Generative AI in finance: Use Cases, Benefits, and Risks

Discover real-world applications of generative AI in finance, including trading, fraud detection, portfolio management, and personalized financial services.

Generative AI is rapidly transforming the financial industry by enabling smarter decision-making, improving operational efficiency, and delivering highly personalized customer experiences. Financial institutions can now analyze massive volumes of structured and unstructured data in real time, allowing them to optimize trading strategies, enhance fraud detection, and deliver tailored investment recommendations. These capabilities are reshaping how banks, asset managers, and fintech companies manage risk and serve clients.

Beyond automation, generative AI empowers financial organizations to generate predictive insights, simulate market scenarios, and improve portfolio performance. At the same time, the technology introduces new considerations related to data privacy, regulatory compliance, and model reliability. As adoption accelerates, generative AI is becoming a strategic driver of innovation and competitive advantage across the financial services ecosystem.

I. Key Applications of Generative AI in Finance

Generative AI is making significant strides across various facets of the financial industry, enhancing operational efficiency, decision-making, and customer experiences. Its applications are diverse, ranging from trading strategies to personalized financial advice and fraud detection.

Trading and Investment Strategies

The evolution of trading has been profoundly influenced by generative AI, transitioning from traditional methods to sophisticated algorithm-driven approaches. Machine learning models can process vast datasets and generate novel trading strategies that adapt in real-time to market conditions. For instance, firms like Renaissance Technologies utilize generative models to analyze market data, resulting in dynamic strategies that consistently outperform traditional benchmarks.

Additionally, generative AI enables the creation of customized investment strategies, allowing investment managers to tailor recommendations based on individual clients’ risk tolerances and financial goals.

Fraud Detection and Risk Management

One of the most impactful applications of generative AI in finance is its role in fraud detection and prevention. By analyzing transaction data for anomalies, AI systems can predict and identify fraudulent activities in real-time.

For example, Mastercard successfully employed generative AI to double its detection rate of compromised cards, significantly reducing false positives and improving fraud detection speed. Furthermore, AI’s capabilities extend to risk management by simulating various economic scenarios, allowing financial institutions to understand potential impacts on their operations and make informed decisions.

Portfolio Management

Generative AI is revolutionizing portfolio management by enabling the creation of optimized and diversified portfolios tailored to individual investor profiles. It analyzes historical data and generates multiple investment scenarios, helping asset managers identify the best strategies for their clients.

The technology’s ability to adjust investment recommendations based on market fluctuations ensures that portfolios remain aligned with clients’ goals and risk appetites, ultimately improving financial outcomes.

Financial Reporting

Generative AI can streamline financial reporting by automating report creation. By analyzing historical financial data, genAI models can produce precise, detailed financial reports, significantly reducing manual effort, saving time, and minimizing the risk of human error.

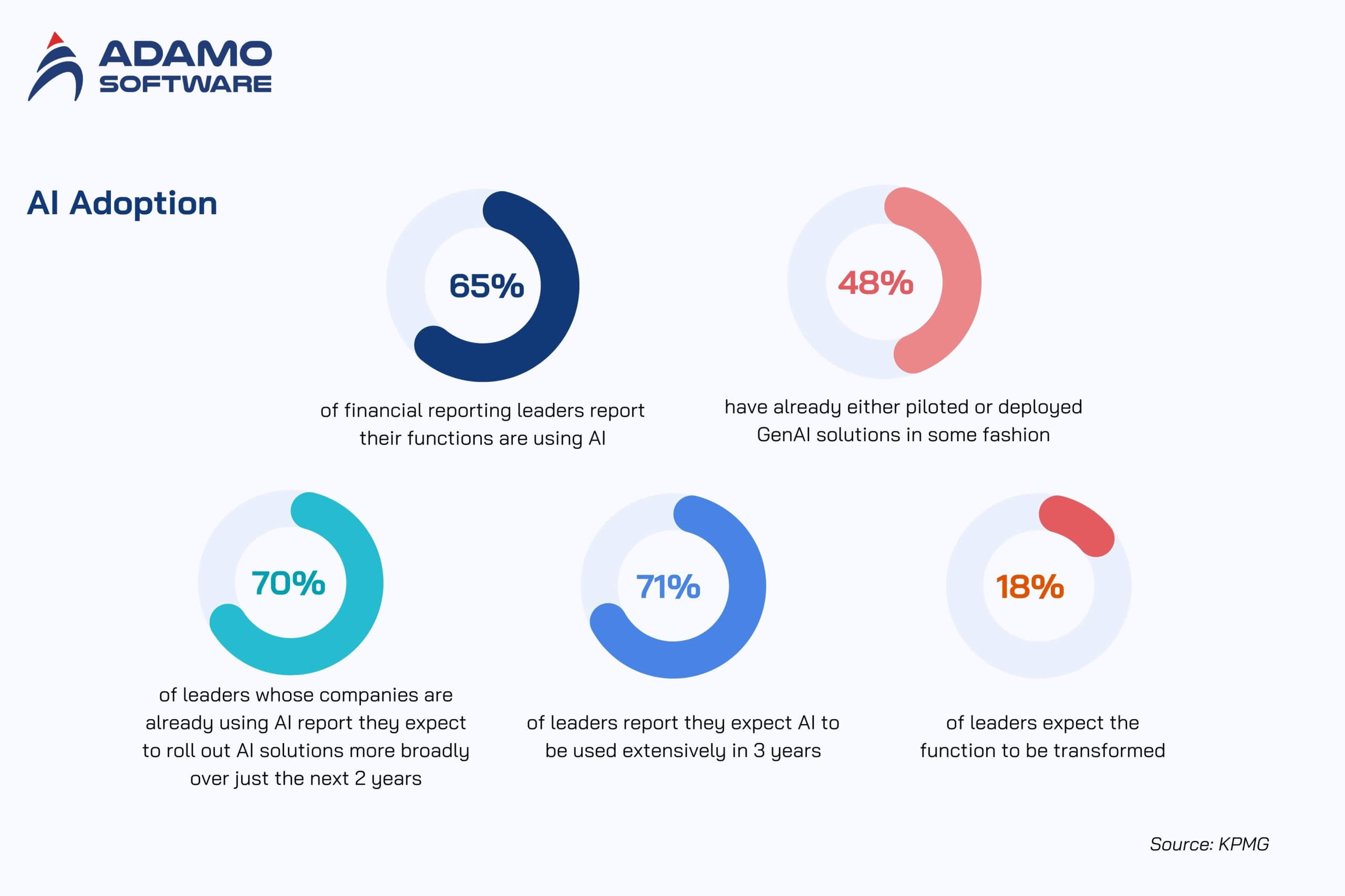

According to KPMG, 65% of financial reporting leaders already incorporate AI and generative AI into their reporting processes. Additionally, 71% anticipate increasing their dependence on AI solutions in the future, while 48% have fully implemented them. KPMG highlights that organizations are seeing clear advantages, including improved efficiency, lower workload for finance teams, greater data accuracy, and meaningful cost reductions.

Customer Experience and Personalization

In the realm of customer service, generative AI enhances personalized financial advice and support. By assessing individual customer data, AI systems can provide tailored recommendations that consider each person’s unique financial situation and objectives. This level of personalization fosters stronger client relationships, as customers feel valued and understood in their financial journeys.

II. Benefits of Generative AI for Financial Institutions

Generative AI is transforming the finance sector by enabling more efficient data processing, personalized customer experiences, and improved risk analysis. The applications of this technology are diverse and profound, with the potential to reshape various aspects of financial services, from algorithmic trading to personalized financial advice.

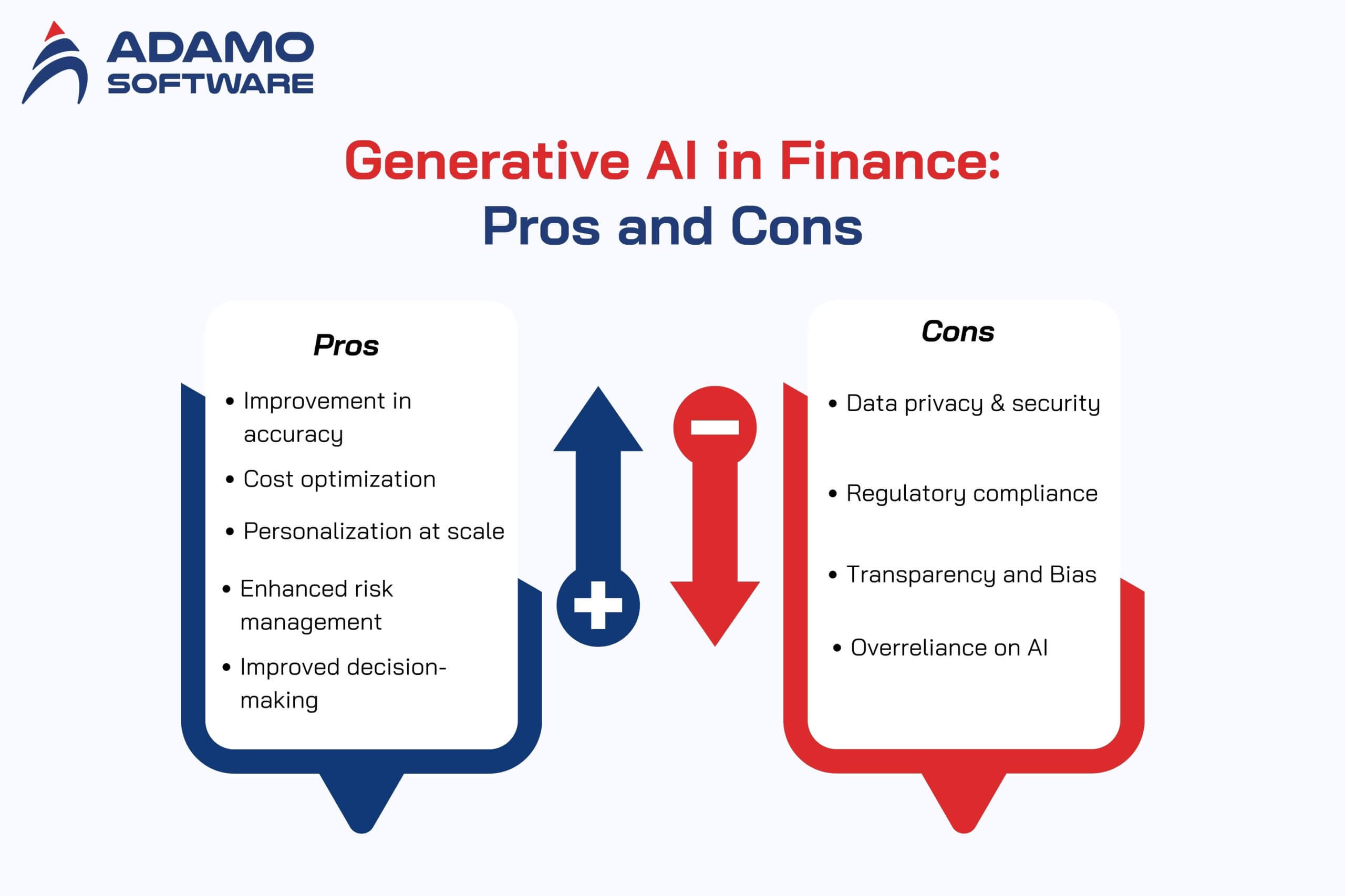

Improvement in Accuracy

One of the primary benefits of generative AI in finance is its ability to enhance accuracy in decision-making processes. By synthesizing vast datasets, including structured financial records and unstructured information like customer communications, generative AI can provide nuanced insights that augment human-designed policies. This leads to better detection of subtle patterns and a quicker adaptation to changing market conditions.

Cost Optimization

Generative AI contributes to cost optimization by streamlining workflows and automating repetitive tasks. For instance, financial institutions can leverage AI to develop forecasts and budgets more efficiently, leading to significant reductions in portfolio volatility and faster rebalancing cycles. Organizations that adopt generative AI can experience operational efficiency gains of up to 40%.

Personalization at Scale

The technology also enables financial institutions to offer personalized services at scale. Generative AI allows firms to analyze customer behaviors and preferences, thereby tailoring financial products and services to meet individual needs. This customization can improve customer satisfaction and loyalty, as clients receive services that are better aligned with their specific requirements.

Enhanced Risk Management

Generative AI plays a critical role in risk management by identifying anomalies that may indicate fraud or noncompliance. It can predict and explain these anomalies, allowing finance teams to mitigate risks proactively. By integrating AI-driven logic with traditional rule-based strategies, organizations can automate high-volume tasks while ensuring that more complex cases are escalated for human review.

Improved Decision-Making

The integration of generative AI into financial decision-making processes enhances overall effectiveness. Financial institutions can leverage this technology to analyze real-time data, improving the informational efficiency of markets and enabling quicker responses to economic changes.

III. Challenges and Risks of Generative AI in Finance

Generative AI (GenAI) has the potential to revolutionize the finance industry, but its adoption faces several challenges and limitations that must be addressed to fully leverage its capabilities.

Data Privacy and Security

The integration of AI in finance raises significant questions surrounding data privacy and intellectual property rights. Financial institutions must navigate the complexities of protecting sensitive data utilized by AI models while also ensuring that customer consent is obtained for data usage.

The risk of unauthorized access and data breaches increases as reliance on large datasets grows, underscoring the need for robust cybersecurity measures and ethical data handling practices.

Regulatory Compliance

As the technology surrounding GenAI evolves, so too must the regulatory frameworks governing its use. Financial institutions face the challenge of aligning their practices with existing and emerging regulations, which can be ambiguous and not fully suited to the nuances of AI technology. Collaboration with regulatory bodies is essential to develop compliance frameworks that prioritize ethical standards and the interests of consumers.

Model Limitations

Despite the advancements in GenAI, these models are not without flaws. One significant issue is the phenomenon known as hallucinations, where the AI generates incorrect or misleading information, which can have serious financial implications, potentially leading to poor decision-making and economic losses.

Furthermore, the complexity of financial markets introduces unpredictability in how these models perform under varying conditions, particularly when novel situations arise during trading.

Transparency and Bias

Inherent biases are a critical concern when employing AI in financial decision-making. Because GenAI relies on human modeling, it can inadvertently perpetuate existing biases present in the training data. This can lead to unfair outcomes, particularly in areas such as AI-based lending decisions, where socioeconomic trends may influence the underlying data. Therefore, it is imperative for financial institutions to implement rigorous vetting processes for AI-generated outputs to ensure transparency and fairness in decision-making.

Overreliance on AI

A notable risk associated with GenAI is the potential for overreliance on its outputs. Without appropriate checks and balances, decisions based on AI-generated data can lead to unintended consequences, including financial and reputational risks.

As AI models are trained on vast amounts of text from the internet, the likelihood of inaccurate information being propagated increases, necessitating thorough human oversight before utilizing automated outputs in critical financial contexts. Addressing these challenges will be essential for the successful integration of Generative AI in the finance sector, ensuring that its benefits can be realized while mitigating the associated risks.

IV. Future Trends of Generative AI in the Financial Industry

The landscape of finance is poised for significant transformation due to the rapid advancement and integration of Generative AI (GenAI) technologies. As organizations increasingly adopt GenAI, it is essential to evaluate both the potential benefits and the inherent challenges that come with its implementation.

According to recent insights, approximately 93% of C-suite executives have already invested or are planning to invest in generative AI, indicating a strong appetite for the technology across various sectors.

Regulatory Developments

As the technology evolves, regulators are faced with the challenge of keeping pace with its growth. For example, the U.S. Securities and Exchange Commission proposed a rule in July 2023 regarding the use of predictive analytics by financial advisors, aiming to mitigate conflicts of interest associated with predictive data. This highlights a growing trend towards regulatory frameworks that address the unique risks posed by AI, balancing innovation with safety and compliance.

Collaboration with Fintech

Traditional financial institutions are increasingly recognizing the need to collaborate with FinTech firms to enhance their custom banking solutions. This partnership is expected to foster innovation, improve customer experiences, and effectively manage the evolving regulatory landscape.

The combination of resources from both sectors can lead to a robust approach to addressing emerging cybersecurity threats while leveraging GenAI for better customer support and fraud detection.

Enhancing Risk Management

Generative AI also holds the promise of revolutionizing risk management within the financial sector. By automating tasks such as breach categorization and resolution, organizations can allocate human resources more effectively to address complex breaches. This shift not only increases efficiency but also enhances the overall resilience of financial institutions against cyber threats.

Navigating the Hype Cycle

Despite the excitement surrounding GenAI, it is crucial for industry leaders to navigate the current hype cycle thoughtfully. A failure to recognize the limitations and potential consequences of AI could lead to operational misalignments and missed opportunities. Firms must focus on identifying realistic use cases where GenAI can add substantial value while ensuring rigorous oversight to manage associated risks effectively.

V. Real-World Examples of Generative AI in Financial Services

Portfolio Optimization

Generative AI has demonstrated significant potential in portfolio optimization by analyzing historical financial data and generating diverse investment scenarios. Financial professionals can utilize these models to identify optimal asset and wealth management strategies, considering factors such as risk tolerance, expected returns, and investment horizons.

For example, BlackRock’s AI tool, Aladdin, assists asset managers globally in detecting early-stage financial risks and assessing portfolio resilience under various economic conditions, showcasing the practical application of AI in risk assessment and management.

Document Processing and Compliance

Financial institutions handle massive volumes of documents, from loan applications to regulatory filings. Generative AI automates document processing by extracting key data from unstructured sources, reducing manual entry errors and ensuring regulatory compliance. A real-world example is HSBC, which employs AI to efficiently process compliance documents, thus adhering to evolving regulations and minimizing manual errors.

Additionally, SafeGuard Financial implemented an AI-driven predictive compliance monitoring system that significantly improved its compliance operations, reducing incidents by over 50% and enhancing accuracy in detecting regulatory breaches.

Tailored Financial Advice

In a competitive finance sector, the ability to provide tailored financial advice is essential. Generative AI enables financial institutions to create customized investment recommendations by evaluating a client’s financial profile, risk preferences, and investment goals.

This personalized approach not only enhances client satisfaction but also fosters loyalty, as institutions leverage Customer Data Platforms to deliver experiences that exceed client expectations.

Automated Trading and Risk Management

AI technologies have transformed trading and risk management processes through automated trading systems and robo-advisors. These systems utilize advanced algorithms and real-time analytics to optimize investments, reducing risk and enhancing returns.

For instance, JPMorgan’s LOXM employs generative models to evaluate complex market scenarios, offering data-driven insights for investment decisions. Such capabilities enable investors to prepare for uncertainties and build resilient portfolios, which is increasingly important in today’s volatile markets.

Early Risk Detection

The predictive capabilities of AI in finance are exemplified by Kensho Technologies, which develops predictive analytics models that assist investment firms in projecting asset trends. By continuously refining these models with new data, AI ensures that forecasts remain accurate and actionable, thus aiding firms in making informed decisions. This proactive approach to risk management positions financial institutions to respond effectively to potential market disruptions.

Through these case studies and examples, it is evident that generative AI is not just a theoretical concept but a practical tool that enhances various aspects of finance, from portfolio management to compliance and customer service.

VI. Conclusion

Generative AI is rapidly becoming a competitive differentiator in the financial industry. Organizations that leverage AI to automate decision-making, detect fraud in real time, personalize financial services, and optimize investment strategies can significantly improve efficiency, reduce operational risks, and deliver superior customer experiences. As financial markets grow more complex and data-driven, relying solely on traditional systems is no longer sufficient to maintain long-term competitiveness.

To unlock the full value of generative AI, financial institutions need more than just technology, they need the right implementation strategy, scalable architecture, and experienced engineering teams capable of building secure, compliant, and production-ready AI solutions. Those who act early will be better positioned to lead the next wave of financial innovation.

If your organization is looking to implement generative AI in fraud detection, automate financial workflows, or build intelligent fintech platforms, Adamo Software is ready to help. Our AI engineers and fintech specialists have extensive experience delivering enterprise-grade, AI-powered software solutions for global financial institutions and fast-growing fintech companies.

We work closely with your team to identify high-impact use cases, develop customized AI models, and integrate them seamlessly into your existing systems, ensuring measurable ROI, faster deployment, and long-term scalability.

Talk to our experts today to explore how generative AI can create real business value for your financial services. Contact Adamo Software now to start your AI transformation.