Cryptocurrency exchange development cost: Considerations for startup

The cryptocurrency market is vast and growing, so there is massive interest in startups entering this market. The first and fundamental is to create a cryptocurrency exchange that works within the scope of a specific enterprise. However, realizing the cryptocurrency exchange development cost is the key to achieving this. This enables startups to forecast their expenditures and manage them. They can identify areas where they never thought they would spend their money.

Cryptocurrency exchanges refer to the marketplace where users can exchange their cryptocurrencies with others or trade in. Creating such platforms is complex and has many aspects that determine its cost. The cryptocurrency exchange development cost also depends on various aspects and levels, from the security features to the final information. By identifying such factors, different businesses can manage their costs effectively and stick to the prepared budget.

Here we will dive through every starting company aspect of the cryptocurrency exchange development cost, what affects it, and how to cope with it.

I. What is a cryptocurrency exchange?

A cryptocurrency exchange is a centralized marketplace or an interface where customers can purchase, exchange, or sell virtual currencies. Its major function is to facilitate the goods’ exchange through purchasing and selling through safe and efficient means. They can also be classified according to their level of centralization. This involves the involvement of the platform’s owner or authority figure in the commodities exchange or digital asset and decentralization. They are where the user-to-user exchange is.

The main services include real-time price quotations, the order book, and managing digital asset wallets. The design and features combined with the security level are directly proportional to the cryptocurrency exchange development cost. These elements are needed for a startup to understand how each works to create the right budget plan. In other words, understanding what a cryptocurrency exchange is enables businesses to gain insight into the cryptocurrency exchange development cost.

To translate this foundational understanding into a practical execution roadmap, businesses should follow proven Guidelines for successful Cryptocurrency Exchange Software Development to ensure regulatory compliance, security resilience, and sustainable platform performance.

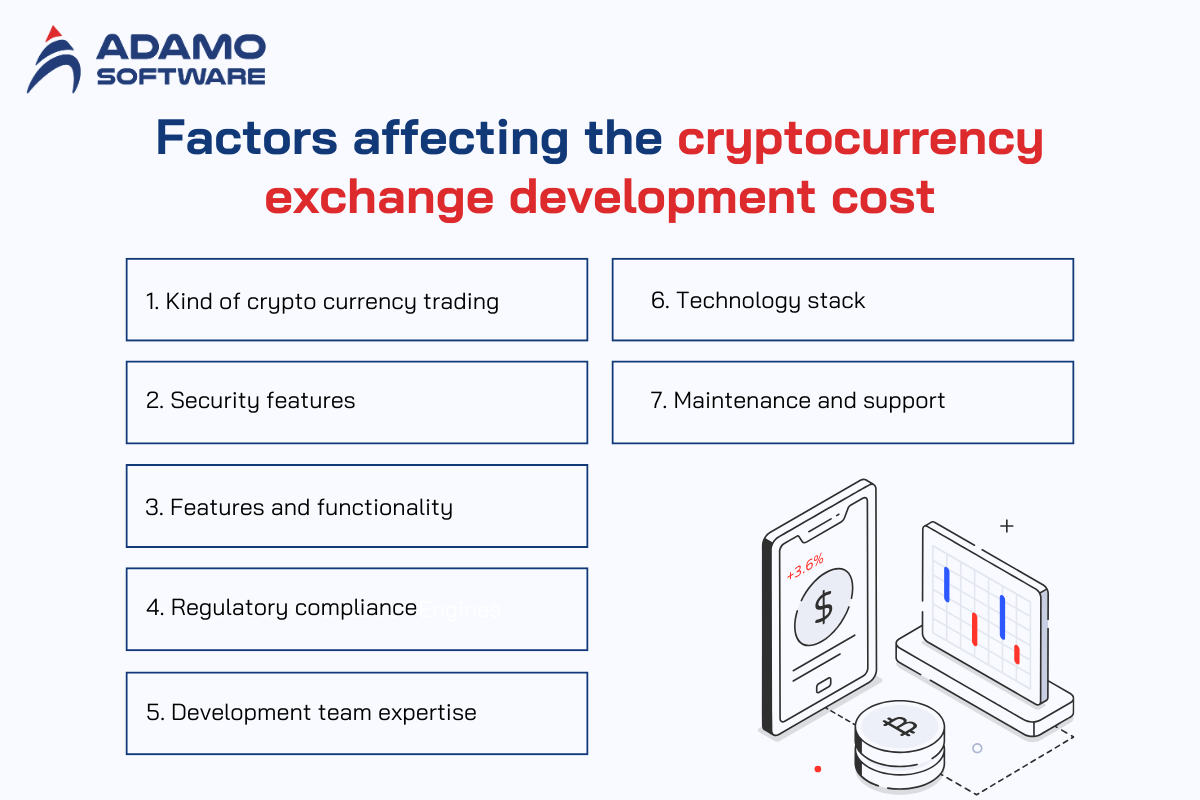

II. Factors affecting the cryptocurrency exchange development cost

The cryptocurrency exchange development cost depends on the following parameters that define the platform’s depth, safety, and capacity. Understanding these elements helps startups know that the exchange has to meet users’ needs and expectations at the least cost possible. Below are the primary factors that affect the cryptocurrency exchange development cost in detail:

1. Kind of Crypto Currency Trading

The type of exchange you choose to develop plays a significant role in determining the overall cost.

- Centralized Exchanges (CEX): They are centralized systems where user accounts, order books, and transaction processing are governed by a specific control. Centralized exchanges always operate on secure servers, maintain the centralized databases, and perform user management. They all need more resources, especially the security of the money. This substantially increases the cryptocurrency exchange development cost.

- Decentralized Exchanges (DEX): Decentralized exchanges enable persons to trade directly from one to the other without passing through middlemen. In the present world, establishing a DEX needs the incorporation of smart contracts, blockchain solutions, and liquidity solutions. DEX platforms are often more difficult to develop primarily because of their blockchain technology. They boost the cryptocurrency exchange development cost.

- Hybrid Exchanges: These markets share both the characteristics of CEX and DEX markets. Hybrid exchange would be even more liquid and secure compared to fully centralized or decentralized exchange. They would need better technical advancement to make it feasible, making up overall costs.

2. Security Features

Safety is one of the most significant barriers to using any virtual currency trading platform. Users want an environment where their assets will not be lost or easily accessed by someone else. Incorporating extra layers of security measures influences the cryptocurrency exchange development cost. However, without hacking, break-ins, and possible fraudulent activities are career- precautions. Key security features include:

- Two-Factor Authentication (2FA): This feature augments the above rundown with an enhanced security measure. They involve users authenticating themselves using another layer, like a mobile number pin.

- Encryption: Data encryption is for the safety of information such as login credentials or other critical transactions. Effective measures of protecting resources require additional time and funds, which will affect the development time and cost.

- Cold Storage: Most user funds are stored in cold storage in most secure exchanges. Solving a cold wallet presents a much higher cost than solving a hot wallet but is essential to safety.

- Anti-DDoS Measures: Other potential threats include a distributed denial of service (DDoS) that severely disables an exchange. It floods the target with traffic. It is crucial to build protection against such attacks, which are becoming constant.

While each of these security measures increases the cryptocurrency exchange development cost, they are essential for the sustainability and reliability of the platform.

3. Features and Functionality

The aspects of features and functionalities that you set with your vision will directly determine how long it will take or how much it will cost you to develop it. Key features that influence the cryptocurrency exchange development cost include:

- Real-Time Trading: Real-time charts, order matching engines, and dynamic market price reflection necessitate a high programming level. This contributes to higher development costs.

- Multiple Payment Gateways: Integrating payment gateways enables users to perform transactions across different currencies and payment types, boosting the costs. These gateways can be credit cards, bank transfers, and e-wallets.

- User Interface (UI) and User Experience (UX) Design: Ease of use with a good graphic interface design ensures people use the site. However, designing and developing the perfect UI/UX will take time and higher prices.

- Multi-Currency Support: The exchange will support several cryptocurrencies or fiat currencies. However, it consumes more time in the functions’ development, such as currency exchange. Besides, there will be a multi-wallet system and exchange approximation.

- Liquidity Management Tools: Liquidity becomes paramount for any exchange so users can effectively place orders to buy and sell assets. This is because automating demand and supply for liquidity also increases costs by establishing systems.

4. Regulatory Compliance

It also costs considerably to meet the local and international regulations, more so for centralized exchanges. Various countries have banned cryptocurrency trade but continues to be traded. This leads to legal problems. Key compliance-related costs include:

- KYC (know your customer) and AML (anti-money laundering): Bylaws in most jurisdictions demand that cryptocurrency exchanges identify their users to block such illicit operations. One primary difficulty connected with KYC/AML is third-party verification services in the cryptocurrency exchange development cost.

- Legal Fees: Seeking assistance from the legal department to ensure the platform meets the governments’ requirements of different countries and regions. This can pull up the price any further. The requirements of one country for data protection, taxes, and security might differ entirely from those of another country.

5. Development Team Expertise

The expertise and location of the development team have a direct impact on the cryptocurrency exchange development cost:

- In-House Team: Employing an internal team of blockchain developers, UI/UX designers, and security personnel may be more costly than outsourcing. This is especially true in areas of core demand for such personnel.

- Outsourcing: Most startups, when developing a product, hire a team from another country with lower rates. However, the organization must choose a competent team with experience in developing blockchain systems and cryptocurrency exchange. The low experience of the team that you outsource your operations could lead to more long-term costs due to delays or technical challenges. Even though outsourcing could mean high costs within the project’s first years.

- Development Time: The complexity of the exchange directly determines the amount of time needed to develop it. A highly secure and rich-featured platform will require time to be developed. Therefore, it increases the general cost.

6. Technology Stack

The cryptocurrency exchange’s technology stack also impacts the cost estimation used to build the software. Optimizing certain aspects of the backend often leads to improvements in scalability or security but also increases cost. They can be the programming language, blockchain, or database management system. Picking the right technology stack for optimal functionality is an important component of the cryptocurrency exchange development cost.

7. Maintenance and Support

The expenses involved after the launch are maintenance and support, which many new companies fail to factor in. Daily updates, correcting bugs, and constant support are indisputable demands required. They maintain the work of the exchange at the highest level of protection. Such costs must therefore be accrued to the total cryptocurrency exchange development cost.

As a result, the cryptocurrency exchange development cost depends on such factors as mentioned. The same factors should therefore be well understood, as startups aim at having an effective and secure exchange that is also affordable.

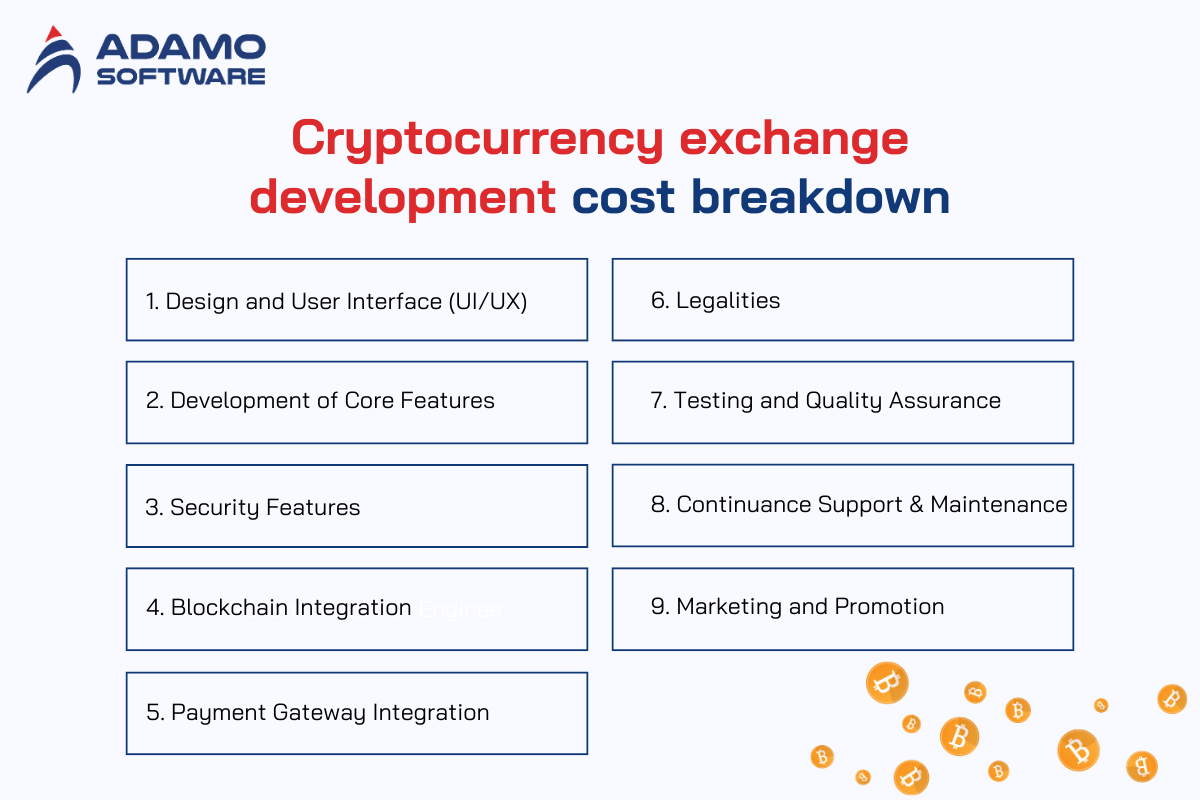

III. Cryptocurrency exchange development cost breakdown

It is crucial for startups to correctly predict the expenses they will incur while developing a cryptocurrency exchange, as it will help them get started. The total cost includes several factors associated with the construction of the exchange platform, its initialization, and sustenance. Every component increases the overall expenditure by a given amount. Therefore, you should be aware of how your money will be distributed. Below is a detailed breakdown of the factors influencing the cryptocurrency exchange development cost:

1. Design and User Interface (UI/UX)

To prevent users from struggling or getting frustrated, the design of the user interface is important. The cost of UI/UX design depends on the complexity of the design of the interface and the extent of differentiation required. A clean design will be cheaper than a tasteful design with many functions and options. UX design also emphasizes the simplicity that is required for the platform. This might also take more time and inflate the cost.

2. Development of Core Features

Creating major components of the cryptocurrency exchange will be more demanding in terms of costs in the exchange development process. Essential components include:

- Trading Engine: The trading engine facilitates the sending and receiving of orders for a particular stock and then makes the trades. For the development cost, the degree of complications engine influences the said amount directly.

- Wallet Integration: There is a need to have a wallet system that will be securely used to store, withdraw, and deposit cryptocurrency. Support for multicurrency wallets and achieving fiat currency support contribute to the total expenditure.

- Order Types and Liquidity Tools: The cryptocurrency exchange development cost will also reflect the choice of the various order types and several tools to manage liquidity.

3. Security Features

To support this argumentation, cryptocurrency exchange development demonstrated that high-level security comes with an increased cost. Finding a way to strengthen the security laws of the platform to avoid hacking and scams is compulsory. Key security features include:

- Data encryption: Personal user information should be protected. Hence, incorporating encryption mechanisms in the development leads to the overall cost.

- KYC/AML Compliance: Regarding regulatory concerns, the exchange must have Know Your Customer (KYC) and Anti-Money Laundering (AML) implemented in the system. This entails more development, which leads to more expense.

- Two-Factor Authentication (2FA): To add another level of security, 2FA is integrated, which makes the process more expensive but more secure for the account.

4. Blockchain Integration

If the exchange is decentralized or supports the trading of cryptocurrencies across different blockchain networks, integration will increase the cryptocurrency exchange development cost. Connecting with several blockchains has to be built separately since they all have different working methods.

5. Payment Gateway Integration

To make it possible for users to swap between cryptocurrencies and fiat currencies, the integration of multiple payment options is required. This enables users to place and cash out through credit cards, bank accounts, or electronic wallets. Integrating such gateways will add to the cost. This leaves the overall question of security and the issue of conformity to the rules and regulations of various markets.

6. Legalities

It is crucial to ensure that your cryptocurrency exchange adheres to the regulatory laws of all the relevant countries. This also involves adopting the KYC/AML procedure, seeking legal counsel, and employing compliance staff. The expenses relating to this aspect can also be diverse. They are also comprised of the cryptocurrency exchange development cost.

7. Testing and Quality Assurance

While Testing and Quality Assurance (QA) is a critical area in software development, it has only a small role in designing and developing the product. However, some preparations need to be made before the platform is launched. It is necessary to confirm that the exchange is stable and safe to use. Quality assurance is checking for bugs, opening doors for security infringements, or even poor performance. The more complex the platform, the longer it takes to test and the longer and costlier the testing phase will be.

8. Continuance Support and Maintenance

Still, after the implementation of the exchange, there is a need to maintain and update the exchange and its security. This includes overcoming security threats to fix security weaknesses, correct glitches, and answer customers’ inquiries. Startups should set a part of the cryptocurrency exchange development expense separately for these operating expenses.

9. Marketing and Promotion

Apart from the technical development costs, popularization of the exchange and attracting customers will be a challenge for the marketing department. This entails media promotions and publicizing activities, such as on social sites. This is not a development cost in its true sense. Since it impacts the exchange’s success, it rightly forms part of the overall investment.

Summary of Cost Breakdown:

- UI/UX Design: From $5,000 to $30,000, which depends on the project’s difficulty.

- Core Features (Trading Engine, Wallets): About functionality, it costs between $50,000 and $100,000.

- Security Features: From $20,000 and up to $50,000 for the protection of higher levels of security.

- Blockchain Integration: $20,000–$50,000 depending on the blockchains employed.

- Payment Gateways: $10,000–$30,000 per gateway, depending on the number of gateways.

- Compliance (KYC/AML): $20,000–$40,000 for legal and regulatory change.

- Testing and QA: Of these costs, possibly ranging from $10,000 to $30,000 depending on the level of testing.

- Maintenance and Support: Monthly sustaining costs of being in the market range between $5,000 and $20,000 per month after launch.

- Marketing: Within the $10,000-$50,000 range for the launch campaigns.

All the mentioned breakdown elements consider the total cryptocurrency exchange development cost. For startups, it is critical to know the origin of these expenses to avoid using up all their financial resources.

IV. Total cost of creating a cryptocurrency exchange app

With all of the above factors, the total cryptocurrency exchange development cost may be from $ 100,000 to more than $ 500,000. This is for a fully functional safe launched with desirable features. With minimum features, encoding, and without complex design, the cost may be less than $50,000. However, adding complicated amenities, legislative requirements, and robust security will increase the final price.

Therefore, knowing the total cryptocurrency exchange development cost assists startups in managing their budget correctly. Platform type, selection of features, security and compliance features, and post-launch costs determine the final costs. As with everything in a startup, it is possible to create an exchange that is right for a particular company. They are something that can be achieved without overextending oneself.

V. Build a friendly-budget cryptocurrency exchange platform with Adamo Software

If startups plan to incorporate a cryptocurrency exchange, one of the biggest issues they face is the high cost. With Adamo Software, you can build a sound platform that can provide the necessary service and product without extra frills. We are an affordable finance software development partner. We focus on developing custom solutions matching efficient functionality and moderate prices. Therefore, Adamo Software can become an ideal solution for companies looking to manage their cryptocurrency exchange development costs.

Thus, Adamo Software regularly budgets new startups by offering flexible packages to reach certain milestones. We help to limit the cryptocurrency exchange development cost. The latter is balanced to contain standard features across platforms while excluding others making it costly to build. Adamo Software shall work with you to develop a roadmap to a position that works for your budget.

1. Customizable Solutions

Adamo Software has a vast benefit as they work on providing clients with flexible development solutions. They give different models of constructing an exchange platform, ranging from a simple platform to complex, sophisticated ones. This flexibility enables fiat control of the cryptocurrency exchange development cost. You can choose the specific features necessary for your business. For example, fundamental features such as the trading engine, wallet, and security remain important. The rest are developed later as the startup moves to another level.

2. Efficient Development Process

Adamo Software has adapted a development model that is efficient in that its development takes less time and costs. We follow agile development. They can easily provide a result in a short while and guarantee that the platform is safe. This way the time is minimized, thus helping startups to launch faster. The overall cryptocurrency exchange development cost incurred due to the long development period is greatly affected. It means that just to have some sort of exchange up and running, you can do it quickly as an MVP. Even though it may take months to develop a fully-fledged solution.

3. Focus on Security

Although the company provides relatively low-cost services, we understand that security comes first. We ensure that the platform incorporates elements of security like 2FA, data encryption, and safe wallet integration as fundamentals. Given that security threats result in high costs related to losses, it pays to incorporate robust security mechanisms. Any costs incurred on these go a long way toward lowering future costs in the long-term development of the exchange.

4. Scalability for Future Growth

Adamo Software also takes into consideration scalability when developing a platform as well. Still, no matter the type of base version of your exchange that you begin with, you can always introduce subsequent extra features. The features include margin trading, fiat currency integration, cryptocurrency support, and many others as you progress. It also enables startups to plan for the cost of their cryptocurrency exchange growth by incorporating more features only when needed.

5. Ongoing Support and Maintenance

Once your exchange is live, Adamo Software offers support and maintenance, so the platform remains relevant and optimized. We prevent costly downtimes to different platforms, which could cause a loss of users and revenue. We give updates, fix bugs, and provide constant technical support. We assist you in financial control of the general cryptocurrency exchange development cost by providing a lasting service. This keeps your software in the best situation.

Adamo Software will provide reliable and affordable solutions for starting using cryptocurrency exchange for the startup. We are beneficial to businesses. Partnering with a company like Adamo Software means that as a business, you set up the foundation to create a very high-quality platform within their budget while leaving room for future expansion.

FAQs

1. What trends can we expect in the future of the cryptocurrency market?

The growth of the cryptocurrency market is due to technological developments. As blockchain solutions advance, cryptographic instruments of several institutions are turning into digital currencies for transactions, payments, and investment. The decentralized finance (DeFi) use case blossoms, with more attention paid to decentralized exchange and lending. Furthermore, there will be enhanced legal understanding and increasing acceptance of currencies in global markets. Comprehending all these trends will enable the formulation of a clear cost strategy. This will enable the business to design and develop an exchange that meets the future market.

2. How can I find the right developer to create a cryptocurrency exchange?

Selecting the right developer is important in the success or failure of your cryptocurrency exchange. Try to find developers or companies with prior experience in the creation of blockchain and those in cryptocurrency exchange. They should understand basic technologies like smart contracts, blockchain protocols, and security mechanisms. Clients should also verify the portfolio, read client feedback, and confirm that the professionals developed exchanges with the required characteristics. The last important aspect is cost transparency. Therefore, you should clear the cryptocurrency exchange development cost to avoid such pitfalls as hidden fees and delays.

3. What are the main security features to include in a cryptocurrency exchange?

The question of security is most relevant when creating a cryptocurrency exchange. Some security measures implemented include 2FA, SSL encryption on data transfers, measures against DDoS, and cold storage for customers’ funds. Other processes include at least the KYC and AML for compliance duties for the organization to meet certain set standards. Some security aspects may add to the cryptocurrency exchange development cost. They are crucial measures that enable users to avoid loss through hacking or fraud.

4. How long does it take to develop a cryptocurrency exchange platform?

The time to create a cryptocurrency exchange depends on many aspects. They include how elaborate the platform is, how many features will be implemented, and the proficiency of the development personnel. Simple exchange requires 4–6 months, while the more complex one with many options and features requires 8 months and over. The timeline will also be a factor that influences the cryptocurrency exchange development cost. Longer projects take more resources in design, testing, and security.

5. What is the difference between centralized and decentralized cryptocurrency exchanges?

A centralized exchange (CEX) is a platform through which a specific company or organization controls the assets and transactions of its users. It results in centralized exchanges having high liquidity and faster transaction rates, but they are prone to hacking. On the other hand, a decentralized exchange (DEX) refers to an exchange that directly facilitates P2P trading between users. Therefore, it offers more customer privacy and control. Nevertheless, decentralized exchanges are less liquid and need a higher level of technical understanding when accessing them. The type of exchange will determine the cryptocurrency exchange development cost, as it does take more work in blockchain programming.