7 Advantages of digital payments & The future to look forward

Digital payment systems are of utmost importance in today’s global economic environment. More than 50% of consumers prefer digital payment methods over cash. They are not just about technology; they are changing daily money management and shaping the e-commerce industry in many ways.

The efficiency, security, and ease of use of digital payments can simplify processes from shopping to transferring money and replacing traditional transactions such as cash and physical cards. In addition, adopting electronic payment systems has become a must for organizations to stay competitive and responsive to the needs of modern consumers.

This blog will explore the advantages and disadvantages of digital payment. At the same time, consider what lies ahead for electronic payments in the future.

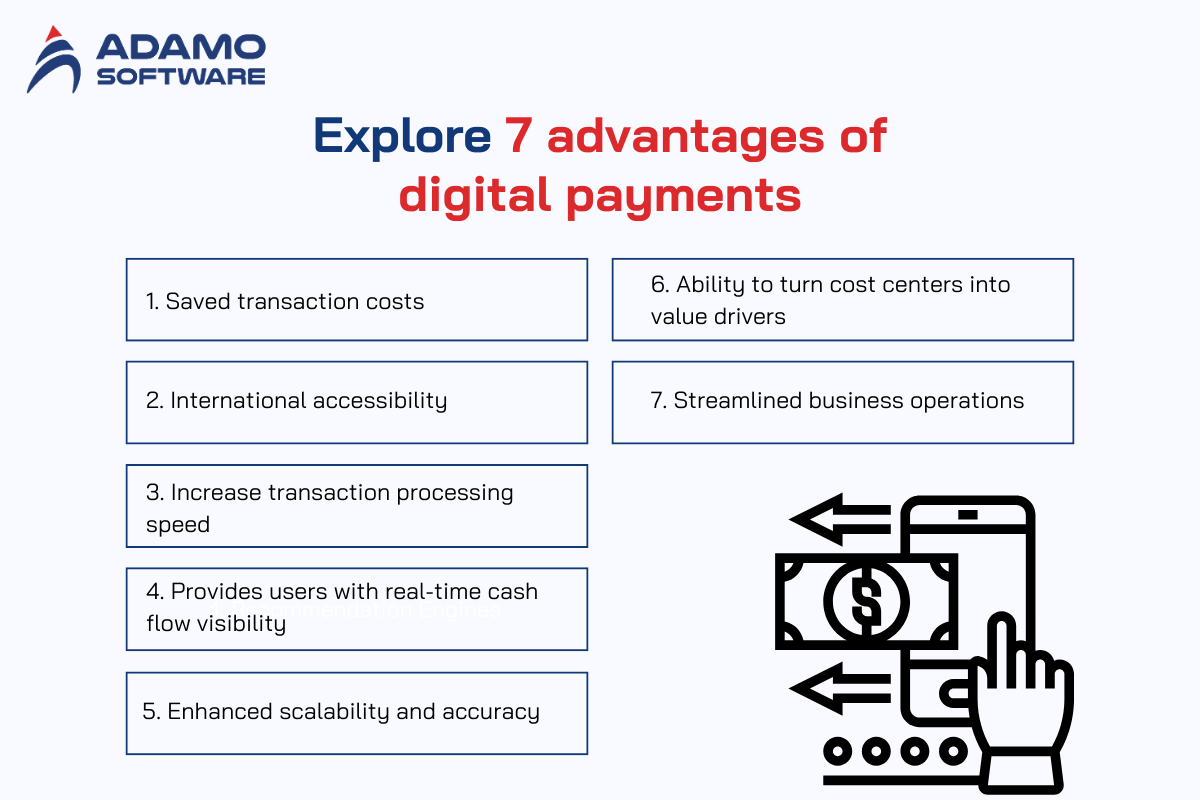

I. Explore 7 advantages of digital payments

Digital payment systems have emerged as a transformative force, bringing numerous advantages to businesses globally. Let’s explore the advantages of digital payments. Learn how these advantages of digital payments positively impact businesses across various sectors and geographical boundaries.

1. Saved transaction costs

The first advantage of digital payments is reduced transaction costs. Over the years, paper checks have dominated business operations. Large businesses make almost half of their payments via paper checks. Small companies make 80 to 90 percent of their payments via paper checks.

However, paper payments are a hassle and a pain for businesses and suppliers. Collecting and processing paper checks is costly for most companies and their suppliers. It can cost businesses around $13 to send an invoice and $5 to process a single check. Additionally, paper payment methods are not only expensive but also time-consuming. It can typically take up to two weeks for a check to clear.

In contrast, the digital payment process is relatively simple. Advantages of digital payments include being faster, safer, more accessible to collect, and less expensive for businesses. By incorporating electronic payments into a business’s accounts payable process, their AP department can save money on every invoice.

According to a report by the Association of Financial Professionals, up to 92% of companies accept paper checks as incoming payments, and 86% take them as outgoing payments. Sending and receiving checks can incur significant processing costs, including bank fees, printing, postage, and secure processing. AFP also found that digital payment fees are much lower, potentially under $0.50 per transaction. It is considered a greener solution. Furthermore, some digital payments have no associated costs or additional fees, which can help businesses earn cash.

2. International accessibility

Global accessibility is one of the advantages of digital payments. Digital payments can break down geographical barriers and provide businesses with international reach. Whether your business is a small local or multinational corporation, digital payments allow you to transact seamlessly across borders.

Global reach also gives businesses a competitive advantage and drives expansion into new markets. For example, expanding the customer base, facilitating international trade, and helping promote economic growth and diversification for businesses of all sizes.

3. Increase transaction processing speed

One advantage of digital payments is that they increase transaction speed. Traditional payment methods can take days or weeks to process and clear. Examples include paper checks or physical cards. Digital payments can happen almost instantly. By digitizing the payment process, companies can pay their bills on time, anytime, anywhere.

4. Provides users with real-time cash flow visibility

Regarding the advantages of digital payments, it gives users real-time cash flow visibility. When making a payment, the account balance reflects the change immediately, and all currency conversions occur during the transaction. As a result, businesses can track expenses and income in real time and make faster business decisions in key areas such as consumer goods, investment, and recruitment.

5. Enhanced scalability and accuracy

The advantages of digital payments are that it also helps increase the scalability and accuracy of transactions. Typically, it can take companies six to ten hours a week to process and reconcile payments. This process is costly and leads to high rates of exceptions, requiring more time and money to correct.

6. Ability to turn cost centers into value drivers

Turning cost centers into value drivers is also one of the advantages of digital payments. Consumers often consider cash-back offers or transaction fees when deciding which credit card to use. Businesses can also receive similar perks with virtual cards (VCCs) to physical credit cards. Additionally, businesses only use the VCC number once, so they decide how much credit to put on the card. Cash-back offers can provide businesses with recurring revenue for each invoice they pay.

7. Streamlined business operations

The ultimate benefit of digital payments is streamlined business operations. Digital payment systems facilitate fast and efficient transactions. They also reduce the processing time associated with traditional payment methods. This is one of the advantages of digital payments for businesses. The efficiency of digital payments is especially beneficial for companies that want to optimize their operations and improve customer satisfaction.

In addition, integrating digital payments into business operations helps streamline processes such as invoicing, inventory management, and reconciliation. Automating these tasks will help reduce manual errors. This allows businesses to increase accuracy and save valuable time to focus on core activities. These streamlining activities can contribute to overall efficiency and productivity.

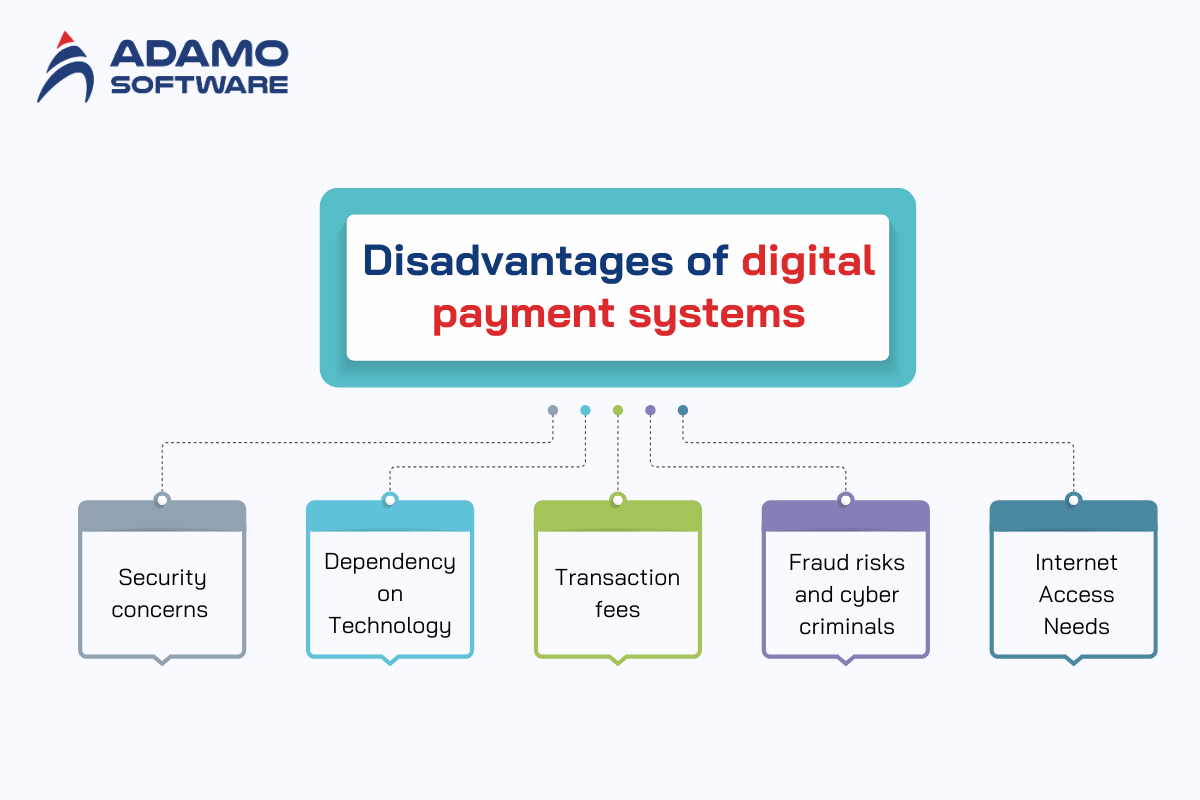

II. Disadvantages of digital payment systems

The advantages of digital payments have brought about transformational changes in the financial landscape. However, businesses should also consider the potential disadvantages and their impact on them.

In this section, we will delve into the disadvantages of digital payments and how they can negatively impact businesses on a large scale.

1. Security concerns

The most significant disadvantages of digital payments are the issues related to safety and security. Here are some of the risks that may occur when using digital payments:

- Digital payment systems are not immune to security risks and vulnerabilities. As such, using digital payments can expose individuals and businesses to various cyber threats. These include fraud, identity theft, phishing attacks, malware infections, and hacking attempts. These risks can result in financial loss, reputational damage, and legal liability for both parties.

- A primary security concern is the risk of fraudulent transactions, where hackers or unauthorized users can access sensitive information or steal money from legitimate account holders. This can happen in various ways, such as copying card information, intercepting passwords, or exploiting vulnerabilities in the system.

- Another dangerous problem is identity theft. When personal data, including names, addresses, and bank account information, is stolen by hackers, who then use that data to make unauthorized purchases or open new accounts. Sometimes, it can take years for users to discover and resolve the breach. It can cause significant damage to a victim’s credit score and finances.

- Phishing issues are also common in digital payments. This is when scammers send emails or text messages that impersonate legitimate companies to trick users into revealing their login credentials or other sensitive information. These attacks may be disguised as urgent notifications about account activity or promotional offers that sound too good to be true.

- Another potential risk is malware infection. When infected with malware, digital payment systems are attacked. It can allow attackers to gain unauthorized access to users’ devices or networks. Once hackers can access a device, they can steal confidential information, launch ransomware attacks, or even completely control the affected computer or mobile device.

- Last but not least, attempts to attack digital payment systems are a considerable concern, especially for large financial institutions and e-commerce platforms. Attackers or hackers may try to breach defenses to steal money, disrupt operations, or damage a business’s reputation.

2. Dependency on Technology

The dependency of digital payments on digital technology exposes businesses to issues, such as technical glitches, power outages, network failures, server downtime, or system failures. These disadvantages can lead to potential financial loss for businesses and inconvenience for customers.

3. Transaction fees

Transaction fees are one of the common disadvantages of digital payments. Digital payments can save money in some ways. However, businesses may still encounter transaction fees, especially with some payment gateways or international transactions. Transaction fees can vary depending on the payment method. They typically range from a few cents to a few dollars per transaction. Financial institutions such as banks or credit card companies process and collect these fees.

Losing transaction fees can hurt businesses and consumers, especially for high-frequency or high-value transactions. Additionally, transaction costs accumulating over time can impact a business’s profitability, especially for small and medium-sized enterprises (SMEs) operating on thin margins.

In addition to transaction fees, payment processors may also impose daily or monthly transaction limits on each user. These limits may vary depending on the type of account used or the type of payment method. For example, while some debit cards have a daily limit of $10,000, others may allow much higher transactions. Likewise, credit cards will have higher transaction limits than debit cards.

Transaction fees or limits can make digital payments less convenient and efficient than cash or checks.

4. Fraud risks and cyber criminals

Fraud risk is one of the biggest concerns with digital payments. Despite security measures, digital payment systems are still vulnerable to fraud, identity theft, and other fraudulent activities. Cybercriminals can use a variety of techniques to steal sensitive information from users. These include social engineering, malware infections, and fake websites.

In addition, digital payment transactions involving large amounts of money can be attractive targets for criminals. The lack of physical contact between the sender and receiver makes verifying the authenticity of transactions difficult.

Financial institutions have implemented security measures such as two-factor authentication, encryption, and firewalls to mitigate these fraud risks. However, these measures are not perfect and are not immune to attackers. Today, cybercriminals continue to find new ways to exploit vulnerabilities in systems.

5. Internet Access Needs

Digital payment systems require Internet access or a stable Internet connection. This disadvantages individuals in areas with limited or no Internet access, preventing them from engaging in digital transactions.

Understanding and mitigating these digital payment disadvantages is essential for individuals and businesses looking to leverage electronic payment systems while addressing potential challenges as we navigate the digital landscape.

III. The future of digital payment to keep an eye of

Emerging technologies, consumer behavior, and the regulatory landscape shape the future of digital payments. Security elements, such as encryption and blockchain technology, are being used to enhance security and improve user experience. Digital currencies, such as Central Bank Digital Currencies (CBDCs), are being developed to enable faster, cheaper, and more secure transactions. The integration of digital currencies into various digital experiences and the proliferation of IoT devices can add convenience and security to digital payments.

1. The growing role of biometrics

Biometrics are gaining prominence in digital payments due to improved security, convenience, and fraud reduction. These methods provide a unique, unclonable identifier, including fingerprint scanning, facial recognition, and eye pattern scanning. Enables frictionless transactions and multi-factor authentication, shaping the future of digital payments.

2. Regulation and compliance

The rapidly growing digital payments sector must adhere to strict rules and regulations to protect consumers, maintain security, and promote stability. These regulations cover consumer rights, licensing, data privacy, cybersecurity measures, anytime, anywhere payments, security requirements, anti-money laundering, interchange fees, and consumer protection. Businesses can maintain credibility and trust by complying with these rules, ensuring a safe, efficient, and inclusive payment ecosystem.

Also read: 10 digital payment types explained – Safety tips for using

IV. Partner with Adamo Software to achieve successful digital payments development

While businesses can take advantages of digital payments, online payments also have disadvantages that you must be aware of. However, you can overcome most of these disadvantages with the proper precautions and management.

At Adamo Software, we provide secure and customized solutions for businesses of all sizes. Our team of fintech software development experts will help your business develop advanced, seamless digital payments and boost your business growth in no time.