efficient, there is always a danger. Some of them are phishing, where the attacker tries to steal your identity, and fake sites, which look like a real service site. There is also a transaction error in which the money transferred is deposited in the wrong account. To avoid such risks, always cross-check the details of your account and only use secure services.

4. What if I enter incorrect account details when transferring money online?

If an improper account number is keyed in by anyone using an online money transfer service, it could be transferred to the wrong party. In such instances, it is advisable to engage your service provider. Several services have measures to recall or undo the transaction. However, the efficiency depends on when the mistake is discovered and whether the wrong person has gotten this money. This problem should be avoided by reviewing all details before confirming any transfer.

5. Are there any fees associated with online money transfers?

Indeed, most online money transfer service providers apply fees for money transfers, particularly in cross-border transfers. Some of these charges are pegged to the kind of service provider, the amount to be transferred, and the destination. Most services provide free transfers within a country. For cross-border transfers, there will be an exchange rate and additional service charge. This is also revealed when it is essential to revisit the fee structure before finalizing a certain transaction.