Fintech App Development Cost: How to Estimate

The growth of the Fintech app has revolutionized the financial services industry, becoming a multi-billion dollar sector in the process. The breakthrough of this technology has enabled financial institutions to offer new and innovative services to their customers, leading to exponential growth in this sector.

According to Mordor Intelligence, the Global Fintech Market is expected to reach $608.35 billion by 2029, growing at a CAGR exceeding 14%. These dynamics are driving innovation and expanding Fintech adoption in industries around the world.

Estimating the cost to develop a Fintech application is not fixed and specific because it is based on the different requirements of each business. Therefore, Fintech app development cost can be affected by many factors.

Suppose you are planning to build Fintech apps but have not determined the cost. Let Adamo help you consider the key factors affecting Fintech app development cost, as well as the estimated costs for each different type of Fintech app.

I. Factors Affecting Fintech App Development Cost

Fintech app development cost is influenced by several factors. From complex technical issues to regulatory considerations, these factors are important in shaping the total cost of Fintech application development.

In this section, we will look at the factors influencing the cost of Fintech application development.

1. Number and complexity of features

The complexity of a Fintech app’s features plays an important role in determining costs. The cost of developing Fintech apps with basic functions like checking account balances is often lower than complex apps that integrate advanced features such as investment tracking and AI-based analytics.

2. Choose a development platform

Choosing a development platform is another important factor that affects Fintech app development cost. For instance, opting for native app development, where separate applications are built for iOS and Android, will have a higher cost of building a Fintech app than cross-platform development, using frameworks like React Native or Flutter to create the unified code base for both platforms.

Adamo Software app development services will help reduce the time and cost of creating a Fintech app by up to 50%, providing a more universal solution that can work on many different platforms.

3. Security measures

Another factor that significantly affects Fintech app development cost is security measures. Basic security tools like username/password authentication are less expensive than advanced security features like biometric authentication, secure API connections, etc.

Additionally, data encryption and privacy measures also affect costs. Implementing basic encryption protocols to secure user data is more cost-effective than combining advanced encryption with advanced algorithms and strict privacy controls for the Fintech app.

4. Integration with financial institutions

Integration with financial institutions can significantly affect Fintech app development cost for your business. Linking to external financial services for fundamental transactions is less expensive than advanced integration, including interaction with multiple banks, payment gateways, or investment platforms.

5. Custom UX/UI design

Custom. UI/UX design contributes to Fintech application development cost. While designing for a standard Fintech app may be low cost, choosing a custom app design with unique elements, animations, and an intuitive interface will increase the Fintech app development cost.

6. Compliance with regulations

Regulatory compliance is an important factor that you should consider if you want to develop a Fintech app. Maintaining a broader regulatory has a cost affect, as they need to meet stringent standards for security, data protection, and financial services, including meeting specific regulatory requirements such as GDPR, PCI DSS, or regional regulations.

7. Integrate payment gateway

Integrating payment gateways such as Stripe and Braintree are an important factor affecting Fintech app development cost. Basic integrations support standard payment methods like credit cards, wire transfers, and PayPal, which are less expensive than advanced integrations, and include multiple payment options, subscription models, or even cryptocurrency financial transactions.

8. Complexity of back-end development

The complexity of backend development also affects Fintech app development cost. A simple backend with a main server setup and database management will be less expensive than a complex backend designed to handle extensive data and user interactions strongly.

9. Technology stack

The choice of technology stack plays an important role in Fintech app development cost. Using standard technologies (e.g. popular programming languages and frameworks, 3rd party APIs, databases, etc.) is often more affordable than implementing new technologies emerging like blockchain or machine learning.

10. Testing and quality assurance (QA)

Testing and quality assurance are an integral part of the development process and affect Fintech app development costs. Basic testing for functionality and security is less costly than comprehensive testing that includes usability, performance, security, and regulatory compliance.

11. Location of the app development team

The location of the app development team affects Fintech app development cost. Hiring local app developers may incur higher labor costs compared to engaging an offshore IT sourcing team from regions with lower labor costs. For example, hiring Fintech developers from the US may cost you $100 – $200 per hour, but Fintech specialists from Asia will ask you for $20 – $50 per hour.

12. Team structure

The structure of the development team is an important factor affecting Fintech app development cost. An effective team can include professionals with a wide range of skills, experience, and industry expertise. However, you can use IT sourcing if you don’t need the whole team but only need a few specific experts to save costs. This approach enables you to attract individual experts with the necessary Fintech expertise.

II. Types of Fintech Applications and Estimated Cost

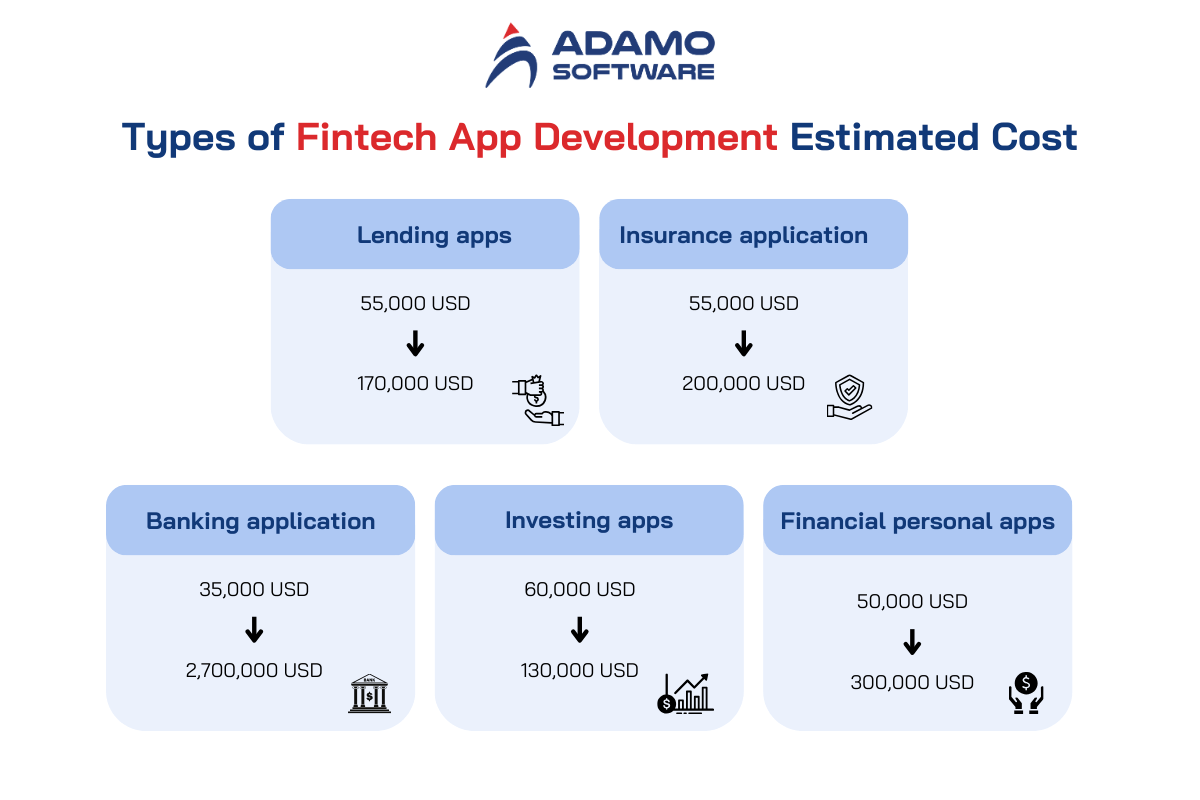

There are different types of Fintech apps and the estimated cost depends on the type of application. Let’s take a detailed look at the estimated costs of some types of Fintech apps such as lending applications, insurance applications, banking applications, investment applications, and personal finance applications.

1. Lending apps

Currently, lending applications are rapidly developing. This application can provide customers with financial solutions through a faster and more accurate process. Intelligent systems that verify and authenticate identities use AI and machine learning techniques to produce error-free results.

As technology is used in lending, it will be easier to estimate income projections, evaluate borrower history, and calculate collateral value.

The estimated cost to develop a Fintech lending application will range from 55,000 USD to 170,000 USD.

2. Insurance application

Insurance Fintech companies are currently working to digitize and transform their services. Through this insurance application, businesses can provide reasonable insurance policies with variable prices.

Insurance companies can create insurance applications for their customers or agents. Once the insurance application has been installed, the end user can access policies across multiple lines. It makes interaction and communication faster and simpler. It also provides users with faster request processing, resulting in quick deal closure.

The estimated cost to develop an insurance Fintech app development cost is between 55,000 and 200,000 USD.

3. Banking application

Digital or Internet banking applications offer all kinds of online financial solutions. Banking apps can provide many core banking services such as creating an account, checking account numbers and balances, savings, loans, credit cards, and other services. Users no longer need to go to a branch to handle any problem because Fintech banking applications can handle it.

In addition, another mobile finance application that is capable of providing various banking services to users and operates exclusively through mobile online channels, without a traditional physical branch network is Neobank. This bank is very concerned about customer experience because all operations are carried out using technology.

Depending on the level of complexity, a Fintech banking application can cost an estimated $35,000 to $2,700,000.

4. Investing apps

The investment application allows users to invest in a variety of services. Certain businesses, such as mutual funds, may develop investment software tailored to their target audience. Other investment solutions include trading apps, cryptocurrency exchanges, and similar platforms.

It is important to understand that developing these applications can increase your overall budget. You should also consider implementing features like real-time credit score tracking, EMI calculator, data analytics, etc.

The price range for Fintech investment app development is from 60,000 to 130,000 USD.

5. Finance Personal Apps

Personal finance applications enable users to manage their finances easily and seamlessly. People may monitor their income and outlays, create a budget, and make sure they follow it. These apps serve as personal diaries for keeping track of all financial transactions.

The estimated cost to build a personal finance app is typically between $50,000 and $300,000.

Also read: Fintech cybersecurity: How to construct safe Fintech solutions

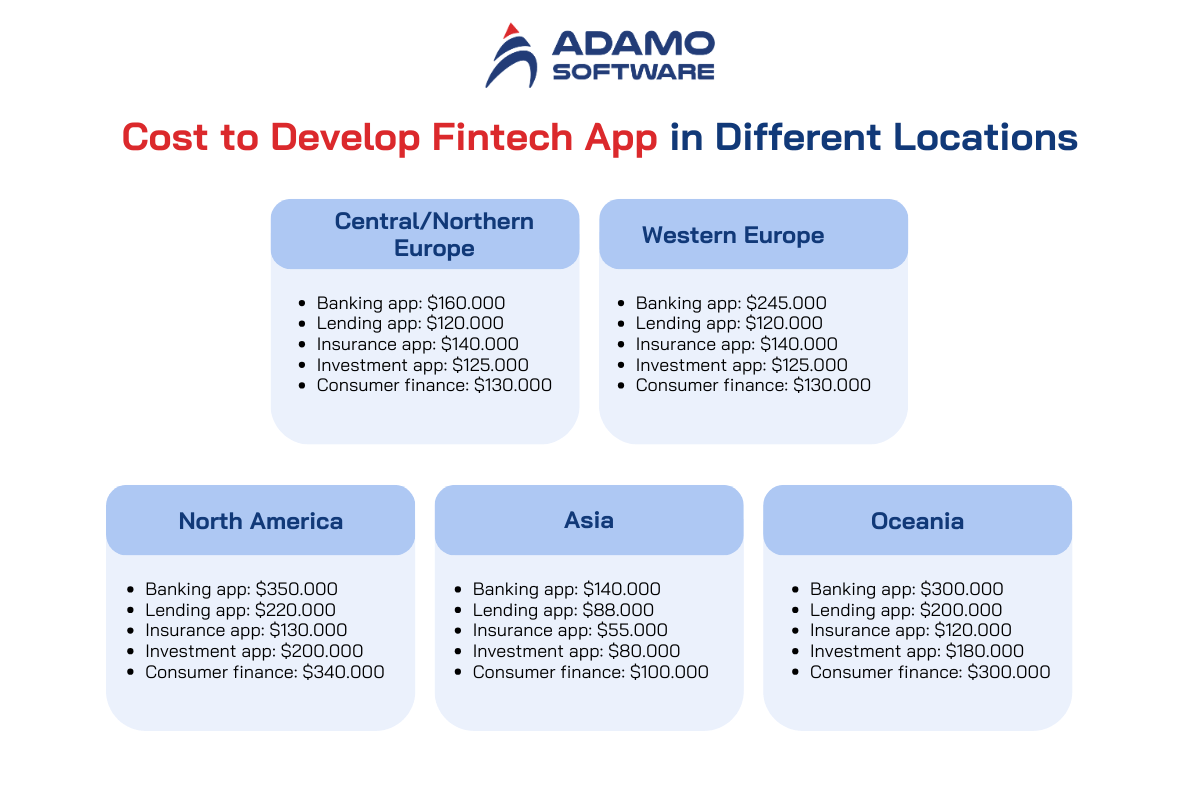

III. Fintech App Development Cost Breakdown by Location

Besides estimating the cost to develop a Fintech app by its type. The cost can also change drastically based on location.

Hiring local developers for your in-house team to work directly or remotely can take time and cost to train. Also, you will be fully responsible for the project results when you choose to develop an in-house team for your company.

If you want to save some budget, you can consider finding Fintech app developers locally or offshore. With this approach, you won’t incur additional costs such as renting office space or purchasing hardware, and you won’t need to be responsible for product management and distribution.

However, Fintech app development cost estimation can differ from country to country, ranging from $350,000 in North America to $140,000 in Asia regions.

We’ve analyzed Fintech app developers’ rates in different regions and estimated the cost of developing the Fintech app mentioned above.

– Cost to develop Fintech app in different areas

1. Central/Northern Europe

Banking app: $160.000

Lending app: $120.000

Insurance app: $140.000

Investment app: $125.000

Consumer finance: $130.000

2. Western Europe

Banking app: $245.000

Lending app: $120.000

Insurance app: $140.000

Investment app: $125.000

Consumer finance: $130.000

3. North America

Banking app: $350.000

Lending app: $220.000

Insurance app: $130.000

Investment app: $200.000

Consumer finance: $340.000

4. Asia

Banking app: $140.000

Lending app: $88.000

Insurance app: $55.000

Investment app: $80.000

Consumer finance: $100.000

5. Oceania

Banking app: $300.000

Lending app: $200.000

Insurance app: $120.000

Investment app: $180.000

Consumer finance: $300.000

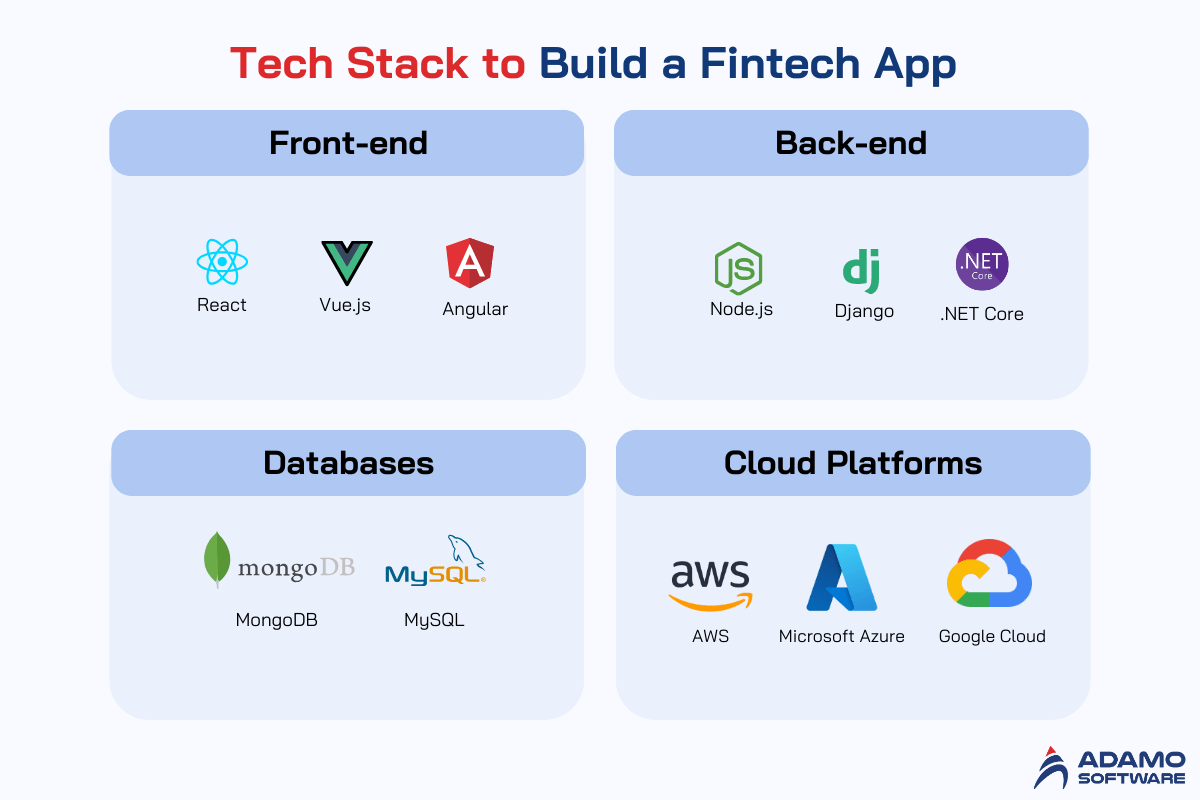

IV. Tech Stack to Build a Fintech App

If you plan to develop a Fintech app, the tech stack is one of the most important factors to consider during the development process. In this section, we will discuss the tech stack for Fintech application development that you can refer to:

1. Programming Languages:

Java:

– Key Characteristics: Object-oriented, platform-independence nt, robust with a strong ecosystem

– Advantages: High-performance, scalable, and extensive collection of open-source libraries.

– Use Cases: Enterprise-level applications, banking, and financial services systems.

Python:

– Key Characteristics: Dynamic, high-level, interpreted; extensive support for numerical and financial libraries.

– Advantages: Easy syntax and rapid development, strong in data analysis and machine learning.

– Use Cases: Backend services, data analysis, algorithmic trading, machine learning.

C#:

– Key Characteristics: Simple, modern, object-oriented, type-safe programming language.

– Advantages: Integration with .NET, strong memory management, good for Windows platforms.

– Use Cases: financial services applications, desktop applications, and games.

2. Frontend Frameworks

React

– Key Characteristics: JavaScript library to build user interfaces; component-based.

– Advantages: High performance, reusable components ts, and large community support.

– Use Cases: Dynamic web apps, single-page applications (SPAs), and mobile apps.

Angular

– Key Characteristics: TypeScript-based open-source web application framework: MVC architecture.

– Advantages: Two-way data binding, comprehensive solution, suitable for large-scale projects.

– Use Cases: Enterprise-level web applications, SPAs, and dynamic content apps.

Vue.js

– Key Characteristics: Progressive JavaScript framework for building UIs; easily integrable.

– Advantages: Lightweight, easy to learn, reactive data binding.

– Use Cases: Single-page applications, web interfaces, lightweight projects.

3. Backend frameworks

Node.js

– Key Characteristics: JavaScript runtime is built on Chrome’s V8 JavaScript engine, an event-driven, non-blocking I/O model.

– Advantages: Scalable, supports thousands of concurrent connections, and fast execution.

– Use Cases: Real-time applications, microservices architecture, and web APIs.

Django

– Key Characteristics: High-level Python web framework; encourages rapid development and clean, pragmatic design.

– Advantages: Secure, scalable, and comprehensive, including ORM for database operations.

– Use Cases: web applications, data-driven applications, CMS systems.

.NET Core

– Key Characteristics: Cross-platform, open-source, managed framework for building various types of applications.

– Advantages: Versatile, high-performance, supported microservices and cloud applications.

– Use Cases: Web APIs, microservices, serverless functions, cloud apps.

4. Databases

PostgreSQL

– Key Characteristics: Open-source, object-relational database system; ACID-compliant.

– Advantages: Advanced features, strong integrity, extensible.

– Use Cases: Complex queries, financial records, and data warehousing.

MongoDB

– Key Characteristics: NoSQL database; document-oriented, high performance, high availability.

– Advantages: Scalability and ease of use with dynamic schemas.

– Use Cases: Big data applications, content management, real-time analytics.

MySQL

– Key Characteristics: World’s most popular open-source database: reliable, scalable, and easy to use.

– Advantages: Cost-effective, widely used, and tested strong community support.

– Use Cases: web applications, online transactions, e-commerce sites.

5. Cloud Platforms

AWS

– Key Characteristics: Comprehensive and evolving cloud computing platform provided by Amazon.

– Advantages: A broad set of tools, global presence, and flexible pricing.

– Use Cases: Web hosting, big data storage, and analytics, serverless computing.

Azure

– Key Characteristics: Cloud computing services for building, testing, deploying, and managing applications.

– Advantages: Seamless integration with Microsoft products and hybrid cloud capabilities.

– Use Cases: Enterprise applications, IoT applications, AI, and machine learning.

Google Cloud

– Key Characteristics: A suite of cloud computing services running on the same infrastructure as Google.

– Advantages: High-performance infrastructure, data, and analytics, machine learning.

– Use Cases: Data analytics, machine learning projects, scalable web applications.

V. Native vs. Hybrid Fintech App Development Cost

Native apps are applications suited for a specific operating system. While hybrid apps can work on multiple operating systems.

A native app is created using programming languages such as Java for Android app development, Objective-C, or Swift for iOS app development. Hybrid apps are built using web technologies like JavaScript, CSS, and HTML, then wrapped in a native container to allow them to run on multiple platforms.

However, building a native app can be a bit expensive because you will need two code bases for Android and iOS. Hybrid apps can have limitations in user experience and performance, especially for complex solutions.

All app development companies charge more for Hybrid apps than for Native apps.

Below are the costs of developing solutions for different operating systems:

– Combined application cost: $80,000

– Android application price: $50,000

– iOS app price: $60,000

VI. How Much Does It Cost to Start a Fintech Company with Adamo Help

Today, businesses choose to invest in fintech application development services because of the great benefits it brings. However, starting a Fintech company can cost a huge amount of money.

As a leading mid-sized software development company in Vietnam, Adamo excels in providing software development services ranging from mobile applications, web-based enterprise solutions, AI development services, and Blockchain to web application solutions.

Adamo is experienced in creating high-quality Fintech applications, customized to customer needs. Our experts are highly trained and experienced in their field and will ensure they meet all your requirements. Additionally, we take advantage of an in-depth understanding of banking and financial systems to provide cutting-edge and sustainable solutions and help you build a Fintech company at a reasonable cost. If you are planning to start your own Fintech company, please feel free to contact our team.