Are digital wallets safe? Secrets to safeguarding your digital payment

Long were the days when we had to keep our dollar bills in a physical wallet. Back then, making payments was complicated. You must’ve struggled not to accidentally give more or less, keep the change, and…just to not lose your wallet. Those struggles are now so far gone thanks to technological advancements.

Digital wallets (or you might know them as e-wallets) have come along and completely changed the way we keep our money. These apps allow us to keep all of our debit and credit cards, as well as monitor our transactions all in one place. Thanks to them, we can make contactless payments at physical stores and online payments in no time.

However, with growing popularity comes a critical question: are digital wallets safe? Though e-wallets provide a much faster payment method, we must also know the associated security risks. There have been various data breaches or hacking attempts aimed at digital wallets. Additionally, if you lose or have your phone stolen, your financial information might also be at risk. Therefore, it is totally understandable that many people are worried about are digital wallets safe to use for everyday transactions?

This article will help you find the answer to the main question: Are digital wallets safe? We’ll also discuss the possible risks of digital wallets and give you tips on safeguarding your digital payments.

By staying informed and proactive, you can enjoy the benefits of digital wallets while keeping your financial data secure.

I. Digital wallets meaning: The widespread of its usage

Before diving deeper into the question of are digital wallets safe, we must first understand what exactly digital wallets are. Once you fully comprehend the term, it will be much easier to grasp other related matters.

To put it simply, a digital wallet is basically a wallet kept in a digital format. Think of the things you keep in your physical wallet: money, debit & credit cards, sometimes even gift cards. A digital wallet can also help you store all that stuff and offers an addition of many other features. Now, instead of bringing your wallet AND your phone every time you leave the house, you will just need your phone.

Digital wallets let you link your bank account and cards to one central app on your smartphone, which you carry everywhere. With these e-wallets, you can easily make transactions with accuracy down to every penny with just a few taps.

Are digital wallets safe to store your cards though? To protect your security, your card numbers are not stored on these apps. Instead, e-wallets and your bank have an encrypted protocol for transactions that won’t expose your card information. Therefore, digital wallets really are a transformative way to secure your financial information.

There are a variety of e-wallets to choose from as the market for this sector is constantly expanding. PayPal is a popular and long-established name among digital wallets. However, in recent years, other e-wallet solutions from Apple Inc., Google LLC, Tencent, and Samsung Electronics have experienced remarkable growth. Phone manufacturers like Apple or Samsung have their own built-in e-wallets. Therefore, their e-wallet user base also grew along with their number of phone users.

One of the most effective indicators of are digital wallets safe to use is expanding the user base. Because of their convenience, millions of people worldwide have been using them as the main payment method.

Forbes Advisor’s survey found that more than half of Americans use digital wallets more frequently than traditional payment methods. In 2023, 70% of the value of e-commerce transactions in the Asia-Pacific region was associated with digital wallets. According to the Global Payments Report, this placed APAC at the world’s leading spot in digital wallet usage.

As e-wallets become more widespread, retail and F&B companies close deals with major e-wallets. For instance, Starbucks and Home Depot have signed up with Square and PayPal to encourage digital payments for their services. However, not every digital wallet is accepted everywhere. Some places only take Apple Pay, while others accept Google Pay or PayPal. Though a quick fix for this can be downloading all the apps on your phone, it is still somehow inconvenient.

It seems that apart from the question: are digital wallets safe? We also need to ask whether they are enough to replace the traditional ones. Hopefully, more stores will adopt digital payments as more people opt for e-wallets as their new everyday wallet. Only then will the true purpose of keeping a solo ‘virtual’ wallet be meaningful.

Also read: How to craft your own mobile payment app like Paypal digital wallet

II. Are digital wallets safe?

Now back to the main question: are digital wallets safe?

To answer this, we need to look into how these wallets work. However, not to keep you waiting, the short answer is YES. Digital wallets are generally considered safer than physical ones. Here’s why:

With a physical wallet, if you accidentally drop it or someone just purposefully steals it from you, it would be a big problem. There they can find your cash, debit card, credit card, and even your ID card. Before you know it, they could’ve spent all your money and swiped your card like crazy until it reached the credit limit. Worse, they can use your ID card for fraud or other illegal crimes.

If you’re still keeping everything in your physical wallet, sorry if we freaked you out a little just now. Anyways, transitioning to a new form of wallet may be full of doubts. So, it’s not surprising if you caught yourself asking are digital wallets safe. We all did at first. But don’t you worry, because e-wallets have layers of protection that shall keep your money safe from thieves.

Have you ever heard of a token? In the case of e-wallets, it is a randomized series of numbers, used to replace your actual account or card number. This technology, called tokenization, is your first level of protection on digital wallets. Thanks to it, all your card information is encoded and not shared with any merchant. Therefore, even if the retail store information system gets hacked, customer card information won’t be revealed. This addresses one major concern about are digital wallets safe.

Next, to make payments, you need to pass all kinds of authentication processes. This procedure adds an extra layer of security to your online transactions and using digital wallets in general. For instance, in some cases, you might be asked to fill in a SmartOTP to proceed with your transactions. For other cases, biometric data such as fingerprints or FaceIDs can be used as alternatives. These authentication steps help the digital wallet confirm if you’re making the transaction before completing it.

Therefore, the phone thief must know your password, SmartOTP, or biometric data to get money from your e-wallet. As a result, the extra protection security design makes an e-wallet much safer than losing a physical wallet. Accessing sensitive financial data is indeed one of the main problems that people worry about when wondering are digital wallets safe. This security layer does an amazing job of addressing just that.

Last but not least, your e-wallet app is built to interact with only a limited number of other applications on your phone. That means it can stop possible malware on your phone from accessing your e-wallet and stealing your information.

We hope that the above breakdown of digital wallet features has answered your question of are digital wallets safe to use. Clearly, with many new technologies being implemented, digital wallets can be a much faster and more secure way to carry out transactions. With that said, you also need to know that they are definitely not risk-free. There are some risks from both outside and within these wallets and precautions must be taken for maximum safety.

III. Hidden risks when using digital wallets

As we have discussed above, it is without question that we can get various benefits from using digital wallets. However, asking are digital wallets safe before deciding whether to use them or not is also important. Their convenience comes with a price. Hence, we must be well aware of what we’re in for to protect ourselves and not be taken aback by any possible risks.

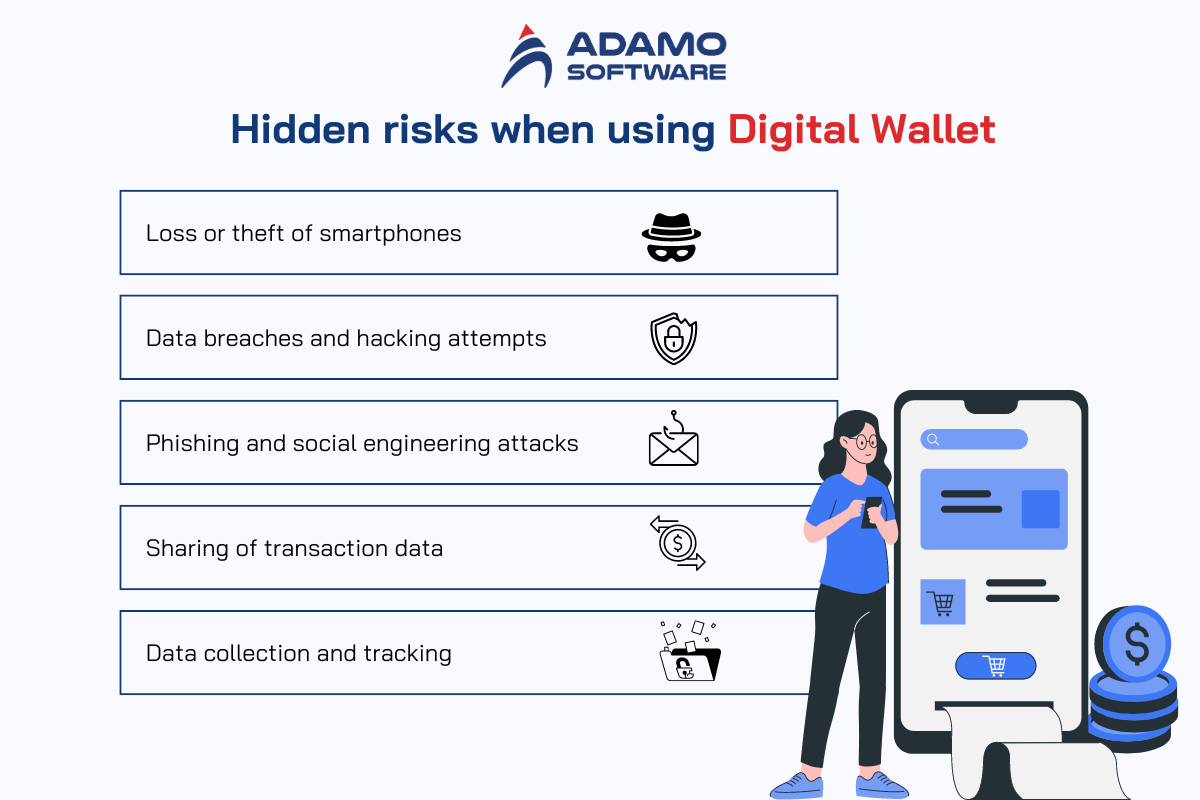

Let’s have a look at some of the most critical issues associated with digital wallets:

1. Loss or theft of smartphones

Carrying a physical wallet around can be risky since someone might try to steal it, or you might drop it somewhere. Are digital wallets safe from this issue? Well, not really. Though you can’t “drop” your e-wallet, your phone with that wallet app can still be lost or stolen. In 2022, there were approximately 70% of consumers with e-wallets, making this risk a problem for many people.

Let’s hope that digital wallet developers try their best to ensure its security. However, as cybercriminals are everywhere nowadays, this security cannot be 100% guaranteed. If you’re so unlucky to have your phone stolen by some tech guru, your finances might be at risk. This is especially true if you don’t have enough security setup for your phone and your e-wallet.

Therefore, always remember to set up biometric authentication and strong passwords for your phone and wallet apps. Sometimes people might turn them off, so they won’t have to go through too many steps. However, this can be very risky. Make sure that you ask yourself are digital wallets safe if you ignore some security features. If the answer is a resounding no, then you know what you must do.

Also, be aware of features like Find My Device to control or delete your data remotely if your phone is lost or stolen.

2. Data breaches and hacking attempts

Data breaches and hacking attempts are major concerns for our online stuff, including our digital wallets. No matter how well-developed an e-wallet app is, the answer to digital wallets safe from cyberattacks cannot yet be a yes. As modern technologies evolve, hackers also develop new tricks to help them get what they want.

Hacking into digital wallets and banking apps is obviously very tempting for cybercriminals. But it’s hard for users and developers to know when they get attacked until it’s happened. The only thing that each of us can do is to make sure we are proactive in keeping our wallets safe. Users must always stay updated with the latest wallet version. Similarly, developers should constantly check for any bugs or security loopholes and take action before it’s too late.

3. Phishing and social engineering attacks

Phishing and social engineering attacks are undoubtedly the most dangerous since they have the highest success rate among all the risks. In 2021, 90% of reported cases of data breaches were caused by phishing and social engineering attacks. That’s an alarmingly high rate. Are digital wallets safe enough to stay clear of these attacks?

The answer is likely no. These cyberattacks are often carried out using fake emails, text messages, or malicious websites. Specifically, criminals would make these platforms seem real thereby tricking people into revealing information like passwords or OTPs. Because of its subtle but highly effective nature, countless users have been victims of this cybercrime.

The reason why these tactics have been so successful is because they use psychology to exploit human fears or greed. Even the most tech-savvy and careful people would have to ask are digital wallets safe. Anyone can be tricked, and therefore you need to be aware of the risks and proactively protect yourself.

Make sure you remember clearly the official links of banks, and e-wallet providers to avoid clicking on fake links. In addition, double-check with your e-wallet provider for any abnormal requests or notices.

4. Sharing of transaction data

Are digital wallets safe in terms of protecting transaction data? That depends on the digital wallet providers. Some wallets might collect your data when you use the app for marketing or data analytics purposes. This will be even more dangerous if they share it with third-party organizations.

Therefore, remember to read an e-wallet privacy policy before agreeing to it. To address the concern of sharing data without consent, ask yourself are digital wallets safe and developed by a trusted company? Only use products of companies that are transparent in how they process your data.

5. Data collection and tracking

When asking the question “Are digital wallets safe?”, you might be worrying about the risk of data collection and tracking. Indeed, this can be a major problem when using digital wallets.

Normally, e-wallets and banking apps might collect data and track your activities to monitor login sessions and detect suspicious actions. The data collected can also be used to improve the UX/UI or security level for those apps. However, you don’t know how much data is being collected, which can be a concern.

To avoid this, you can check your privacy settings and withdraw consent to the collection and tracking of data that you don’t want. Another thing you can do is, again, using digital wallets of companies that are transparent in their privacy policy.

IV. Tips to reduce digital wallet safety risks

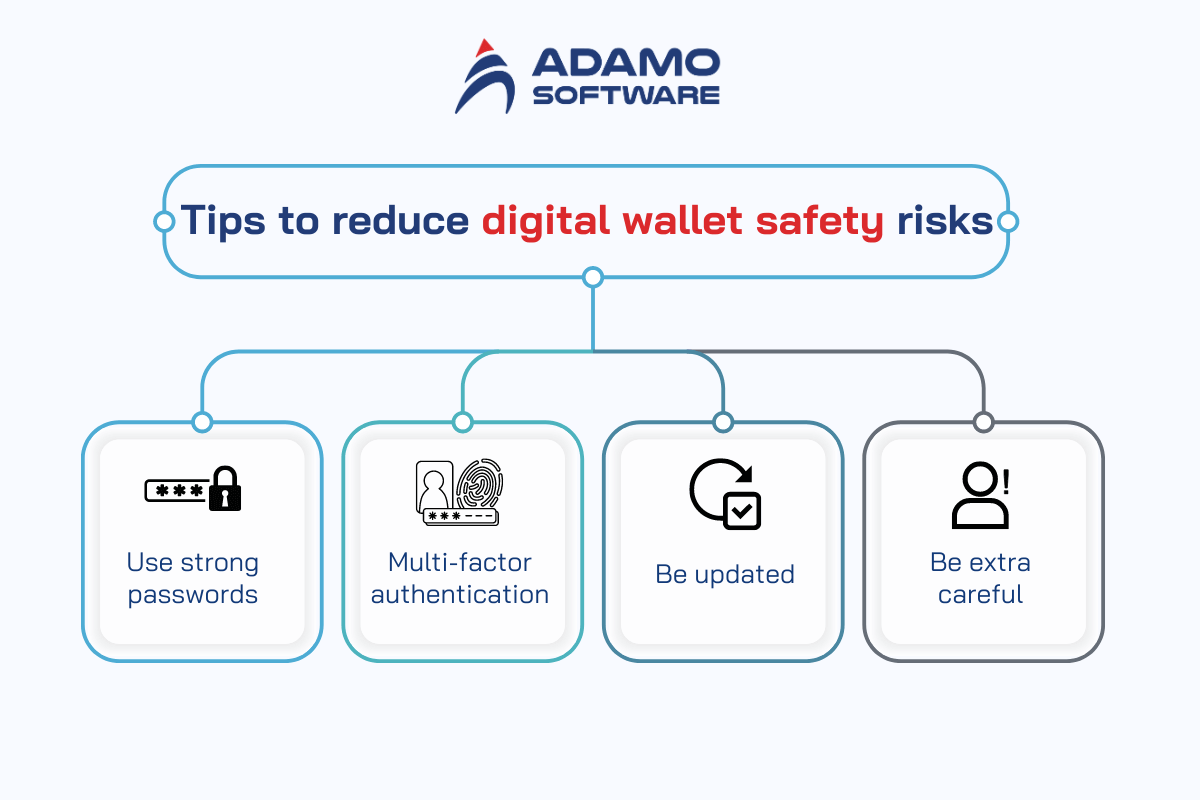

By now, you’ve gotten your response to the questions are digital wallets safe and all the risks associated with using them. It’s time to move on to some tips that you can do to keep your digital payment platform more secure:

- Use strong passwords: This is the first step that you must take to secure your e-wallets. A strong password will effectively shield you from dictionary attacks.

- Multi-factor authentication: Turn it on. A few extra steps will save you from your worst nightmare of being hacked.

- Be updated: Update your apps and phone regularly, and also update yourself on the latest security measures.

- Be extra careful: Double-check all information related to your wallet. It’s also important that you are aware of what you do with your money and in the same way, the transactions. Last but definitely not least, don’t share your unencrypted login credentials with anyone, ever.

We hope that those few tips will be helpful for you somehow in maintaining a secure environment for your e-wallet. Remember to practice them and regularly ask yourself the important question of are digital wallets safe to be proactive in everything.

V. How to enhance the security of digital wallets with Adamo Software

Since “are digital wallets safe?” becomes such a common question, it is crucial for companies to level up their security for e-wallets. Turn to Adamo Software for strengthening the protection of your digital wallets. We are a Vietnam-based software development company with many clients worldwide. We offer top-notch services that cut across the health sector, F&B, e-commerce, FinTech, and many more.

With over 6 years of operation, we have acquired various experiences creating efficient FinTech solutions to safeguard your e-wallets. Our talented teams of software engineers will assist you in implementing state-of-the-art technologies such as encryption or blockchain for the most secure environments.

More importantly, all our high-quality solutions are fairly priced with variations that suit organizations of all sizes. By outsourcing your digital wallet to us, we will ensure that your digital wallet is secure, cheaper to maintain, and easy to use.

Contact us now to start safeguarding your digital wallet solutions.