Digital payment solution: Costs and tips to minimize it

The era of relying on bank accounts and visiting local bank offices for transactions is a thing of the past. As everyone becomes more proficient with technology, the widespread embrace of mobile banking solutions is further propelling the shift towards digital payments. The $1-billion market of 2020 is set to increase nearly fivefold, reaching $4.91 billion by 2026 – a future that is just around the corner.

Therefore, fintech companies are allocating resources towards new technologies to create digital payment solutions. Experts estimate that, given the current rate of development, the market for digital payment apps will reach $305 billion by 2025. Building a profitable digital payment solution presents a challenge—unless you adopt the right strategies to minimize app development costs and enhance profits in the competitive market.

I. Essential features of a modern digital payment solution

Payment apps lead the financial revolution in a time marked by fast technical development. They have evolved into complete financial management platforms from simple transactional utilities. Still, what really distinguishes the current payment app? Let us explore the fundamental elements defining these apps in 2024, separating the extraordinary from the ordinary. We have listed here a table including these basic components together with their importance.

| Features | Description |

| User-Friendly Interface | Easy-to-use designs that allow users to navigate options smoothly. Seamless navigation, clear structure, and a tidy interface are essential. |

| Quick Onboarding | Quick and simple onboarding, enabling users to begin transactions in minutes. |

| Instant Peer-to-Peer (P2P) Transfers | Users can send or request money instantly from their contacts or through a registered number or email. |

| Multi-Currency & Cross-Border Transactions | Ability to handle various currencies and transfer funds internationally with low costs. |

| Secure Authentication | Biometric authentication, two-factor authentication (2FA), and face recognition enhance transactional security. |

| Transaction History & Analytics | Allowing users to monitor transaction history with analytical insights and budgeting tools tailored to spending patterns. |

| E-Receipts & Bill Splitting | Digital receipts provide easy access and allow for convenient bill splitting among friends or colleagues. |

| Notifications & Real-time Alerts | Instant notifications for account balance, transaction updates, and alerts on suspicious activity. |

| Integration with Other Apps & Services | Integrations with various apps and services allow users to pay for services, shop online, or book tickets seamlessly. |

| Customer Support & Chatbots | Chatbots provide immediate assistance, complemented by effective customer support for resolving issues. |

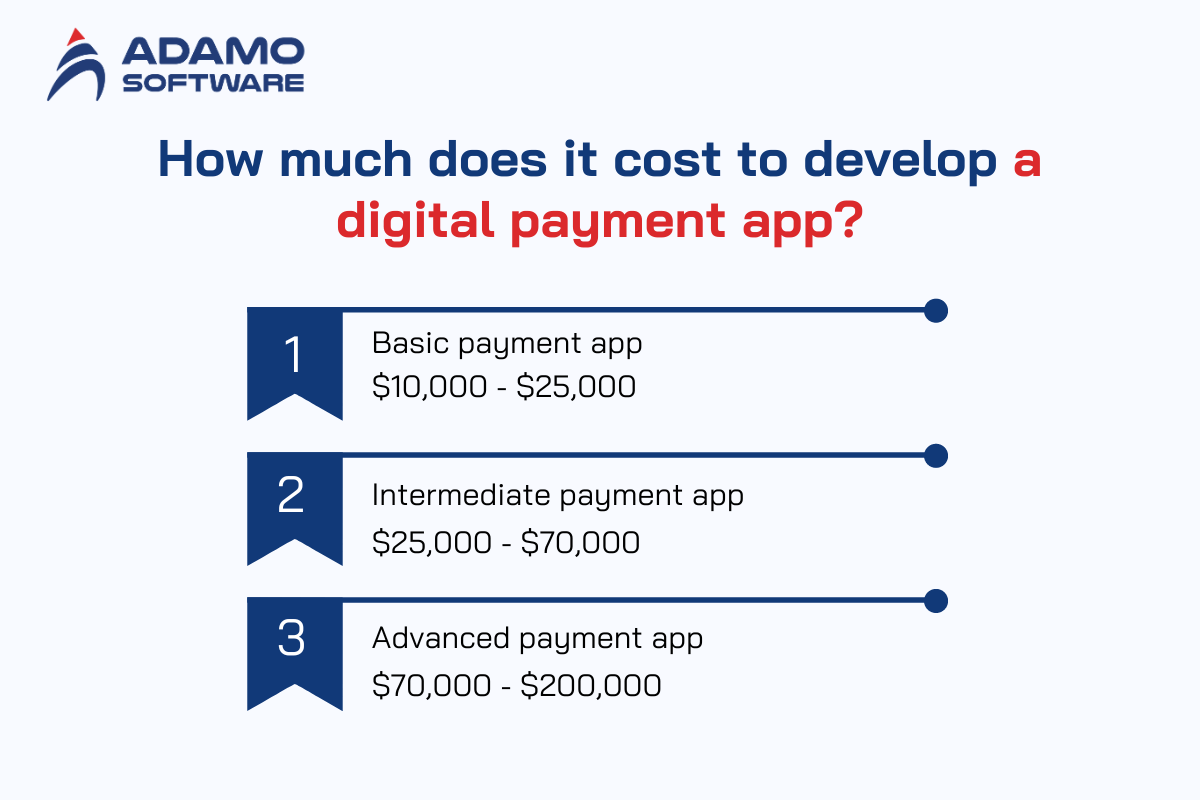

II. How much does it cost to develop a digital payment app?

Regarding digital payment solutions, the costs can fluctuate considerably depending on the app’s complexity, features, and other factors such as security measures and integrations. In order to gain a more comprehensive understanding of the costing structure, it can be deconstructed into three levels of complexity: Basic, Intermediate, and Advanced.

1. Basic payment app

Peer-to-peer transactions are the primary focus of a basic digital payment solution, which provides limited features.

- Features: Basic security measures, transaction history, user registration, bank details, and money transfer/receipt.

- Design: A straightforward user interface and user experience (UI/UX) that is devoid of complex designs or animations.

- Development Time: Typically, 2-3 months.

- Cost Estimate: The cost of a basic payment app can vary from $10,000 to $25,000, contingent upon the development team’s expertise and the region.

For instance, the initial iterations of applications such as Google Pay, which concentrated solely on peer-to-peer payments.

2. Intermediate digital payment solution

The user experience and security are both improved by the introduction of additional features and integrations in an intermediate digital payment solution.

- Features: fundamental functionality, QR code payments, invoice generation, bill payments, chat support, and improved security.

- Design: A more intuitive design that may include custom animations and a dark mode.

- Development Time: Typically, four to seven months.

- Cost Estimate: The cost may vary between $25,000 and $70,000 due to the complexity and supplementary features.

For instance, applications such as Venmo provide more than just fundamental payment capabilities and integrate social feeds.

3. Advanced payment digital methods

An advanced digital payment solution is a comprehensive solution that integrates a wide range of features, guarantees top-tier security, and frequently integrates ML and AI to facilitate fraud detection and personalized experiences.

- Features: This includes all the aforementioned features, as well as advanced analytics, investment options, loan integration, international transfers, multi-currency support, AI-driven personal finance insights, NFC payments, and more.

- Design: A design that is innovative and frequently adaptive to user behavior, offering a wide range of customization options.

- Development Time: Typically, 8-12 months or more.

- Estimated Cost: The cost of developing an advanced payment app can range from $70,000 to $200,000 or more, due to the extensive features and technologies that are in play.

For instance, applications such as Square’s Cash App or Revolut that provide comprehensive financial management experience.

Also read: How to create a digital payment app: A step-by-step explanation

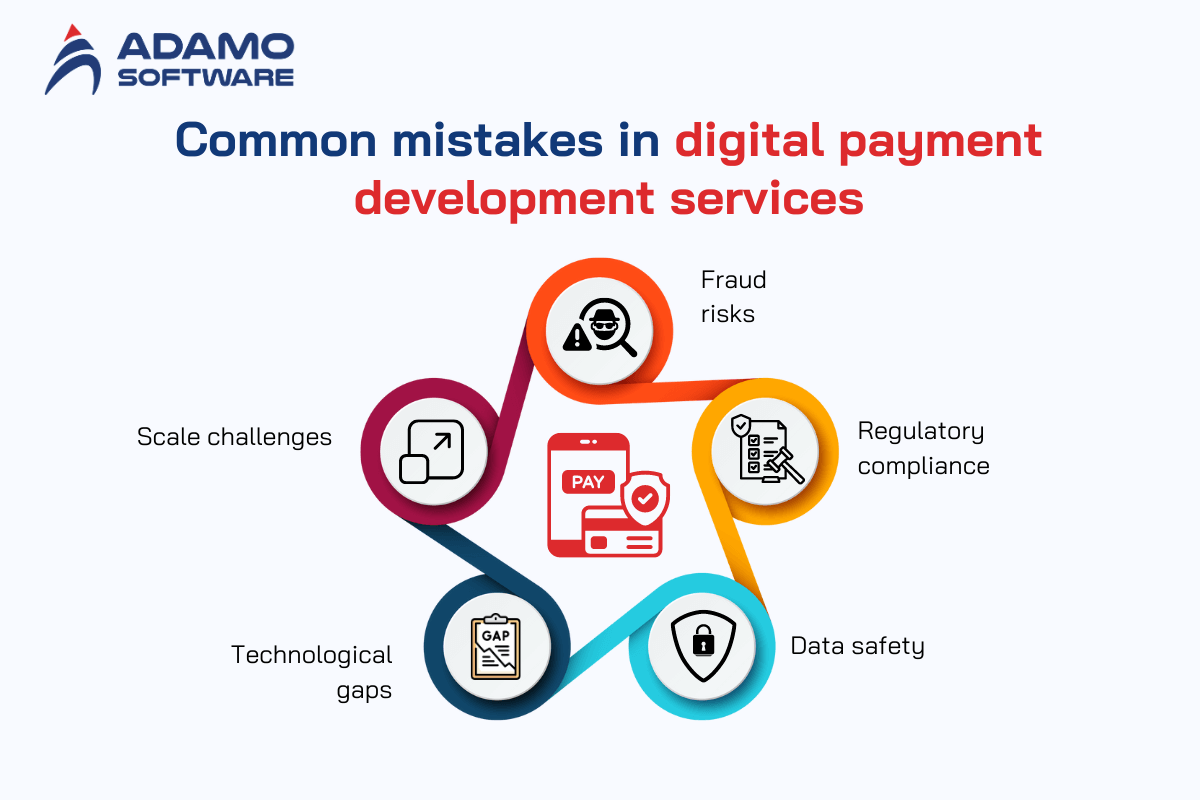

III. Common mistakes in digital payment development services

It is important to acknowledge that developing a digital payment solution presents significantly greater challenges compared to other commercial applications. Certain concerns need to be addressed at the outset, as they will impact the final release of the app.

1. Fraud risks

Digital payment solutions serve as essential financial interfaces, with users potentially storing thousands of dollars in their e-wallets. Ensuring the app is safeguarded against unauthorized access is crucial, as this could lead to fraudulent activities.

In addition to implementing safeguards such as two-factor authentication, developers need to guarantee that payment data is encrypted during transmission between terminals, servers, or devices.

2. Regulatory compliance

All functionalities implemented in the app must adhere to the regulations set forth by governing bodies to ensure legal operation. For instance, digital payment solutions that gather credit card information are required to comply with the PCI DSS.

Digital payment solutions are required to uphold stringent compliance with Know-Your-Customer regulations, including FinCEN’s CDD rule, to combat money laundering effectively.

3. Data safety

Digital payment solution providers are entrusted by users to safeguard their privacy without exception. The exposure of personal information, transaction history, or sensitive financial data to malicious actors would have serious consequences.

Service providers should implement preventive measures, including enforcing cloud security and presenting a clearly articulated privacy policy.

4. Technological gaps

Creating a digital payment solution necessitates the collaborative input of specialists across various software fields. This task cannot be assigned to a freelancer; it necessitates a team of highly skilled developers. A digital payment solution comprises various interconnected modules, including an e-wallet, blockchain technology, encryption methods, APIs, data warehouses, and other innovative technologies.

5. Scale challenges

A successful release leads to heightened visibility and a rapidly expanding user base. If your digital payment solution lacks a focus on scalability, it will encounter bottlenecks, resulting in service disruptions, instability, and an increased churn rate.

Prepare for the future expansion of your digital payment solution by implementing scalable cloud infrastructure, utilizing technological modules, and adopting microservices. Establish a distinct financial calculation module to alleviate the heavy load on the core payment system.

6. Versatility

Mobile payment is a segment of fintech characterized by rapidly evolving requirements. Supporting basic payment options is important, but it is also vital to comprehend consumer behaviors and adjust the app accordingly. A strictly digital payment solution may need to incorporate ride-hailing providers to maintain its relevance.

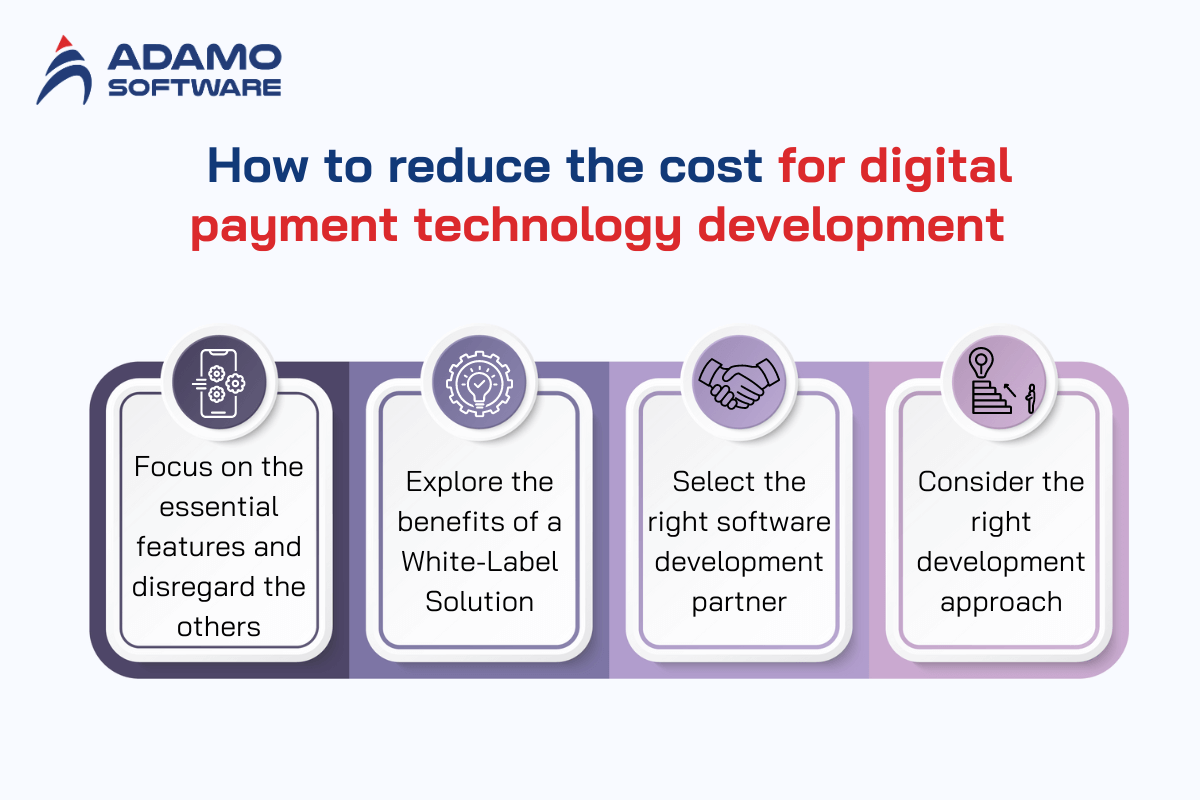

IV. Strategies for lowering costs for digital payment technology development

Having understood the costs associated with digital payment solution, it’s now essential to explore strategies for minimizing the expenses involved in creating your app.

1. Focus on the essential features and disregard the others

Each feature in your digital payment solution contributes to the total development expense. To adhere to the initial budget, it is essential to focus on the core requirements only. Focus the development on the essential features required for the app, avoiding the inclusion of tools that do not enhance the overall user experience.

2. Explore the Benefits of a White-Label Solution

Consider utilizing a white-label solution from Adamo Software to optimize your time and resources while developing a fintech or banking application. This white-label solution also adheres to all compliance standards necessary for developing a digital payment solution. Additionally, obtaining the source code license allows you to customize the code to align with your unique business requirements.

3. Select the right software development partner

Engaging a fintech software development company with practical experience can lead to significant cost savings for your solution. These companies possess a team of seasoned professionals with extensive industry experience in developing digital payment solutions. Simultaneously, you will have the opportunity to choose a cooperation model that aligns with your budget for the digital payment app.

4. Consider the right development approach

Most digital payment solution development teams adopt the Agile methodology due to its facilitation of continuous iterations and sprint-oriented development. To meet delivery time frames and minimize the likelihood of errors in the product, it is essential to seek a project manager who possesses experience in Agile, SCRUM, Lean, and various other methodologies.

V. How Adamo Software can help to build successful digital payment app

Adamo Software has a proven history of assisting startups in the development and launch of successful digital payment solutions in the market. Our team is composed of diverse software specialists proficient in fintech technologies essential for developing digital payment solutions. Our in-house expertise encompasses blockchain, smart contracts, and AI, which are among the most essential technical skills for the expanding fintech market.

In addition to developing innovative solutions, we genuinely take into account the human aspect of the equation. We carry out feasibility studies and usability tests, utilizing the feedback to create apps that resonate with user needs. Additionally, we recognize the importance of time sensitivity, budget considerations, and alignment with our clients’ business goals.

In essence, Adamo Software integrates technologies, collaboration, and insightful perspectives to create effective digital payment solutions.