Types of digital wallets: Explore some main players in the realm of e-wallets

Today, money handling has dramatically changed due to advanced digital technologies and a faster speed of life. Among these most important options is the emergence of the digital wallet as one of the major trends. These virtual options enable users to store, transfer, and receive money without a physical wallet and other payment systems.

There are different types of digital wallets. Each has the strength to fulfill particular requirements. They become a perfect all-in-one solution for individuals and businesses. This has prompted the need to identify what kind of digital wallet to choose from, which is vital regarding money in its traditional form.

This article discusses the main types of digital wallets, the principal distinctions between digital and crypto wallets, and existing payment methods. We will also show you how to choose the right digital wallet for you and your company.

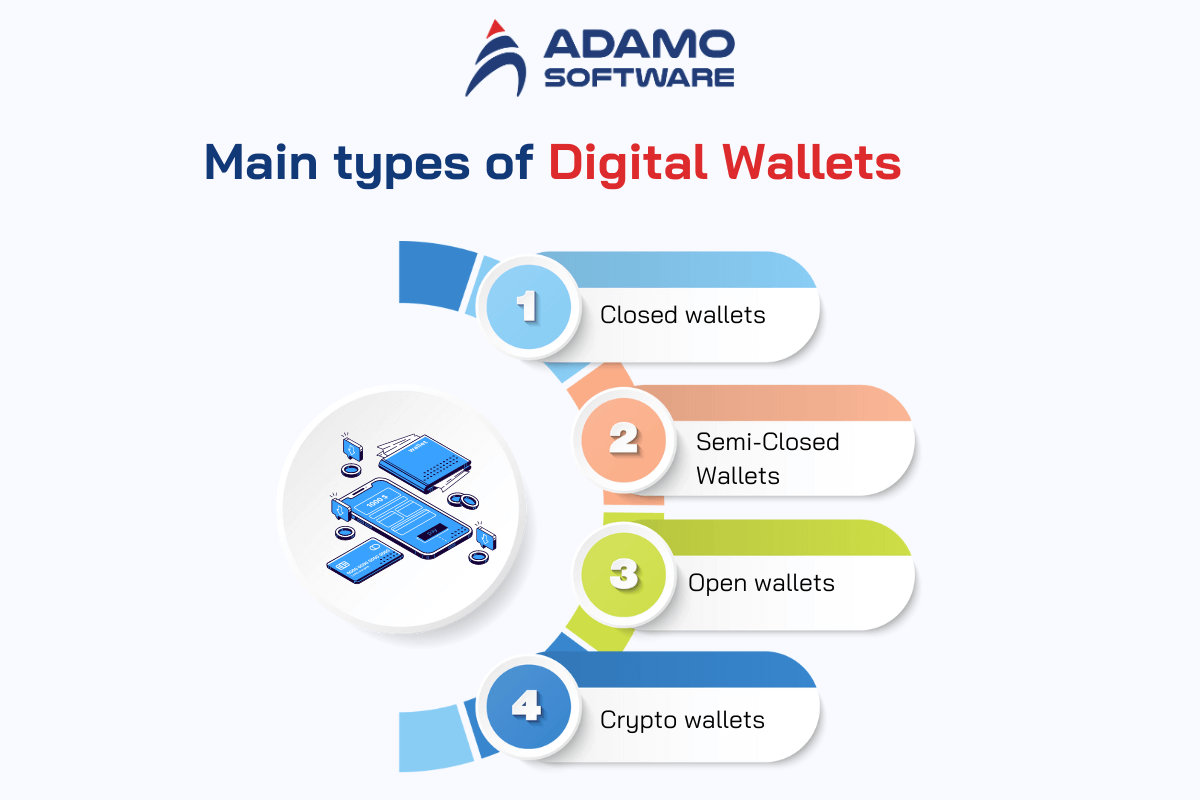

I. Types of digital wallets

Mobile payments have become preferable ways of handling and spending money, with several types of digital wallets. With this knowledge, users can choose the digital wallets that suit their needs. Here is the list of the current commonly used types of digital wallets.

1. Closed Wallets

They are individual to certain merchants and are only usable within that particular merchant’s financial network.

Key Features:

- Applicable only in transactions between the buyer and the issuing merchant.

- Very often, they are packaged with incentives or repeat business points.

- They can be made for Internet and mail orders or face-to-face transactions with the merchant.

2. Semi-Closed Wallets

The semi-closed wallet can be used for transactions with several types of merchants, but they accompany certain use restrictions.

Key Features:

- They are accepted to be used in several areas.

- Semi-closed wallets help users with flexibility over how payment can be made, among other options.

- Semi-closed wallets include paying bills and other online purchases.

3. Open wallets

The most flexible account type would be the open wallet. They are used at any merchant that accepts cards or digital means of payment.

Key Features:

- Open wallets are accepted at a large number of merchants and online stores.

- Some can be directly associated with an e-bank account or credit/debit card.

- Frees up a large pack of payment types, including P2P transactions.

4. Crypto Wallets

A crypto wallet is meant for holding crypto assets like Bitcoin and Ethereum.

Key Features:

- It facilitates legitimate storage and trading in digital currencies.

- Exists mostly in hardware form (physical) and application form.

- Offers functionalities for buying and selling coins, tokens and performing swaps.

Therefore, it is easier to choose the best digital wallet after learning about the various types of digital wallets. Understanding the types of digital wallets available helps you to select a suitable wallet that meets your requirements. Regarding a single need to transact with a specific merchant, multiple merchants, or simple discreet cryptocurrency storage.

II. Digital wallets vs. Crypto wallets: Key differences

| Aspect | Digital Wallets | Crypto Wallets |

| Purpose | Digital wallets have been applied to storing traditional money and payment methods that are in circulation. | Crypto wallets are intended for storing and utilizing other digital assets such as Bitcoin and Ethereum. |

| Currency | Accepts fiat currencies such as the US dollar and euro. | Concerns digital currencies and tokens. |

| Types | It contains closed wallets, semi-closed wallets, and open wallets. | It consists of physical hardware wallets and software ones too. |

| Usage | Purchasing goods and services online; paying bills; making in-store purchases. | Earlier utilized for purchases, sales, and exchange of cryptographic currencies. |

| Security | Usually protected by passwords, PINs, and even biometrics. | Improved security using private keys as well as the introduction of encryption. |

| Accessibility | It is incorporated into banking systems and payment processing networks. | Available and is located through blockchain networks and decentralized platforms. |

| Transaction Speed | Preferred in the case of paying for goods and services in existing payment systems. | Interactions could be slower because of the blockchain’s computation time. |

| Regulation | That operates under the principles of financial regulation and standards. | Moderated, although the extent of moderation can differ according to the country governing the various currencies. |

Therefore, although both types of digital wallets help in organizing the money, they are designed for different audiences. Digital wallets are used for conventional money-based transactions, while crypto wallets are used for cryptocurrency transactions. The sophistication of these differences makes it easier to select the most suitable types of digital wallets depending on the financial activities performed and the requirements made.

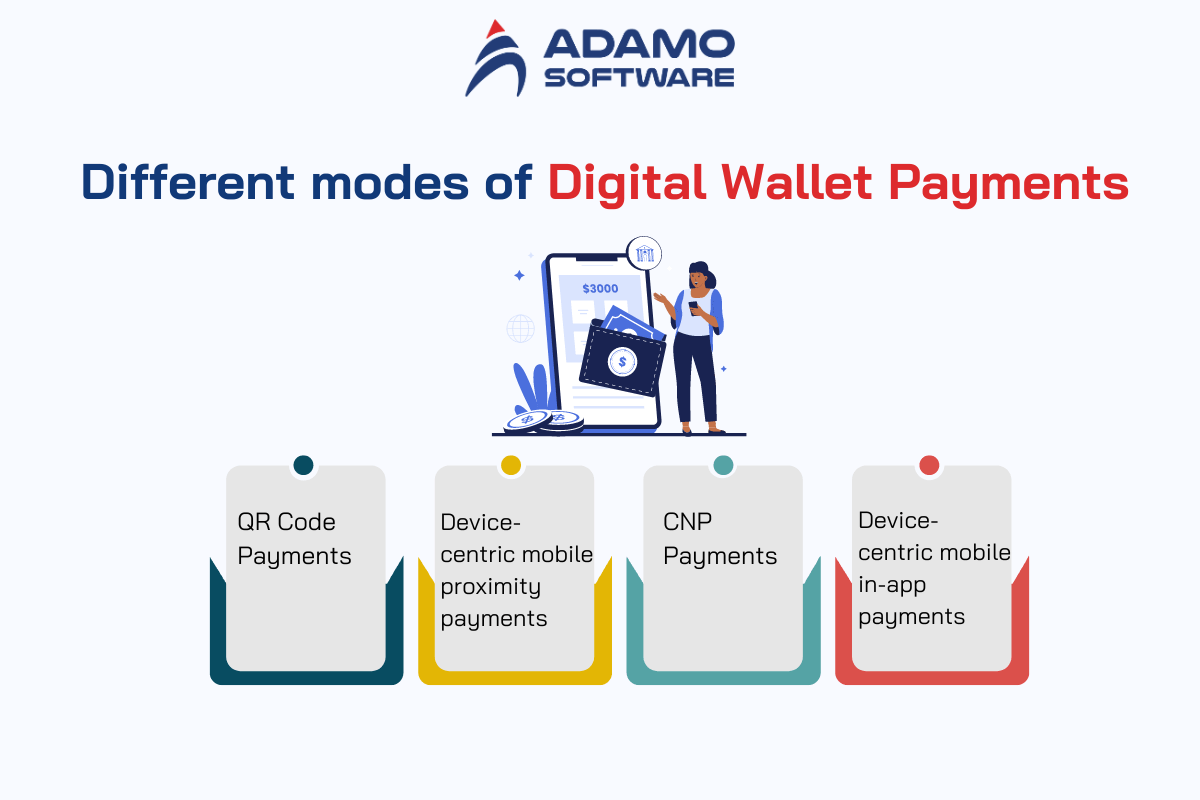

III. Different modes of digital wallet payments

It is vital to know the various forms of payment to enable the effective use of digital wallets. All these modes provide quite different advantages, increasing the level of convenience and security for users. Below are the major types of digital wallet payments that you ought to understand.

1. QR Code Payments

The QR code payment method is flexible and is used in most digital wallets as one of the options. These payments use the mobile device to scan a two-dimensional code while transacting. QR codes are easy as they are flexible with most devices and browsers.

Key Features:

- Real-time payment processing.

- Compatible with most wallet apps.

- Some common types of payments include Google Pay, which is supported by several digital wallet platforms.

2. Device-centric mobile proximity payments

Mobile proximity payments focusing on devices are those that employ Near Field Communication (NFC) as enablement technology. Customers just place their mobile devices close to the POS terminal to execute a payment. This method entails using NFC-enabled gadgets and cards.

Key Features:

- The instant payment method while making purchases in a physical store.

- A secure payment method through NFC.

- It is easy for users who do not want to contact physical money.

3. Card-Not-Present (CNP) Payments

With a card-not-present payment solution, users can make payments where physical cards are unnecessary. It involves storing card information used to complete the transactions, and the need to input the data repeatedly is eliminated. It is geared toward online shopping and other transactions that do not require physical card handling.

Key Features:

- Streamlined checkout process.

- Correct storage of the card information.

- Timesaving for those who often shop online while ordering products at Amazon.

4. Device-centric mobile in-app payments

Mobile in-app payment is a payment system where a consumer pays for goods and services through a digital wallet in a mobile app. Such payments employ EMV Payment Tokenization, where credentials are stored in the mobile device or cloud. Device-centric mobile in-app payments allow buying items within an app without typing the card details.

Key Features:

- Tokenization: They use it to increase security measures implemented in their systems.

- Compatibility with mobile apps without any interface jump.

- If only a user constantly spends on an in-app purchase, he/she can go for it.

The mentioned types of digital wallet payments show the effectiveness of the technological advancement of digital wallet payments. This paper has looked at the various types of digital wallets and payment methods available. Therefore, the business and users will have a better way of selecting the best solution to improve their payment methods.

Also read: Are digital wallets safe? Secrets to safeguarding your digital payment

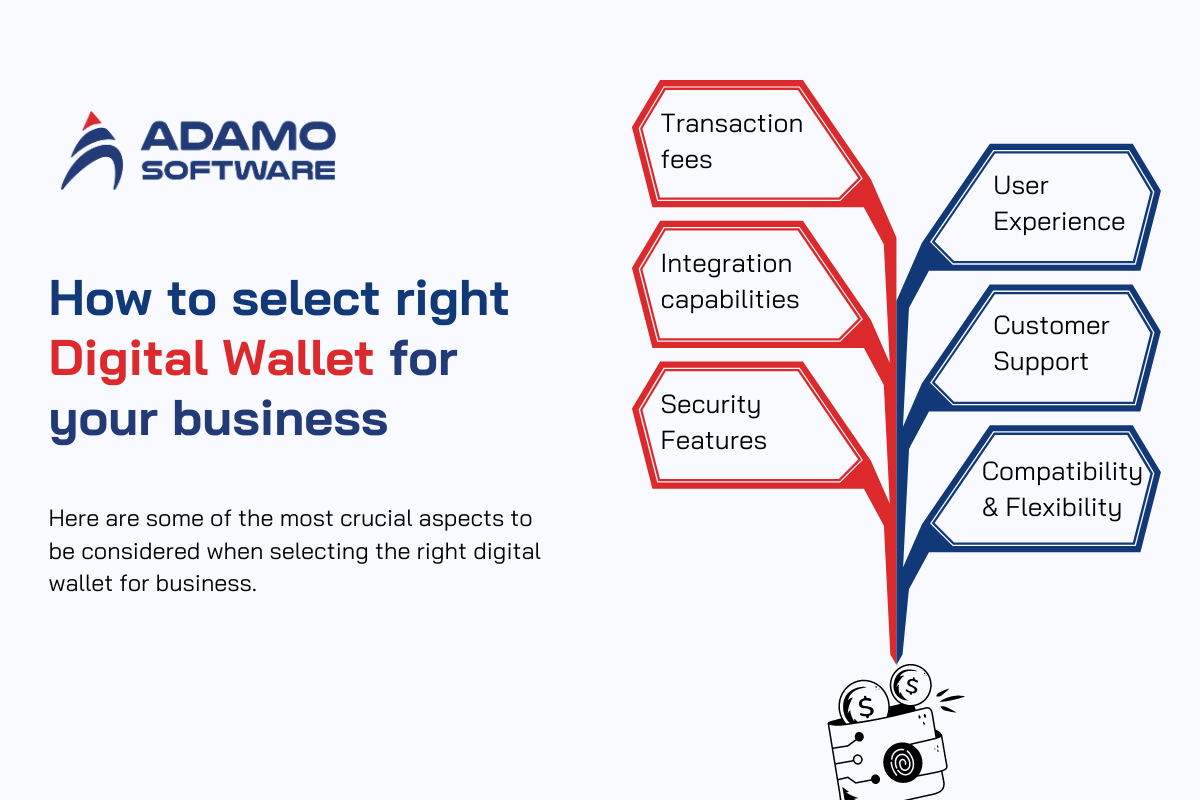

IV. How to select the right digital wallet for your business?

You must select the appropriate digital wallet to facilitate sound and secure financial processing for your company. There are several types of digital wallets. Choosing the right one for your business operations can improve organizational performance and customer experiences. Here are some of the most crucial aspects to be considered when selecting the right digital wallet for business.

1. Transaction Fees

There are various types of digital wallets, and they have charges regarding the transactions they process. When choosing a wallet, one must look at the fee structure of every wallet and decide if it fits their budget. There are also merchant wallet options that attract some charges, especially in completing your transactions. These will add to your costs.

2. Integration capabilities

Make sure the wallet you select can easily work with your existing systems and platforms of payment. Integration can also help you solve problem areas with your payments and make it easier for you in terms of operation. Consider wallets that enable links with online merchants and other POS assets.

3. Security Features

Protection issues are the most important criteria when choosing a digital wallet. Compare the level of security provided by different types of digital wallets, such as encryption, multi-factor authentication, and isolated fear of fraud. An optimum wallet will shield the data and the transactions that involve cash from the dark web danger.

4. User Experience

Think from the user’s perspective for both your side and your customer. Another aspect that needs to be focused on and developed is the functionality and clear layout. An impressive product will increase the product engagement frequency of customers.

5. Customer Support

Sustained customer help support is critical for providing solutions concerning any complications that frequently develop. Select a digital wallet service provider who has friendly and reliable customer care support whenever there is a technical issue or if you have any questions.

6. Compatibility and Flexibility

Vary the devices, such as smartphones, and operating systems you use to test digital wallet compatibility. Policies concerning payments and allowances for multiple currencies also come in handy. When operating in different jurisdictions or dealing with customers from other countries.

Therefore, these are the major factors that must be considered in choosing the right digital wallet for business. By doing so and getting more informed about the types of digital wallets, one can arrive at the right decision that can meet the business needs and, in turn, improve the way of carrying out financial transactions.

V. Notable examples of digital wallets

Some of the most adopted digital wallets globally include the following remarkable characteristics: these types of digital wallets vary with each other and provide additional features and services to fit these requirements. The following are some of the conspicuous samples that you must make use of.

1. PayPal

PayPal is an international platform considered one of the most widely used digital wallets. It enables users to pay bills online, transfer money, and purchase from millions of merchants globally.

Key Features:

- Compatibility with internet selling platforms.

- Accepts different currency types and wide payment options.

- Entails buyer protection as well as seller protection.

2. Apple Pay

Apple Pay is a mobile payment platform for iPhone users that allows them to make payments through their iPhone, Pad, or Apple Watch.

Key Features:

- Apple Pay is integrated with contactless payments, especially through Near Field Communication, or NFC.

- Blends right into the Apple environment for a well-oiled operation.

- It also provides a higher level of security by verifying the user through recognition of his face.

3. Google Wallet

Google Wallet now Google Pay is one of the options for Android for integrated digital wallets. Tangible and digital are both types of payments that are accepted by it.

Key Features:

- Google Wallet is compatible with the Google services and applications.

- It can be paid through contactless payment and the Internet.

- It ensures the payment process is safe and easy.

4. Samsung Pay

Samsung Pay is specific to Samsung devices. It can make payments via Near Field Communication and its technology, Secure Transmission.

Key Features:

- This type of digital wallet is compatible with most payment terminals.

- It provides possible reward schemes and cash-back features.

5. Venmo

Venmo is a peer-to-peer digital wallet offered by the PayPal company specializing in social payment methods.

Key Features:

- Venmo enables the instant transfer of money between users.

- Organizes payments’ sharing features to support social features for sharing.

- Accepts different kinds of payments, such as banks and credit cards.

Finally, the above-highlighted digital wallets give an idea about the versatility and options available in these digital wallets. Both provide special services, including safe mobile payments and flexible Internet purchases. It is easier to opt for a specific digital wallet after analyzing the examples that relate to one’s preferences and financial operations.

VI. Experience the cutting-edge digital wallet solutions with Adamo

Adamo provides enhanced solutions concerning digital wallets, giving superior variants that meet various customer requirements. Since the evolution of several types of digital wallets. The firm is positioned at the forefront to incorporate technologically advanced methods into the digital wallet systems.

Adamo Digital Wallet is a technology and solution that provides a more convenient and secure use. Adamo guarantees that the types of digital wallets we produce conform to the highest standards of efficiency and convenience. This is well suited for all possible payments, whether through QR codes or contactless mobile payments by NFC.

Key Features of Adamo’s Digital Wallet Solutions:

- Comprehensive Integration: Adamo’s solutions can work with types of digital wallet to maintain integration with the existing platforms.

- Enhanced Security: Our platforms have adopted enhanced security features to ensure the safety of data and transactions.

- User-Friendly Design: Adamo also aims to make the necessary interface friendly for the users regarding handling the new wallets.

- Customizability: Different businesses can adopt Adamo’s solutions concerning the usage and management of digital wallets.

When deciding on a digital wallet supplier, businesses get some of the most complex types of digital wallets. Adamo has a deep knowledge of digital wallet technology. Users can enjoy the most advanced options and strong security with continued advancements in digital wallets. Adamo also continues to deliver product and service innovations that align with trending trends and technologies.