What is a Superbill in Healthcare? How do Superbills Work?

In today’s broad and intricate healthcare system, supplying precise billing details to insurers is crucial for the revenue cycle. This process is often facilitated through a patient’s insurance. However, when patients receive care from out-of-network providers, they are usually provided with a document known as a Superbill.

Medical practices need to understand Superbills and their application in billing. What is a Superbill in healthcare? In this article, we will discuss the definition of a Superbill, how it works, its pros and cons, and identify the benefits of Superbill in healthcare.

This article will provide you with a deeper understanding of Superbills and guide you on how to incorporate them into your practice.

I. What is a Superbill in Healthcare?

A Superbill is an important tool for paying for out-of-network health care services. If you have ever received services outside your health insurance network, you may have received a document called a Superbill. Superbills can be a little confusing, so let’s take a look at what they are.

What is a Superbill in healthcare? A Superbill isn’t really a bill at all. It’s a detailed receipt for each patient visit, listing services provided by physicians, therapists, or other healthcare professionals

Superbills are sometimes called charge slips or encounter forms. They include all the crucial details, like diagnostic and procedural codes, needed for patients to get reimbursed by their insurance for the care they received. In addition, insurance companies usually rely on Superbills to reimburse patients directly instead of the providers or services rendered.

You can explore more about Hospital Management Systems: Types, Key Features & Must-Know Insights here.

II. How Does a Superbill Work in Healthcare

Superbills are usually given to patients by healthcare providers not in the patient’s insurance network. Thus, patients pay for their treatment directly. Superbills are typically provided by healthcare providers who aren’t part of the patient’s insurance network. It means the patient must pay for their treatment themselves. After treatment, patients can submit a Superbill to their insurance to be reimbursed for part of the total cost.

How much of the total amount of the bill can you receive as reimbursement? The amount you can get reimbursed depends on your specific plan. You may have limitations such as benefit caps, permissible charges, deductibles for out-of-network services, and out-of-pocket maximums.

Given these variations in insurance policies, everyone needs to understand their health plan before beginning any treatment. Additionally, be mindful that obtaining prior authorization may be required to access certain out-of-network services.

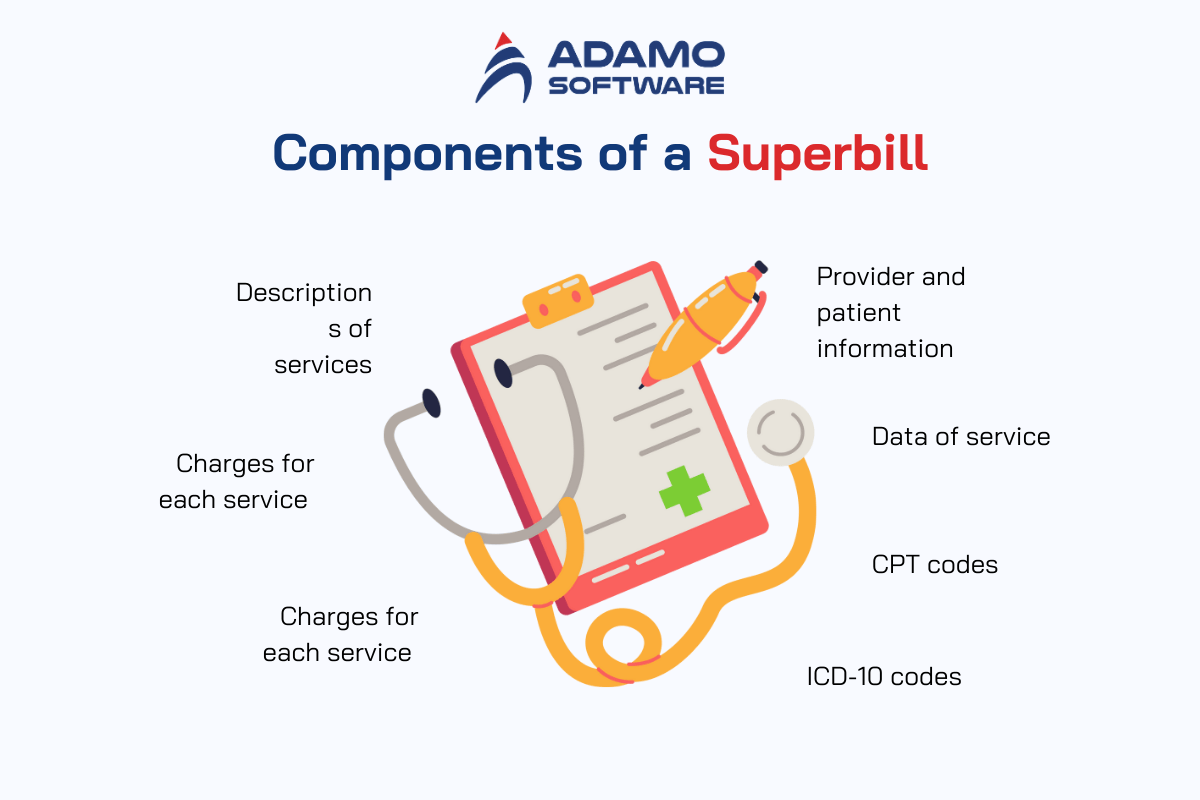

1. Components of a Superbill

A Superbill typically includes:

- Provider and Patient Information

- Date of Service

- CPT Codes

- ICD-10 Codes

- Descriptions of Services

- Charges for Each Service

- Patient’s Responsibilities

After receiving the Superbill from their healthcare provider, the patient needs to submit it to their insurance company for payment. The patient must check the Superbill for accuracy and completeness.

2. Patient’s Responsibilities

After receiving the Superbill from their healthcare provider, patients are required to submit it to their insurance company to initiate the payment process. It is imperative for the patient to thoroughly check the Superbill to ensure its accuracy and completeness. This verification helps prevent delays or disputes in payment due to errors or omissions in the document.

3. How Insurance Handles It

The insurance company meticulously reviews the Superbill to determine the extent of coverage and the corresponding reimbursement amount. This evaluation is crucial to confirm that the listed services are indeed covered under the patient’s insurance plan. It also ensures that the Superbill accurately uses the correct medical billing codes.

4. Getting Reimbursed

Once approved, the insurance company issues reimbursement to the patient. The amount reimbursed, whether it is the full cost or a partial amount, depends on the specific terms outlined in the patient’s insurance plan.

Factors such as deductibles, co-payments, and coinsurance rates play a crucial role in determining the reimbursement’s extent. Therefore, patients need to understand their insurance policy details thoroughly.

III. Common Components of a Superbill

To ensure accuracy and transparency in medical billing, understanding the common components of a Superbill is essential. The section provides an in-depth look at the essential elements typically included in a Superbill, from the patient’s personal information to details of the medical services provided.

There are 3 components of a Superbill:

1. Provider Information

The provider information is straightforward. This section contains all necessary details about the practice needed for submitting a claim to insurance, which includes:

- Provider’s first and last name

- Provider NPI number

- Provider’s address

- Provider tax identification number (TIN) or employer identification number (EIN)

- Provider’s phone number

- Provider’s email address

- Provider’s signature

- Referring provider name (if applicable)

- Referring to provider NPI number (if applicable)

- Rendering provider’s license number

- If there is a referring provider, be sure to also include:

- Referring provider’s name

- Referring provider’s phone number and email address

- Referring provider’s NPI number (if applicable)

A National Provider Identifier, or NPI, is a unique 10-digit number. It is assigned to healthcare providers in the United States by the Centers for Medicare and Medicaid Services (CMS).

2. Patient Information

The patient information section contains all the necessary details about the patient. This would include:

- Patient first and last name

- Patient address

- Patient phone number

- Patient’s date of birth

- Insurance type

- Insurance name

- Insurance ID number

3. Visit Information

Visit information is a critical component of Superbills. Unlike a typical receipt or invoice, a Superbill must contain Procedure Codes (CPT), Diagnosis Codes (ICD-10), Modifiers, and additional data pieces to avoid denying claims. This information includes:

- Date of visit

- Procedure Codes and Description (CPT)

- Diagnosis Codes and Description (ICD-10)

- Modifiers

- Units or Minutes

- Fees Charge

Current Procedural Terminology (CPT) Codes detail the medical procedures performed by a provider on a patient. American Medical Association (AMA) issued and oversaw these codes.

The 10th revision of the International Classification of Diseases (ICD) coding system by the World Health Organization is known as ICD-10. The ICD-10-CM (Clinical Modification) codes document diagnoses across various healthcare environments, while the ICD-10-PCS (Procedure Coding System) codes document procedures exclusively in inpatient settings.

According to M-Scribe, a modifier is a code that the reporting physician uses to indicate a specific alteration to a service or procedure. Despite this modification, the original definition and code of the service or procedure remain unchanged.

IV. Pros and Cons of a Superbill

Superbills allow patients to pay directly and then be reimbursed by insurance. This approach makes it easier for providers to collect fees without having to fight insurance companies. However, it also places the burden of upfront costs on patients.

So, who benefits most from this system? Likely the providers and insurance companies. Patients face more work and uncertainty. However, Superbills offer flexibility to an otherwise inflexible billing process. For some people, the benefits still outweigh the disadvantages.

Here are the pros and cons of Superbills in healthcare:

| PROS | CONS |

| Save cost for patients | |

| The provider receives reimbursement directly, bypassing any intermediaries | Creating superbills that meet the requirements of different insurance networks demands specialized knowledge |

| Reduces the overhead costs for providers | Patients are often uncertain about the amount they will be reimbursed |

| Offers a transparent and detailed summary of services provided and their charges | Complexity and the need for precision

|

| Assists patients in obtaining reimbursements from insurance for out-of-network services | Responsibilities of the patient

|

| A comprehensive log of medical services for both patients and providers, aiding in the monitoring of medical history and expenses | Development and management of Superbills |

| Enables patients to comprehend their healthcare expenses better and manage the insurance reimbursement process | Potential for misunderstandings or confusion |

| Serving as a documented record of potentially tax-deductible healthcare expenses |

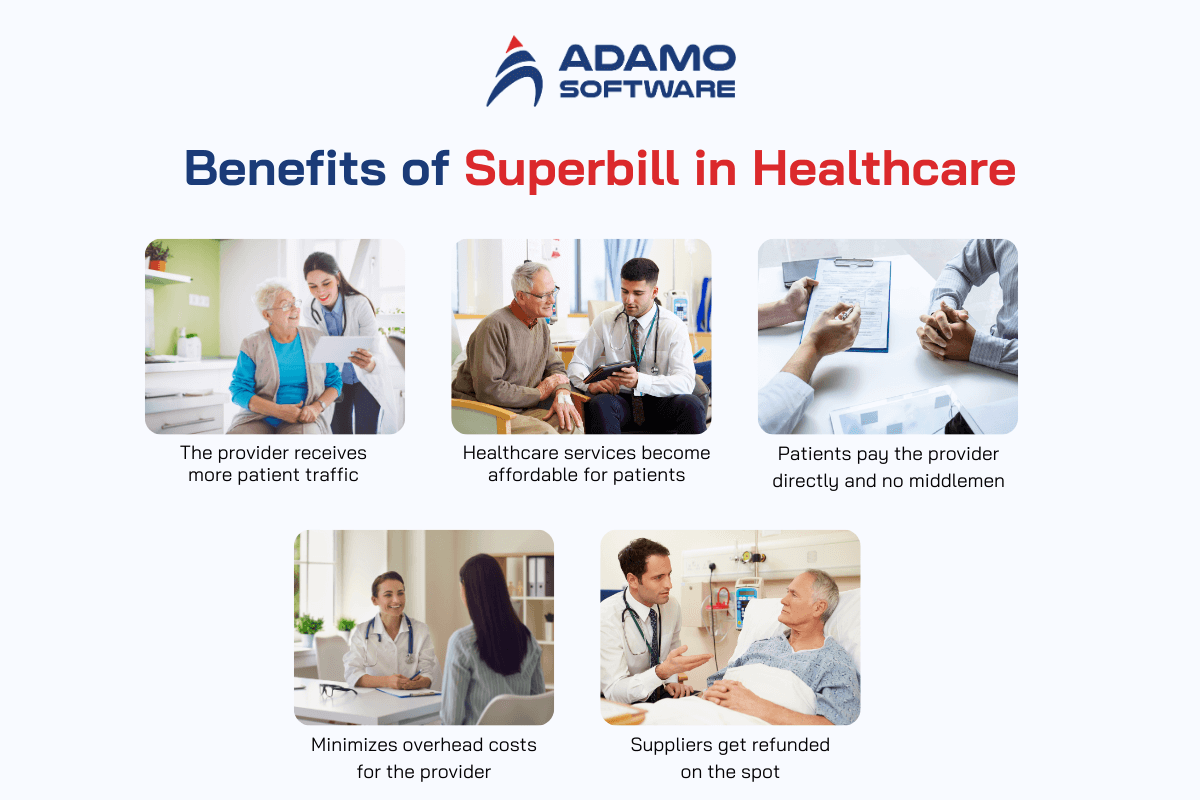

V. Benefits of Superbill in Healthcare

Superbills play a crucial role in modern healthcare. In this section, we will explore the key advantages of integrating Superbills into healthcare practices. Then, we will highlight how they streamline operations, improve financial transparency, and assist in the management of patient records. Whether you are a healthcare provider or a patient, grasping the benefits of Superbills is essential for navigating the complexities of medical billing and insurance claims.

1. The provider receives more patient traffic

Offering patients a Superbill allows them to get a partial refund from their insurance companies. This will bring new clients to your practice.

Let’s take the example of an elderly Mrs. Jenkins, who is suffering from arthritis. Her insurance covers her medical bills. You are in a difficult situation, looking for relief. You give her a Superbill along with her medication. A few days later, Mrs. Jenkins goes out and tells all her friends at the church social that you are the only doctor she likes because you have insurance and charge honest prices. In a flash, you will have more clients and the chances are that those clients will come from all the individuals who attended Mrs. Jenkins’ social.

2. Healthcare services become affordable for patients

The advantage of Superbill is that more people can access healthcare services more conveniently. Some patients can’t afford to pay a provider’s fees if their insurance company doesn’t reimburse them. When doctors supply the necessary paperwork for patient reimbursement, more individuals can visit their doctor and receive the care they require.

3. Patients pay the provider directly and no middlemen

As an independent physician, using Superbill makes life easier. You can forget about having to jump through insurance company hoops to get “approved”. Approved to explore their member services. No need to fill out form after form, and then do it all over again every few years to keep getting proof.

If you don’t have to deal with insurance companies, you also don’t have to have a staff that spends all day arguing over bills. You don’t have to pay staff just to complete tasks, insurance companies pay what they owe for services provided. And you avoid the accounting nightmare of claims, tracking what insurance companies say they will pay versus what they provide.

With Superbill, your patients pay you directly. There’s no middleman. That means more time practicing, and less time messing with paperwork. For a doctor, that’s a great thing. Automate your focus on your patients, not forms and bookkeeping.

4. Minimizes overhead costs for the provider

As a doctor, using Superbills in your practice means you can keep more of your hard-earned paycheck. When you refuse to deal with insurance companies, you also refuse to pay third-party medical billing services. The services of the companies are expensive, charging a monthly fee and a percentage of your income to process insurance claims.

With Superbills, it’s simple. Patients pay you in full after the visit, you provide them with a receipt for the services, and you keep the money you earn. There’s no middleman taking a commission account. There’s no red tape. It’s just you, the patient, and a simple cash transaction. The money goes where it should: in your pocket. Superbills offer simplicity, cost savings, and the ability to keep the money you earn.

5. Suppliers get refunded on the spot

Superbills allow doctors to get paid instantly. Instead of filling out forms and waiting weeks for insurance companies to send in test claims, doctors can leave the office with cash on the last day.

For a small practice, a steady flow of payments means the doctor can pay the premises and staff on time without worrying about where the money is coming from. Your insurance company has to jump through a lot of hoops before they pay. Lots of paperwork, phone calls, and headaches. The Superbill bypasses all that clutter. The patient pays the full amount, the doctor provides the care.

VI. Are You Using Paper Superbills? – E-Superbills is a Better Way

As a manager or owner of a healthcare facility, it is important to stay abreast of industry changes to reduce costs. Finding ways to minimize wasted effort and avoid redundancy is important. If your team is frequently entering the same patient and accessing the details into your system, it is a significant waste of time and resources. Addressing this inefficiency quickly is essential.

Entering codes into the system the traditional way is a tedious task and subject to human error. This often happens when staff manually enter codes into the system. These codes come from a Superbill sheet that the physician fills out during the visit.

Using E-Superbill is the best way. Because it will help overcome this problem by entering codes into the billing system through the EHR. But what if your practice doesn’t use an EHR solution for any reason? There must be an alternative method. The answer lies in having a system equipped with an electronic Superbill. Here are three advantages of using an electronic Superbill in a non-EHR setting.

1. Save Medical Professionals Valuable Time

Using a tablet, laptop or desktop computer, physicians will be able to use Superbill electronically. Ideally, Superbill will automatically populate with patient information. The physician then simply checks or enters each diagnosis and procedure code for the visit for that data to be automatically transmitted to the billing system.

With built-in handwriting recognition, physicians will be able to sign the e-Superbill as they would a paper Superbill.

2. Ready for ICD-10

Is your practice taking the necessary steps to prepare for the mandatory change from the International Classification of Diseases, Version 9, to ICD-10?

With ICD-10 approaching, the best e-Superbills will have a built-in ICD-10 code converter for quick and accurate selection of ICD-10 codes based on current ICD-9 codes.

3. Improve Revenue Cycle Management

The billing system should be able to retain codes in the patient record used during the current visit for future reference, reporting, and for recalls of medications or products as well as prompt reminders based on the patient’s condition.

An electronic Superbill is especially useful for revenue cycle management companies. This software solution is a great way for their customers to enter codes for the RCM company to process. Furthermore, the problem of missing paper Superbills is eliminated with the use of e-Superbills.

Remember that the e-Superbill should have a built-in cross-checking function to alert you of mismatched codes. Otherwise, it can lead to ridiculous issues, such as a code that says you are trying to indicate a male pregnancy.

Once you have realized the efficiency of computerizing more of your healthcare organization’s core functions, the idea of using electronic Superbills will be a welcome addition to your staff. They will save time and effort while improving your cash flow as the lack of paper Superbills will no longer be an issue.

VII. See how Adamo can help?

As a leading healthcare software development company in Vietnam, our dedication to our clients has established us as a top industry performer.

At Adamo Software, our team ensures that all information regarding providers, patients, and visits is accurately captured and that the super invoice is completed perfectly.

Let our expert team manage your Superbill design and other invoicing requirements. With our help, you can concentrate on serving your customers and growing your business, confident that your revenue will also growth.