Tips for selecting the perfect partner for fintech software development outsourcing

In the modern world, the pace of financial market evolution is constantly growing. Fintech software development outsourcing is one of the most effective strategies for competitive organizations. Due to the changing innovative environment due to the rapid advancement of technology. Financial organizations have to innovate and adapt more frequently. Outsourcing also allows for acquiring professional skills and utilizing more advanced techniques unavailable within the company. This growing trend strengthens and sustains strategic fintech solutions. It also prepares fintech for growth in a shorter period with greater effectiveness. Financial institutions can achieve a stronger market presence in a relatively small window of significant rise.

As firms aim to meet the constantly shifting needs of their clients in fintech, outsourcing becomes more relevant. Outsourcing fintech software development allows firms to use the latest technologies without employing all technical staff or investing in technology infrastructure. Selecting the right outsourcing vendor is key to increasing efficiency and controlling costs. It also keeps firms up to date with fintech innovations. This approach enables firms to offer innovative services with the flexibility needed in the market.

I. Market and Trends in Fintech Software Development Outsourcing

The market for fintech software development outsourcing is also expanding at a speedy pace. This is due to the growth in demand for financial services on the digital platform. As revealed in a scenario created by Boston Consulting Group, it is estimated that the revenue from financial technology will increase from $245 billion to $1.5 trillion by 2030. This is clear that outsourcing fintech software development is crucial in today’s society.

Among the pointed trends in the development of outsourcing services for financial technology software, it is possible to highlight the growth of mobile banking. Mobile banking refers to performing mobile financial transactions with the help of a mobile device. Some of the operations carried out by the organization include moving funds, payment of bills, and managing deposits. This is one of the reasons why many people prefer to use mobile banking services, which, in turn, enhances the demand for outsourcing fintech software development.

Another trend is higher-level technologies such as artificial intelligence, blockchain technologies, and cloud technologies. These technologies are being incorporated into fintech to improve security, effectiveness, and ease of use. Fintech software development outsourcing harnesses such sophisticated applications.

Furthermore, the global IT services outsourcing market covering fintech development has $525 billion with a CAGR of 8%. 2% until 20322. This is due to the customers’ tendency to look for cheap and efficient solutions, which makes outsourcing fintech software development appealing to numerous companies.

Therefore, fintech software development outsourcing is growing with digital money products, mobile banking, and new technology implementation. Because of this, market growth requires the increasing application of fintech software development outsourcing. Companies therefore can be more competitive and innovative.

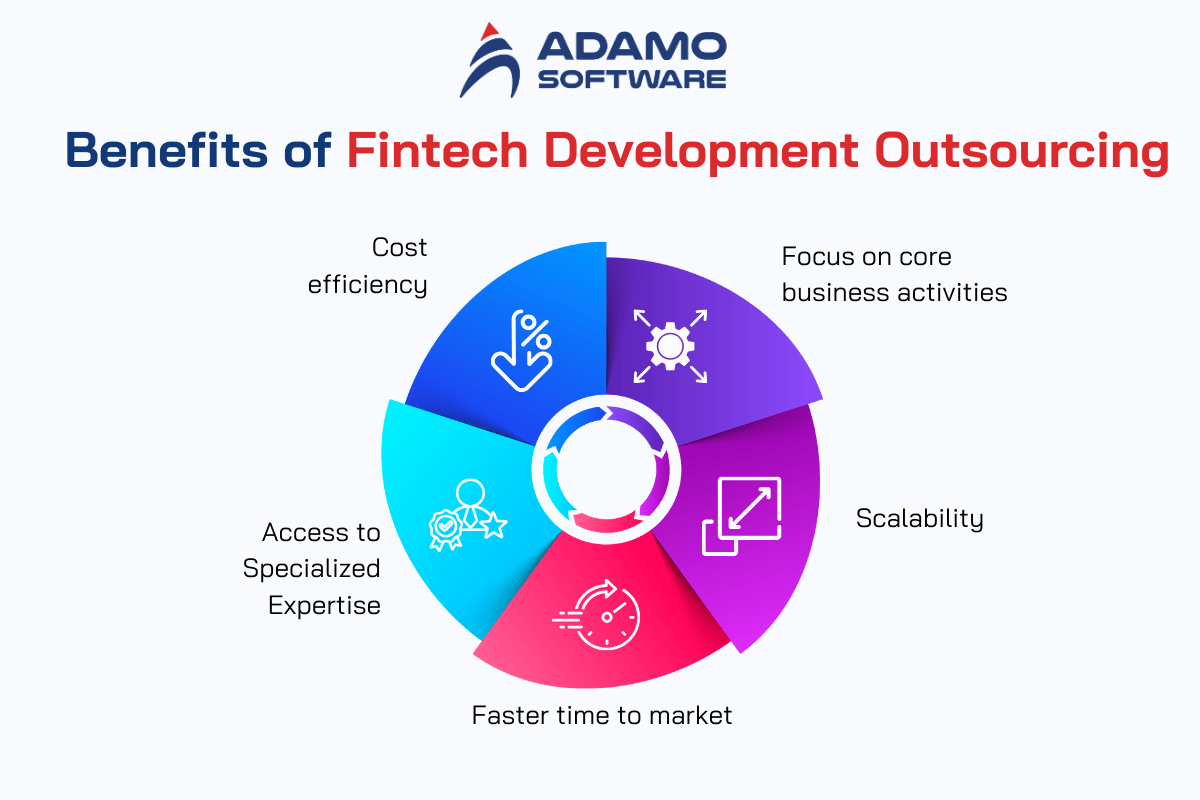

II. Benefits of fintech development outsourcing

Hiring third-party service providers is one of the significant approaches that fintech ventures allow to sustain the competitive advantage. Therefore, increasing portfolios through fintech software development outsourcing brings more benefits than cost reduction. These benefits are:

1. Cost Efficiency

The lower operational costs are one of the key advantages of fintech software development outsourcing. These industries can affiliate with outsourcing firms in areas where labor costs are fairly low. Thereby, it reduces fixed and transport costs while attaining quality results. This enables businesses to focus on other vital fields such as marketing or innovation.

2. Access to Specialized Expertise

Fintech software development outsourcing gives businesses free access to global talent. Most outsourcing partners have a team of experts in various forms of new solutions, such as blockchain, artificial intelligence, and machine learning. Fintech software development outsourcing is another opportunity to access this expertise to improve their offerings.

3. Faster Time to Market

With outsourcing, the fintech firms can reduce several factors that lead to delays in the market. Outsourcing providers usually have twofold development procedures, and a team fully assigned to the project’s development. It also leads to increased speed of achieving the set project goals. Therefore, it enables corporate players to operate ahead in the complex fintech industry. Fintech software development outsourcing means businesses can easily deliver new products and advanced features.

4. Scalability

Yet another benefit found via fintech software development outsourcing is the ability to manage scales of operations. There is no long-term contract for hiring such professionals. Hence, corporations can easily hire more or lay off those working on development projects as and when required. In this context, it is possible to identify scalability advantages, especially for the expanding fintech organizations. This expansion enlarges the range of services while observing the optimal expense levels.

5. Focus on core business activities

Fintech software development outsourcing enables firms to accord adequate attention to their core operations. Businesses can focus on strategy, customers, and products since technical issues are handled by outsourcing partners. They make fintech software development outsourcing ideal for the future growth of a business.

To sum up, fintech software development outsourcing shares several advantages. These benefits will help the fintech companies improve their business, increase their pace of entry into the market, and outrun their competitors. This approach emphasizes future development strategy while providing customer satisfaction by delivering superior, state-of-the-art products.

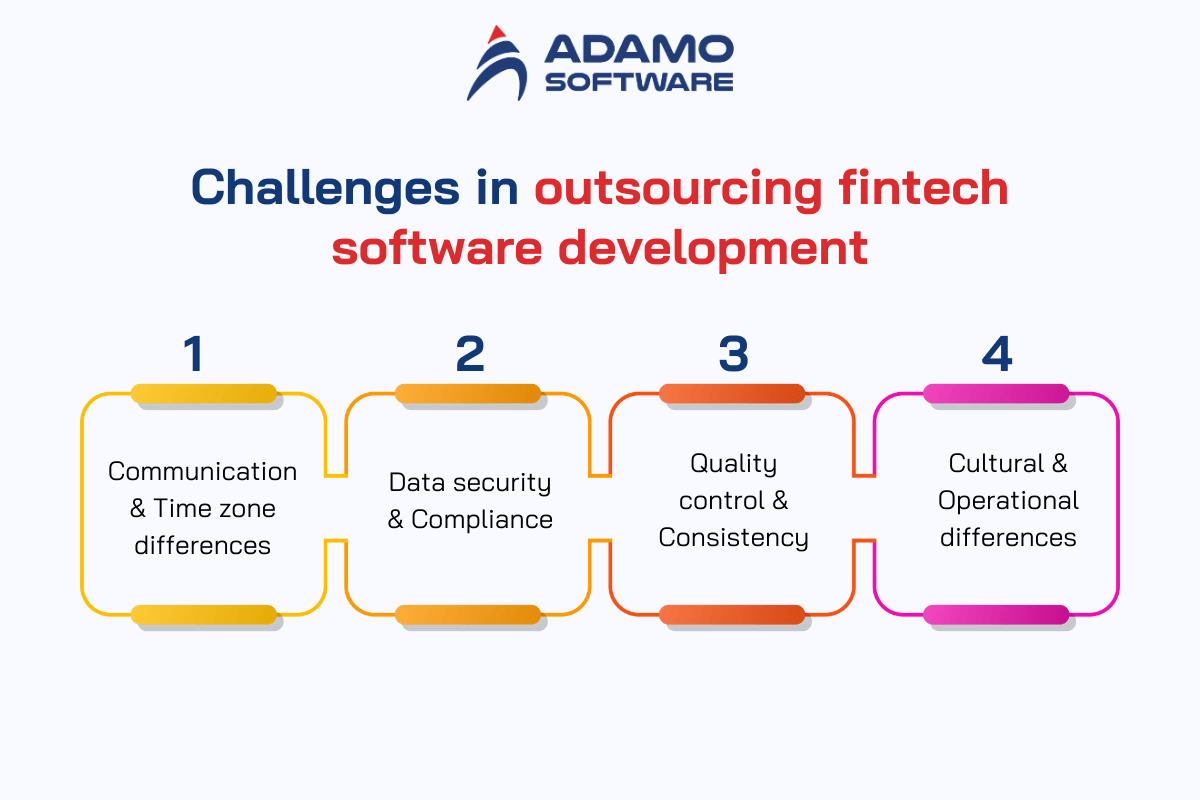

III. Challenges involved in outsourcing fintech software development

As appealing and beneficial as the concept of fintech software development outsourcing can be, the process has certain drawbacks. That is why it is critical to understand these difficulties to achieve efficient outsourcing strategies.

1. Communication and Time Zone Differences

Getting past communication is one of the greatest problems in fintech software development outsourcing. Outsourcing partners are in other regions, making it challenging to organize working shifts due to differences in time zones. And communication barriers, inclusive of those that arise due to language differences. When not well handled, such problems cause unavoidable timelines within the general project duration or even cause misunderstandings.

2. Data Security and Compliance

The financial sector especially faces this major problem in protecting the data of their clients as well as meeting legal requirements. The external development teams might cause financial details to be exposed to hackers or violate the GDPR or PCI DSS. To protect data within outsourcing, the outsourcing partner must comply with the security measures set out in fintech software development outsourcing.

3. Quality Control and Consistency

Another problem is high-quality correspondence at the same level during the development. Specialized skills and work environments may differ between the outsourcing team and the in-house team of employees. This may lead to variations in the content of the code, or the nature of the requirements set for software design. In fintech software development outsourcing, hence, it has to be regulated properly.

4. Cultural and Operational Differences

Differences in individuals’ beliefs, ambition for risk-taking, problem-solving, decision-making, and ways of managing work also impact. These operational differences may slow down or cause friction during the outsourcing process. If not explained at the outset of the fintech software development outsourcing partnership.

However, many opportunities can be derived from fintech software development outsourcing if it has its fair share of challenges. These challenges can be dealt with if a business selects the right partner, communicates well, and focuses on security and quality. Addressing these challenges beforehand will help to gain a successful outsourcing experience regarding value and risk.

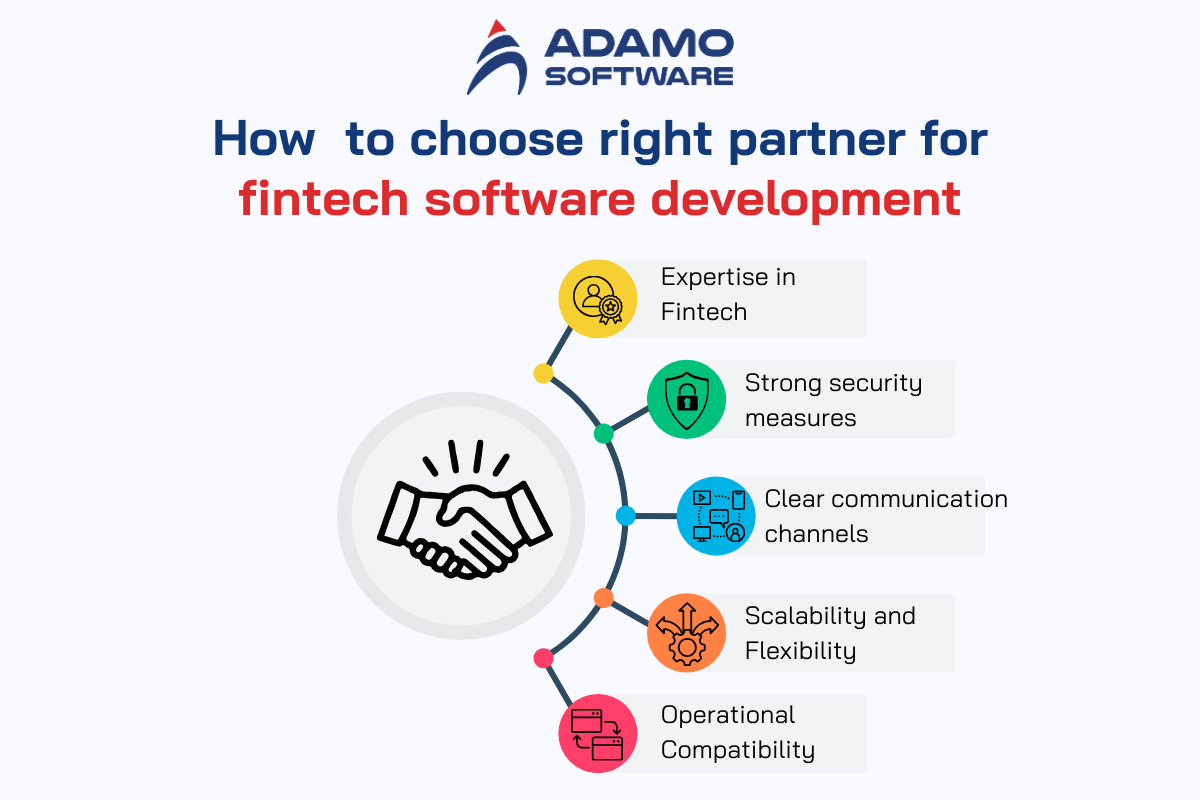

IV. How to choose the right partner for fintech software development

It is crucial to choose the right partner in fintech software development outsourcing. The ideal partner should also possess the relevant technical qualities and knowledge of the fintech business model. Today, there are some critical success factors that businesspeople are required to assess before outsourcing their activities to contractors.

1. Expertise in Fintech Development

The first criterion for choosing the right partner in fintech software development outsourcing is checking whether the candidate has experience in fintech projects. Search for a company that meets the financial requirements for technology and select the company with the best portfolio. This helps them understand the current regulation and security measures and the requirements of the firms in the fintech industry.

2. Strong security measures

This is crucial because security is the highest priority for any player in the fintech market, and your outsourcing partner must meet requirements for data protection. First, inquire if they adhere to compliance standards such as GDPR or PCI DSS. Ensure have never violated those compliance standards while handling sensitive financial data. An efficient and trustworthy partner will incorporate security features in all FinTech software development outsourcing.

3. Clear communication channels

Therefore, efficient communication is necessary when having fintech software development outsourcing. Ensure the communication is regular and effective and note that your partner must have an efficient project management system. That helps avoid confusion, such as working in different time zones or shifting.

4. Scalability and Flexibility

Hence, a great partner in fintech software development outsourcing should be scalable and flexible. They should be able to increase or decrease their manpower or any other aspect as required by the project that you are to work on. This flexibility ensures that your development needs are catered for as your organization expands.

5. Cultural and Operational Compatibility

That is why choosing a partner with a similar work ethic and approaches to the operation can affect the success of your FinTech software development outsourcing. Cultural compatibility is achieved to facilitate increased understanding between the teams and to ensure a mutual understanding of the goals to be executed.

Therefore, to choose the right partner for fintech software development outsourcing, consider their understanding of fintech, security measures, communication approaches, growth capabilities, and cultural compatibility. By evaluating such factors, the organizations will gain confidence in their outsourcing partner. This leads to excellent outcomes and contributes to the fintech industry’s growth and enhanced ideas in the long run.

Also read: Fintech software development services: Cost to build your own apps

V. Why choose Adamo Software as a partner for your fintech software development

The reasons to collaborate with Adamo Software as a fintech software development outsourcing company are our rich experience and constant commitment to quality. The Adamo team boasts of experience in the fintech industry in various parts of the world. This means you will get a professional approach to your project development as our team strictly adheres to industry standards.

Security is another reason to have your fintech software development outsourced to Adamo. Adamo Software knows the significance of protecting customers’ financial information and complies with payment processing security standards. This ensures that all the fintech projects are initiated with security measures to reduce the risks in future implementations.

Also, we offer flexibility and scalability in our financial technology software development outsourcing services. Regardless of the number of individuals you need, Adamo can change the circumstances. We also operate as an agile development team. Therefore, we can adjust based on market changes while completing the orders on time and within the required quality.

Lastly, there is open communication about the FinTech software development outsourcing with Adamo Software. We make certain timely reporting and instant coordination. This helps to keep the businesses abreast of progress and have control over the work. Adamo’s experience, security-oriented approach, and fully adaptable processes make it possible to consider Adamo as the perfect partner.

To sum up, Adamo Software provides all the necessary factors that contribute to effective fintech software development outsourcing. In choosing Adamo, clients are assured of a harmonious business relationship that results in effective and secure fintech solutions.

FAQs

1. What is fintech software development outsourcing?

Fintech software development outsourcing is sourcing services from outside parties, persons, or companies. This is to develop, manage, or enhance solutions in the fintech sector. This approach assists businesses in sourcing specialized expertise while cutting development costs. Fintech software development outsourcing thus means that companies can leave the responsibility of software development to experts for their core activities.

2. Why should I consider fintech software development outsourcing?

Fintech software development outsourcing has the following advantages:

- Accessing the global talents of developers

- Cost efficiency of development

- Fast time to market for solutions

- Fast access to scalability in development manpower.

It also opens opportunities to rely on developers, at least partially, who are abreast with the evolving fintech trends and tools.

3. How do I ensure the security of my financial data when outsourcing?

Fintech software development outsourcing involves several risks to security. You should ensure the outsourcing partner adheres to international security standards including PCI, DSS, or GDPR. They should also demonstrate other practices such as encryption, secure coding, and vulnerability scans to guard the information.

4. What challenges should I expect when outsourcing fintech software development?

Nevertheless, there are some disadvantages of fintech software development outsourcing. They include poor communication due to language barriers, different geographical location, and issues with the quality of work. Such risks are mitigated and eliminated by choosing an appropriate partner with experience and past performance in dealing with FinTech.

5. How do I choose the best partner for fintech software development outsourcing?

When choosing a partner, it is most useful to focus on the fintech portfolio, knowledge of the regulations and compliance, and security and innovation experience. There is a need to effectively communicate, be flexible, and, more importantly, have teamwork when outsourcing.